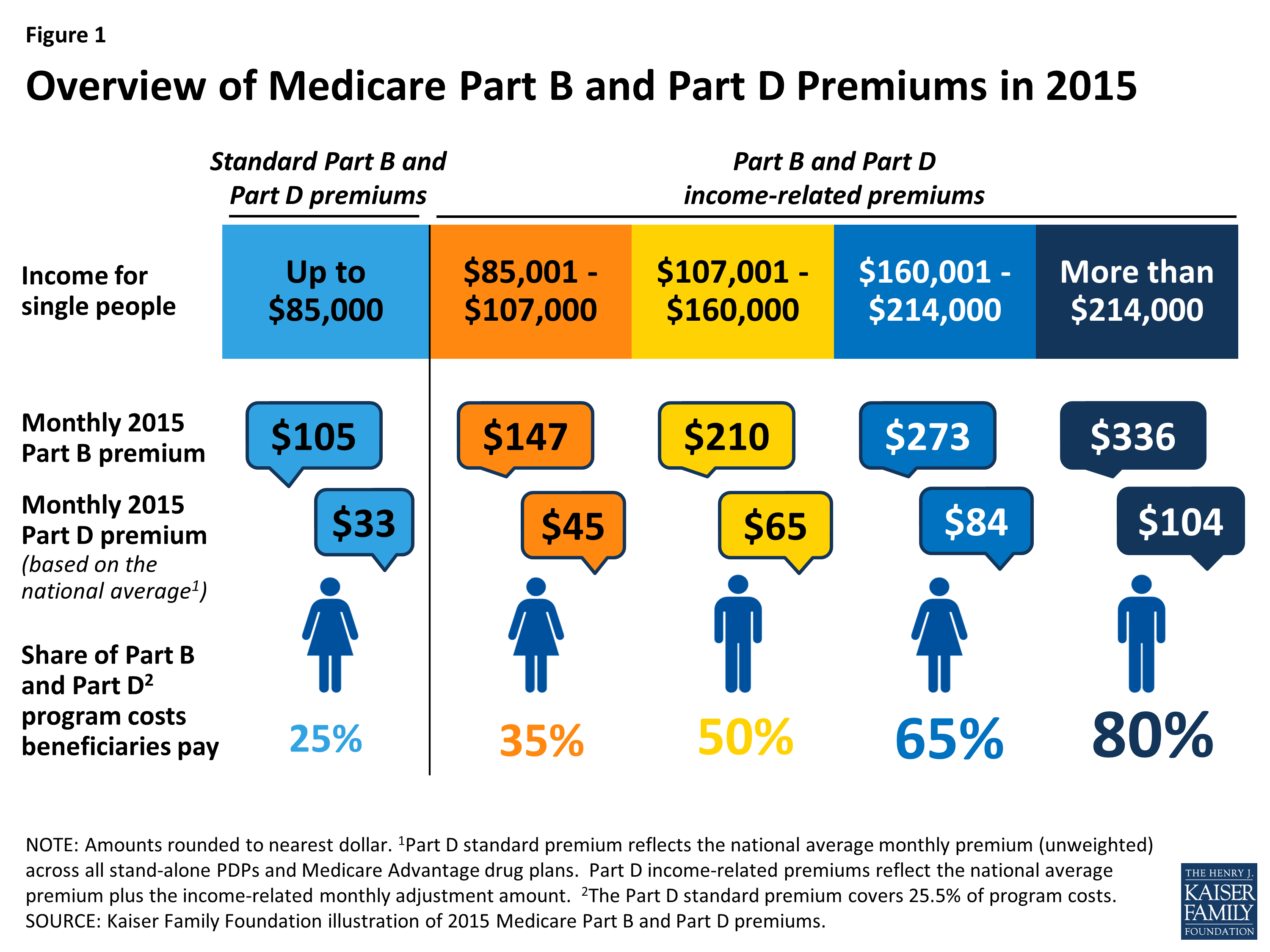

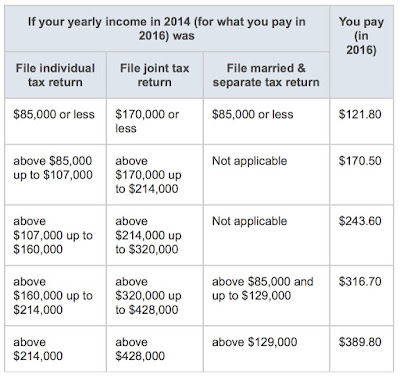

In 2016, these people will have to pay the $121.80 base amount plus a high-income surcharge of $48.70 to $268 per month, depending on their income. "Modified adjusted gross income" includes all taxable income, whether from a job, interest, dividends, capital gains or a pension, plus it adds in tax-exempt interest.

