How Much Do Blue Cross Blue Shield Medigap Plans Cost?

| Plan | Blue Cross and Blue Shield of Montana2 ( ... | Blue Cross and Blue Shield of Texas*3 (D ... | Independence Medicare* (Philadelphia, Pa ... | Anthem4 (Los Angeles, Calif.) |

| A | $122.33 – $206.69 | $211.00 | $119.16 | $143.50 |

| B | N/A | N/A | $144.60 | N/A |

| C | N/A | N/A | N/A | N/A |

| D | N/A | N/A | N/A | N/A |

| Plan name | Monthly premium† | Part A hospital deductible |

|---|---|---|

| Plan A | $101.56 | $1,556 |

| Plan G | $115.50 | $0 |

| Plan N | $105.21 | $0 |

What is anthem mediblue HMO?

Anthem offers Medicare Supplement plans, all of which cover 100% of Part A and Part B coinsurance. All of our plans also include SilverSneakers® fitness memberships , and other value-added programs like ScriptSave/WellRx, a prescription savings program, and SpecialOffers, which provides discounts on vitamins and weight loss programs. Benefits*.

Which providers accept anthem Medicare plans?

Cost of Medicare Part B. Your Medicare Part B premium is also based on your income. Much like Part A, deductibles change from year to year and can also vary based on your location. The good news is once you meet your deductible, you only pay 20% for most Medicare Part B services during the year. Medicare Part B provides coverage for outpatient ...

What is Medicare anthem?

Sep 26, 2021 · Below, we’ll review Anthem Medicare Supplement plans for 2022. Anthem Medicare Supplement Plans for 2022. Supplements have been designed to fill in the “gaps” that don’t get covered by Part A and Part B of Original Medicare, such as …

What is Anthem Insurance?

Nov 07, 2019 · Anthem Medicare Supplement Plan A. This low-cost plan offers basic coverage for the following out-of-pocket expenses: 100% coverage of Medicare Part B copayments and coinsurance. Additional 365 days of hospital coverage after Part A benefits are exhausted. 100% coverage of your hospice coinsurance or copayment under Part A.

What does Medicare supplemental coverage cost?

Which Medicare supplement plan has the highest level of coverage?

What is the plan G on Anthem?

Does Anthem Plan G have a deductible?

Plan A is the most basic of Medigap plans, with the lowest premiums. It is the only Medicare Supplement plan that doesn't cover the Part A deductible.

What is the deductible for Plan G in 2022?

What is the difference between Plan G and high deductible plan G?

What is the difference between Medicare Supplement Plan G and Plan G select?

What is Medicare supplement G plan?

Can you be denied a Medicare supplement plan?

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

What is the difference between Medicare Advantage and Medicare supplement?

Is Anthem Blue Cross medical?

What is the 2021 Medicare Supplement Plan?

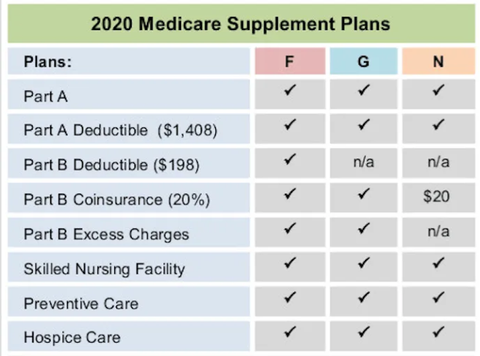

Anthem Medicare Supplement Plans for 2021. Supplements have been designed to fill in the “gaps” that don’t get covered by Part A and Part B of Original Medicare, such as coinsurance, deductibles, and co-payments. These plans are standardized, so regardless if you go with an Anthem Medicare Supplement plan or with another carrier, ...

Do all lettered insurance policies have the same premiums?

Although the law requires that the insurance companies provide the same benefits for all the lettered plans, the premium rates for the policies are not the same. This is the main reason the experts advise consumers to shop around to search for a plan that can suit their needs.

What is Plan G?

Plan G includes all the same benefits as Plan F minus your Part B excess charges that you might incur from a doctor’s visit. This plan is the second most common plan; the premium is lower and still includes a lot of benefits. It does include coverage for foreign travel and Medicare preventive care Part B coinsurance.

Do all Supplement Plan G policies have the same rate increase?

Rate increases are state and policy specific. So, all Supplement Plan G policies with Anthem in one specific state will have the same increase. Then all Plan N policies will have a separate rate increase amount. Therefore, predicting rate increases can be nearly impossible.

What is ASA in Medicare?

Anthem Senior Advantage, or ASA, is a Medicare+Choice contract with a health maintenance organization. After you enroll, Anthem will pay a fixed amount to administer your healthcare benefits. Medicare money usually ends up going further due to their large network of doctors & hospitals agreeing to lower medical costs.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is issue age rated insurance?

Issue-age-rated – the plans base their premiums on your age during the time you registered for the policy. The younger you were when registering, the lower the premium will be

What is the Medicare anthem?

Anthem is one of the private insurance companies that offers Medicare Supplement plans, this guide explains some of the different plans and benefits available to Medicare beneficiaries.

