What is the current Medicare premium amount?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

When are Medicare premiums deducted from Social Security?

- If you have healthcare expenses that exceed 7.5 percent of your AGI and choose to itemize.

- If you’re self-employed and choose to deduct your Medicare premiums pretax and lower your taxable income.

- If you planned for the long term and now pay your Medicare premiums with tax-free HSA funds that you set aside before enrolling in Medicare.

Does Medicare have monthly premiums?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021 ($499 in 2022). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 ($499 in 2022).

How to calculate Medicare premiums?

- Deductions for what you give to charity 8

- Deductions for adoption expenses 9

- Dependent tax credits 10

- The earned income tax credit (EITC) 11

How much did Medicare Part B premiums go up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

What is the Medicare Part B premium for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Is Medicare cost increasing in 2021?

That's an increase from $203 in 2021, and a much more significant increase than normal. Some enrollees have supplemental coverage that pays their Part B deductible. This includes Medicaid, employer-sponsored plans, and Medigap plans C and F.

Will 2022 Part B premium be reduced?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

How can I reduce my Medicare Part B premiums?

Those premiums are a burden for many seniors, but here's how you can pay less for them.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.

How much money is taken out of my Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

Will Medicare cost go up 2022?

Medicare Part A and Part B Premiums Increase in 2022 But for those who have not paid the required amount of Medicare taxes, Part A premiums will increase. Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).

How much will Social Security take out for Medicare in 2022?

The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much is Medicare Part B 2021?

2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

How much is the 2021 deductible?

The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible. The Part A deductible amount may increase each year, and it will likely be higher in 2022.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments . This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above.

What are the factors that affect the cost of a Medigap plan?

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates. Medigap premiums can increase over time due to inflation and other factors, so you can typically expect Medigap plan premiums to be higher in 2022 than they will be in 2021.

Is Medigap 2021 higher than 2021?

This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above. Some 2021 Medigap plan premiums may also be higher. Each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Original Medicare Part A Premiums and Costs

Most people do not pay a monthly premium for Part A, as their work history qualifies them to receive this coverage for free. However, if you have worked in the United States and have paid taxes for less than 10 years (or 40 quarters), you may need to pay a premium for Part A coverage.

Original Medicare Part B Premiums and Costs

The standard Part B premium amount for 2021 is $148.50, although you may have to pay more depending on your income. To find out exactly how much you will pay, reference the chart below.

Medicare Part C Premiums and Costs

Medicare Advantage (Part C) plans are sold by private insurance companies as an optional replacement to Original Medicare. Regulated by the federal government, these plans are required to provide the same standard benefits covered under Parts A and B. However, these plans often include coverage for additional benefits, including:

Medicare Part D Premiums and Costs

Medicare Part D plans are sold by private insurance companies as an optional addition to Original Medicare. These plans provide their members with coverage for the prescription drugs they need to survive. Each Part D plan has a unique formulary, which is the list of drugs it covers.

Medicare Supplement Premiums and Costs

Medicare Supplement plan benefits are standardized by the government, but the prices for these plans can vary depending on which insurance company you purchase a plan from. Ten Medicare Supplement plans are available, lettered A through N, and each of these plans offers a different combination of benefits.

How Can I Reduce My Medicare Premiums and Costs?

The best way to save money on Medicare is to enroll in the right plan when you first sign up for an additional coverage option. Prices for similar coverage can vary widely between carriers, and doing your research beforehand can end up saving you a lot of money over the course of the year.

Ready to Enroll?

If you are ready to explore coverage options in your area, chat with a licensed Medicare professional who can help you find the coverage you need at a price that fits your budget.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

Does Medicare pay for prescription drugs?

Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

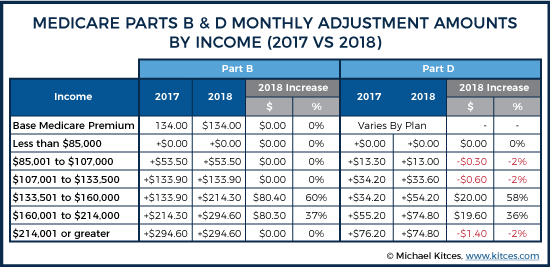

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.