Medicare Part C: Varies: Varies: Varies: $7,550 in-network: Private insurers: No: Medicare Part D: $33.06 and up: Varies: Varies: $6,550: Private insurers: Yes: Medigap: Varies ($20 to $500+) Varies: Varies: Varies by plan: Private insurers: No

Full Answer

How much will I pay in Medicare Part D costs?

Dec 25, 2021 · The average Medicare Advantage premium will be around $23. This is lower than Medicare Part D. However, when you have Medicare Advantage, you will still have Part B premiums. In addition to this, youll still have to pay a deductible and coinsurance for your Medicare Advantage plan. In addition to this, your premiums can vary.

How much does Part C Medicare cost?

Jul 30, 2019 · Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.06 in 2021) times the number of full, uncovered months you didn't have Part D or creditable coverage. This penalty is assessed when you enroll, and you’ll pay the higher amount for as long as you keep your Part D coverage.

How to reduce Medicare Part D cost?

Feb 15, 2022 · What is the average cost of Medicare Part D prescription drug plans? In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month. 1. Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location. Learn about the average cost of Part D plans in your state.

What is the average cost of Medicare Part D?

Medicare drug coverage (Part D) late enrollment penalty . The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period ends, there’s a period of 63 or more days in

Is there Medicare Part C and D?

You can't have both parts C and D. If you have a Medicare Advantage plan (Part C) that includes prescription drug coverage and you join a Medicare prescription drug plan (Part D), you'll be unenrolled from Part C and sent back to original Medicare.

What does Medicare C and D cover?

Medicare is a federal insurance plan. Medicare Part C combines the benefits of Part A and Part B, while Medicare Part D covers prescription drugs. Medicare Part A and Part B are known collectively as original Medicare. Part A covers hospital costs, and Part B covers other medically necessary expenses.

What is the average cost of a Medicare Advantage plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

How much does a plan C cost?

For 2022, the average cost of a Medicare Part C plan with prescription drug coverage is $33 per month....What's the average cost of Medicare Part C?Medicare Part C plan type# of plans offeredAverage monthly costRegional PPO29$805 more rows•Jan 24, 2022

What is the difference between Medicare C and D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the highest rated Medicare Advantage plan?

The Aetna Medicare Advantage plans are number one on our list. Aetna is one of the largest health insurance carriers in the world. They have earned the title of an AM Best A Rated Company. These plans have options- HMO or PPO, zero or low premiums, and added benefits.

Is there a premium for Medicare Part D?

How much does Part D cost? Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Is Medicare Part C or Part G better?

Medicare Choices at Age 65: Why a Medicare Supplement Plan G is often the best option. Strong financial pressures exist for most private health insurance companies to initially direct new enrollees to a Medicare Advantage plan. A Medicare Supplement Plan G is a much better choice for many.

Does Medicare Part C cost more?

Medicare Part C premiums vary, typically ranging from $0 to $200 for different coverage. You still pay for your Part B premium, though some Medicare Part C plans will help with that cost.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Who sells Medicare Advantage plans?

Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live. This guide shows the average cost of Medicare Part C plans in each state.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the difference between generic and brand name drugs?

Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more. Medicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

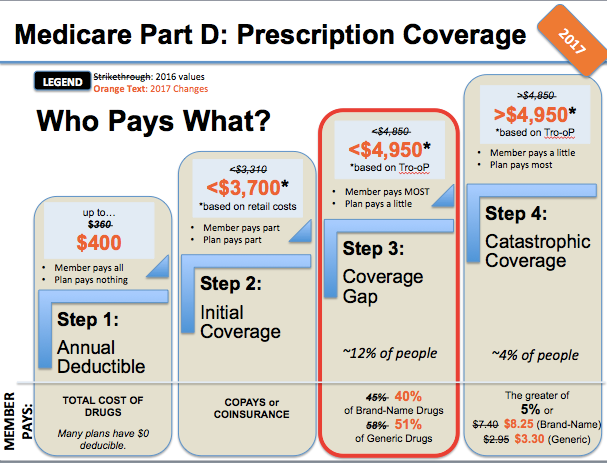

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

How many enrollment periods are there for Medicare Advantage?

