How much will Medicare Part B cost in 2012?

Oct 27, 2011 · This premium will be $451 for 2012, an increase of $1 from 2011. Those who have between 30 and 39 “quarters of coverage” may buy into Part A at a reduced monthly premium rate which is $248 for 2012, the same amount as in 2011.

What is the Medicare Part a hospital deductible for 2012?

2012 Medicare Part A Premium: Your Medicare Part A premium will increase by $1 per month. 2012 Medicare Part A Deductible : The Medicare Part A deductible will increase going from $1,132 per benefit period to $1,156 (*1184) per benefit period in 2012.

How much did Medicare premiums increase in 2012?

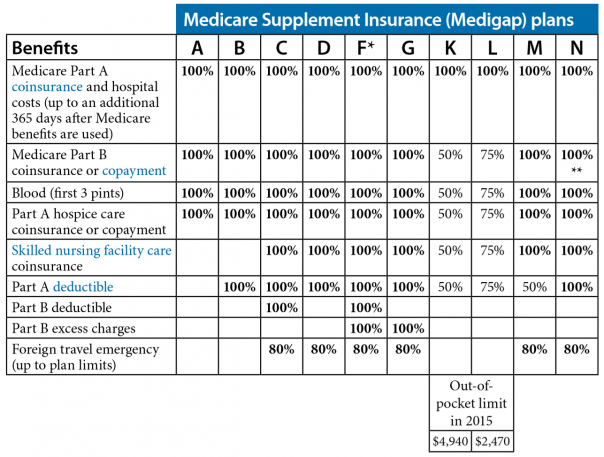

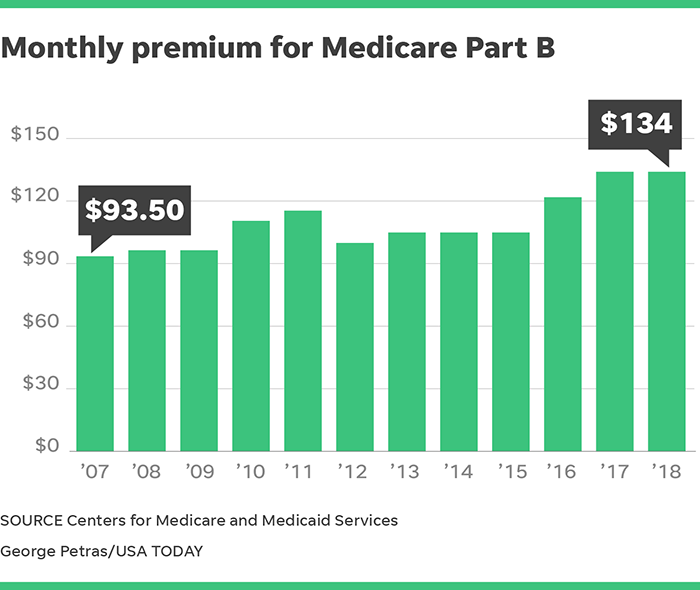

Nov 07, 2011 · The Medicare Part A deductible is fully covered under Medigap Plans B, C, F, G, and N. Medicare Part B Premium. What changed: The 2011 Medicare Part B premium was $115.40, so the 2012 $99.90 premium price would be a $15.50 decrease. Monthly social security payments to enrollees will increase by 3.6%. The Medicare Part B 2012 deductible will be $22 lower at $140. …

How much does Medicare Part a cost a month?

Mar 09, 2021 · If you worked fewer than 30 quarters (7 1/2 years), you’ll typically pay $471 per month. If you worked more than 30 but fewer than 40 quarters (around 7 1/2 to under 10 years), you’ll typically pay $259 per month. There’s also a monthly premium for Medicare Part B, and most beneficiaries do have to pay the premium.

How much did Medicare cost in 2011?

Tax Return Income (Individual)Joint Tax Return Income (Married Couples)2011 Monthly Part B PremiumNew 2011 Medicare enrollees Up to $85,000Up to $170,000$115.40$85,001 to $107,000$170,001 to $214,000$161.50$107,001 to $160,000$214,001 to $320,000$230.70$160,001 to $214,000$320,001 to $428,000$299.901 more row

Is there a monthly fee for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Does Medicare Part A premium change every year based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the Medicare premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

How much does Medicare cost at age 83?

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

How much will Part B go up in 2022?

$170.10Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Will Social Security get a raise in 2022?

Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022. The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $147,000.

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

What is changing in 2012?

2012 Medicare Part A Premium: Your Medicare Part A premium will increase by $1 per month.

How do the 2012 changes in Medicare affect you?

2012 Medicare Part A Premium: This $1 increase in the 2012 Medicare Part A premium will not affect many beneficiaries because 99% of beneficiaries are exempt from paying the Medicare Part A premium. This is because most Americans pay into this amount while working.

Medicare Part A

What changed: Medicare Part A Premiums will increase $1 per month and Medicare Part A deductible will increase by $24.

Medicare Part B Premium

What changed: The 2011 Medicare Part B premium was $115.40, so the 2012 $99.90 premium price would be a $15.50 decrease. Monthly social security payments to enrollees will increase by 3.6%.