Premium based on income is as follows:

| Individual Annual Income | Couples Annual Income | What you pay in addition to your regular ... |

| Equal to or below $85,000 | Equal to or below $170,000 | $0 |

| $85,001 – $107,000 | $170,001 – $214,000 | $12.40 |

| $107,001 – $133,500 | $214,001 – $267,000 | $31.90 |

Full Answer

What is the cheapest Medicare Part D?

52 rows · Nov 18, 2021 · The average Part D plan premium in 2022 is $47.59 per month. 1. Because Original Medicare ...

What does Medicare Part D really cost?

The maximum Part D deductible is $480 in 2022. Initial Coverage Period: This period occurs after you have met your deductible and your plan begins to cover your drug costs. How much does Medicare pay for prescriptions? During this period, your plan will cover some of the drug cost and you will pay your copayment or coinsurance.

What is the monthly premium in Medicare Part D?

Feb 17, 2021 · How Much Does Medicare Part D Cost? The national base beneficiary premium for Part D plans is $33.37 per month for 2022. Roberta Pescow Jan 4, 2022 Many or all of the products featured here are...

What is the deductible for Medicare Part D?

Feb 24, 2022 · Your share of Medicare Part D prescription drug costs include your monthly premium, yearly deductible, and copays or coinsurance. The average base premium for a Medicare Part D plan in 2021 is $43.07, and the maximum deductible a plan could set is $445, but some plans have no deductible. Connect With a Medicare Expert.

What is the average cost for Medicare Part D?

Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan. In most plans, after spending usually $4,430 in total drug costs, you reach the coverage gap.

What is the Part D premium for 2021?

