Full Answer

How much does Medicare cost in Florida?

Read below to learn more about Medicare in your state. Florida has one of the lowest weighted average Medicare Advantage Prescription Drug Plan premiums in the United States in 2021, at $13.17 per month. Average monthly premium cost in 2021 (weighted): $13.17

How much does Part D Medicare Part D cost in Florida?

In Florida, the average cost of a Clear Spring Medicare Part D plan is $20 per month, which is 57% cheaper than average. Plus, you can get a plan for as little as $13 per month with a $445 drug deductible. These affordable plans can also provide good coverage, helping you reduce your prescription drug costs.

How much does Medicare Part a cost?

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

How many people are enrolled in Medicare in Florida?

More than 4.6 million people are enrolled in Medicare in Florida. Nearly half of Florida Medicare beneficiaries select Medicare Advantage plans. Residents in Florida can select from between seven and 83 Medicare Advantage plans in 2020, depending on where they live.

Is there a monthly fee for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

How much does Medicare cost a month in Florida?

In Florida, the average cost of Medicare Advantage is $23 per month, and the average cost of Medicare Part D is $47 per month.

Do we have to pay premium for Medicare Part A?

Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.

How much does Florida Medicare cost?

How much does Medicare Part C cost in each state in 2022?StateAverage PremiumAverage Drug Deductible for Plans With Prescription Drug CoverageFlorida$67.84$233.53Georgia$48.91$271.47Hawaii$57.40$308.00Idaho$40.81$232.3446 more rows•Feb 15, 2022

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Do you pay for Medicare out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How is Medicare Part A paid for?

You pay a deductible and coinsurance costs for Medicare Part A services when you receive inpatient or skilled nursing care. There are state programs, called Medicare savings programs, that can help you cover the costs of your coinsurance and deductibles for Medicare Part A, if you're eligible.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

How much is the Part A deductible?

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022.

Is Medicare free in Florida?

How Much Does Medicare Cost in Florida? The cost of Original Medicare in Florida will be the same as the rest of the nation. With qualifying work history, most people are eligible for premium-free Part A coverage. Part B premiums for most people are $148.50 in 2021, but those with higher incomes will pay more.

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What percentage of Florida Medicare beneficiaries are private?

43 percent of Florida Medicare beneficiaries selected private Medicare Advantage plans in 2018. Nationwide, the average was 34 percent, so Medicare Advantage is more popular in Florida than it is nationwide. Most of the remaining 52 percent of the state’s Medicare beneficiaries had opted instead for coverage under Original Medicare, ...

How many Medicare Advantage plans are there in Florida?

Nearly half of Florida Medicare beneficiaries select Medicare Advantage plans. Residents in Florida can select from between seven and 83 Medicare Advantage plans in 2020, depending on where they live. Florida has a tool residents can use to compare prices on Medigap plans in each county. Florida law guarantees access to Medigap plans ...