Full Answer

How much will Medicare Part B premiums increase in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

When are Medicare premiums due and how much are they?

Original Medicare (parts A and B) premiums are due on the 25th day of the month. However, premiums for Medicare Advantage plans, Part D plans, and Medigap plans are due on whatever date is on the monthly bill. Aside from premiums, Medicare costs include copays, deductibles, and coinsurance.

How much will Medicare premium mitigation Save you in 2016?

The CMS Office of the Actuary estimates that states will save $1.8 billion as a result of this premium mitigation. CMS also announced that the annual deductible for all Part B beneficiaries will be $166.00 in 2016. Premiums for Medicare Advantage and Medicare Prescription Drug plans already finalized are unaffected by this announcement.

What is the Medicare Part a deductible for 2016?

The Medicare Part A annual deductible that beneficiaries pay when admitted to the hospital will be $1,288.00 in 2016, a small increase from $1,260.00 in 2015. The Part A deductible covers beneficiaries' share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

How much did Medicare go up in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What are the Irmaa brackets for 2016?

If Your Yearly Income Is2016 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$48.70$107,001 - $160,000$214,000 - $320,000$121.80$160,001 - $214,000$320,000 - $428,000$194.903 more rows•Jul 30, 2015

What was the monthly cost of Medicare in 2017?

Days 101 and beyond: all costs. Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

Are Medicare premiums quarterly?

So, it's known as a quarterly bill. If you have original Medicare (parts A and B), you'll continue to receive bills directly from Medicare until you start collecting either Social Security or RRB benefits. Once your benefits begin, your premiums will be taken directly out of your monthly payments.

How do I find my Irmaa?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

How is Medicare Irmaa calculated?

How is my income used in my IRMAA determination? IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

What is the cost for Medicare Part B for 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

How much are Medicare premiums for 2019?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

When did Medicare start charging a premium?

July 30, 1965July 30, 1965: With former President Harry S. Truman at his side, President Lyndon B. Johnson signs the Medicare bill into law.

How do I find my Medicare premium amount?

Visit Medicare.gov/your-medicare-costs/medicare-costs-at-a-glance to find the information in this chart. If you have questions about your Part B premium, call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. If you pay a late enrollment penalty, these amounts may be higher.

How do I check my Medicare payments?

Visiting MyMedicare.gov. Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

What months are quarterly Medicare payments due?

A calendar quarter is a three-month period of time ending with March 31, June 30, September 30, or December 31. Social Security counts each calendar quarter that you work and pay into Social Security and Medicare taxes toward your eligibility for premium-free Part A.

Do Irmaa brackets change each year?

IRMAA is based on your Modified Adjusted Gross Income (MAGI) from two years ago. In other words, the 2022 IRMAA brackets are based on your MAGI from 2020. If the 2020 amount is not available, your 2019 MAGI is used.

How do you calculate modified adjusted gross income for Irmaa?

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

What is the Irmaa amount for 2022?

What will the Medicare IRMAA be in 2022?2022 (based on 2020 individual tax return)2022 (based on 2020 joint tax return)More than $142,000 up to $170,000More than $284,000 and up to $340,000More than $170,000 up to $500,000More than $340,000 up to $750,000More $500,000More than $750,0003 more rows•Feb 15, 2022

What are the Part D Irmaa brackets for 2022?

2022 Medicare Part D Income Related Adjustment Amount (IRMAA) Income BracketsIf your filing status and yearly income in 2020 (filed in 2021) wasabove $142,000 up to $170,000above $284,000 up to $340,000above $170,000 and less than $500,000above $340,000 and less than $750,000$500,000 and above$750,000 and above4 more rows•Nov 13, 2021

How much is Medicare Part B in 2016?

As a result, by law, most people with Medicare Part B will be “held harmless” from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90. Beneficiaries not subject to the “hold harmless” provision will pay $121.80, as calculated reflecting the provisions of the Bipartisan Budget Act signed ...

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not pay a Part A premium since they have at least 40 quarters of Medicare-covered employment.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold-harmless” provision are those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and beneficiaries who pay an additional income-related premium.

Do you have to file a separate tax return for a spouse who is married?

Premiums for beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouse at any time during the year, but file a separate tax return from their spouse:

See Also -- CALCULATOR: How Much You'll Pay for Medicare in 2016

Medicare beneficiaries who have Part B premiums withheld from their Social Security checks--about 70% of beneficiaries--will continue to pay $104.90 per month for Part B. If you aren't collecting Social Security yet or will enroll in Medicare in 2016, you will have to pay $121.80 per month in 2016.