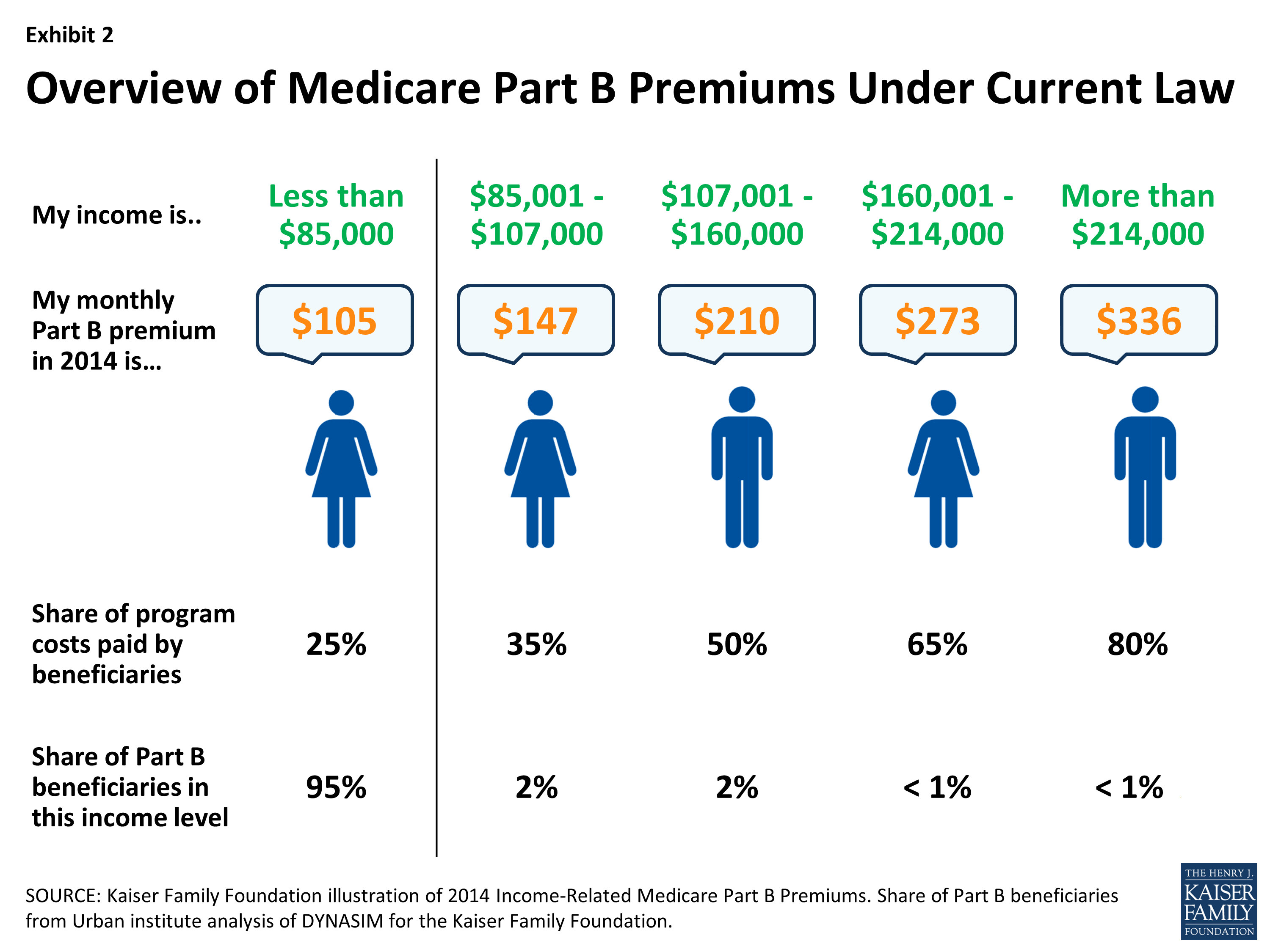

$33.06As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

What is the cost of Part D for 2022?

Highlights for 2022 The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.Nov 2, 2021

Do you have to pay for Medicare Part D?

How much does Part D cost? Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

What is the Part D deductible for 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What does Medicare Part D include?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

Key Takeaways

Does Medicare pay for prescriptions? Yes—drug coverage is available through Medicare Part D.

How much does Medicare Part D cost?

Medicare will pay part of the costs of prescription drug coverage for everyone who enrolls in a Part D plan. How much you pay will depend on which prescription drug plan you choose and whether or not you qualify for Extra Help that assists in covering the costs of this coverage.

Medicare Part D Deductible

Remember, a plan with a deductible will not pay for your prescriptions until you pay the deductible amount out-of-pocket. The highest deductible a plan can charge in 2022 is $480. Some plans offer $0 deductible and will pay for your prescriptions right away. Other plans may offer a deductible lower than the maximum of $480 such as $150 or $250.

Copayments and Coinsurance

A copayment, or copay, is a fixed dollar amount for your prescriptions. For example, you might have to pay $5 for a generic drug, $25 for a "preferred" brand name drug and $40 for a non-preferred brand name drug.

What are copay tiers?

Each plan places the drugs it will pay for in different levels, called tiers. Each tier has its own copay or coinsurance amount. Your drugs may be included in all the plans in your area, but they could be listed on different tiers with different copay amounts.

Phases of Part D Prescription Costs

Prescription drug costs may change throughout the year depending on which phase of Part D coverage you are in. There are four phases of Part D coverage:

When does the coverage gap end (catastrophic coverage)?

In Part D, you and the plan you join share the cost of drugs. The money that you spend is called your out-of-pocket costs. That determines if and when the catastrophic coverage begins. In 2022, the catastrophic coverage starts when you have paid $7,050 out-of-pocket.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

What is Medicare Part D?

While the government provides Parts A and B directly, Part D policies are issued by private insurance companies that have contracts with the federal government. If you choose Original Medicare, purchasing an additional Part D plan adds important prescription coverage to your overall health insurance protection.

How much does Medicare Part D cost in 2021?