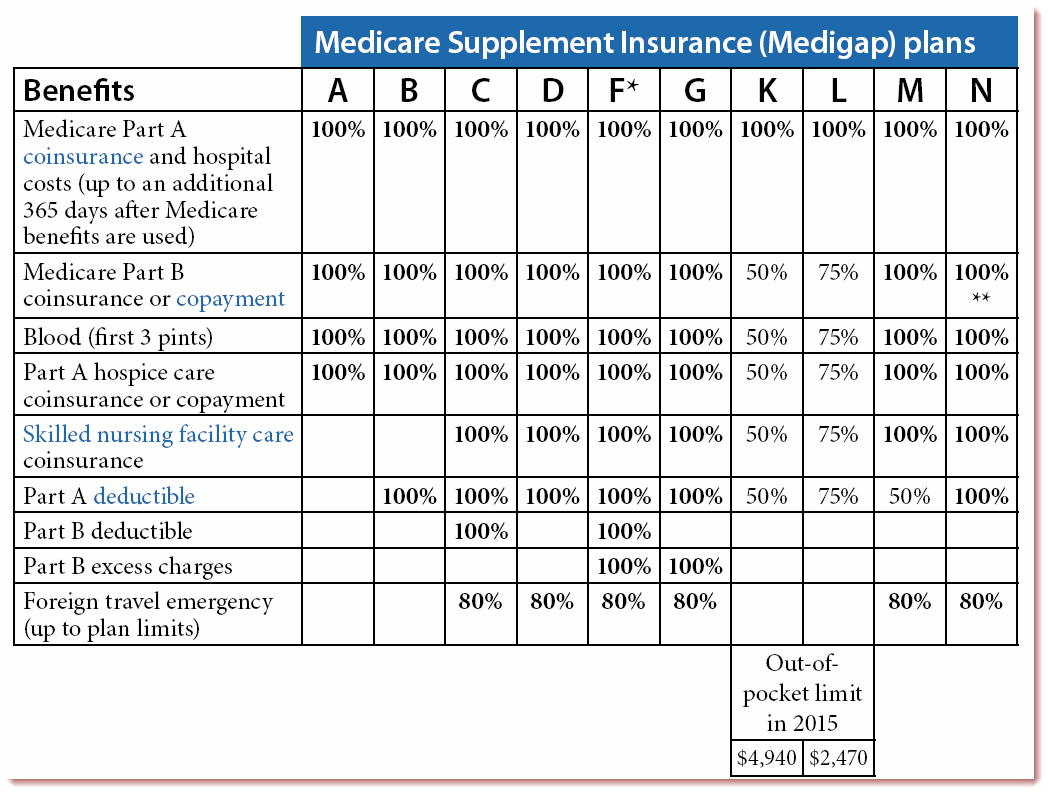

What is a Medigap plan?

Medigap plans are used to supplement Original Medicare, covering some or all of the out-of-pocket costs (for coinsurance and deductibles) that people would otherwise incur if they only had Original Medicare on its own.

What is Medicare Advantage?

Medicare Advantage includes all of the basic coverage of Medicare Parts A and B, and these plans generally include additional benefits — such as integrated Part D prescription drug coverage and extras like dental and vision — for a single monthly premium.

How to contact Medicare in Florida?

Visit the SHINE website or call 1-800-963-5337. Visit the Medicare Rights Center.

How many people will be on Medicare in Florida in 2020?

Medicare enrollment in Florida. Medicare enrollment in Florida stood at 4,672,774 as of October 2020. That’s more than 21 percent of the state’s total population, compared with about 19 percent of the United States population enrolled in Medicare. For most people, Medicare coverage enrollment happens when they turn 65.

When is Medicare Advantage enrollment?

Medicare Advantage enrollment is available when a person is initially eligible for Medicare, but there’s also an annual enrollment window each fall (October 15 – December 7) when Medicare beneficiaries can select a different Medicare Advantage plan, or switch between Medicare Advantage and Original Medicare.

How much Medicare does Florida pay?

In general, you can expect to pay up to $471 per month for Part A coverage and around $149 per month for Part B. As an alternative to Original Medicare, Florida has 67 Medicare Advantage Plans ...

How many Medicare Advantage Plans are there in Florida?

As an alternative to Original Medicare, Florida has 67 Medicare Advantage Plans if you're seeking more robust coverage. Read on to learn more about the different types of Medicare plans in Florida and the state agencies and organizations that can help you evaluate and plan for your health care needs. Jump to section:

How to save money on Medicare Supplement?

Many with Original Medicare save money by adding a Medicare Supplement Insurance policy . Opting for a plan that includes prescription drug coverage or adding this coverage to your policy may help you save money over time.

What is Florida glow?

Florida SHINE is a statewide program that provides free health insurance counseling for those who qualify for Medicare. Through its network of trained volunteers, you can get answers to questions regarding Original Medicare costs and benefits, help identifying and comparing the Medicare Advantage Plans available in your region, and assistance with understanding medical billing statements. Volunteers may advocate on your behalf and help you dispute denied claims for covered services. The program also provides community and one-on-one education to recognize and prevent Medicare fraud through the Senior Medicare Patrol.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, covers some of your cost-sharing responsibilities to reduce your overall expenses. These policies are provided by private health insurance companies and have monthly premiums that you pay in addition to your Medicare premium.

What is the Florida Senior Legal Helpline?

The firm also operates the Florida Senior Legal Helpline, which is available to seniors throughout the state and answers Medicare questions. The helpline is operational on weekdays from 9 a.m. to 4:30 p.m. and is reached at 888-895-7873. Contact Information: Website | 800-625-2257.

What can a counselor do for Medicare?

They can help you organize and settle medical bills , spot billing errors, dispute denied claims, and understand your Original Medicare benefits . Counselors can also help you identify the available Medicare Advantage Plans in your region and compare their prices and coverage options.

