How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

How to collect a part B deductible?

- The beneficiary was later determined to have been entitled to Medicare benefits;

- The beneficiary’s entitlement period fell within the time the provider’s agreement with CMS was in effect; and

- Such amounts exceed the beneficiary’s deductible, coinsurance or non covered services liability. ...

Is Medicare Part B payments tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is the 2019 deductible for Medicare Part B?

$185 in 2019On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

Does Medicare Part B have deductibles?

The Part B deductible is $233. You will usually then pay 20 percent of the cost for anything covered by Part B after you have met your deductible. How do Medicare deductibles work? A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs.

What are the annual premiums for Part B coverage in 2019 and 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019.

What is the Medicare Part B deductible for 2021?

$203 inThe annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is the Medicare Part B deductible for 2020?

$198 in 2020The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

What is Medicare Part A deductible for 2022?

The 2022 Medicare deductible for Part A (inpatient hospital) is $1,556, which reflects an increase of $72 from the annual deductible of $1,484 in 2021. This is the amount you'd pay if you were admitted to the hospital.

How much does Medicare deduct from Social Security?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Does Medicare cover 100 percent of hospital bills?

Medicare generally covers 100% of your medical expenses if you are admitted as a public patient in a public hospital. As a public patient, you generally won't be able to choose your own doctor or choose the day that you are admitted to hospital.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

How much will Medicare premiums decrease in 2019?

On average, Medicare Advantage premiums will decline while plan choices and new benefits increase. On average, Medicare Advantage premiums in 2019 are estimated to decrease by six percent to $28, from an average of $29.81 in 2018.

What is CMS eMedicare?

As announced earlier this month, CMS launched the eMedicare Initiative that aims to modernize the way beneficiaries get information about Medicare and create new ways to help them make the best decisions for themselves and their families.

How much does Medicare pay for inpatient hospital admission?

The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,364 in 2019, an increase of $24 from $1,340 in 2018.

How much will Medicare pay in 2019?

An estimated 2 million Medicare beneficiaries (about 3.5 percent) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

When does Medicare open enrollment end?

Ahead of Medicare Open Enrollment – which begins on October 15, 2018 and ends December 7, 2018 – CMS is making improvements the Medicare.gov website to help beneficiaries compare options and decide if Original Medicare or Medicare Advantage is right for them.

Is Medicare deductible finalized?

Premiums and de ductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Last month, CMS released the benefit, premium, and cost sharing information for Medicare Advantage plans in 2019.

What is the standard Part B premium for 2021?

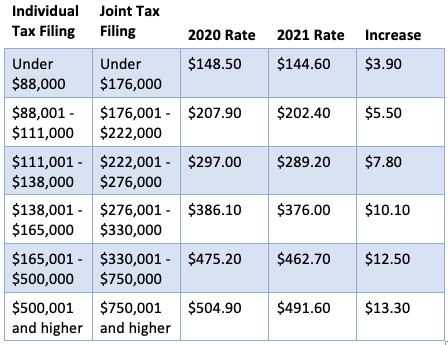

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is Medicare Part B?

Medicare Part B requires a monthly premium. The standard premium for Part B in 2019 is $135.50 per month, although some people will pay more than that amount and others may pay less.

How long does it take to pay coinsurance for a hospital stay?

You pay no coinsurance during the first 60 days of an inpatient hospital stay during each benefit period. This means that your hospital costs are covered at 100% (after you meet your Part A deductible).

What happens if you don't accept Medicare?

If you visit a health care provider who does not accept Medicare assignment (which means they don't accept Medicare reimbursement as payment in full for their services), the provider reserves the right to charge you up to 15% more than the Medicare-approved amount.

How much will Social Security increase in 2019?

A day before CMS’ announcement about 2019 Medicare costs, the SSA announced their plans to raise the COLA 2.8 percent in 2019. As a result, retired workers collecting Social Security can expect to see their checks rise by an average of about $39 per month next year. Retired couples will receive an average of about $67 in additional Social Security benefits in 2019.

How much is Medicare Part B premium?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

Will Medicare be released in 2021?

The Centers for Medicare & Medicaid Services have released the Medicare costs for 2021. Please see our most recent article, 2021 Medicare Part A and Part B Premiums and Deductibles, for current facts and figures

What is the Medicare deductible for 2019?

