How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

Does Medicare Part B cost money?

• Part B Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

What is Medicare Part B monthly payment?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

What did Medicare cost in 2012?

$99.90The standard Medicare Part B monthly premium will be $99.90 in 2012, a $15.50 decrease over the 2011 premium of $115.40. However, most Medicare beneficiaries were held harmless in 2011 and paid $96.40 per month. The 2012 premium represents a $3.50 increase for them.

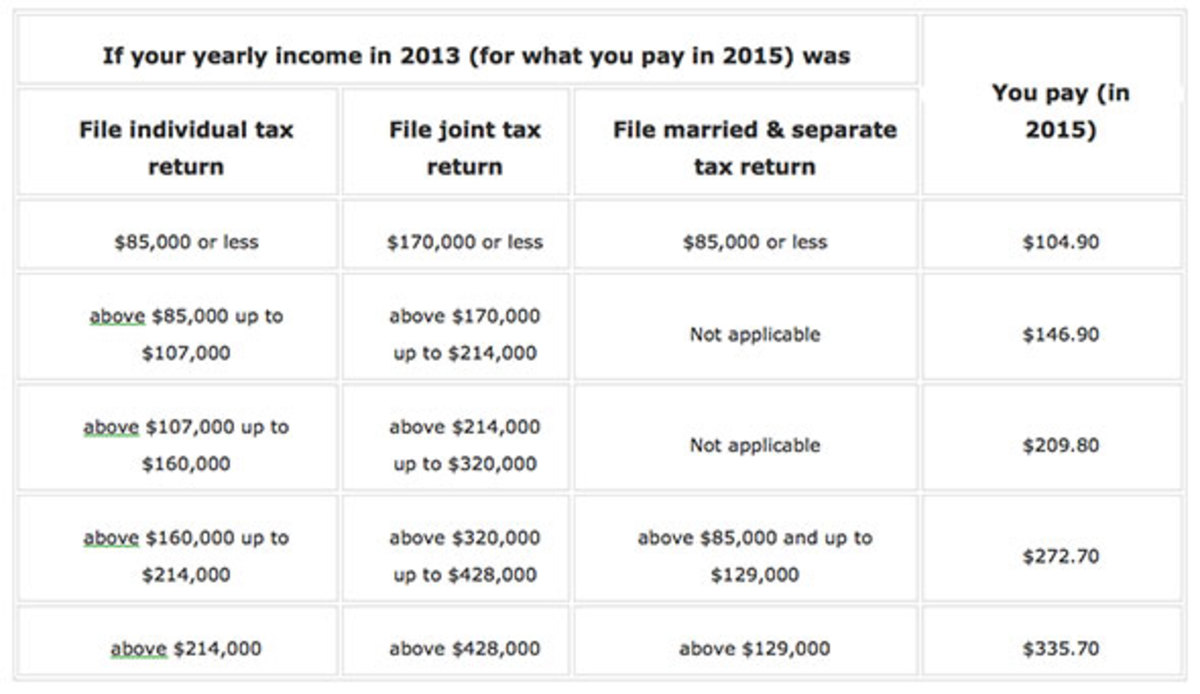

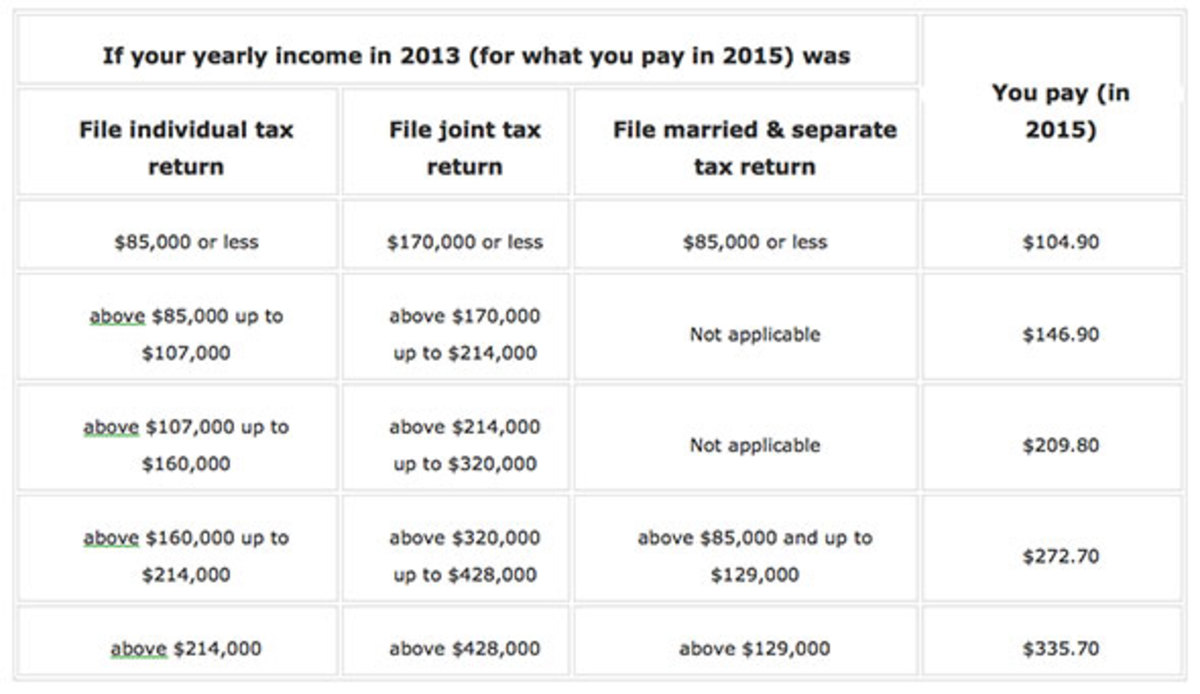

What was the cost of Medicare Part B in 2015?

$104.90 per monthHow much will Medicare premiums cost in 2015? Medicare Part B premiums will be $104.90 per month in 2015, which is the same as the 2014 premiums.

What was the Medicare Part B premium in 2010?

Medicare Part B Premiums for 2010 The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

What was the cost of Medicare Part B in 2009?

$96.40Fact sheet. CMS ANNOUNCES MEDICARE PREMIUMS, DEDUCTIBLES FOR 2009. The standard Medicare Part B monthly premium will be $96.40 in 2009, the same as the Part B premium for 2008. This is the first year since 2000 that there was no increase in the standard premium over the prior year.

What was Medicare premium in 2013?

Today we announced that the actual rise will be lower—$5.00—bringing 2013 Part B premiums to $104.90 a month. By law, the premium must cover a percent of Medicare's expenses; premium increases are in line with projected cost increases.

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Medicare premium for 2014?

CMS said the standard Medicare Part B monthly premium will be $104.90 in 2014, the same as it was in 2013. The premium has either been less than projected or remained the same, for the past three years. The Medicare Part B deductible will also remain unchanged at $147.

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

How much did Medicare cost in 2008?

$96.40The standard Medicare Part B monthly premium will be $96.40 in 2008, an increase of $2.90, or 3.1 percent, from the $93.50 Part B premium for 2007.

What year did Medicare start charging premiums?

1966President Johnson signs the Medicare bill into law on July 30 as part of the Social Security Amendments of 1965. 1966: When Medicare services actually begin on July 1, more than 19 million Americans age 65 and older enroll in the program.

What was Medicare Part B premium in 2005?

Part B Deductible background: The Part B deductible was increased to $110 in 2005 and was subsequently indexed to the increase in the average cost of Part B services for aged beneficiaries, as part of the Medicare Modernization Act. The reason for the increase in the average cost of Part B services was described above.

How much will Medicare B go up in 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What is the Medicare premium for 2017?

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. 4 The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration's cost-of-living adjustments (COLA).

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

When do you get Medicare if you don't have Social Security?

If you're not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare .

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Does Medicare have a hold harmless?

Medicare has a "hold harmless" provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. 4 While this keeps seniors from paying more than they should, you'll have to pay the increased premiums if your COLA is higher than the increase.

What is Medicare Advantage Plan?