Best Florida Medicare Advantage plans

Medicare Advantage, also called Medicare Part C, is a popular way to simplify coverage by providing a single policy for medical care, hospitals, prescription drugs and other health care benefits. In Florida, about 51% of Medicare enrollees are signed up for a Medicare Advantage plan.

Best Medicare Part D plans in Florida

Medicare Part D is a standalone plan for prescription coverage, and the average cost of Medicare Part D in Florida is $18 per month.

Frequently asked questions

We recommend AARP/UnitedHealthcare Medicare Advantage as the best overall provider in Florida. The company offers $0 plans in all of Florida's 67 counties. Plus, it is well rated and has in-network providers across the country.

Methodology

Cost, quality and enrollment data for Medicare Part C and Part D was sourced through the Centers for Medicare & Medicaid Services (CMS) public use files. Comparisons used the most recent data available at the time this article was created.

What is Medicaid in Florida?

Medicaid in Florida is sometimes referred to as the Statewide Medicaid Managed Care (SMMC) program. The Medicaid managed care program for long-term care services for the elderly and disabled is called the Long-term Care (LTC) program. All other health care services outside of long-term care are provided via the Managed Medical Assistance (MMA) ...

How long does it take for Medicaid to check in Florida?

One should be aware that Florida has a Medicaid Look-Back Period, which is a period of 60 months that immediately precedes one’s Medicaid application date. During this time frame, Medicaid checks to ensure no assets were sold or given away under fair market value.

How much is the spousal allowance for Medicaid in 2021?

That said, this spousal allowance may be as high as $3,260.00 / month (effective January 2021 through December 2021) and is based on one’s shelter and utility costs. This rule allows the Medicaid applicant to transfer income to the non-applicant spouse to ensure he or she has sufficient funds with which to live.

What income is counted for Medicaid?

Examples include employment wages, alimony payments, pension payments, Social Security Disability Income, Social Security Income, IRA withdrawals, and stock dividends.

What is the exemption for Medicaid?

Exemptions include personal belongings, household furnishings, an automobile, irrevocable burial trusts, and one’s primary home, given the Medicaid applicant either resides in the home or has “intent” to return to it, and his / her equity interest in the home is not greater than $603,000 (in 2021).

Does Medicaid count as income?

Medicaid does not count Covid-19 stimulus checks as income, which means they do not impact eligibility. When only one spouse of a married couple is applying for institutional Medicaid or home and community based services, only the income of the applicant is counted.

Can you take the Medicaid Eligibility Test in Florida?

Alternatively, one may opt to take the Medicaid Eligibility Test.

How much does Medicare cost in Florida in 2021?

Florida has one of the lowest weighted average Medicare Advantage Prescription Drug Plan premiums in the United States in 2021, at $13.17 per month. Average monthly premium cost in 2021 (weighted): $13.17. Average in-network out-of-pocket spending limit: $4,116.

How many Medicare Advantage plans are there in Florida in 2021?

Plans by Type. Local Resources. There are 178 different Florida Medicare Advantage Prescription Drug (MAPD) plans in 2021. 1 Not every plan is available in each county, so it's important to find out which ones are offered where you live.

What age do you have to be to get Medicare Advantage in Florida?

To be eligible for Original Medicare at age 65 , you must meet the following requirements:

How many stars does Medicare Advantage have?

Each year, the Centers for Medicare & Medicaid Services (CMS) issues Star Ratings for all Medicare Advantage plans using a system of one to five stars. 2. In order for a Medicare Advantage plan to be considered a top-rated plan, it must have four or more stars out of five stars.

What are the five categories of Medicare Advantage plans?

Medicare Advantage plans are rated in the following five categories: Preventive care and health maintenance (screenings, tests, vaccines, etc.) Management of chronic conditions. Member experiences and ratings of the plan. Member complaints, problems receiving services and member retention.

When is the Medicare enrollment period?

Medicare Annual Enrollment Period (AEP): October 15 – December 7. From October 15 to December 7 every year, you may enroll in a Medicare Advantage plan or switch from one Medicare Advantage plan to another. You may also drop your existing Medicare Advantage plan and return to Original Medicare.

When is Medicare open enrollment?

Medicare Advantage Open Enrollment Period: January 1 – March 31. If you're already enrolled in a Part C plan, from January 1 to March 31 every year, you may switch Medicare Advantage plans or drop your Medicare Advantage plan and return to Original Medicare.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.