What is the average cost of Medicare Part C?

52 rows · Jan 21, 2022 · The chart below shows the average monthly premium for Medicare Part C plans in 2018. 1 Florida Medicare Advantage plans had the lowest monthly costs, with average premiums of $3.34 per month in 2018. Minnesota Medicare Advantage plans had the highest monthly costs. Average Part C premiums in Minnesota were $131.73 per month in 2018.

Which part of Medicare requires premium payment?

Nov 17, 2021 · Your Medicare Part C plan premium is the cost you must pay – typically monthly – to belong to the plan. In 2022, the average premium for a Medicare Part C plan is around $63 per month . This varied from plans with premiums as low as $38 per month in Maine and South Carolina to as high as over $100 per month in North and South Dakota, Massachusetts, …

How much is the deductible for Medicare Part?

Medicare Part C Costs. You will still have to pay your Medicare Part B premium (Part A is free for most people anyway), and – depending on the Part C plan you choose – may or may not have an additional monthly premium for Part C. Overall, Medicare Part C plans provide an economical option. Some providers even offer zero dollar plans, where ...

What does Medicare Part C cover and cost?

Sep 30, 2021 · While the average cost for Medicare Part C is $25 per month, it’s possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of...

How much does a plan C cost?

What's the average cost of Medicare Part C?Medicare Part C plan type# of plans offeredAverage monthly costHMO-POS202$47Cost plan13$53PFFS19$77Regional PPO29$802 more rows•Jan 24, 2022

Is there a premium for Part C?

While the average cost for Medicare Part C is $25 per month, it's possible to get a Medicare Advantage plan with a $0 monthly premium. In fact, according to Kaiser Family Foundation, 60 percent of Medicare Advantage plan enrollees pay no premium for their plan, other than their Medicare Part B premium.Sep 30, 2021

Does Medicare Part C require premiums?

Medicare Part C, or Medicare Advantage, is a bundled alternative to traditional Medicare that includes coverage for parts A and B. People with Medicare Part C still have to pay their monthly premium for Part B, but they may get Part A without a monthly charge. A standalone Part C premium may also apply.Mar 30, 2020

How are Medicare Part C premiums paid?

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan.Nov 8, 2021

What is the difference between Medicare Advantage and Medicare Part C?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

Is Medicare Part C the same as Medicare Advantage?

The takeaway Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great option for people interested in coverage for prescription drugs, vision and dental services, and more.

What is covered by Medicare Part C?

What Does Medicare Part C Cover?Routine dental care including X-rays, exams, and dentures.Vision care including glasses and contacts.Hearing care including testing and hearing aids.Wellness programs and fitness center memberships.

How can a Medicare Advantage plan have a $0 premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

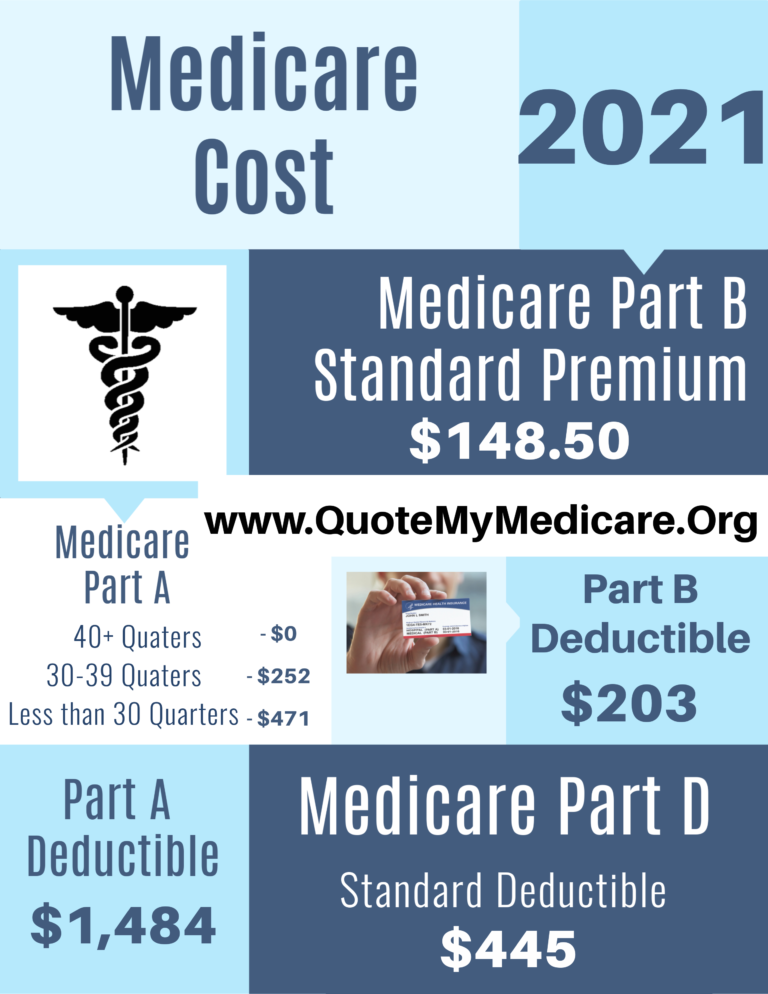

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How much does Medicare cost at age 83?

