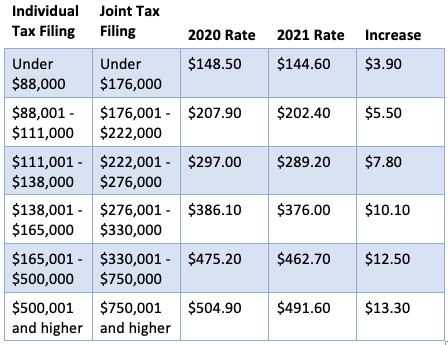

Medicare Part B IRMAA

| 2020 Individual tax return | 2020 Joint tax return | 2020 Married and separate tax return | 2022 Part B monthly premium |

| $91,000 or less | $182,000 or less | $91,000 or less | $170.10 |

| More than $91,000 and up to $114,000 | More than $182,000 and up to $228,000 | N/A | $238.10 |

| More than $114,000 up to $142,000 | More than $228,000 up to $284,000 | N/A | $340.20 |

| More than $142,000 up to $170,000 | More than $284,000 up to $340,000 | N/A | $442.30 |

How much will my Medicare premiums be?

Taxes on your bonuses are likely to be varying between 40% and 45%. In addition to these costs, you will also have to pay National ... but you will also pay Social Security, Medicare, unemployment, and state or local taxes. bonuses are subject to income ...

What is the current Medicare premium amount?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

When do Medicare premiums increase?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. The increases in the 2022 Medicare Part B premium and deductible are due to:

When are Medicare premiums deducted from Social Security?

- If you have healthcare expenses that exceed 7.5 percent of your AGI and choose to itemize.

- If you’re self-employed and choose to deduct your Medicare premiums pretax and lower your taxable income.

- If you planned for the long term and now pay your Medicare premiums with tax-free HSA funds that you set aside before enrolling in Medicare.

How much will Medicare premiums increase in 2022?

$170.10 a monthMedicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

How much will the premium be for Medicare Part B in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Why did my Medicare premium increase for 2022?

The increases in the 2022 Medicare Part B premium and deductible are due to: Rising prices and utilization across the health care system that drive higher premiums year-over-year alongside anticipated increases in the intensity of care provided.

What is the monthly cost of Medicare for 2022?

$170.10 per monthFor most people, the cost of Medicare Part B for 2022 is $170.10 per month. This rate is adjusted based on income, and those earning more than $91,000 will pay higher premiums. For high-earners, the cost of Medicare Part B is based on your adjusted gross income (AGI) from your previous year's taxes.

Is there a Medicare increase for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

Will 2022 Part B premium be reduced?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

How much will Social Security take out for Medicare in 2022?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What will Medicare cost in 2023?

CMS finalizes 8.5% rate hike for Medicare Advantage, Part D plans in 2023. The Biden administration finalized an 8.5% increase in rates to Medicare Part D and Medicare Advantage plans, slightly above the 7.98% proposed earlier this year.

What is the COLA for 2022?

5.9 percentThe COLA for 2022 increased to 5.9 percent in what was the largest rise in almost 40 years, with this coming into effect from January 1, 2022, for Social Security beneficiaries and December 30, 2021, for Supplemental Security Income beneficiaries.

What is the Social Security increase for 2022?

a 5.9%Social Security beneficiaries saw the biggest cost-of-living adjustment in about 40 years in 2022, when they received a 5.9% boost to their monthly checks.

What is the deductible for Medicare Part D in 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

What is the Medicare Part A deductible for 2022?

$1,556The 2022 deductible for Medicare Part A is $1,556 for each benefit period: $0 for days 1-60, $389 coinsurance per day for days 61-90 and $778 per each "lifetime reserve day" after 91 days.

How Much is Medicare Part A & Part B Going Up in 2022

The prices for Medicare Parts A and B are, among other things, tied to inflation. So it’s no surprise they go up almost every year. And 2022 is no exception. There are important price changes happening to both your hospital and medical Medicare benefits, and you need to know what those are in order to budget accordingly.

How Much is Medicare Advantage Going Up in 2022

As more and more baby boomers reach retirement age, Medicare Advantage numbers are expected to grow. The Medicare changes to enrollment in 2022 are predicted to jump from 26.9 million to 29.5 million seniors.

How Much is Medicare Part D Going Up in 2022

Lastly, there’s Medicare Part D. There are some minor yet noteworthy Medicare changes happening for the government-sponsored prescription drug program in 2022. Sadly, there will be an increase in the monthly premium for all seniors across the board.

How Much is the Deductible for Medigap High Deductible Plans F, G, & J Going Up in 2022

High deductible Medigap plans F, G, and J will experience a significant price hike in 2022. This deductible is tied to the Urban Consumer Price Index, which explains why plan members will have to pay so much more starting next year.

How to Get Help with Your Medicare Options in 2022

If you still have a question that isn’t answered above, feel free to reach out and contact us. We’re here to help. You can get a rate quote for plans in your area by filling out our online form.

Key Takeaways

Premiums, deductibles, and coinsurance for Medicare Parts A and B will increase in 2022.

Medicare Part A

Medicare Part A covers inpatient hospital, skilled nursing facility, hospice, and inpatient rehabilitation care, as well as some home healthcare services.

Medicare Part B

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services that aren't covered by Medicare Part A.

Medicare Part D

Medicare Part D provides coverage for prescription medications. For 2022, the Centers for Medicare & Medicaid Services announced changes to the income-related monthly adjustments that will affect about 8% of enrollees.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

How much are Medicare premiums going up by?

Medicare's Part B standard premium is set to jump 14.5% in 2022, meaning those relying on the coverage will face an increase of more than $21 a month.

What is Medicare?

Medicare is a federal health insurance program for those age 65 and older.