Does Medicare cover coinsurance?

Each of these plans helps offset some of the costs that Original Medicare doesn’t cover, such as: Coinsurance (the percentage you pay as your portion of Medicare-approved expenses) Copayments (typically a flat amount you pay as your share of Medicare-approved costs)

Does Medicare Part A cover out of pocket expenses?

If you are nearing Medicare eligibility or are currently enrolled in Original Medicare, you may have questions and concerns about the out-of-pocket expenses that Medicare Part A and Part B do not cover.

What is coinsurance in Medicare?

Coinsurance (the percentage you pay as your portion of Medicare-approved expenses) Copayments (typically a flat amount you pay as your share of Medicare-approved costs) Part B excess charges for doctors who do not accept Medicare’s approved amount as full payment for covered services. Deductibles*.

What is a copayment in Medicare?

Copayments (typically a flat amount you pay as your share of Medicare-approved costs) Part B excess charges for doctors who do not accept Medicare’s approved amount as full payment for covered services. Deductibles*. Emergency health care during foreign travel, up to plan limits.

What is Part B excess?

Part B excess charges for doctors who do not accept Medicare’s approved amount as full payment for covered services. Deductibles*. Emergency health care during foreign travel, up to plan limits. As a Medicare beneficiary, you may have several Anthem Medicare Supplement plans available to you.

What is a Medigap Plan G?

Medigap Plan G includes all the benefits available under Medicare Supplement Plan A, plus the following additional benefits: 100% coverage of your Medicare Part A deductible. 100% of coinsurance for skilled nursing care. 100% coverage of Part B excess charges. Coverage for foreign travel emergencies, up to plan limits.

Does Medicare Supplement cover outpatient care?

Medicare Supplement plans, also called Medigap plans, cover what Original Medicare doesn’ t.

Does Medicare cover prescription drugs?

Prescription Drug Plans (Part D) Medicare Part D covers prescription drugs, something Original Medicare (Part A and Part B) does not cover. Part D is important if you take regular medications for a condition such as high blood pressure.

Does Medicare cover blood pressure?

Medicare Part D covers prescription drugs, something Original Medicare (Part A and Part B) does not cover. Part D is important if you take regular medications for a condition such as high blood pressure.

Does Medicare Advantage include dental?

Original Medicare doesn’t come with dental or vision coverage, but Medicare Advantage plans often include routine dental and vision care . If you want more coverage, there are add-on dental and vision packages for Medicare Advantage and Medicare Supplement plans.

Does Medicare cover dental and vision?

Medicare Dental and Vision Coverage. Original Medicare doesn’t come with dental or vision coverage, but Medicare Advantage plans often include routine dental and vision care. If you want more coverage, there are add-on dental and vision packages for Medicare Advantage and Medicare Supplement plans. Explore All Medicare Plans.

Does Anthem Blue Cross and Blue Shield cover dental?

As with all things health care, there are a wide variety of options to consider when it comes to Medicare Supplement plans. Anthem Blue Cross and Blue Shield offers a range of plans that cover added health-care expenses that do not fall under Medicare Part A and Part B, and it is easy to sign up for additional vision and dental coverage at the same time you apply for a Medigap plan through their site. However, they do not have any high-deductible options for those who are interested in a lower monthly premium in exchange for a higher up-front deductible.

What is the Blue Cross and Blue Shield app?

Anthem Blue Cross and Blue Shield offers easy access to plan information through their mobile app, Sydney. This app, available for iPhone and Android, allows users to view their benefits and ID cards, as well as provides reminders, alerts, and a health tracker.

Where is the anthem located?

Headquartered in Indianapolis, Indiana, Anthem offers Medigap plans for those living in California, Colorado, Connecticut, Georgia, Indiana, Kentucky, Maine, Missouri, New Hampshire, Nevada, New York, Ohio, Virginia, and Wisconsin. There are a variety of Medigap plans available through Anthem, as well as additional coverage ...

Does Mutual of Omaha offer Medigap?

When it comes to Medigap coverage, Mutual of Omaha offers Medigap plans A, F, G, N, and high-deductible G options. FYI: If you are currently employed and receiving health-care benefits through your workplace, the Social Security Administration advises that you speak with your employer before signing up for Medicare.

Is Cigna a high deductible plan?

Cigna: Cigna is a popular choice around the world, serving customers in over 30 countries. They offer a range of plans, including some high-deductible options which allow for a lower monthly premium. Cigna provides Medigap plans F, G, N, and A, in addition to the high-deductible plan F.

Is Blue Cross Blue Shield a Medicare Supplement?

Anthem Blue Cross Blue Shield is a large company, but its Medicare Supplement plans are only offered in select states. If you don’t reside in one of the states listed below, then you’ll need to use a different provider for your Medicare Supplement Insurance.

Does Medigap cover dental?

Neither Original Medicare nor Medigap cover prescription drugs, dental, or vision. However, those who choose to can conveniently add all three forms of coverage to their Anthem plan. You can add “premium” packages to most Medigap plans to add varying levels of vision or dental.