Social Security will be the biggest expense, budgeted at $1.196 trillion. It's followed by Medicare at $766 billion and Medicaid Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…Medicaid

What percentage of the budget is Medicare?

Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the...

What is Medicare annual budget?

Medicare consists of four "parts":

- Part A pays for hospital care;

- Part B provides medical insurance for doctor’s fees and other medical services;

- Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits;

- Part D covers prescription drugs.

What is Medicare SSA benefits?

The takeaway

- Medicare coverage is available for people with a disability who receive SSDI.

- You’ll automatically be enrolled in parts A and B after your 24th month of SSDI benefits.

- You can choose to decline Medicare Part B coverage if you have other options that work better for your budget.

What are the benefits of SSA?

Social Security's Disability Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). Social Security pays disability benefits to you and certain members of your family if you have worked long enough... Social Security and Retirement.

How much of the US budget goes to Medicare and Medicaid?

Historical NHE, 2020: NHE grew 9.7% to $4.1 trillion in 2020, or $12,530 per person, and accounted for 19.7% of Gross Domestic Product (GDP). Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE.

What percentage of the federal budget goes toward Medicare?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

How much of every tax dollar goes to welfare?

For example, in California, counties administer many public welfare programs, including Medicaid and TANF. As a result, in 2019 public welfare spending accounted for nearly half of state government direct expenditures (44 percent) but a small share of local government direct expenditures (4 percent).

What is the budget for Social Security?

In fiscal year (FY) 2022, our programs will provide a combined total of over $1.2 trillion in Social Security benefits and SSI payments to over 74 million beneficiaries.

What is the biggest part of the US budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

What percentage of the US government budget goes to welfare and Social Security?

Today, Social Security is the largest program in the federal budget and typically makes up almost one-quarter of total federal spending.

Where do most of our taxes go?

As you might have expected, the majority of your Federal income tax dollars go to Social Security, health programs, defense and interest on the national debt. In 2015, the average U.S. household paid $13,000 in Federal income taxes.

What percent of our taxes goes to welfare?

Safety net programs: About 8 percent of the federal budget in 2019, or $361 billion, supported programs that provide aid (other than health insurance or Social Security benefits) to individuals and families facing hardship.

What might happen if the government abolished the Social Security tax?

Companies would immediately see their tax rate fall, which means that the leftover money would immediately fall to their bottom lines. Currently, the two trust funds that help provide Social Security benefits have $2.8 trillion. If that money were immediately freed up, it could serve a number of purposes.

Which president took money from Social Security?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19646.REMARKS WITH PRESIDENT TRUMAN AT THE SIGNING IN INDEPENDENCE OF THE MEDICARE BILL--JULY 30, 196515 more rows

What are the 3 largest categories of federal government spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Together, mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

What is the yearly cost to the American taxpayer for Social Security?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

How is Social Security funded?

Social Security is funded through payroll taxes.

How much of Medicare will be paid by 2034?

That means Medicare contributes to the budget deficit. Rising health care costs mean that general revenues would have to pay for 49% of Medicare costs by 2034. 13 As with Social Security, the tax base is insufficient to pay for this.

What is Medicare Part A?

Medicare has two sections: The Medicare Part A Hospital Insurance program, which collects enough payroll taxes to pay current benefits. Medicare Part B, the Supplementary Medical Insurance Program, and Part D, the new drug benefit. Payroll taxes and premiums cover only 57% of benefits.

What does it mean when the government has a high level of mandatory spending?

In the long run, the high level of mandatory spending means rigid and unresponsive fiscal policy. This is a long-term drag on economic growth.

How much is mandatory spending in 2021?

Mandatory spending is estimated to be $2.966 trillion for FY 2021. 1 The two largest mandatory programs are Social Security and Medicare. That's 38.5% of all federal spending. It's more than two times more than the military budget. 2.

Why is mandatory spending growing?

That's one reason mandatory spending continues to grow. Another reason is the aging of America. As more people require Social Security and Medicare, costs for these two programs will almost double in the next 10 years. 18 At the same time, birth rates are falling. As a result, the elder dependency ratio is worsening.

How much is Social Security in 2021?

Social Security is the single largest federal budget item, costing $1.151 trillion in FY 2021. 1 The Social Security Act of 1935 guaranteed that workers would receive benefits after they retired. It was funded by payroll taxes that went into a trust fund used to pay out the benefits. 7

Why are Social Security benefits part of the federal government?

The benefits these programs pay are part of the Federal Government’s mandatory spending because authorizing legislation ( Social Security Act) requires us to pay them. While Congress does not set the amount of benefits we pay each year, they decide funding for our administrative budget.

