What is the maximum premium for Medicare Part B?

Nov 06, 2020 · For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020.

How high will the Medicare Part B deductible get?

Part B deductible & coinsurance In 2022, you pay $233 for your Part B deductible [glossary] . After you meet your deductible for the year, you typically pay 20% of the Medicare-Approved Amount for these: Most doctor services (including most doctor services while you're a hospital inpatient) Outpatient therapy

Does Medicaid pay for Part B premium?

Nov 24, 2021 · The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What are the rules for Medicare Part B?

2021 Medicare Part B Premiums and Deductibles Unfortunately, for a third year in a row we are seeing the Medicare Part B premium and deductible increase. The standard Medicare Part B premium 2021 will be $1148.50, which is an from the $144.60 Part B premium in 2020.

What is the standard premium for Medicare Part B in 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Is the Part B premium going up in 2021?

This year's standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer's disease.Jan 10, 2022

What is the 2021 Part B Medicare deductible?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Did Medicare Part B go up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

How much does Medicare take out of Social Security?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

What are excess Medicare Part B charges?

What is a Medicare Part B excess charge? An excess charge happens when you receive health care treatment from a provider who does not accept the Medicare-approved amount as full payment. In these cases, a provider can charge you up to 15% more than the Medicare-approved amount.Nov 17, 2021

How much will Part B go up in 2022?

$170.10Part B costs The standard monthly premium for Part B will be $170.10 in 2022, up from $148.50 this year and marking the program's largest annual jump dollar-wise ($21.60).Dec 31, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Is Social Security giving extra money this month?

Average benefit increase: $93 a month The average beneficiary will receive an extra $93 a month, the Social Security Administration said, meaning the typical monthly check will rise to $1,658 in January from $1,565 previously.Jan 4, 2022

What is the standard Part B premium for 2021?

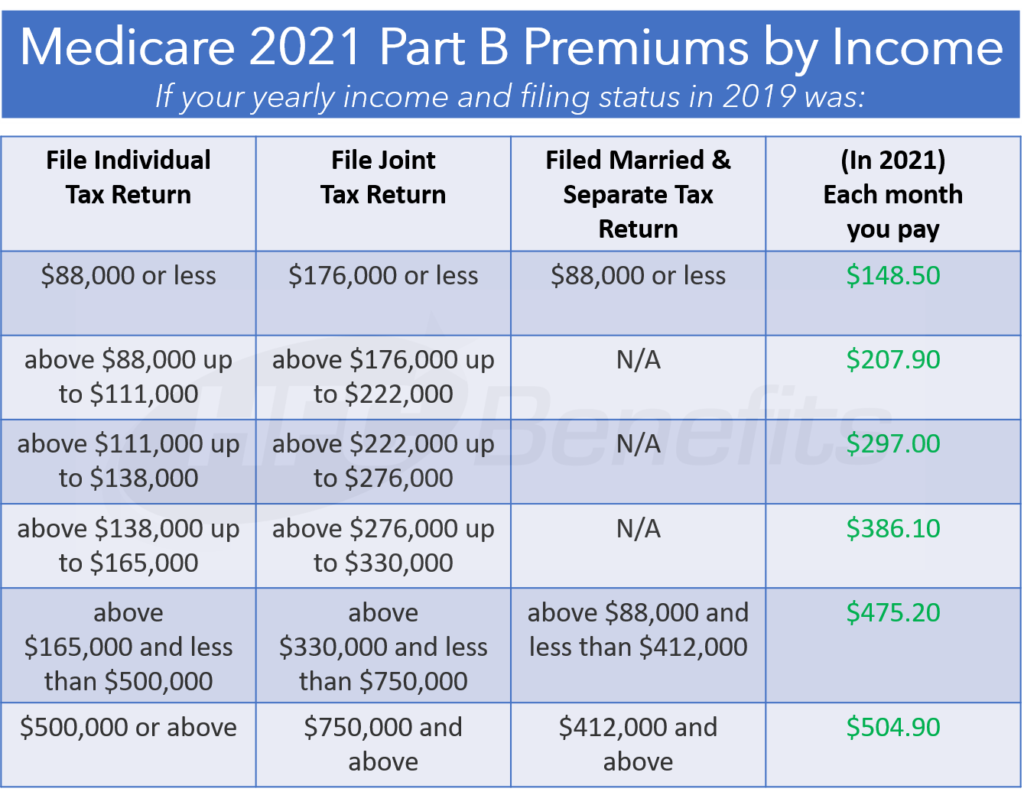

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the Medicare premium for 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Will Social Security send out a letter to all people who collect Social Security benefits?

Social Security will send a letter to all people who collect Social Security benefits ( and those who pay higher premiums because of their income) that states each person’s exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most.

What is the Medicare deductible for 2021?

The Medicare Part B deductible 2021 for beneficiaries is rising to $203, which is an increase from the annual deductible of $198 in 2020.

When will Medicare eliminate the first dollar coverage?

First dollar coverage plans where eliminated in 2020 for those who become eligible for Medicare after January 1st 2020. Those plans include Medicare Supplement Plan C, Medicare Supplement High Deductible Plan F, and the very popular Medicare Supplement Plan F. This is no surprise as the Medicare access and chip re-authorization act of 2015 stated this would take place in 2020.

How much will you pay for a brand name drug in 2021?

In 2021 if you enter the coverage gap, you’ll pay no more than 25% of the price for the brand-name drug, and almost the full price of the drug will count as out-of-pocket costs to help you get out of the coverage gap.

Is Medicare cost going up in 2021?

Medicare cost in 2021 are on the rise. These changes, are not significantly higher, but do outpace the Social Security cost-of-living adjustment and effect many seniors who are on a fixed income. The Centers for Medicare and Medicaid services (CMS), officially released news in November 2020 of the new Medicare cost 2021 changes. Medicare Part A and Medicare Part B cost will be increasing, as will certain components of Medicare Part D. Medicare Advantage plans will see average cost being lowered, and additional benefits added.

Do you pay Medicare premiums?

Most people in America do not pay a premium for Medicare Part A since they have worked and paid taxes into Medicare over their lives. Other Medicare Part A cost include deductibles and some coinsurance on certain services. For seniors in America who do not have a Medicare supplement or Medicare advantage plan, these Part A cost can add up.