| Plan name | Average monthly cost for AARP Medigap |

|---|---|

| Plan F | $256 |

| Plan G (our recommendation for best overall plan) | $193 |

| Plan G (1) | $173 |

| Plan K | $70 |

What is the best AARP Medicare supplement plan?

Sep 21, 2021 · To apply for AARP Medicare Supplement Plan G or any other Medigap plan from AARP, you must be an AARP member. Memberships are $16 per year in 2021 and include a number of savings and discounts on travel, dining, shopping and more. How Do I Apply for Medicare Supplement Plan G?

Does AARP offer the best Medicare supplemental insurance?

Plan G comes with all the benefits that AARP offers to its members, including discount programs. What Does Plan G Cover? Plan G is identical to Plan F, except the Part B deductible is NOT covered. That deductible is $233 for the year 2022. Other than the deductible, Plan G covers the full 20% that Medicare does not cover.

How much does AARP Medicare supplemental insurance cost?

Compare AARP Medicare Supplement Plan G with Other Medigap Plans. If you are shopping for a Medicare Supplement Plan G, AARP is one option. This Medigap plan will help you pay your portion of the costs of your Medicare Part A and Medicare Part B benefits. The panel above briefly outlines the coverage.

How much does AARP plan cost?

Oct 21, 2020 · Before you qualify for an AARP Medicare Supplement plan, you must become an AARP member. Luckily, that’s simple and inexpensive to do — a membership costs about $16 per year. Next, pay careful...

Does AARP offer high deductible plan G?

AARP also offers a high-deductible version of Plan G. This option will require you to pay a deductible of $2,340 before the plan begins to assist with costs. Once you've met your deductible, the plan will pay 100% of covered costs for the remainder of the year.Jan 4, 2022

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

Does AARP Part G cover prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications.May 27, 2020

Does AARP plan G pay Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Is Plan G the best?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

Are all Medicare Part G plans the same?

Medicare Supplement plans are completely standardized, so the benefits will be the same from company to company. All Medicare Supplement plans, including Plan G, are standardized in the following ways: Benefits – You don't have to worry about which company offers the best or most benefits.

What is the out of pocket maximum for Medigap Plan G?

There is no limit on how much your plan pays each year. You can't “use up” your benefits. Plan G pays 100% of your out-of-pocket costs (except for the Part B deductible), regardless of the cost of your medical care.Sep 22, 2021

What is the monthly premium for AARP Medicare Supplement?

Medicare Supplement plans from AARP by UnitedHealthcare have monthly premiums between roughly $45-$300. However, many plans are available for between about $80-$150. Plan K, L, and N will typically be the least expensive plans if offered in your area, and plans C and F (if you're eligible) will be the most expensive.May 29, 2020

What Plan G does not cover?

Medigap Plan G doesn't cover: Private-duty nursing. Dental care. Vision care. Prescription drugs (available only on plans purchased before Jan.Nov 19, 2021

What is Plan G?

Other than the deductible, Plan G covers the full 20% that Medicare does not cover. Plan G is accepted anywhere in the country that takes Medicare, no referrals are needed.

When will UHC start offering Plan G?

UHC/AARP has announced they will be offering a Plan G in many states across the country starting July 1st, 2017. Rates appear they will be competitive. Call us at (800) 208-4974 for a free quote comparison!

What are the benefits of AARP UHC?

There are many advantages to purchasing a plan with AARP/UHC. For one, you will get the Silver Sneakers benefit. This allows you to go to many gyms across the country free of charge. In addition, you get portable coverage that follows you, where ever you go. In most states, the rates are “community” rates so they won’t increase because of your age. Also, coverage is guaranteed renewable. Plan G comes with all the benefits that AARP offers to its members, including discount programs.

Is AARP a publicly traded company?

AARP Medicare supplement plans are offered through their partner, UnitedHealthcare. UHC is a publicly-traded company and is a member of the Dow Jones Industrial Average. In 2014 Forbes ranked UHC No. 14 in its 2014 rankings of the 500 largest U.S. corporations. It is safe to say, AARP and UHC have a very prominent brand authority and a lot of folks rely on them for their insurance needs.

