How much does Medicare Part D cost?

Feb 24, 2022 · The average monthly premium for a Part D plan is $43.07 in 2021, according to the U.S. Centers for Medicare & Medicaid Services. Paying higher copays may lower your monthly premiums. If you have a higher income — $91,000 for an individual tax filer, $182,000 if you and your spouse file jointly — you will have to pay extra Medicare Part D costs.

What is the average cost of Part D?

Aug 25, 2020 · Premiums for Medicare Part D plans in 2021 will continue to trend in a favorable direction for consumers. The Centers for Medicare & Medicaid Services (CMS) announced the average basic premium for a Part D plan will be roughly $30.50 per month in 2021. Learn More About Medicare

How much does a part D cost?

52 rows · Nov 18, 2021 · Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2022 is $47.59 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans …

How much does a part D plan cost?

How much is the Part D penalty? You’ll pay an extra 1% for each month (that’s 12% a year) you could have signed up for Part D, but didn’t. The penalty is added to your monthly premium. It’s not a one-time late fee — you’ll pay the penalty each month for as long as you have Part D coverage (even if you change plans).

What is the Part D premium for 2021?

$33.06As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

How much is Medicare Part D every month?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the cost of Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

What is the SilverScript premium for 2021?

If not, here's the range of monthly premiums you'll pay for each plan in 2021: SilverScript SmartRx: $5.70 to $7.80. SilverScript Choice: $18.10 to $49.70. SilverScript Plus: $52.20 to $88.60.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

How are Medicare Part D premiums calculated?

The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Your additional premium is a percentage of the national base beneficiary premium $33.37 in 2022. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the difference between SilverScript choice and SilverScript plus?

The SilverScript Plus plan offers a $0 deductible for medications on all tiers. The policy has even more drug coverage than the Choice plan and you can get your drugs delivered to you at no additional cost. This plan is a fantastic option for those who take high-tier drugs.Feb 10, 2022

Is SilverScript Part D good plan?

Fortunately, the SilverScript SmartRx plan has very low copays on the most common prescriptions. It won't be the best fit for everyone, but it can be a good choice for those on only Tier I generics. The Choice or Plus plan can also be a good fit if you're taking more expensive medications.

Can GoodRx be used with Medicare Part D?

You can't use GoodRx and Medicare together. But you can use GoodRx as an alternative to Medicare. You may want to use GoodRx instead of Medicare in certain situations, such as when Medicare doesn't cover your medication, the GoodRx price is cheaper than your Medicare copay, or you won't reach your annual deductible.Sep 27, 2021

Key Takeaways

If you have a Medicare Part D plan you may pay premiums, deductibles, co-payments, or co-insurance for your prescription coverage.

Part D Cost Sharing

Most people enrolled in a Part D plan (and not eligible for LIS/Extra Help assistance) have out-of-pocket expenses. Expenses may include:

Former Coverage Gap ("Donut Hole") Payments

If you exceed the spending threshold in the Initial Coverage Period, you will enter what used to be called the Part D coverage gap /"donut hole." While this gap officially “closed” in 2020, you are still responsible for paying 25% of the costs of your generic and brand name drugs in this phase.

What Determines Medicare Part D Premiums?

Medicare Part D premiums are the monthly fee you pay for coverage. Medicare Part D prescription drug plans are sold by private insurance companies that contract with Medicare.

What Is the Medicare Part D Deductible?

The Medicare Part D deductible is the amount of money you have to pay out of your own pocket for your prescriptions each year before your prescription drug plan starts paying its share.

Medicare Part D Copays and Coinsurance

Once you pay your Medicare Part D deductible, you will only pay a portion of the cost for your prescriptions for the rest of the year. These payments will be in the form of either a copayment or coinsurance.

Help Covering Medicare Part D Costs

If you have limited income and resources, a program called Extra Help may be able to help you with Medicare Part D prescription drug costs, including premiums, coinsurance and your deductible.

What is Medicare Part D?

Medicare Part D plans are sold by private insurers and provide coverage for prescription medications. It is one of two ways for Medicare beneficiaries to obtain Medicare drug coverage, along with enrolling in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

What is the maximum copay for insulin?