Deductibles will also go up in 2019. The deductible for Medicare Part A, which covers hospital services, will increase from $1,340 in 2018 to $1,364 in 2019. The deductible for Medicare Part B, which covers physician services and other outpatient services, will see a mild bump from $183 to $185.

Why do Medicare beneficiaries pay less?

A small group of Medicare beneficiaries (about 3.5%) will pay less because the cost-of-living increase in their Social Security benefits is not large enough to cover the full premium increase. The “hold-harmless provision” prevents enrollees’ annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security ...

How much is the premium for singles?

And premiums for singles earning $133,501 to $160,000 ($267,001 to $320,000 for joint filers) will rise from $348.30 to $352.20. If you had higher income than that, your monthly premium for 2018 was $428.60. In 2019, there will be an extra surcharge tier for people with the highest income.

How much is Social Security going up in 2019?

Social Security benefits are increasing by 2.8% in 2019, which will cover the increase in premiums for most people. Premium increases are also minor for most higher-income beneficiaries—those with adjusted gross income plus tax-exempt interest income of more than $85,000 if single or $170,000 if married filing jointly.

How much is the 2019 tax surcharge?

If your income is between $160,001 and $499,999 ($320,001 to $749,999 for joint filers), you’ll pay $433.40 per month. Single filers with income of $500,000 or more ($750,000 or more for joint filers) will pay $460.50 per month.

How much does Medicare pay in 2019?

Answer: The Centers for Medicare & Medicaid Services announced that most people will pay $135.50 per month for Medicare Part B in 2019, up slightly from $134 per month in 2018.

Can you contest a Medicare surcharge?

If you’ve experienced certain life-changing events that have reduced your income since then, such as retirement, divorce or the death of a spouse, you can contest the surcharge. For more information about contesting or reducing the high-income surcharge, see Save Money on Medicare.

What is Medicare Part B 2020?

Part B, which helps millions of Americans pay for medical care, requires certain costs, two of which are premiums and deductibles. The prices are set by federal law, but the exact amount you’ll pay varies depending on certain factors like your income. Read on for details about Part B premiums and ...

What percentage of Medicare deductible is coinsurance?

Coinsurance: This is a percentage that you pay for most services after you meet your deductible. For most services, your coinsurance is 20% of the Medicare-approved amount.

How much is the 2020 Medicare premium?

In 2020, that's $144.60 (up from $135.50 in 2019). 1. People who earn more than the standard premium threshold will pay higher premiums. This premium increase is called the Income-Related Monthly Adjusted Amount (IRMAA). 2. The table below outlines the 2020 premiums by income.

What is the deductible for Part B?

Part B includes a yearly deductible. This is the amount you must pay for most health care services before Part B starts to help. The federal government sets the deductible, and it may change from year to year, similar to the premium. In 2020, the deductible is $198 (up from $185 in 2019). 4 After you meet the deductible, ...

How much is Part B premium?

The standard monthly Part B premium is $144.60 in 2020. In 2019, it was $135.50. 3. If you receive any of the retirement benefits below, your premium will be automatically deducted ...

What is the standard Part B premium?

The standard monthly Part B premium is $144.60 in 2020. In 2019, it was $135.50. 3. If you receive any of the retirement benefits below, your premium will be automatically deducted from your monthly benefit payment. Social Security.

What does it mean to pay higher Social Security premium?

In general, this means that the higher your income is, the higher premium you’ll pay. Social Security uses the modified adjusted gross income (MAGI) that you reported on your taxes the year before. For example, to determine your 2020 premium, Social Security uses the income you earned in 2018 and reported when you filed your taxes in 2019.

What is the Medicare Part B deductible for 2019?

As mentioned above, the annual Medicare Part B deductible for 2019 is $185. So what exactly does that mean? You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What happens after you meet your Medicare Part B deductible?

What Happens After You Meet the Part B Deductible? After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019. On Jan. 1, 2020, your deductible will reset, and you will have to pay the 2020 Medicare Part B deductible before your Part B ...

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What is Part B insurance?

Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care. Some durable medical equipment (DME) Medicare Supplement Insurance (Medigap) Plan F and Plan C both provide full coverage for the 2019 Part B deductible.

How much is a knee injury deductible in July?

In July, you injure your knee and schedule another appointment with your doctor. This time you are billed $150 for the appointment. You will be responsible for paying the first $65 of the $150 for the appointment out of your own pocket, because that is how much is left on your deductible. After the $65 is paid, ...