How do you calculate Medicare late enrollment penalty?

For example, if the national average premium is $36 in a particular year, and you had gone for five full years (60 months) without creditable coverage, your penalty would be 60 x 36 cents (1 percent of $36) = $21.60. This amount would be added every month to …

Can I delay Medicare Part D enrollment?

How’s the late enrollment penalty calculated? Medicare, not the plan, calculates the late enrollment penalty when a person subject to the penalty first gets Medicare drug coverage (Part D). The late enrollment penalty amount typically is 1% of the “national base beneficiary premium” (also called the base beneficiary

What are the pros and cons of delaying Medicare enrollment?

These Part D late enrollment penalty fees go into effect if at any point after initial enrollment you go 63 consecutive days without prescription drug coverage. The penalty — a 1% surcharge on the national base beneficiary premium for each month you go without coverage after first reaching eligibility — has the potential to become significant for beneficiaries who go years without …

What happens if I delay enrolling in Medicare?

How do I calculate the Part D late enrollment penalty?

Currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($33.37 in 2022) by the number of full, uncovered months that you were eligible but didn't enroll in Medicare drug coverage and went without other creditable prescription drug coverage.

Is there a maximum penalty for Part D?

The late enrollment penalty amount typically is 1% of the “national base beneficiary premium” (also called the base beneficiary premium) for each full, uncovered month that the person didn't have Medicare drug coverage or other creditable coverage.

How do I calculate Part D Penalty?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

Does Part D penalty go away when you turn 65?

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay a premium penalty, once you turn 65 you will no longer have to pay the penalty.

What happens if I don't want Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

When did the Medicare Part D Penalty start?

When the Part D program began in 2006, people already in Medicare could sign up until May 15 of that year without incurring a late penalty.

Do you have to pay for Medicare Part D?

How much does Part D cost? Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Can I add Medicare Part D anytime?

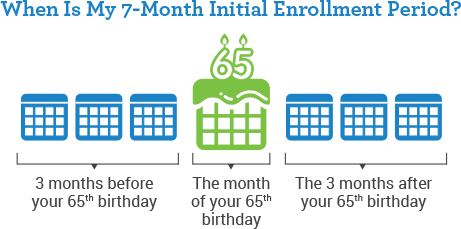

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

How do I appeal Medicare Part D late enrollment penalty?

Part D Late Enrollment Penalty Reconsideration Request Form An enrollee may use the form, “Part D LEP Reconsideration Request Form C2C” to request an appeal of a Late Enrollment Penalty decision. The enrollee must complete the form, sign it, and send it to the Independent Review Entity (IRE) as instructed in the form.Dec 1, 2021

Do I need Medicare Part D if I don't take any drugs?

If you don't take any medications at all, you'll still want to enroll in Part D when you're first eligible (unless you have other creditable drug coverage), to avoid the late enrollment penalty described above.

When did Part D become mandatory?

Medicare Part D Prescription Drug benefit Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans. These plans are sometimes called "Part C" or "MA Plans.” The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.Dec 1, 2021

What is the 63 day rule for Medicare?

The law says that you will be liable for Part D late penalties if you go for more than 63 days without Part D or creditable drug coverage after enrolling in Medicare Part A and/or Part B. So 63 days is often given as the length of the special enrollment period you can use to avoid a penalty.

Is Mrs Martinez on Medicare?

Mrs. Martinez is currently eligible for Medicare, and her Initial Enrollment Period ended on May 31, 2016. She doesn’t have prescription drug coverage from any other source. She didn’t join by May 31, 2016, and instead joined during the Open Enrollment Period that ended December 7, 2018. Her drug coverage was effective January 1, 2019

Does Mrs Kim have Medicare?

Mrs. Kim didn’t join a Medicare drug plan before her Initial Enrollment Period ended in July 2017. In October 2017, she enrolled in a Medicare drug plan (effective January 1, 2018). She qualified for Extra Help, so she wasn’t charged a late enrollment penalty for the uncovered months in 2017. However, Mrs. Kim disenrolled from her Medicare drug plan effective June 30, 2018. She later joined another Medicare drug plan in October 2019 during the Open Enrollment Period, and her coverage with the new plan was effective January 1, 2020. She didn’t qualify for Extra Help when she enrolled in October 2019. Since leaving her first Medicare drug plan in June 2018 and joining the new Medicare drug plan in October 2019, she didn’t have other creditable coverage. However, she was still deemed eligible for Extra Help through December 2018. When Medicare determines her late enrollment penalty, Medicare doesn’t count: