Full Answer

How much will I pay in Medicare Part D costs?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

How much does the average Medicare Part D plan cost?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much does it cost for Medicare Part D?

As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state. What affects Medicare Part D costs each year?

How much does Medicare Part B and D cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount. You can add Part D coverage to Medicare Parts A and/or B.

How much is Medicare Part D every month?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What are average Medicare Part D premiums?

Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan. In most plans, after spending usually $4,430 in total drug costs, you reach the coverage gap.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the 2021 Part D premium?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

What is the max out-of-pocket for Medicare Part D?

As expected, a $2,000 cap on out-of-pocket spending would generate larger savings than a $3,100 cap. Average out-of-pocket spending was $3,216 among the 1.2 million Part D enrollees with out-of-pocket spending above $2,000 in 2019.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

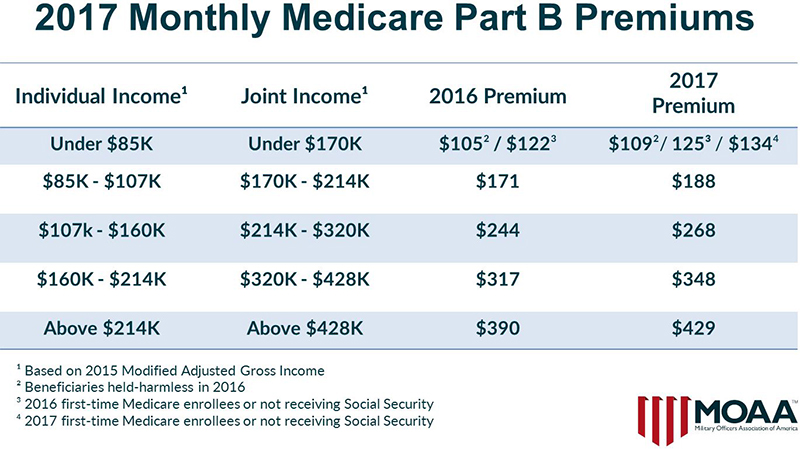

Are Part D premiums based on income?

In addition to the monthly premium, Part D enrollees with higher incomes ($88,000/individual; $176,000/couple) pay an income-related premium surcharge, ranging from $12.30 to $77.10 per month in 2021 (depending on income).

Do I have to pay for Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

How is Part D premium determined?

The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Your additional premium is a percentage of the national base beneficiary premium $33.37 in 2022. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium.

How much does Medicare Part D cost?

As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How to find out if Medicare covers prescription drugs?

One way to learn about your Medicare prescription drug coverage options is to speak with a licensed insurance agent . You can compare Medicare Advantage plan costs in your area and find a plan that covers the prescription drugs you need.

Why do we detail Part D costs?

We also detail Part D plan costs so that you can better understand your Medicare prescription drug coverage options.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is copayment insurance?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin.

How much out of pocket is considered catastrophic?

Once you reach $6,550 in out-of-pocket spending, you are out of the donut hole and enter “ catastrophic coverage ,” where you typically only pay a small copayment or coinsurance payment for the rest of the year.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

How long do you have to pay late enrollment penalty?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is Medicare Part D?

Medicare Part D is Medicare’s prescription drug benefit. It helps cover the costs of outpatient prescription drugs, something that’s typically not covered by Original Medicare Parts A or B, which cover hospital and outpatient medical insurance, respectively.

Are Part D plans expensive?

In general, no — at least, not compared to standard premiums for Part B, which are $170.10 per month in 2022 for most Medicare recipients. However, these Part D plans aren' t premium-free, like Part A generally is, and some can be quite costly.

Are there additional costs for high-income earners?

If your income exceeds a certain amount, you may have to pay a surcharge on your Medicare Part D insurance. This surcharge is known as the Part D Income-Related Monthly Adjustment Amount, or Part D IRMAA, and is not part of your premium.

How much does Medicare Part D cost in 2021?

The national base beneficiary premium for Part D plans is $33.06 per month for 2021, according to Centers for Medicare & Medicaid Services, which calculates this number in part by using ...

How does Medicare determine the penalty amount?

Medicare determines the penalty amount by multiplying the number of full months you were eligible for but didn’t have drug coverage by 1%, then multiplying that product by the national base beneficiary premium ($33.06 for 2021). The result is rounded to the nearest 10 cents.

What to do if you lose your prescription?

If you’ve lost your prescription plan, enroll in Medicare drug coverage immediately. Keep good records of your drug insurance history so you’ll be able to provide proof of continuous previous coverage. If you think Medicare has penalized you in error, you can request a reconsideration.

What is Medicare Part D surcharge?

This surcharge is known as the Part D Income-Related Monthly Adjustment Amount, or Part D IRMAA, and is not part of your premium.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

What is a single grace period?

Single Grace Period – When there’s been at least one payment that’s been unpaid during your grace period, your health plan can end your coverage at the end of the timeframe allotted.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

What is the maximum deductible for Medicare 2021?

The highest annual deductible allowed by Medicare in 2021 is $445 (up from $435 in 2020). 5 Many plans come with a much smaller deductible and some don’t have one. Each plan will also have a copayment and coinsurance amount. A copayment is a fixed amount that you pay for your prescriptions.

How much is a copayment for a generic drug?

The copayment on generic drugs might be $5, while brand name drugs on certain tiers might require a $25 copayment. Higher tiers might require a larger copayment. You might pay a coinsurance amount for drugs in the highest tiers. If the prescription costs $400, you might pay a coinsurance of 25%, making your portion of the bill $100. 6 .

What is Medicare Part D?

Medicare Part D covers prescription drugs. It can be added to Parts A and/or B, or you can receive prescription drug coverage through a Medicare Advantage Plan (Part C).

What happens if you don't sign up for prescription drug coverage?

Just like parts A and B, if you don’t sign up for prescription drug coverage when you’re first eligible you’ll probably pay a late enrollment penalty unless one of two conditions apply: You are still working or have qualifying prescription drug coverage from another source.

What is the coverage gap for 2021?

The coverage gap is a temporary limit on what the plan will cover for drugs. If you receive extra help from Medicare, you won’t enter a coverage gap, ...

How much is Medicare Part D 2021?

This varies depending on your income and the plan you choose, but the nationwide base premium is $33.06 per month for 2021. 4

How much is Part B in 2021?

Part B costs most people $148.50 per month in 2021, and it's projected to cost an average of $170.10 per month in 2022. 2 Part D, which can be added to Part B, is set to cost an average of $33 per month in 2022. 3