Earlier in the year, CMS introduced the Part D Senior Savings Model, which allows Medicare beneficiaries to choose a Part D plan that provides access to insulin with a maximum copay of $35 for a one month’s supply.

How to compare Medicare Advantage and Medicare?

You can compare Medicare prescription drug plans and Medicare Advantage plans with drug coverage by calling to speak with a licensed insurance agent or by comparing plans online. You’ll be able to find out what types of plans are available near you, their cost, the drugs they cover and more.

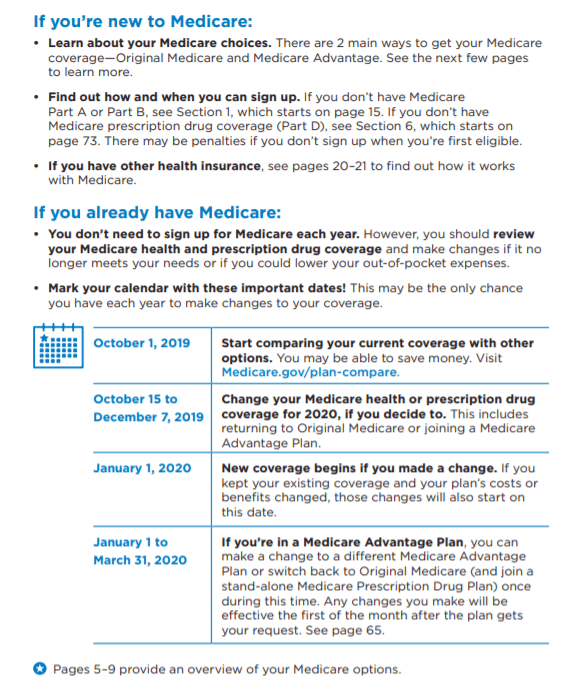

When is the open enrollment period for Medicare?

The fall Medicare Open Enrollment Period lasts from October 15 to December 7 and allows current beneficiaries the chance to sign up for, drop or change a Medicare Advantage plan or Medicare Part D plan. Any enrollment or disenrollment actions that beneficiaries take during AEP will become effective January 1, 2021.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

How much does a PDP payer pay in 2021?

For drugs on the non-preferred tier (which can be all brands or a mix of brands and generics), virtually all PDP enrollees pay coinsurance between 25% and 50% in 2021, while most MA-PD enrollees (83%) pay copayments between $90 and $100. The maximum cost-sharing amount permitted by CMS is $47 or 25% for preferred brands ...

How much is Part D 2021?

For PDPs, the average Part D deductible in 2021 is $350, 3.5 times larger than the average drug deductible in MA-PDs ($102) (Figure 5). The increase in the weighted average Part D deductible for PDPs was particularly steep between 2019 and 2020, when two national PDPs modified their plan design from charging no deductible to charging a partial ...

How many Medicare beneficiaries will receive low income subsidies in 2021?

An increasing share of beneficiaries receiving low-income subsidies are enrolled in Medicare Advantage drug plans, with just over half now enrolled in MA-PDs. In 2021, nearly 13 million Part D enrollees, or just over 1 in 4, receive premium and cost-sharing assistance through the Part D Low-Income Subsidy (LIS) program.

How much is MA PD insurance in 2021?

For MA-PDs, the monthly premium for the Part D portion of covered benefits averages $12 in 2021 (and $21 for Part C and Part D benefits combined). The average premium for drug coverage in MA-PDs is lower than the average premium for PDPs due in part to the ability of MA-PD sponsors to use rebate dollars (which may include bonuses) ...

How many people are in Medicare Part D?

A total of 48 million people with Medicare are currently enrolled in plans that provide the Medicare Part D drug benefit, representing more than three-quarters (77%) ...

What is Medicare Part D 2021?

Published: Jun 08, 2021. The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What is a SNP in Medicare?

SNPs limit enrollment to beneficiaries with certain characteristics, including those with certain chronic conditions (C-SNPs), those who require an institutional level of care (I-SNPs), and those who are dually enrolled in Medicare and Medicaid ( D-SNPs), which account for the majority of SNP enrollees.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is a 504.90?

504.90. Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follow s: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.