Does Medicare Part A have a deductible?

Nov 12, 2021 · The Medicare Part A inpatient hospital deductible that beneficiaries pay if admitted to the hospital will be $1,556 in 2022, an increase of $72 from $1,484 in 2021. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

Does Medicare Part A have a premium?

Medicare Part A deductibles work as follows, during a hospital stay: - Beneficiary pays deductible of $1,100 during days 1-60 of hospital stay - Beneficiary then pays $275 per day for days 61-90 of hospital stay - Beneficiary then pays $550 per day for days 91-150 of hospital stay

Do I have to pay the annual Medicare deductible?

If so, how much is the deductible? En español | The 2020 deductible for Medicare Part A is $1,408 for each benefit period. This period begins when you are admitted to a hospital or nursing home for up to 60 consecutive days, and ends 60 days after you’ve left. You must pay the hospital or nursing home deductible for each benefit period.

How much does Medicare Part a cost per month?

If you don't qualify for premium-free Part A, you can buy Part A. People who buy Part A will pay a premium of either $274 or $499 each month in 2022 depending on how long they or their spouse worked and paid Medicare taxes.

What is the standard deductible for Medicare Part A?

$1,556If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. You pay: $1,556 deductible for each benefit period.

Does Medicare Part A have a deductible?

Does Medicare have a deductible? Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

How often do you pay Medicare Part A deductible?

Key Points to Remember About Medicare Part A Costs: With Original Medicare, you pay a Medicare Part A deductible for each benefit period. A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization.

What is the Medicare Part A deductible in 2021?

$1,484 inMedicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare Part A cover 100%?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is the Part D deductible for 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

How does the Part A deductible work?

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022. The Part A deductible is not an annual deductible; it applies for each benefit period.

Does Medicare Part A cover emergency room visits?

Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Is there a maximum out of pocket for Medicare Part A?

Medicare Part A. With Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered.

How much does Medicare cost at age 83?

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

Does Medicare have a deductible 2022?

The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.Nov 15, 2021

How long does Medicare Part A deductible last?

At the beginning of each benefit period, the Medicare Part A deductible must be paid by beneficiaries. A benefit period extends from the day a patient is admitted to the hospital until the final day treatment is received. If a beneficiary goes 60 days in a row without receiving treatment, the benefit period restarts and a deductible will have ...

How long does Medicare cover a room?

After the initial Part A deductible has been paid by the beneficiary during the first 60 days, Medicare will cover all other costs associated with a room, meals, doctor and nursing services, treatment, and exams. If a beneficiary needs to stay in the hospital beyond 150 days, or returns to the hospital with less than 60 days between visits ...

What is Medicare for seniors?

Medicare was designed with the goal of providing all senior citizens in America with reliable and affordable health care coverage. The program also strives to provide senior citizens with quality coverage and while the program eliminates many costs associated with health care for seniors, the system still has premiums, co-insurances, ...

Does Medicare Part A require a deductible?

The other portion of health care that Medicare Part A covers generally doesn’t require a deductible to be paid first. After a certain period of time, beneficiaries who require a stay in a skilled nursing facility will have to pay out of pocket for their stay. These costs include:

Does Medicare pay for hospice?

The only out of pocket costs associated with Part A coverage for home health services and hospice stays involve premiums for medication and durable medical goods. Medicare strives to pay for as much of the cost involved in a senior citizens health care as possible, but the system does have deductibles that must be met first before full coverage ...

How much is the 2020 Medicare deductible?

If so, how much is the deductible? En español | The 2020 deductible for Medicare Part A is $1,408 for each benefit period. This period begins when you are admitted to a hospital or nursing home for up to 60 consecutive days, and ends 60 days after you’ve left.

Can you deduct nursing home care?

You must pay the hospital or nursing home deductible for each benefit period. As long as care is medically necessary and a covered service, there is no limit on the number of benefit periods you can have and no limit on how much care you can get. Care cannot be denied because you’ve already had one knee replacement and need a second one or ...

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

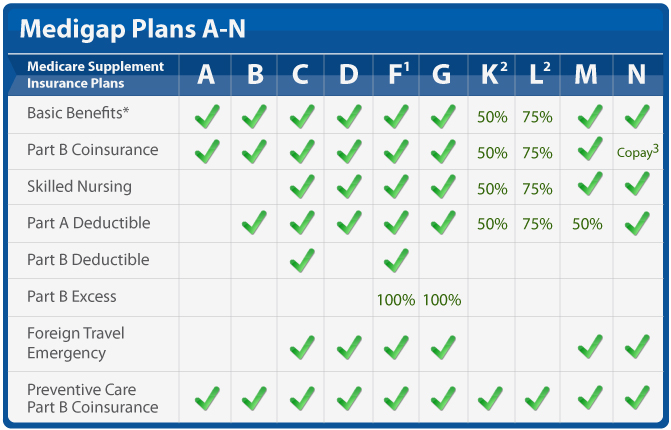

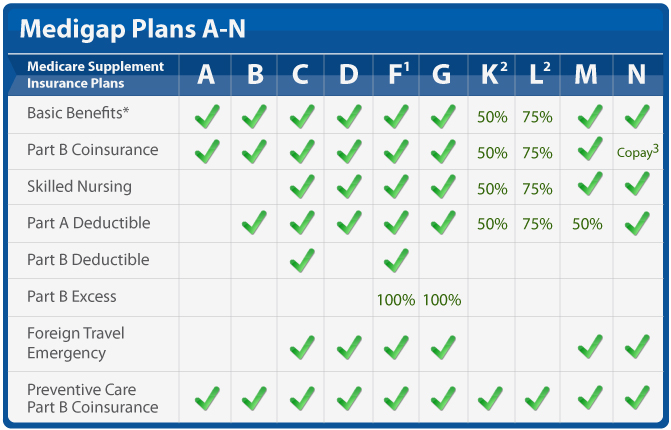

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.