There are 2 separate enrollment periods each year. See the chart below for specific dates.

What is the late enrollment penalty for Medicare?

The late enrollment penalty is an amount that’s permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Medicare drug coverage or other creditable prescription drug coverage. Creditable prescription drug coverage is coverage (for example, from an employer or union) that’s expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage. If you have a penalty, you’ll generally have to pay it for as long as you have Medicare drug coverage. For more information about the late enrollment penalty, visit Medicare.gov, or call 1‑800‑MEDICARE (1‑800‑633‑4227). TTY users can call 1‑877‑486‑2048.

What are the special enrollment periods?

When certain events happen in your life, like if you move or lose other insurance coverage, you may be able to make changes to your Medicare health and drug coverage. These chances to make changes are called Special Enrollment Periods. Rules about when you can make changes and the type of changes you can make are different for each Special Enrollment Period.

How long does it take to get Medicare Part D?

Like Medicare Part C, you are eligible to enroll in Medicare Part D during the seven-month period around your 65th birthday—beginning three months before the month of your 65th birthday, including the month of your birthday, and up to three months after the end of your birthday month.

How much is Medicare Part A 2020?

The 2020 Medicare Part A premium for those who do not qualify for $0 premiums is either $252 or $458 per month, depending on how long you worked and paid Medicare taxes.

What is Medicare Part A?

Medicare Part A (also known as hospital insurance) is a basic insurance plan that covers medical services related to inpatient hospitalization and skilled nursing care. It is offered at low or no cost to Americans who are 65 years old and have contributed toward Social Security, as well as other qualified individuals.

How much is the 2020 Social Security premium?

Premium: $0 per month. 2020 Deductible: $1,408 for each benefit period. The 2020 Medicare Part A premium for those who do not qualify for $0 premiums is either $252 or $458 per month, ...

Who administers Medicare Part A and B?

While Medicare Part A and Medicare Part B are administered by the Centers for Medicare and Medicaid Services (CMS ), Medicare Part C and Medicare Part D are managed by private insurance companies. Medicare is similar to the health insurance coverage you’ve probably had with an employer or an individual policy.

When does an IEP start?

Your IEP begins three months before the month of your 65th birthday, includes your birth month, and lasts up to three months after your birthday month. When you apply for Social Security benefits, you’re automatically enrolled in Medicare Part A.

How to get Medicare Part D?

Either way you decide to get Medicare Part D coverage, there are a few things to keep in mind: 1 Not every plan will cover every prescription drug. If you’re on medications, you might want to make sure your Medicare prescription drug plan covers them. Each plan has its own formulary – that’s a list of prescription drugs the plan covers. 2 Even if you find a plan that covers your prescriptions, know that a plan may change its formulary anytime. Your plan will notify you when necessary. 3 Every fall, your plan will send you Annual Notice of Change and Evidence of Coverage documents. Check to see how your coverage may be changing next year, including if any of your medications will be dropped from the formulary, or if your costs are going up. 4 You don’t have to sign up for prescription drug coverage under Medicare Part D. But if you decide to sign up after your Medicare Initial Enrollment Period, you could face a Part D late enrollment penalty.

Does Medicare have a spending limit?

Medicare Advantage plans have annual maximum out-of-pocket spending limits. If you pay up to that limit within a calendar year, the plan generally pays for your covered medical expenses for the rest of that year. This spending limit may vary from plan to plan and from year to year.

Does Medicare cover all prescriptions?

Not every plan will cover every prescription drug. If you’re on medications, you might want to make sure your Medicare prescription drug plan covers them. Each plan has its own formulary – that’s a list of prescription drugs the plan covers. Even if you find a plan that covers your prescriptions, know that a plan may change its formulary anytime.