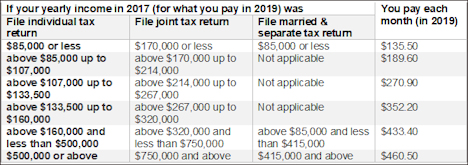

Medicare Part D In 2018

| If you earned (single tax filing): | If you earned (joint tax return): | You’ll pay: |

| Up to $85,000 | Up to $170,000 | The plan premium |

| Over $85,000 to $107,000 | Over $170,000 to $214,000 | $13.30 + plan premium |

| Over $107,000 to $160,000 | Over $214,000 to $320,000 | $34.20 + plan premium |

| Over $160,000 to $214,000 | Over $320,000 to $428,000 | $55.20 + plan premium |

Who is eligible for Medicare Part D?

6 rows · Part D coverage varies by plan, but as mentioned above, there are caps in place that all plans ...

How to compare Medicare Part D plans?

4 rows · Nov 24, 2017 · Part D plans can't charge a deductible that's more than $405 in 2018, but you can find many ...

What is the average cost of Part D?

Feb 16, 2018 · This is partially due to the fact that private insurance companies provide Part D benefits and can set their own prices according to what their customers need in coverage, but the average nationwide monthly premium for 2018 is $34.

How much does Medicare Plan D cost?

Part D plans can't charge a deductible that's more than $405 in 2018, but you can find many plans that charge less. Some Part D plans don't have any deductible at all.

What were Medicare Part D premiums in 2018?

The average monthly premium for Medicare Advantage plans in 2018 was $12 and in 2019, the amount was $8. Prescription drug plan premiums also decreased slightly, from $26 in 2018 to $25 in Medicare costs 2019.Dec 30, 2021

What were Medicare Part D premiums in 2019?

2019 Medicare Part D premiums The average Part D plan premium in 2019 is around $41.21 per month, which is a 2 percent increase from the 2018 average premium. Part D plan premiums can also be subject to a Medicare IRMAA for higher income earners.

What is the annual cost of Medicare Part D?

Want to make changes to your Part D coverage? Discuss your options with a licensed Medicare advisor at 1-844-309-3504. The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

What is the cost of Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Can Medicare Part D be deducted from Social Security?

If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit or to pay the plan provider directly.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the max out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

How Much Does Medicare Part D Cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency th...

What Does Medicare Part D Cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers. Often, you...

Don't Miss Out on The Prescription Drugs That You Need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their hea...

Find out more about your Medicare prescription drug benefits

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

How much does Medicare Part D cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency that oversees Medicare doesn't set fixed amounts for most of those costs.

What does Medicare Part D cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers.

Don't miss out on the prescription drugs that you need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their healthcare expenses. By finding out what a Part D plan will cover and how much it will cost, you'll be in a better position to choose the right plan to meet your specific medical needs.

What is Medicare Part D?

Prescription drug coverage, or Medicare Part D, is a relatively new feature of Medicare, but millions of seniors take advantage of the program to help lower their prescription drug costs. Here’s what you need to know about Medicare Part D and the costs for 2018.

How long do you have to sign up for Part D?

If you want to enroll in Part D coverage, make sure you do it at the right time: the seven-month period around your 65 th birthday month, including the three months leading up to it. If not, you could be penalized for signing up 63 days or more after your Initial Enrollment Period is over. If you don’t sign up during your Initial Enrollment Period, you will have to wait for the Fall Open Enrollment Period, which is October 15 – December 7, and you could be penalized.

What is the coverage gap for prescription drugs?

Once your out-of-pocket drug costs have reached $3,750, you fall into the coverage gap, also known as the donut hole. This means your plan stops paying for your prescription drugs until you reach catastrophic coverage. For 2018, catastrophic coverage begins once your out-of-pocket expenses have reached $5,000. Until you reach that, there are coverage gap discounts available to you: in 2018, name brand drugs will be discounted 65% and generic drugs will be discounted 56%. All payments (including discounts) will count toward your out-of-pocket costs and help you reach catastrophic coverage.

Do Part D plans require copays?

Copays and coinsurance are also typical under Part D plans. Some plans require you to pay a certain percentage of prescription drug costs (coinsurance), while others charge a fixed dollar amount (copayment). Prescription drug costs also depend on whether the drug is name brand or generic.

How many Medicare beneficiaries are in Part D?

Enrollment. More than 43 million Medicare beneficiaries, or 72 percent of all Medicare beneficiaries nationwide, are enrolled in Part D plans. This total includes plans open to everyone and employer-only group plans for retirees of a former employer or union (Figure 2). Most Part D enrollees (58 percent) are in stand-alone prescription drug plans ...

How much is Part D PDP?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred. Overall, average monthly PDP premiums increased by a modest 2 percent in 2018.

How much is the PDP premium in 2018?

Deductibles: More than 4 in 10 PDP and MA-PD enrollees are in plans that charge no Part D deductible, but a larger share of PDP enrollees than MA-PD enrollees are in plans that charge the standard deductible amount of $405 in 2018.

What percentage of Medicare Part D enrollees are in stand alone plans?

Most Part D enrollees (58 percent) are in stand-alone prescription drug plans (PDPs), but a rising share (42 percent in 2018, up from 28 percent in 2006) are in Medicare Advantage prescription drug plans (MA-PDs), reflecting overall enrollment growth in Medicare Advantage.

How much does a LIS beneficiary pay in 2018?

On average, the 1.2 million LIS beneficiaries paying Part D premiums in 2018 pay $26 per month, or more than $300 per year (Figure 12). This amount is up 13 percent from 2017 and is nearly three times the amount in 2006.

How much is MA PD premium?

The average MA-PD premium is $34 in 2018, which includes Part D and other benefits.

Do Part D plans charge coinsurance?

The vast majority of Part D plans (both PDPs and MA-PDs) charge copayments for preferred brand-name drugs rather than coinsurance. Among Part D enrollees in plans that use copayments for preferred brands, enrollees typically face lower copayments in PDPs than MA-PDs (Figure 9).