A Medicare Advantage Plan needs to be what CMS calls actuarially equivalent to or better than what a Medicare beneficiary would receive in Original Medicare. In other words, the average member of a Medicare Advantage plan should not be expected to spend any more for their healthcare in a MA plan than if they had stayed in Original Medicare.

What is county capitation rate?

The county capitation rate is one of the items insurance companies look at when they are deciding to offer a Medicare Advantage Plan for a particular county. The monthly capitation rate is what they expect to be reimbursed by CMS for each Medicare beneficiary enrolled in one of their plans. This is a highly simplified overview that doesn’t take into account reimbursements for plan members that may have End Stage Renal Disease (ESRD), Program of All-inclusive Care for the Elderly (PACE), or Special Needs Plan (SNP) all of which have higher reimbursement rates. Plan reimbursements are further broken down by half star ratings that I didn’t include in the above table.

How much is Medicare Part A 2013?

The 2013 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $441.

How much is the 2013 Part D plan?

The 2013 Part D plan premiums range from $3 to $166.

What is the age limit for a Part B?

You’re 65 or older, and you have (or are enrolling in) Part B and meet the citizenship and residency requirements.

What is modified adjusted gross income?

Your modified adjusted gross income is your adjusted gross income plus your tax exempt interest income. Each year, Social Security will notify you if you have to pay more than the standard premium. The amount you pay can change each year depending on your income.

What is Medicare Part A 2013?

Medicare Part A 2013 mostly covers inpatient hospitals, skilled nursing facilities as well as home healthcare. Medicare Part A Premium 2013 are set to drop from $451 to $441.

How much is the deductible for Part B?

The deductibles for part B will also increase from $ 140 to $147. You will also be required to pay a penalty if you do not sign up when eligible.

What changes were made to Medicare in 2013?

Medicare Fee Schedule and Medicare Eligibility Changes in 2013 are set to be experienced in Medicare part A and Medicare Part B premiums deductibles and the coinsurance paid by beneficiaries. The premiums paid on Part A and part B of the Medicare insurance is the ones that have been slightly changed. 2013 Medicare Premiums are set ...

How much of Medicare do you have to pay for outpatient services?

One will be required to pay for 20% of Medicare approved for most doctor services; this will mostly affect outpatient therapy and durable medical equipment. For outpatient mental health services, you will be required to cater for 20% of the Medicare approved amount.

How much of Medicare do you have to pay for mental health?

One will be required to pay for 20% of Medicare approved for most doctor services; this will mostly affect outpatient therapy and durable medical equipment. For outpatient mental health services, you will be required to cater for 20% of the Medicare approved amount. This mostly affects instances when you visit a doctor or other health care provider for monitoring or diagnosis of the condition.

Does Medicare have a late enrollment penalty?

Medicare Part A also comes with a late enrollment penalty payment. The Medicare Part A Premiums will be set to go higher by up to 10% requiring one to pay for them for up to twice the number of years one ought to have paid for it.

Will Medicare premiums increase in 2013?

2013 Medicare Premiums are set to rise by $5 a month; this is less than what was anticipated but set to eat up to a quarter of a typical retiree’s cost of living. This will mainly affect social security payments. Deductibles premiums for Medicare part B will increase while premiums for Part A will experience a drop.

How much is Medicare Part B 2021?

Medicare Part B premium 2021: $148.50. Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

How does Medicare calculate Part A premium?

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

How much does Medicare Part A coinsurance increase?

Part A coinsurance increases when your length of stay in a facility increases: 0 to 60 days. 61 to 90 days. You have a lifetime limit of reserve days to use if your stay lasts longer than 90 days. Medicare Part A daily coinsurance rates: Days 0-60: $0. Days 61-90: $371 per day. Lifetime Reserve Days: $742 per day.

What is Medicare Part A deductible?

Medicare Part A Deductible. Most Part A costs come from the inpatient. Inpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facility.

What is Medicare Part A?

Medicare Part A is part of Original Medicare.

How to find affordable Medicare?

If you need help finding an affordable Medicare plan, contact GoHealth. Our licensed insurance agents can help you navigate the different options and see what makes the most sense for you.