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

Is Medicare Part C tax deductible?

Part B premiums are tax deductible as long as you meet the income rules. Part C premiums. You can deduct Part C premiums if you meet the income rules.

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Who sells Medicare Part C?

Medicare Part C is sold by private insurance companies who are free to set their own prices according to market competition. Location. It’s not uncommon for a Medicare Part C plan to cost more in a big city than in a rural area, just as the overall cost of living will often be different between the two locations.

What is the Medicare Part C premium for 2021?

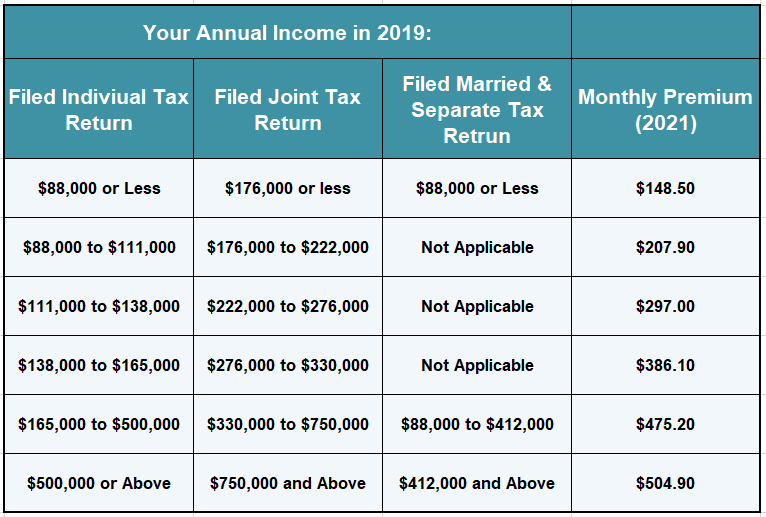

One of the eligibility requirements for belonging to a Medicare Part C plan is maintaining enrollment in Original Medicare (Medicare Part A and Part B). Most people do not pay a premium for Medicare Part A. However, Medicare Part B requires a standard monthly premium of $148.50 in 2021, and higher income earners may have to pay an additional surcharge.

Why are Medicare premiums so low?

A big reason for the low monthly premiums is that many beneficiaries are enrolled in $0 premium Medicare Advantage plans. In fact, 60% of beneficiaries enrolled in Medicare Advantage plans with prescription drug coverage (known as MA-PD plans) pay no monthly premium for their plan. And 96% of all beneficiaries have access to at least one $0 plan.

What is a copayment for a doctor?

A copayment is similar to coinsurance but comes in the form of a flat fee instead of a percentage. When you visit a doctor using your Part C plan, you might be responsible for a $20 copayment for the visit and your plan will cover the rest of the cost.

What is 20% coinsurance?

For example, a 20% coinsurance means you would pay for 20% of your medical bill and your Part C plan would pick up the remaining 80%. Most Medicare Part C plans have coinsurance requirements ...

How much is Medicare Part B in 2021?

However, Medicare Part B requires a standard monthly premium of $148.50 in 2021, and higher income earners may have to pay an additional surcharge. Even though you will be getting your Part B coverage through your Medicare Advantage plan, you must still pay the Part B premium in order to maintain your enrollment.

What is the MA PD deductible?

Deductible. A deductible is the amount you must pay out of your own pocket for covered care before the plan’s coverage kicks in. Some Part C plans have a separate deductible for medical care and drug coverage. The average drug deductible for MA-PD plans is $167.31 per year in 2021. Some Medicare plans may feature $0 deductibles.

Medicare Part C Costs

You will still have to pay your Medicare Part B premium (Part A is free for most people anyway), and – depending on the Part C plan you choose – may or may not have an additional monthly premium for Part C.

What does Medicare Part C cover?

Part C plans must be authorized by Medicare and offer at least the same benefits by private health insurance companies. Many Medicare Advantage plans provide further benefits to be competitive, such as prescription drug coverage, wellness and fitness memberships, or even include help with dental care, eyeglasses, or hearing aids.

Who is eligible for Medicare Part C?

Anyone who is eligible for Medicare. Private Part C Plan providers are not allowed to turn down any individual according to health conditions, so choosing a Medicare advantage plan really could be a wise decision for less healthy applicants.

How to compare Medicare Part C Plans?

