2013 Medicare Part B monthly premium: $104.90: $146.90: $209.80: $272.70: $335.70: 2013 Medicare Part D monthly premium: premium only: $11.60 surcharge: $29.90 surcharge: $48.10 surcharge: $66.40...

What determines the cost of a Medicare Part D plan?

9 rows · begins once you reach your Medicare Part D plan’s initial coverage limit ($2,970 in 2013) ...

How much does Medicare Part D prescription drug coverage cost in 2021?

Apr 03, 2013 · Medicare prescription drug coverage (Part D) costs. Plan premiums vary by company: There is NOT a plan offered by Medicare. They are all offered by private insurance companies. Based on 2011 returns for 2013. Single and joint returns listed . single $85,000 or less: joint $170,000 or less Your plan premium

Does Medicare Part D have a deductible?

Dec 02, 2012 · Mary Pat Whaley discusses collecting Part B Medicare deductibles, and gives information on Medicare Parts A, B, C and D for the new year. The Part B Medicare deductible for 2013 is $147.00. What should you do with this information?

What is the donut hole for Medicare Part D in 2022?

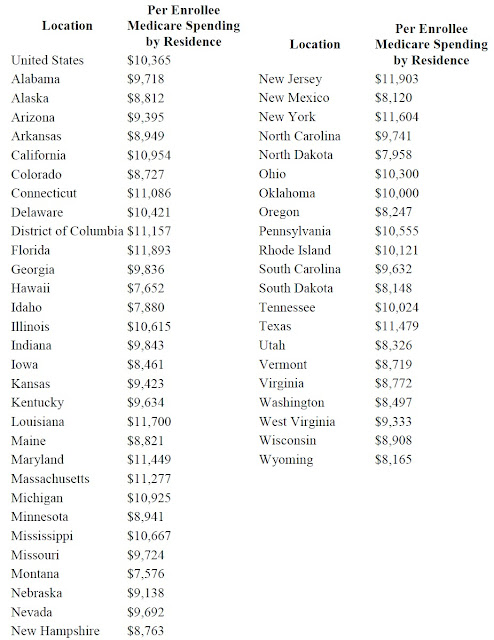

Nov 18, 2021 · How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2022 is $47.59 per month.. The average Part D plan deductible in 2022 is $367.80 per year. 1. The table below shows the average premiums and deductibles for Medicare Part D plans in 2022 for each state.

What were Medicare premiums in 2013?

Today we announced that the actual rise will be lower—$5.00—bringing 2013 Part B premiums to $104.90 a month. By law, the premium must cover a percent of Medicare's expenses; premium increases are in line with projected cost increases.Nov 16, 2012

What was the Medicare premium for 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What is the annual cost of Medicare Part D?

Want to make changes to your Part D coverage? Discuss your options with a licensed Medicare advisor at 1-844-309-3504. The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

What were Medicare Part D premiums in 2018?

The average monthly premium for Medicare Advantage plans in 2018 was $12 and in 2019, the amount was $8. Prescription drug plan premiums also decreased slightly, from $26 in 2018 to $25 in Medicare costs 2019.Dec 30, 2021

What was the Medicare deductible in 2014?

$1,216The Medicare Part A deductible that beneficiaries pay when admitted to the hospital will be $1,216 in 2014, an increase of $32 from this year's $1,184 deductible. The deductible covers beneficiaries' costs for up to 60 days of Medicare-covered inpatient hospital care in a benefit period.Oct 28, 2013

What was Medicare Part B premium in 2016?

Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the maximum out of pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

What are 2021 Medicare premiums?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the premium for Medicare Part B for 2019?

$135.50The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is Part B insurance?

Part B includes coverage for: Services from doctors and other health care providers.

How long is the Medigap open enrollment period?

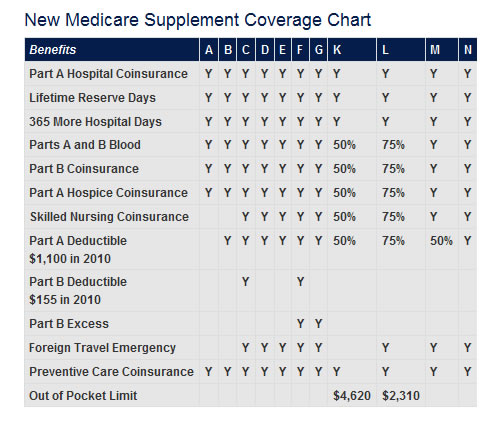

Patients have a one-time 6-month Medigap Open Enrollment Period which starts the first month they are 65 and enrolled in Part B. This period gives patients a guaranteed right to buy any Medigap policy sold in their state regardless of their health status.

Do some insurance plans have deductibles?

Some plans have deductibles and some do not . Most drug plans have a coverage gap referred to as the “donut hole”, which means coverage is temporarily limited after the patient and drug plan have spent a certain amount for covered drugs.

Does Medicare Advantage have a deductible?

Medicare Advantage Plans: Part D: Medicare Drug Coverage for 2013 – monthly premiums will vary based on income, and whether or not Part D is included if the patient opts for Part C coverage. Some plans have deductibles and some do not. Most drug plans have a coverage gap referred to as the “donut hole”, which means coverage is temporarily limited ...

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

How much did Medicare increase in 2016?

will increase from $4,700 in 2015 to $4,850 in 2016. begins once you reach your Medicare Part D plan’s initial coverage limit ($3,310 in 2016) and ends when you spend a total of $4,850 in 2016.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

How much does a generic cost for Part D?

For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.70 for generic drugs and $9.20 for brand-name medications each month or 5% the cost ...

What is NBBP in Medicare?

The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. Your best bet is to avoid Part D penalties altogether, so be sure to use this handy Medicare calendar to enroll on time.

How much will a generic drug cost in 2020?

The remaining costs will be paid by the pharmaceutical manufacturer and your Part D plan. 6 . For example, if a brand-name drug costs $100, you will pay $25, the manufacturer $50, and your drug plan $25. For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket ...

How much was Medicare Part B in 2014?

How much will I pay in premiums for Medicare Part B in 2014? And is there still a high-income surcharge for Part B and Part D prescription-drug coverage? The monthly premium for Medicare Part B remains $104.90 for most people in 2014 – the same as in 2013.

How much did Medicare deductible increase in 2014?

The Centers for Medicare and Medicaid Services also announced that the Medicare Part A deductible, which people pay when admitted to the hospital, will increase by $32 in 2014, to $1,216.

What is the Part B and Part D surcharge based on?

Both the Part B and Part D surcharges are based on your income in 2012, which is the last tax return the government has on file for most people.

What is the income limit for seniors in 2012?

Seniors whose 2012 adjusted gross income (plus tax-exempt interest income) was more than $170,000 if married filing jointly or $85,000 if single will continue to pay higher premiums, as they have since 2007. The high-income surcharges remain the same as in 2013.