What is Plan G?

Here's a quick look at what costs Plan G covers: Medicare Part A hospital coinsurance and all costs up to 365 days after Original Medicare benefits are exhausted. Part A hospice care coinsurance or co-payment. Part A deductible. Medicare Part B preventive care coinsurance coverage. Part B coinsurance or co-payment coverage.

Why do you need a Plan G?

Excess Charges are extra costs in addition to the Medicare-approved charge. Because Plan G covers Part B Excess Charges, all of your out-of-pocket costs are paid.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is almost the same as a Plan F policy. Each plan gives seniors comprehensive coverage and are among the most robust of all supplements sold by AARP (Insured by UnitedHealthcare Insurance Company). The only difference is that Plan G makes the beneficiary pay the Medicare Part B deductible out-of-pocket.

How much does it cost to enroll in AARP?

Luckily, that’s simple and inexpensive to do — a membership costs about $16 per year. Next, pay careful attention to your enrollment period.

What is Medicare Supplement Plan?

A Medicare Supplement plan helps you cover costs such as deductibles, coinsurance, copays, and extended hospital care. iStock. AARP has joined forces with UnitedHealthcare, one of the largest insurance providers in the country.

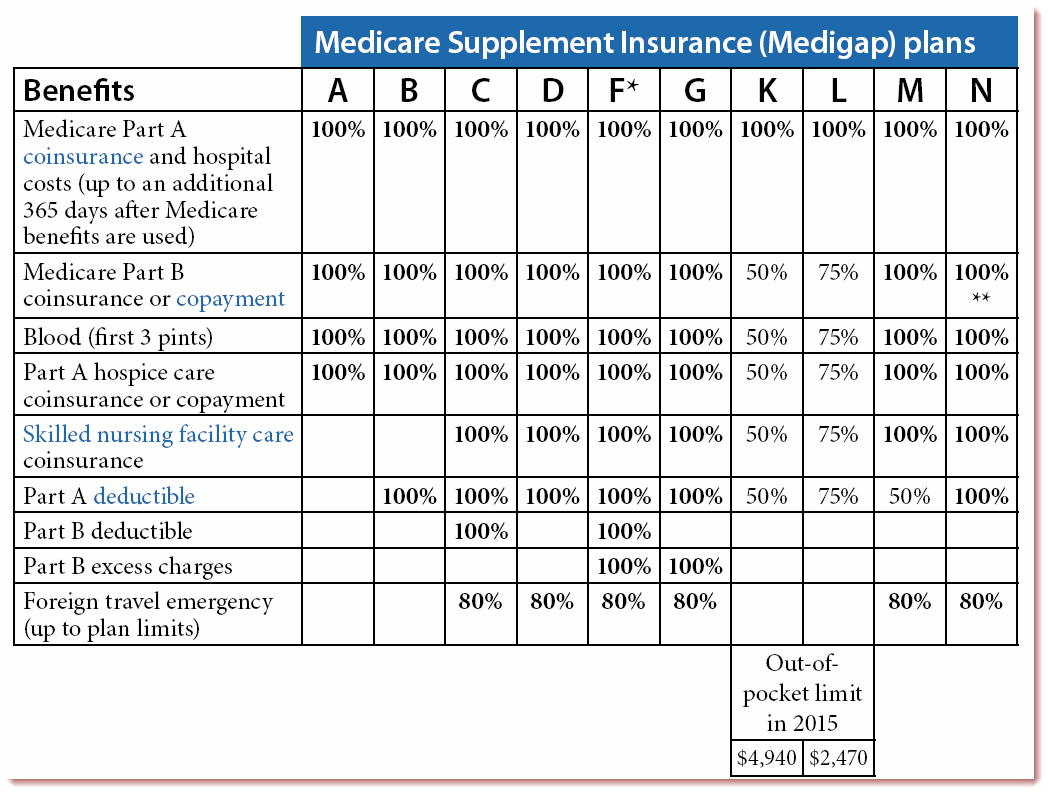

What percentage of Medicare does Plan K cover?

