What is the premium for Medicare Part A?

Most people don’t pay a Part A premium because they paid Medicare taxes while . working. If you don’t get premium-free Part A, you pay up to $499 each month. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty. Hospital stay. In 2022, you pay $1,556 deductible per benefit period

How much is the Medicare Part a premium?

7 rows · Nov 12, 2021 · Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with ...

How much will Medicare cost this year?

4 rows · Understanding the costs of Original Medicare can help you choose the right coverage options. Most ...

How much does Medicare Part B costs?

Feb 15, 2022 · If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month. How it changed from 2021 The 2021 Part A premiums increased by $15 and $28, respectively, in 2022. 2022 Medicare Part B premium

What is the estimated Medicare cost for 2022?

$170.10 per monthFor most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums. For high-earners, the cost of Medicare Part B is based on your adjusted gross income (AGI) from your previous year's taxes.Mar 18, 2022

What will Medicare Part A deductible be in 2022?

Medicare Deductibles. The 2022 deductible for Medicare Part A is $1,556 for each benefit period: $0 for days 1-60, $389 coinsurance per day for days 61-90 and $778 per each "lifetime reserve day" after 91 days. The Medicare Part B deductible is $233.

Will Medicare premiums be going up in 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Is there a monthly fee for Medicare Part A?

Part A premiums If you don't qualify for premium-free Part A, you can buy Part A. People who buy Part A will pay a premium of either $274 or $499 each month in 2022 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B.

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Why did my Medicare premium go up in 2022?

The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

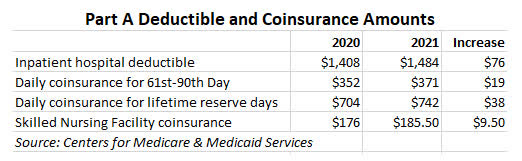

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How much does Medicare take out of Social Security?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Does Medicare Part A cover emergency room visits?

Does Medicare Part A Cover Emergency Room Visits? Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

What is the deductible for Medicare Part A 2021?

In addition, a large cost for Medicare Part A is the deductible. Enrollees will find that in 2021, the deductible is $1,484, which represents an increase of $76 from the previous year. However, this cost is usually covered if you enroll in a Medigap policy or Medicare Advantage.

How much is Medicare Part B deductible for 2021?

For 2021, the Part B deductible is $203, which means you would need to pay $203 before coinsurance benefits would kick in.

How does a Medigap policy work?

The cost of a Medigap policy, also called a Medicare Supplement policy, will depend on two factors: the policy you choose and the pricing structure of the company. Firstly, different plan letters have different prices since each policy provides a different level of coverage.

How much does Medigap cost at 65?

In this case, premiums will be lower for people who buy at a younger age. For example, if you bought a Medigap policy at age 65, your premium could be $200, but if you bought the same plan at 80, that policy might cost $300.

What is Medicare Part C?

Part C is a pure private health insurance product, meaning that it is not standardized across companies, and every policy has different levels of coverage, premiums and deductibles.

How much does Medicare Part B cost?

Generally, when you file your taxes, if you make less than $88,000 a year, then you would pay $148.50 per month. Below you can find an exact breakdown of the different income thresholds for Medicare Part B premiums.

How long do you have to work to get Medicare Part A?

If you have worked for more than 10 years or 40 quarters, then you are eligible to pay $0 for Medicare Part A. This is because, during your working years, you contributed to Social Security and Medicare payroll taxes.

How Much Is Medicare Part B in 2022?

For most people, $170.10 but let’s start with Part A first, then move on to Part B below. First off, your Part A isn’t “Free”. You paid for that coverage through Medicare withholding taxes during your career.

How Much Is Medicare Part C?

Medicare Part C, also known as Medicare Advantage. Part C pricing is dictated by the insurance companies that sell it. Many Part C plans are $0 per month. Anyone interested in buying Part C should be well educated on Medicare Advantage vs Medigap. Lucky for you, we have an article on how to choose between the two.