2018 Medicare Part D Plans By State

| State | Average Monthly Premium | Average Deductible |

| ALABAMA | $50.31 | $253.40 |

| ALASKA | $49.36 | $270.00 |

| ARIZONA | $44.51 | $281.30 |

| ARKANSAS | $47.95 | $242.14 |

Who is eligible for Medicare Part D?

6 rows · Over $428,000. $76.20 + plan premium. In 2018, premium brackets will change for Part D just as ...

How to compare Medicare Part D plans?

· Here’s what you need to know about Medicare Part D and the costs for 2018. Premiums. Unlike Medicare Part A and Part B, Part D does not have premiums set by the government, so costs can vary based on the plan you choose and where you live. This is partially due to the fact that private insurance companies provide Part D benefits and can set their own …

What is the average cost of Part D?

4 rows · · How much does Medicare Part D cost? ... The Part D monthly premium surcharge in 2018 ...

How much does Medicare Plan D cost?

Part D plans can't charge a deductible that's more than $405 in 2018, but you can find many ...

What was the Medicare Part D premium for 2018?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred.

How much is Medicare Part D every month?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What was the cost of Medicare in 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What is the cost of Part D for 2022?

Highlights for 2022 The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What is the average cost of Part D Medicare?

Varies by plan. Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

How much are Medicare premiums for 2019?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What is the cost of Medicare Part B for 2019?

$135.50 for 2019The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

Is there a premium for Medicare Part D?

How much does Part D cost? Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

What is the max out-of-pocket for Medicare Part D?

As expected, a $2,000 cap on out-of-pocket spending would generate larger savings than a $3,100 cap. Average out-of-pocket spending was $3,216 among the 1.2 million Part D enrollees with out-of-pocket spending above $2,000 in 2019.

Is Medicare Part D worth getting?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

How Much Does Medicare Part D Cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency th...

What Does Medicare Part D Cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers. Often, you...

Don't Miss Out on The Prescription Drugs That You Need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their hea...

What is Medicare Part D?

Prescription drug coverage, or Medicare Part D, is a relatively new feature of Medicare, but millions of seniors take advantage of the program to help lower their prescription drug costs. Here’s what you need to know about Medicare Part D and the costs for 2018.

Do Part D plans require copays?

Copays and coinsurance are also typical under Part D plans. Some plans require you to pay a certain percentage of prescription drug costs (coinsurance), while others charge a fixed dollar amount (copayment). Prescription drug costs also depend on whether the drug is name brand or generic.

How long do you have to enroll in Part D?

If you want to enroll in Part D coverage, make sure you do it at the right time: the seven-month period around your 65 th birthday month, including the three months leading up to it. If not, you could be penalized for signing up 63 days or more after your Initial Enrollment Period is over. If you don’t sign up during your Initial Enrollment Period, you will have to wait for the Fall Open Enrollment Period, which is October 15 – December 7, and you could be penalized.

What is the coverage gap for prescription drugs?

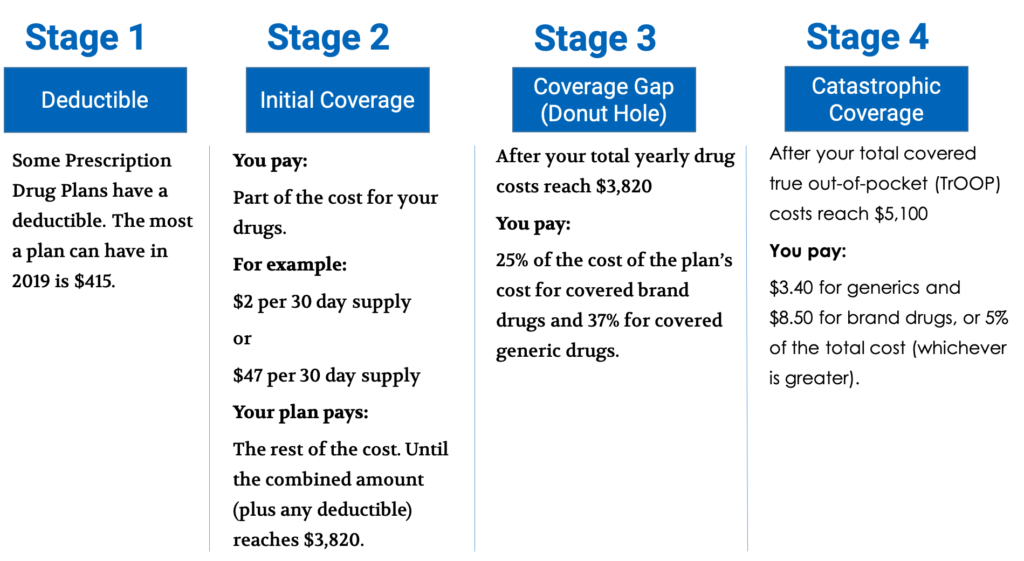

Once your out-of-pocket drug costs have reached $3,750, you fall into the coverage gap, also known as the donut hole. This means your plan stops paying for your prescription drugs until you reach catastrophic coverage. For 2018, catastrophic coverage begins once your out-of-pocket expenses have reached $5,000. Until you reach that, there are coverage gap discounts available to you: in 2018, name brand drugs will be discounted 65% and generic drugs will be discounted 56%. All payments (including discounts) will count toward your out-of-pocket costs and help you reach catastrophic coverage.

Find out more about your Medicare prescription drug benefits

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

How much does Medicare Part D cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency that oversees Medicare doesn't set fixed amounts for most of those costs.

What does Medicare Part D cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers.

Don't miss out on the prescription drugs that you need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their healthcare expenses. By finding out what a Part D plan will cover and how much it will cost, you'll be in a better position to choose the right plan to meet your specific medical needs.

What is the Medicare premium for 2018?

The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees. For these enrollees, any increase in Part B premiums must be lower than the increase in their Social Security benefits.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Does Medicare Part D have coinsurance?

Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing. Some Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, ...

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is Part D deductible?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage. Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.