To offset this coverage, Plans K and L don’t cover any Medicare services at 100 percent. Plan K covers some benefits at 50 percent, and Plan L covers some benefits at 75 percent. Your travel plans can also help you narrow down your choice of Medicare Supplement plans.

What is the most comprehensive Medicare Supplement plan?

All carriers who offer Medicare Supplement plans are required to offer at least Plan A, so that will be an option for you no matter where you live. Plans C and F are the most comprehensive plans, but they are only available to beneficiaries who were eligible for Medicare prior to January 1, 2020.

When is the best time to join Medicare Supplement?

The best time to join a Medicare Supplement plan — AARP or otherwise — is during your Initial Enrollment Period (IEP). During this time, you are guaranteed to be accepted into a Medicare Supplement plan, regardless of any health problems.

Does AARP pay royalty fees?

AARP endorses Medicare Supplement insurance plans through UnitedHealthcare. AARP is not an insurer — UnitedHealthcare pays AARP royalty fees for the use of its name . In terms of name recognition with seniors, AARP Medicare Supplement plans are noteworthy.

Is AARP the least expensive insurance?

Must be an AARP member to purchase. Plans aren’t the least expensive, but they are competitive in some areas. Often a better deal for beneficiaries who manage health conditions. Note: Some low ratings are due to customer service issues, but many of them are coverage complaints.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

What states have high deductible plan G?

High-Deductible Plan G is available in 13 states, including Alabama, Arizona, Delaware, Georgia, Illinois, Iowa, Kansas, Louisiana, Maryland, North Carolina, Ohio, Pennsylvania, and South Carolina. Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

When did Medicare stop allowing Part B deductible?

When Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, it changed which Medicare Supplement Plans could be made available to new Medicare beneficiaries. The law required discontinued plans that paid the Part B deductible. This is why, starting on January 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. There are no current plans to discontinue Plan G, and high-deductible plans were made available for the first time in 2020. 5

Does BCBS offer a discount on Medicare?

Although AARP by UnitedHealthcare offers a higher New to Medicare discount in its first year, BCBS offers the most discount savings over time. Check with your state’s plan for details about BCBS discount programs. BCBS prices Medicare Supplement Plan G according to attained-age in most states.

Is Humana a high deductible plan?

It offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan G is available in all of those states except Missouri.

Does Mutual of Omaha offer Medicare Supplement Plan G?

Mutual of Omaha offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available, and High-Deductible Plan G in all of those states except New York.

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.

What is Plan K for Medicare?

Plan K. Plan K is similar to Plan C, but it pays only 50% rather than 100% of certain costs. Hospital Services for Medicare Part A: Plan K pays only 50%—or $742—of the $1,484 Part A deductible. Regarding care at a skilled nursing facility, it pays up to $92.75, instead of $185.50, per day for days 21 to 100.

What is covered by Plan B after day 100?

After day 100, you are responsible for all skilled nursing care costs. Plan B also covers the first three pints of blood and, for hospice care, any co-payment and co-insurance Medicare may require for outpatient drugs and inpatient respite care. 3 .

How much does Medicare pay for hospitalization?

Hospital Services for Medicare Part A: Plan B pays the $1,484 deductible for Part A for the first 60 days of hospitalization. It then acts like Plan A. For days 61 to 90, Plan B pays the $371 per day that Medicare doesn't cover. For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days.

How much does Medicare pay for days 61 to 90?

For days 61 to 90, the plan pays the $371 per day that Medicare does not cover. Days 91 and beyond are covered at $742 per day while using your 60 lifetime reserve days. Once the lifetime reserve days are used, Plan A continues to pay for all Medicare-eligible expenses that would not otherwise be covered by Medicare for an additional 365 days.

How much does Plan B pay?

For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days. After the lifetime reserve days are used, Plan B continues to pay 100% of Medicare-eligible expenses for an additional 365 days. After that period, you are responsible for all costs. If you have been in the hospital for at least three days ...

Does AARP provide Medicare Supplement?

AARP Medicare Supplement Plans are provided through UnitedHealthcare Insurance Company. For seniors who are concerned that their Medicare plan may not provide all the health insurance coverage they need, these plans are available to supplement their Medicare coverage.