Looking for the best and most cost-effective Medicare Advantage insurance policy can be a discouraging adventure. There are many solutions but not all alternatives are created for anyone.

Medicare Part C Ratings

Advantage plans with more than 500 enrollees are officially rated on a 5 star scale by the federal government agency CMS. A superior rating means further federal government funds for the plan provider which may likely help to maintain rates low and help beneficiaries compare plans.

Is Medicare Part C the same as Medigap?

No, it’s not. ‘ Medigap ‘, also referred to as ‘Medicare supplement plans’ or ‘Supplemental insurance’ is the other option to upgrade your original Medicare. Instead of replacing your Part A and B with a private Part C insurance, a Medigap policy adds additional coverage to original Medicare.

Medicare Part C vs. Medigap (Medigap Supplement plans)

With a supplemental insurance you don’t have to use a network of health care providers and therefore a wider choice of doctors. However, compared to advantage plans, the benefits are typically less and the total costs higher.

How much is Medicare Part B premium?

For 2020, the Centers for Medicare and Medicaid Services announced that the standard monthly premium for Medicare Part B enrollees is $144.60. Medicare Part C works differently than Original Medicare. Medicare Advantage plans are offered by private companies approved by Medicare.

What is a Medicare deductible?

Deductible Your deductible is how much you have to pay before your Medicare Advantage plan begins to pay for covered services. For example, if you have a $2,000 deductible, you pay for the first $2,000 in covered services yourself. Once you reach your deductible, you typically only pay your copayment or coinsurance for covered services, ...

What happens when you reach your deductible?

Once you reach your deductible, you typically only pay your copayment or coinsurance for covered services, and your insurance pays for the rest of the cost. In general, the lower your deductible, the higher your premium will be. Once you reach your deductible, you may have a copayment or coinsurance. Copayment Your copayment is how much you pay ...

How much does Medicare cost in 2020?

According to the Kaiser Family Foundation, the average monthly premium for enrollees of Medicare Part C plans was $25 for 2020. With Medicare Advantage plans, Medicare pays a fixed amount toward your care each month to the private companies providing Medicare Part C plans. While the average cost for Medicare Part C is $25 per month, ...

What is coinsurance in health insurance?

Coinsurance This is the percentage of health services you have to pay for after you’ve reached your deductible. For example, your plan may have a 20 percent coinsurance rate for doctor visits. Plans with lower monthly premiums tend to have higher coinsurance rates.

What is a copayment after deductible?

Once you reach your deductible, you may have a copayment or coinsurance. Copayment Your copayment is how much you pay for covered health services after you reach your deductible. For example, you may have a $20 copay for doctor visits. Once you reach your deductible, you’ll pay only $20 every time you see a doctor.

Is Medicare Part C run by the government?

Medicare Part C isn’t run by the government, so you’ll have to pay for Medicare Advantage plans. iStock. Medicare Advantage plans, often called Medicare Part C, are an alternative option to Original Medicare. Instead of having to get separate Part A (hospital insurance), Part B (medical insurance), and prescription drug coverage, ...

What are the benefits of Medicare Part C?

Medicare Part C is an alternative to traditional Medicare. Some people may choose a Medicare Part C plan for the following reasons: 1 They have a medical condition that requires specific services and medications. Medicare Part C offers Special Needs Plans for people with specific conditions, such as congestive heart failure or diabetes. These targeted plans may provide cost savings to a person. 2 They need additional services that Medicare does not offer, such as hearing or vision care. 3 They receive benefits under a group plan. Some employers and unions offer their retired employees a group plan under Medicare Advantage. These firms may provide additional services at a lower cost to their former employees. An estimated 19% of all Part C enrollees are part of an employer- or union-sponsored group plan, according to the KFF.

How much will Medicare Part C cost in 2021?

A person with Medicare Part C will still need to pay the monthly Part B premium. For 2021, this premium amounts to $148.50. The Social Security Administration will typically deduct this premium amount from a person’s check.

How much does Medicare pay for donut holes?

However, Medicare has an arrangement with drug manufacturers to provide these medications at no more than 25% of the original cost. Once a person spends $6,550 in the donut hole, they pay 5% of prescription drug costs. Each Medicare Part C plan has a different list of drugs, called a formulary.

What is a formulary in Medicare?

Each Medicare Part C plan has a different list of drugs, called a formulary. This list separates medications into categories, including generic, brand name, and premium drugs. If a doctor prescribes generic drugs under a person’s Medicare Part C plan, the person will save on medication costs.

How much is Part D 2021?

The deductible could be up to $445 before a person begins to pay their copayments or coinsurance. Once a person meets their deductible, they will pay coinsurance for medications.

What is the donut hole in Medicare?

