How much does Medicare coverage cost?

Oct 12, 2018 · The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.

How much is the standard Medicare premium?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. How it changed from 2018 The 2019 Part A premiums increased a little over 3 percent from 2018. 2019 Medicare Part B premium

What is the best health insurance for Medicare?

Jan 04, 2019 · The standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security...

Is there a monthly premium for Medicare?

Oct 13, 2018 · The standard Medicare Part B monthly premium for 2019 will be $135.50, a modest increase of just $1.50 per month over 2018's standard premium. In addition, the annual Medicare Part B deductible...

What are Medicare premiums for 2019?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium. This higher Part B premium is called the Income-Related Monthly Adjusted Amount (IRMAA).

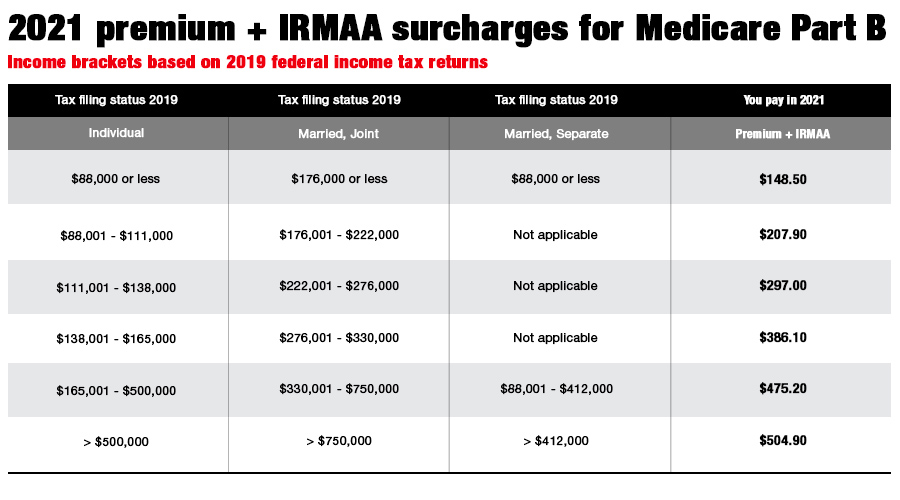

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the Medicare premium for seniors?

Those who are enrolled in Medicare but aren't yet collecting Social Security have to pay those premiums directly. Those who are receiving Social Security, meanwhile, have their Part B premiums deducted from their benefits. This year, the standard monthly Medicare Part B premium costs seniors $148.50 a month.Nov 17, 2021

What was the 2019 Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.Oct 12, 2018

How much does Medicare take out of Social Security?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

What is Medicare Part B 2020 premium?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

How is Medicare premium calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare free for seniors?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How much does Medicare cost at age 83?

$220.81How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F82$236.5383$220.8184$225.5685$234.2018 more rows•Dec 8, 2021

How much does Medicare Part B increase each year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

What happens if you don't receive your Part B?

If you don’t receive any of these benefit payments, you will simply get a bill in the mail for your Part B premium. How it changed from 2018. The 2019 Part B premiums rose by close to 1.1 percent from 2018 across all income levels.

Will Medicare IRMAA increase in 2020?

It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020. This means that fewer people may have to pay the IRMAA, and the adjustment will delay when other beneficiaries are required to pay more for their 2020 Part B premiums.

How much is Medicare premium in 2019?

The standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security benefits in recent years have been insufficient to keep up with the rising cost of Medicare premiums.

How much is Medicare Part A deductible?

You can see all the options in the table below: Medicare Charge. 2019 Cost (Change From 2018) Hospital deductible. $1,364 ( up $24) Coinsurance for days 61-90 of hospital stay.

How much does Medicare pay if you don't qualify?

Those who don't qualify have to make premium payments. Those who have 30 to 39 quarters of qualifying work will pay $240 per month, up $8 from last year. If you have less than 30 quarters, then the monthly charge jumps to $437, up $15 from 2018. If you end up using your Medicare Part A coverage, then you'll also have to pay deductibles ...

Does Medicare have a monthly premium?

One of the most important parts of Medicare often comes with no monthly premium for participants. Hospital insurance coverage, also known as Medicare Part A, is free to those who had 40 quarters of qualifying employment for which they paid Medicare payroll taxes during their careers or are married to a spouse who did so.

Can Medicare retirees afford to pay more?

Many Medicare participants are retired and can't afford to pay any more than they have to for their healthcare coverage. Although 2019's increases to Medicare costs are relatively modest, they'll still put some strain on the finances of millions of older Americans in the coming year.

Do prescription drugs go up over time?

Although costs generally go up over time, you can sometimes find cheaper plan alternatives. However, it's important to look not only at monthly premium costs but also the out-of-pocket expenses you'll pay for the prescription drugs or other medical care that you'll need.