The national base beneficiary premium for Part D plans is $33.06 per month for 2021, according to Centers for Medicare & Medicaid Services, which calculates this number in part by using ...

How does Medicare determine the penalty amount?

Medicare determines the penalty amount by multiplying the number of full months you were eligible for but didn’t have drug coverage by 1%, then multiplying that product by the national base beneficiary premium ($33.06 for 2021). The result is rounded to the nearest 10 cents.

What is the Part D IRMAA?

This surcharge is known as the Part D Income-Related Monthly Adjustment Amount , or Part D IRMAA, and is not part of your premium. You won’t owe a Part D IRMAA in 2021 unless you’ve earned more than $88,000 filing an individual tax return, or $176,000 filing jointly.

How long does it take for Medicare to respond to a penalty?

If you think Medicare has penalized you in error, you can request a reconsideration. You’ll have 60 days from the date you receive notification about the penalty to respond, and you’ll need to send the documentation that supports your case. Usually, you’ll receive a decision within 90 days.

How much is Kaiser insurance in 2021?

Depending on the plan you choose, however, your upfront costs might be much higher or lower. In 2021, plan premiums ranged from $5.70 per month to $205.30 per month, according to the Kaiser Family Foundation. Additional charges apply if you enroll late, have an extended gap in drug coverage or earn a high income.

When does Medicare pay late enrollment penalties?

Medicare imposes a late enrollment penalty if you don’t purchase Part D coverage before the end of your Initial Enrollment Period — the seven-month period starting three months before the month you turn 65 — or if you’ve gone 63 consecutive days or more without prescription drug coverage.

What Determines Medicare Part D Premiums?

Medicare Part D premiums are the monthly fee you pay for coverage. Medicare Part D prescription drug plans are sold by private insurance companies that contract with Medicare.

What Is the Medicare Part D Deductible?

The Medicare Part D deductible is the amount of money you have to pay out of your own pocket for your prescriptions each year before your prescription drug plan starts paying its share.

Medicare Part D Copays and Coinsurance

Once you pay your Medicare Part D deductible, you will only pay a portion of the cost for your prescriptions for the rest of the year. These payments will be in the form of either a copayment or coinsurance.

Help Covering Medicare Part D Costs

If you have limited income and resources, a program called Extra Help may be able to help you with Medicare Part D prescription drug costs, including premiums, coinsurance and your deductible.

What is Medicare Part D?

Since 2006, Americans have had the option to purchase Medicare Part D, an insurance plan that helps cover drug costs for those with Medicare. 1. Unlike Medicare Part A and Part B, you purchase Part D from private insurers or get it as part of your Medicare Advantage Plan. 2 The average Medicare beneficiary had 30 prescription drug plans ...

How much is the deductible for Medicare 2021?

Your deductible varies based on your plan but cannot exceed $445 in 2021, up from $435 in 2020. 9 Some Medicare drug plans don’t have any deductible at all. Before choosing a low- or no-deductible plan, it’s important to calculate the total cost of your plan, including premiums and copays or coinsurance.

What are the tiers of drugs?

What Are Drug Tiers? Drug plans publish a formulary, or list of covered drugs. Often, they separate their formularies into “tiers,” with Tier 1 drugs (usually generic drugs) costing the least and Tier 4 drugs (non-preferred, brand name prescription drugs) costing the most.

How much is extra help?

If you have limited resources, you can apply for “Extra Help,” worth about $5,000 from the Social Security Administration. 12 To qualify, you’ll need to have a net worth (excluding your home and personal possessions) of less than $14,610 and an income of less than $19,140.

How much will the Donut Hole cost in 2021?

Once the total amount of drug costs (including those paid by both you and the plan) reach $4,130 in 2021 on plan-covered drugs, you enter the Coverage Gap, also known as the “ donut hole ” and have to pay 25% of your drug costs. 10. Once you’ve spent $6,550 out of pocket, you enter Catastrophic Coverage.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.