What is covered by Medicare Part D?

QUINCY (WGEM) - For those of you with a Medicare D plan, a list of vaccines is now covered for you in Adams County. Starting on Monday, the Adams County Health Department will begin offering vaccines for Shingles, Tetanus, Hepatitis A and B, and more.

Who is eligible for Medicare Part D?

Medicare Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don ...

Can Medicare Part D be deducted from Social Security?

recognize that they can offer that only because the government pays them a fixed amount for your care from the Medicare Part B premium taken from your Social Security. The Part B premium you are paying from your Social Security benefit is why your Medicare ...

What is Medicare Plan D deductible?

What is the Medicare Part D coverage gap (“donut hole”)?

- Brand-name drugs. Once you hit the coverage gap, you will owe no more than 25 percent of the cost of the brand-name prescription drugs covered by your plan.

- Generic drugs. Once you hit the coverage gap, you will owe 25 percent of the cost of the generic drugs covered by your plan.

- Catastrophic coverage. ...

What is the current deductible for Medicare Part D?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year.

What is the deductible for Part D in 2021 & 2022?

$480Most Part D PDP enrollees who remain in the same plan in 2022 will be in a plan with the standard (maximum) $480 deductible.

What is the Medicare D deductible for 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

Does Medicare have a $200 deductible?

For 2019, it increased slightly, to $185. And for 2020, it increased by another $13, to $198. The $5 increase in 2021 pushed it over $200 for the first time, with the 2021 Part B deductible reaching $203. And for 2022, the increase was fairly significant, pushing the deductible to $233.

How much is the 2021 Medicare deductible?

$203 inThe annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the 2021 Part D premium?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Do all Part D drug plans have a deductible?

Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

How do I avoid the Medicare Part D donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

How much is Part D insurance in 2020?

Nationwide, the average monthly Part D premium in 2020 is $30. 1 If you find a plan that’s cheaper, it might be tempting to snag it and call it a day. Unfortunately, premiums aren’t the only cost Part D beneficiaries encounter. You may also come up against deductibles, copayments or coinsurance, and other out-of-pocket costs.

What is Part D copayment?

Copayments and coinsurance are similar: they represent the portion of costs you pay for your Medicare prescription drugs after you meet your deductible. The difference is in the way insurers calculate those portions. Copayment: a set dollar amount—such as $10—that you pay for covered prescription drugs.

What is Medicare premium based on?

The Medicare portion based on your income. The insurer’s portion, which varies from plan to plan. The Medicare portion of your premium depends on your Modified Adjusted Gross Income (MAGI) from your most recent tax return.

Is eligibility.com a Medicare provider?

Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Does CMS charge late enrollment penalties?

CMS adds late enrollment penalties onto your monthly Part D premium s if you don't enroll when you're first eligible. The longer you wait to join, the higher the fee if you do eventually enroll. These fees will apply for as long as you have Part D coverage.

Does Part D change?

Your Part D coverage changes as you spend. Throughout the year, the portion of drug costs you pay will change. That’s because you’ll enter different phases of coverage. The first phase begins as soon as your coverage starts with a pre-deductible phase.

Can you see your Part D coverage?

When you apply for a Part D plan with an insurer, it might see proof of creditable coverage in your records. If not, the company sends you a form to fill out with your previous coverage information. To make this process easy on yourself, keep records of your prescription drug coverage.

How much is deductible for Part D?

First, plans are allowed by law to charge deductibles of as much as $435 in 2020, up $20 from 2019's levels. However, Part D plans don't have to charge the full amount, or any deductible at all. Also, Part D plans can set fixed copays or certain coinsurance percentage amounts to require participants to bear some of the costs ...

How much is the catastrophic coverage level for Part D?

Once the total of your cost and the value of any manufacturer discounts you received on your prescription drugs hits $6,350, you'll reach the catastrophic coverage level.

What is Medicare Part A?

Medicare is an essential part of how retirees manage their finances. Historically, Medicare recipients only had access to hospital coverage under Part A and outpatient medical services like doctor visits under Part B.

Why is Medicare Part D important?

In its short history, Medicare Part D has become quite popular, and it's important for those retirees struggling to make ends meet. Looking into Part D coverage can be the best move an older American can make to protect their health.

How much does Medicare pay for married filing separately?

Data source: Medicare. Note: Married persons filing separately who live together at any time during the year pay $70 if their income is $87,000 to $413,000, or $76.40 if their income is more than $413,000. There are a few other costs you might have to pay.

Does Medicare Part D cost?

As with coverage options, what you'll pay for various Medicare Part D plans can differ substantially. Some Part D plans are actually available at no cost at all , although their coverage of prescription drugs tends to be limited, at best. More comprehensive plans typically charge at least modest monthly premiums.

Can Part D plans have higher copayments?

Some plans put drugs into categories, some of which have higher copayments than others. Plans can require using certain pharmacy benefit management companies to fill prescriptions. However, there are limits on how much flexibility Part D plans have.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is the Medicare premium for 2020?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due ...

How much will Medicare premiums decline in 2020?

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage ...

What percentage of Medicare Part B premiums are based on income?

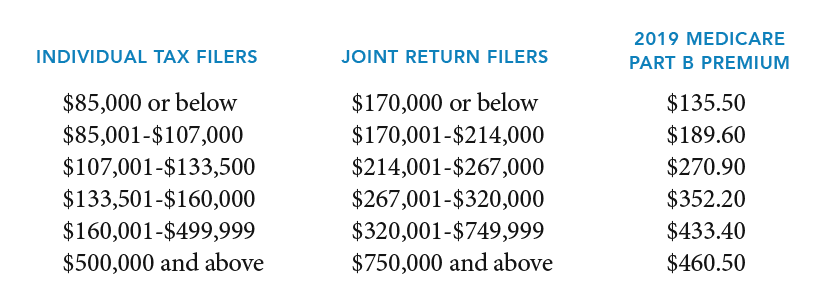

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

What is Medicare Part A premium?

491.60. Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much is coinsurance for 2020?

In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61st through 90th day of a hospitalization ($341 in 2019) in a benefit period and $704 per day for lifetime reserve days ($682 in 2019). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

Why is the Part B premium going up?

The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible. From day one, President Trump has made it a top priority to lower drug prices.

Do you have to file a separate tax return for a high income beneficiary?

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is the maximum deductible for Medicare Part D 2021?

In 2021, the maximum deductible for Medicare Plan D is $445. Medicare Part D helps pay for brand name and generic drugs that have been prescribed by a doctor. A person must have original Medicare, parts A and B, to be eligible for a PDP. Private insurance companies approved by Medicare administer Part D plans, and they must provide ...

How much is a deductible for Medicare 2021?

Some Medicare plans, such as Medicare Part D, are administered by private insurance companies. In 2021, private insurance companies may not charge more than $445 for the Part D deductible. In this article, we discuss what is covered by Medicare Part D, ...

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is a Medicare deductible?

What is a deductible? A deductible is the amount of money a person pays for their healthcare before their insurer starts to cover costs. Medicare Part D charges a deductible that usually changes each year. As a general rule, the higher the deductible, the lower the monthly premium.

What will Medicare cover in 2021?

According to the Kaiser Family Foundation (KFF), in 2021, around 89% of Medicare Advantage plans will include cover for prescription drugs. An individual can compare plans using the Medicare Advantage plan finder.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.