Can Medicare Advantage be used as a replacement for Medicare?

Others use Medicare Advantage as a substitute for traditional Medicare. Private insurers offer both Medicare Advantage and Part D plans, and so costs can vary greatly depending on the level of coverage and the insurance company. Although costs generally go up over time, you can sometimes find cheaper plan alternatives.

How much is Medicare Part B 2019?

I won't keep you in suspense. The standard Medicare Part B monthly premium for 2019 will be $135.50, a modest increase of just $1.50 per month over 2018's standard premium. In addition, the annual Medicare Part B deductible will increase, but by just $2, to $185.

How much is the cost of living adjustment for 2019?

Since many beneficiaries were already paying lower-than-standard premiums because of this rule, the 2.8% cost-of-living adjustment that kicks in for 2019 won't be enough to cover the increase to $135.50 per month. So, beneficiaries whom this applies to will pay a lower premium than $135.50.

What is Medicare Part B?

Medicare Part B is the medical insurance component of the Medicare program. It pays for costs like doctor's office visits, medical equipment, and outpatient procedures.

Will Medicare beneficiaries receive a monthly increase in 2019?

This year, with a 2.8% COLA and few Medicare beneficiaries still qualifying for the hold-harmless provision, most Medicare beneficiaries who receive Social Security benefits will actually notice an increase in their monthly checks in 2019. The Motley Fool has a disclosure policy.

Is Medicare Part B rising?

The Centers for Medicare and Medicaid Services just announced the 2019 Medicare Part B premiums. You might not be surprised to learn that premiums are rising, but you might be pleasantly surprised to learn that they aren't rising by very much.

Is Medicare Part A premium free?

Meanwhile, Medicare Part A, which mainly covers hospital stays, remains premium-free for most American seniors, although the Part A deductible is rising from $1,340 in 2018 to $1,364 in 2019.

Do Medicare beneficiaries pay less than the premium?

Some beneficiaries will pay less than the standard premium. In contrast to the high-earner discussion, some Medicare beneficiaries will actually pay less than the standard monthly premium.

Part B and Part D Standard Premiums

Monthly premiums for most people on Medicare equal 25 percent of average per capita Part B expenditures for Part B enrollees and 25.5 percent of average per capita Part D expenditures for drug plan enrollees.

Income-Related Premiums for Part B and Part D

People on Medicare with incomes above $85,000 for individuals and $170,000 for couples are currently required to pay higher premiums for Medicare Part B and Part D. These premiums were first required for Part B in 2007 and for Part D in 2011, and have been modified over time, with the latest change taking effect in 2019 (Figure 1).

How Do the Income Thresholds Change Over Time?

For the first few years that the Medicare Part B income-related premium was in effect (between 2007 and 2010), the income thresholds that determined who paid the higher amounts were set to increase annually with the rate of price inflation so that about 5 percent of Part B enrollees would pay the income-related premium each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is the 2019 Medicare surcharge?

High-income surcharges for 2019 are generally based on your 2017 income. If you've experienced certain life-changing events that have reduced your income since then, such as retirement, divorce or the death of a spouse, you can contest the surcharge. For more information about contesting or reducing the high-income surcharge, see Save Money on Medicare. Also see Medicare Premiums: Rules for Higher-Income Beneficiaries for the procedure.

Why do Medicare beneficiaries pay less?

A small group of Medicare beneficiaries (about 3.5%) will pay less because the cost-of-living increase in their Social Security benefits is not large enough to cover the full premium increase. The "hold-harmless provision" prevents enrollees' annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security benefits if their premiums are automatically deducted from their Social Security payments. Social Security benefits are increasing by 2.8% in 2019, which will cover the increase in premiums for most people.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.

How many Medicare beneficiaries will pay less than the full Medicare premium?

An estimated 2 million Medicare beneficiaries (about 3.5%) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

How much does Medicare Part B plus FEHB cost?

For others, it does not. In 2019 Medicare Part B PLUS FEHB Aetna Direct Self +1 costs about $426/mo (total for both) after the $1,800 medical fund to help pay for Part B is considered. $271 for Medicare Part B and $155/mo for Aetna Direct after the refund ($305/mo Self + 1 minus $150/mo Part B refund).

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Is Medicare A free?

Medicare A is "free" (You have already paid for it). You will have to pay for Medicare B. The cost, beyond the normal premium depends on your income. if your income is too much, you will pay more. Also, learn about the maximum pay out per year you will make before FEHB pays 100% of your expenses.

Is Medicare Part B based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 5 percent of people with Medicare Part B.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar.

Who is Dana Anspach?

Linkedin. Follow Twitter. Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm.