What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

Does Medicaid pay for Part B premium?

Does Medicaid pay for Medicare premiums? Medicaid pays Part A (if any) and Part B premiums. Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

How much are Medicare Part B premium?

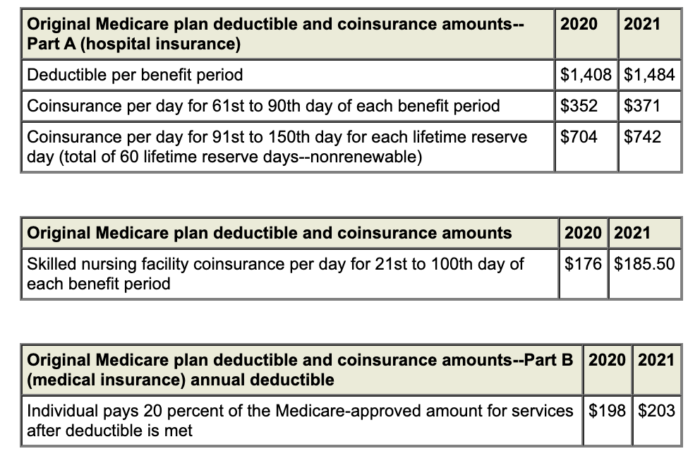

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

How much does Part B insurance cost?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

How much will Medicare B go up in 2022?

$170.10The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

What is premium for Part B in 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022.

Will 2022 Part B premium be reduced?

Medicare Part B Premiums Will Not Be Lowered in 2022.

Will Medicare premiums be going up in 2022?

Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

What tax year is 2022 Medicare premiums?

Part B costs Keep in mind that the government uses your tax return from two years earlier to determine whether you'll pay those monthly adjustments. So for 2022, it would be your 2020 return.

What will the Medicare Part B deductible be in 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

What will Medicare cost in 2023?

CMS finalizes 8.5% rate hike for Medicare Advantage, Part D plans in 2023. The Biden administration finalized an 8.5% increase in rates to Medicare Part D and Medicare Advantage plans, slightly above the 7.98% proposed earlier this year.

Is Medicare going down in 2022?

Medicare's highest-ever price increase in 2022 was driven by estimated costs for the controversial Alzheimer's drug Aduhelm.

Why is Medicare going up so much in 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

What is the COLA for 2022?

5.9%The final COLA for 2022 was 5.9%, which was a 40-year high. Of course, depending on whether the Federal Reserve is successful in its attempts to crack down on inflation, this estimate will likely change over the course of the year before the final COLA is announced in October 2022.

Will Medicare premiums increase in 2023?

After record rate hike this year, Medicare Part B could see a low premium increase for 2023. While Medicare Part B monthly premiums jumped almost 15% in 2022, unexpected savings on a new, expensive drug may mean a much smaller rise in rates for 2023.

What is the Social Security premium rate for 2021?

Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate. The Social Security COLA for 2021 is 1.3%. 3 This is estimated to be an additional $20 per month for the average recipient but the amount could be less.

How long do you have to pay Medicare premiums?

You pay monthly premiums for Medicare. If you do not pay your premiums in a timely manner, your coverage will be taken away. You are given a 90-day grace period to make payments before your Part B coverage is canceled.

What is Medicare Advantage Plan?

Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Does Medicare Part B premium apply to Part D?

However, keep in mind that the holds harmless provision does not apply to Medicare Part D.

Will Medicare premiums increase in 2021?

With a $3.90 increase in monthly premiums for 2021, it is unlikely that many people will have their premiums reduced this year. For those who are dual eligible, Medicaid will pay their Medicare premiums. They will be charged the higher Part B premium rates.

How much is Part B insurance in 2021?

The monthly Part B premiums that include income-related adjustments for 2021 will range from $207.90 to $504.90, depending on the extent to which an ...

How much is the Part B premium?

Total monthly Part B premium amount. Less than or equal to $88,000. Less than or equal to $176,000. $0.00.

Why do Medicare beneficiaries pay less than Medicare?

Some Medicare beneficiaries will pay less than this amount because, by law, Part B premiums for current enrollees cannot increase by more than the amount of the cost-of-living adjustment for social security (railroad retirement tier I) benefits.

What percentage of Medicare beneficiaries pay the larger premiums?

CMS estimates that about 7 percent of Medicare beneficiaries pay the larger income-adjusted premiums. Beneficiaries in Medicare Part D prescription drug coverage plans pay premiums that vary from plan to plan. Part D beneficiaries whose modified adjusted gross income exceeds the same income thresholds that apply to Part B premiums also pay ...

What information does SSA use for 2021?

To make the determinations, SSA uses the most recent tax return information available from the Internal Revenue Service. For 2021, that will usually be the beneficiary’s 2019 tax return information. If that information is not available, SSA will use information from the 2018 tax return. Railroad retirement and social security Medicare beneficiaries ...