What is the maximum premium for Medicare Part B?

4 rows · Nov 10, 2015 · As a result, by law, most people with Medicare Part B will be “held harmless” from any ...

How much are Medicare Part B premiums?

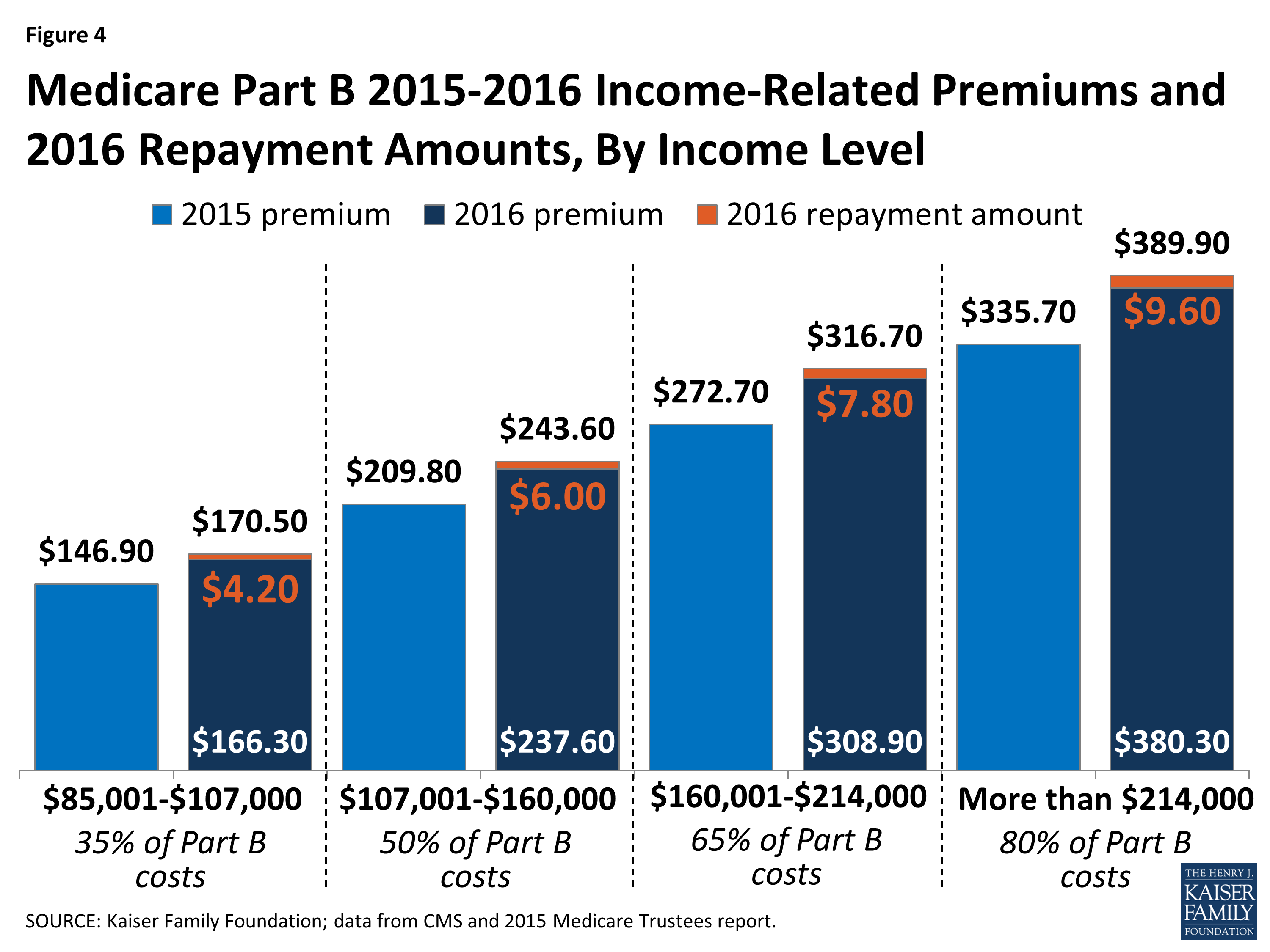

4 rows · Nov 12, 2015 · Under the rules, the remaining 30% of Medicare beneficiaries must cover the rest of the cost of ...

Do I have to pay Medicare Part B premium?

Aug 25, 2016 · If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90. Your 2016 monthly premium is typically $121.80 if any of the following is true for you: You enrolled in Medicare Part B in 2016 for the first time. You don’t receive Social Security benefits. You get a bill for the Part B premium.

Does Medicaid pay for Part B premium?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

See Also -- CALCULATOR: How Much You'll Pay for Medicare in 2016

Medicare beneficiaries who have Part B premiums withheld from their Social Security checks--about 70% of beneficiaries--will continue to pay $104.90 per month for Part B. If you aren't collecting Social Security yet or will enroll in Medicare in 2016, you will have to pay $121.80 per month in 2016.

See Also: 10 Things You Must Know About Medicare

Your income is usually based on your last tax return on file, which would be your 2014 return, for 2016 premiums. But you may be able to get the high-income surcharge reduced or eliminated if your income has decreased since then because of certain life-changing events, such as the death of a spouse, divorce, retirement or reduced work hours.

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

How much is Medicare Part B deductible?

Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

Is Medicare dual eligible?

You quality for both Medicare and Medicaid benefits, and Medicaid pays for your premiums. This is called being “dual-eligible.”. Your income exceeds a certain dollar amount. Your premium could be higher than the amount listed above, as there are different premiums for different income levels.

Does Medicare Advantage have a deductible?

Premiums and deductibles for Medicare Advantage plans vary depending on which plan you choose . In brief, Medicare Advantage plans are offered by private health insurance companies contracted with the Centers for Medicare & Medicaid Services (CMS) to provide your benefits, and it is required by law to offer at least the same coverage as Original Medicare (with the exception of hospice care, which is still covered under Medicare Part A). Some plans offer extra coverage ( routine dental or vision services, for example).

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

When do you pay income related premium surcharge?

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. [2019 tax returns were filed in 2020, so those are the most current returns available when income-related premium adjustments are determined for 2021.]

How much is the 2020 Social Security Cola?

But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020. And for 2021, the 1.3 percent COLA is adequate to cover the increase to ...

Does Medicare cover coinsurance?

But supplemental coverage (from an employer-sponsored plan, Medigap, or Medicaid) often covers these coinsurance charges. For people who became eligible for Medicare before the start of 2020, there are Medigap plans available (Plans C and F) that cover the Part B deductible, in addition to coinsurance charges.