See Also: 10 Things You Must Know About Medicare

Your income is usually based on your last tax return on file, which would be your 2014 return, for 2016 premiums. But you may be able to get the high-income surcharge reduced or eliminated if your income has decreased since then because of certain life-changing events, such as the death of a spouse, divorce, retirement or reduced work hours.

How much is Medicare deductible for 2016?

For 2016, that deductible is $1,288, which is up $28 from 2015. At that point, Medicare pays all of the allowed costs of hospital care for the first 60 days of your stay. From the 61st to the 90th day of your hospital stay, Medicare still covers most of the cost, but you'll have to pay a daily coinsurance amount.

What does the SSI cover?

It covers semi-private rooms, meals, general nursing, drugs received as part of your inpatient treatment, and other hospital services. Coverage takes effect when a doctor officially orders that you need to stay overnight for at least two nights for medically necessary care that can be given only in a hospital.

How long does a skilled nursing facility stay in the hospital?

For separate skilled nursing facilities, Medicare requires that you have a qualifying hospital stay of at least three days of inpatient care associated with your admission to the facility. In addition, your doctor needs to determine that you need daily skilled care by qualified staff. What you'll pay for inpatient services under Medicare Part A.

What is Medicare Part A?

In particular, Medicare Part A coverage offers help with the expensive cost of care in hospitals and other inpatient facilities.

Does Medicare pay for skilled nursing after 100th day?

After the 100th day, you're responsible for all costs, and there's no provision for lifetime reserve days for skilled nursing facilities. Image based on Medicare data. Hospital and skilled nursing facility charges can be astronomical, and Medicare pays the lion's share of costs for these expenses.

Does Medicare cover skilled nursing?

Medicare covers all costs for the first 20 days of skilled nursing care, with no deductible because the required hospital stay related to the skilled nursing facility admission involved the hospital deductible.

Does Medicare Part A have a monthly premium?

For the vast majority of participants, Medicare Part A coverage comes with no monthly premium. Instead, Part A requires you to pay deductibles and coinsurance amounts when you actually use hospital services. The latest Medicare cost figures for 2016 just came out, and as you'd expect, costs are heading up next year.

How often is Medicare Part A premium due?

Help with costs. Summary. A person enrolled in original Medicare Part A receives a premium bill every month, and Part B premium bills are due every 3 months. Premium payments are due toward the end of the month. Original Medicare consists of Part A, which is hospitalization insurance, and Part B, which is medical insurance.

What is Medicare Supplement?

Medicare supplement insurance. Medigap is a Medicare supplement insurance plan that pays 50–100% of the original Medicare (parts A and B) out-of-pocket costs. These plans are available to people enrolled in original Medicare, and there will be a monthly premium to pay. Learn more about how Medigap plans work here.

What is Medicare Advantage?

Medicare Advantage. Instead of enrolling in original Medicare (parts A and B), some people choose to enroll in Part C, or Medicare Advantage. This is an alternative to original Medicare. In that case, a person must pay their Part B premiums in addition to their Medicare Advantage plan costs. Learn more about choosing a Medicare Advantage plan here.

How often do Medicare payments come out?

People who do not get SS or RRB benefits will receive bills for their Medicare premiums. Medicare will issue Part A bills monthly and Part B bills every 3 months. There are several ways to pay the premiums, including: through the Medicare account. online through a bank’s bill payment service.

What is the average Part D premium for 2020?

In 2020, the average Part D monthly premium base was $32.74 for people with an income of $87,000 or under. As with Part B, the premiums increase in relation to having an income above a certain amount. People can use this online tool to compare various Part D plans.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What happens if you are late on Medicare?

For original Medicare (parts A and B), Medicare will send a person a First Bill. If they are late with payment, they will get a Second Bill, which includes the past-due premium amount and the premium that is due the following month.

Find out how much your paycheck will suffer

One of the first things you notice when you get your first paycheck is that your take-home pay is less than your wage or salary would suggest. That's because part of your earnings gets withheld to cover taxes, and a big part of that withholding goes toward Social Security and Medicare taxes.

Social Security, Medicare, and FICA

Tax withholding can appear on your paycheck in different ways depending on how your employer handles its payroll. Some employers break out Social Security taxes separately from Medicare taxes. Others lump them into one big category called FICA, which stands for the Federal Insurance Contributions Act.

Are changes coming to payroll tax withholding?

Tax increases are rarely popular. However, when it comes to Social Security and Medicare taxes, some policymakers believe that there's an opportunity to change the payroll tax withholding system in a way that will generate more tax revenue.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.