Once a person meets their deductible, they will pay coinsurance for medications. This should come to no more than 25% of the total drug cost, up to a limit of $4,130. Once a person reaches the $4,130 spending limit, they become responsible for their drug costs. This coverage gap is known as the “ donut hole .”.

How much is Medicare Advantage 2020?

For 2020, the average monthly premium cost for all Medicare Advantage plan types was $25, according to the Kaiser Family Foundation (KFF). Different Medicare Advantage plan types are available.

What is Medicare Part C premium?

The premium you may pay is used to cover the wider range of services available with Medicare Part C . The Medicare-approved private insurance companies that offer Medicare Part C coverage decide what services the plans will cover, so monthly premiums vary from plan to plan and state to state. Insurance companies are only allowed to make changes ...

When are Medicare premiums due?

Premiums are due the 25th of every month and coverage will end in the fourth month if past due payments are not made. Contact your Medicare Part C provider if you think you will miss a payment. Private insurance companies have their own rules on plan cancellation for nonpayment.

How is Medicare Part B billed?

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Here’s how you pay Medicare and your private insurance company. Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, ...

What happens if you don't receive Medicare?

If you don’t receive these benefits, you will receive a bill called ‘Notice of Medicare Premium Payment Due’. You can then pay by mailing a check, use your bank’s online billing to make payments every month, or sign-up for Medicare’s bill pay to have the premium come out of your bank account automatically.

What is Medicare Advantage?

A Medicare Advantage plan is health insurance offered by Medicare-approved private insurance companies. It’s a single plan that includes all Original Medicare (Part A and Part B) ...

What is the Medicare Advantage premium for 2020?

What Is the Premium for Medicare Advantage? In 2020, the average monthly premium for plans that include Medicare Part D prescription drug (MA-PD) benefits is $25, according to the Kaiser Family Foundation. (The average monthly premium is weighted by enrollment.)

How much is Medicare Part B 2021?

Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate. Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What are the added costs of Medicare Part C?

The added costs of Medicare Part C are in proportion to the extras that you receive for a private health insurance plan. Most plans include prescription drug coverage, vision and dental, as well as wellness programs and hearing care.

What is Medicare Part C?

Medicare Part C, which is also called Medicare Advantage, is a combination of A and B with various extras depending on plan type. Part C is sold through private companies, but it’s also partially sponsored by the government.

How much is Medicare Part B 2020?

Medicare Part B has a standard monthly premium of $144.60 for new enrollees in 2020, with a yearly deductible of $198. These amounts increase to $148.50 and $203, respectively, in 2021.

How much does Medicare Advantage cost in 2021?

With Medicare Advantage, you pay a Part B premium and a premium for your Medicare Advantage plan. Premiums for Medicare Advantage average less than $30 in 2021. And as we said earlier, there are Medicare Advantage with zero dollar premiums, meaning you’ll pay nothing on top of your Part B premium for this coverage.

What changes did the Affordable Care Act make to Medicare?

In 2014, the Affordable Care Act changed the healthcare system in America and also changed small parts of Medicare. The only real change that most people noticed is that now Medicare and Medicare Advantage plans must include preventive care and cannot reject anyone for pre-existing conditions.

How long do you have to be in Medicare for the first time?

Enroll in a Medicare Advantage plan for the first time. During the 7-month period surrounding your 65 th birthday (three months before you turn 65, the month you turn 65, and three months after you turn 65) Under 65 and disabled. Enroll in a Medicare Advantage plan for the first time.

Which is better, Medicare Part D or Medicare Part C?

Medicare Part D is prescription drug coverage. Medicare Part C is one of the better plans to go with if you’re in need of healthcare and want a more affordable, government-sponsored option that provides more than what Original Medicare offers. There are various plans that qualify as Medicare Advantage.

Additional Medicare Costs

- As with most any type of health insurance, the monthly premium isn’t the only cost to beneficiaries. Below is a look at the other cost requirements for Medicare Part C plan members.

Out-Of-Pocket Limits

- One of the advantages of a Medicare Part C plan is that they are required by law to include an annual out-of-pocket limit. An out-of-pocket limit (or out-of-pocket maximum) is the highest amount that you will be required to pay for covered care out of your own pocket over the course of the year. Once that limit is reached, the plan then pays for 100% of covered care for the remaind…

Factors That Affect Cost

- There are a few different factors that can affect the cost of a Medicare Part C plan. 1. Carrier Medicare Part C is sold by private insurance companies who are free to set their own prices according to market competition. 2. Location It’s not uncommon for a Medicare Part C plan to cost more in a big city than in a rural area, just as the overall co...

Compare Medicare Part C Plan Costs in Your Area

- Plan pricing is not always made readily available on an insurance company’s website. But a licensed insurance agent can help you gather up the costs for the various Medicare Part C plans available in your area and help you better understand the terms and conditions of each. You can also compare plan costs online from multiple different insurance companies.