What is the cheapest Medicare Part D?

8 rows · Nov 15, 2021 · It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $7,050. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if …

What are the best Medicare Part D plans?

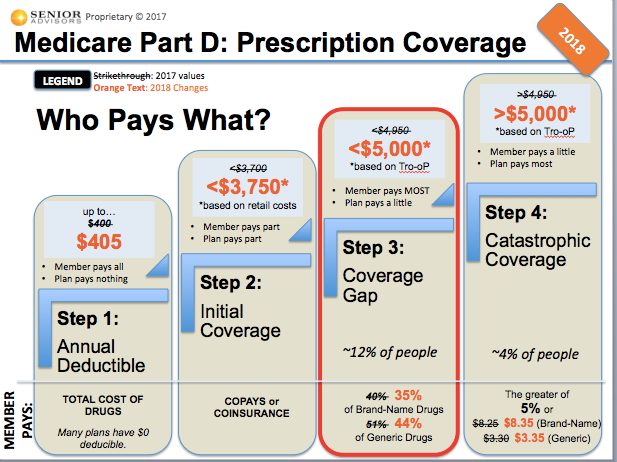

Some Part D plans charge deductibles, and the annual limit on that amount in 2021 will go up by $10 to $445. However, a plan can charge a smaller deductible, or no deductible at all. There are...

Who is eligible for Medicare Part D?

What Medicare Part D drug plans cover. Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site. Costs for Medicare drug coverage. Learn about the types of costs you’ll pay in a Medicare drug plan. How Part D works with other insurance

What are the requirements for Medicare Part D?

May 04, 2020 · Yearly deductible. $445 is the maximum deductible that Medicare Part D plans can charge in 2021. Initial coverage. The initial coverage …

What is the Part D premium for 2021?

$33.06As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

How much is the Part D deductible for 2021?

$445$445 is the maximum deductible that Medicare Part D plans can charge in 2021. Initial coverage. The initial coverage limit for Medicare Part D plans in 2021 is $4,130.

What is the cost of Part D for 2022?

Highlights for 2022 The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.Nov 2, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

What is the Medicare donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

Is there an out-of-pocket maximum for Medicare Part D?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.Nov 24, 2021

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the 2022 Part D initial coverage limit?

$4,430The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

What is Medicare Part D?

One of the newer elements of the Medicare program is prescription drug coverage, added under what's known as Medicare Part D. Part D coverage is an optional add-on that participants can use regardless of whether they have traditional Medicare coverage under Parts A ...

What is Part D insurance?

Part D comes with highly variable costs. Less expensive plans often omit certain drugs from their coverage, while more expensive plans typically offer more comprehensive selections of prescriptions. Plans are also allowed to have different copayments and to treat various types of drugs differently, such as charging less for generic versions of drugs than for name-brand pharmaceuticals.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

Is Medicare Part D good for retirement?

Prescription drugs play a vital role in keeping people healthy, but paying for them in your retirement years can be challenging. Medicare Part D offers a valuable way to control healthcare costs, but it's important to know the ins and outs of the program to make sure that you get everything you can out of it.

Does Medicare cover shingles?

Image source: Getty Images. There is some uniformity across all Part D plans. Medicare requires that all insurers cover drugs in certain protected classes, including prescriptions necessary for fighting various forms of cancer, as well as vaccines to fight diseases like shingles.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is the maximum deductible for Medicare Part D 2021?

When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is Medicare Part D copayment?

The Medicare Part D copayment and coinsurance amounts are the costs you pay after your Part D deductible has been met. Depending on the plan you choose, you will either owe copayments or coinsurance fees.

What is a donut hole in Medicare?

Most Medicare Part D plans have a coverage gap , also called a “ donut hole .”. This coverage gap happens when you’ve reached the limit of what your Part D plan will pay for your prescription drugs. This limit is lower than your catastrophic coverage amount, however, which means that you will have a gap in your coverage.

How much do you owe for generic drugs?

Once you hit the coverage gap, you will owe 25 percent of the cost of the generic drugs covered by your plan. You pay 25 percent and your plan pays the remaining 75 percent.

What is a prescription drug plan?

Prescription drug plan formularies cover both brand-name and generic drugs from the commonly prescribed drug categories. Before you enroll in a Part D plan, check that your medications are covered under the plan’s formulary. When you enroll in Part D, there are plan fees in addition to your original Medicare costs.

How long can you go without prescription drug coverage?

If you go without prescription drug coverage for a period of 63 consecutive days or more after you initially enroll in Medicare, you will be charged a permanent Medicare Part D late enrollment penalty. This penalty fee is added to your prescription drug plan premium each month you are not enrolled.

Is Medicare Part D mandatory?

Medicare Part D coverage is mandatory as a Medicare beneficiary, so it is important to choose a plan that works for you. When shopping around for prescription drug coverage, consider which of your medications are covered and how much they will cost.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the difference between generic and brand name drugs?

Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more. Medicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell.

Does Medicare Part D have coinsurance?

Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing. Some Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, ...

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

What is the coverage gap for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you’re in the doughnut hole, where you’ll now receive a 75% discount on both brand-name and generic drugs.

What is the donut hole in Medicare Part D?

The 2021 Doughnut Hole for Medicare Part D Explained. Most plans with Medicare prescription drug coverage (Part D) have a coverage gap –referred to as a "donut hole.”. This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for your prescriptions up ...

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...