What is the GRP number for Medicare?

Policy form No. GRP 79171 GPS-1 (G-36000-4). In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease. Not connected with or endorsed by the U.S. Government or the federal Medicare program. This is a solicitation of insurance.

What is Medicare Supplement?

Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own. These plans, also known as "Medigap", are standardized plans. Each plan has a letter assigned to it, and offers the same basic benefits.

Does Medicare Supplement work with Medicare?

Medicare Supplement insurance plans work with Original Medicare (Parts A & B) to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans:

Does AARP endorse agents?

AARP does not employ or endorse agents, brokers or producers. AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals. Please note that each insurer has sole financial responsibility for its products. AARP® Medicare Supplement Insurance Plans.

What is Medicare Supplemental Insurance?

This is health insurance that helps pay for some of your costs in the Original Medicare program and for some care it doesn’t cover. Medigap insurance is sold by private insurance companies.

What does Medigap cover?

None of the standard Medigap plans cover: • long-term care to help you bathe, dress, eat or use the bathroom. • vision or dental care. • hearing aids. • eyeglasses. • private-duty nursing.

What are excess charges for Medicare Part B?

Medicare Part B Excess Charges#N#When you see a doctor who doesn’t “accept assignment,” he or she doesn’t accept Medicare’s approved amount as payment in full. The doctor can charge you up to 15 percent more than Medicare’s approved amount.#N#Medigap Plans F and G pay 100% of these excess charges. You might want this benefit if you don’t know whether the doctors you see accept assignment, such as when you are in the hospital.#N#Foreign Travel Emergency#N#Medicare does not cover any health care you receive outside of the United States. Medigap Plans C, D, F, G, M and N cover some emergency care outside the United States. After you meet the yearly $250 deductible, this benefit pays 80 percent of the cost of your emergency care during the first 60 days of your trip. There is a $50,000 lifetime maximum.#N#Plans K and L#N#Important: Plans K and L offer similar coverage as plans A - G, but the cost-sharing for the benefits are different levels and have annual limits on how much you pay for services. The out-of-pocket limits are different for plans K and L and will increase each year for inflation. In 2010, the out-of-pocket limit was $4,620 for plan K and $2,310 for Plan L.#N#Ongoing Coverage#N#Once you buy a Medigap plan, the insurance company must keep renewing it. The company can’t change what the policy covers and can’t cancel it unless you don’t pay the premium. The company can increase the premium, and should notify you in advance of any increases.

What percentage of Medicare pays for mental health?

It pays 50 percent of mental health services and 100% of some preventive services. Medigap plans cover all or part of your share of these services – 20 percent of the Medicare-approved amount for doctor services and 50 percent for mental health services.

How long does Medicare pay for skilled nursing home?

Skilled Nursing Home Costs. The Original Medicare Plan pays all of your skilled nursing home costs for the first 20 days of each benefit period. If you are in a nursing home for more than 20 days, you pay part of each day’s bill.

How many days does Medicare cover?

All 11 Medigap plans cover (pay) your costs for days 61 through 150. In addition, once you use your 150 days of Medicare hospital benefits, all Medigap plans cover the cost of 365 more hospital days in your lifetime.

Does Medicare cover blood?

Blood. The Original Medicare Plan doesn't cover the first three pints of blood you need each year. Plans A-D, F-G, and M through N pay for these first three pints. Plans K pays 50% and L pays 75% part of the cost.

How much does a 65 year old woman pay in Georgia?

In Georgia an age 65 female will see rates ranging from $114 to $244. All benefits are identical. If your friend had an F plan it is supposed to pay all deductibles and coinsurance after Medicare pays their part. If a G plan, it pays everything EXCEPT the Part B deductible.

Is Medicare Supplement Insurance standardized?

Medicare.gov - What's Medicare Supplement Insurance (MEDIGAP) Yes, Medigap plans are standardized in their contractual coverage. Medicare.gov - How To Compare Medigap Policies. Pricing varies by the insurer, the state in which you reside and how the specific Medigap policy is rated in your state.