What is the purpose of the Justification of Estimates for Appropriations Committees?

The Justification of Estimates for Appropriations Committees informs members of Congress about SSA’s funding request, including how it will support performance goals and initiatives to improve service. For specific sections, please see the following:

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

Why is Medicare underfunded?

Medicare is already underfunded because taxes withheld for the program don't pay for all benefits. Congress must use tax dollars to pay for a portion of it. Medicaid is 100% funded by the general fund, also known as "America's Checkbook.".

How much is Biden's budget for 2022?

President Biden’s budget for FY 2022 totals $6.011 trillion, eclipsing all other previous budgets. Mandatory expenditures, such as Social Security, Medicare, and the Supplemental Nutrition Assistance Program account for about 65% of the budget. For FY 2022, budget expenditures exceed federal revenues by $1.873 trillion.

What is the budget for 2022?

The discretionary budget for 2022 is $1.688 trillion. 1 Much of it goes toward military spending, including Homeland Security, the Department of Veterans Affairs, and other defense-related departments. The rest must pay for all other domestic programs.

How much is discretionary spending?

Discretionary spending, which pays for everything else, will be $1.688 trillion. The U.S. Congress appropriates this amount each year, using the president's budget as a starting point. Interest on the U.S. debt is estimated to be $305 billion.

What is the most expensive program in 2022?

It also includes welfare programs such as Medicaid. Social Security will be the biggest expense, budgeted at $1.196 trillion.

How long does it take for the President to respond to the budget?

The president submits it to Congress on or before the first Monday in February. Congress responds with spending appropriation bills that go to the president by June 30. The president has 10 days to reply.

Is Social Security covered by payroll taxes?

Social Security costs are currently 100% covered by payroll taxes and interest on investments. Until 2010, there was more coming into the Social Security Trust Fund than being paid out. Thanks to its investments, the Trust Fund is still running a surplus. Important.

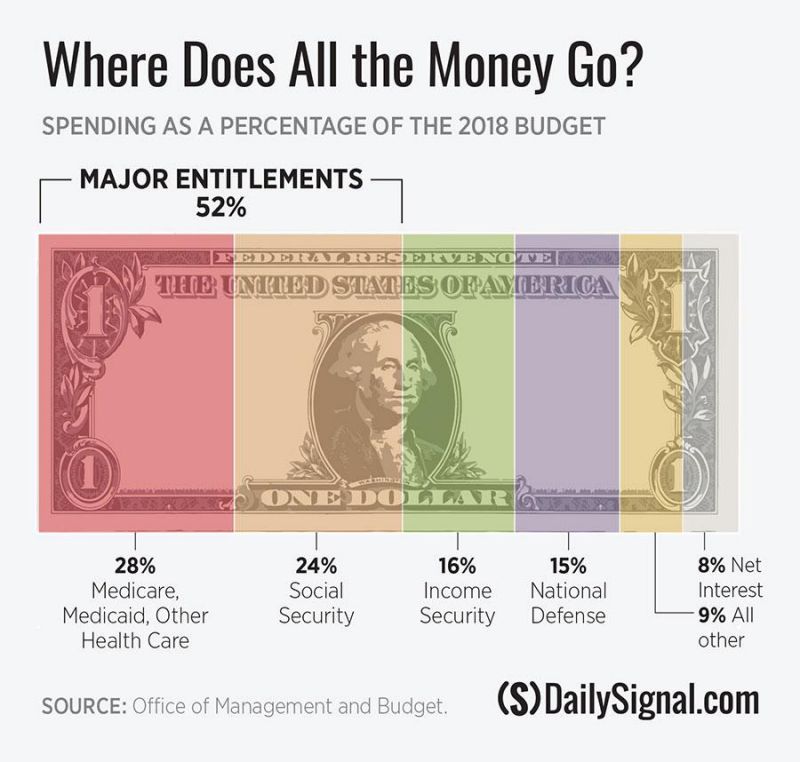

How much of the federal budget does Medicare and Social Security absorb?

Social Security, Medicare, and Medicaid already absorb 42 percent of the federal budget and are growing by 7 percent annually, making them the largest impediment to balancing the budget. Furthermore, many believe that anyone over age 55 should be exempt from entitlement reforms.

How is Medicare Part A funded?

Medicare Part A is funded by payroll taxes that are theoretically "saved" in a trust fund for future retirees. Parts B and D are not funded by payroll taxes. As with Social Security, Congress has already spent all past surpluses for Part A, leaving taxpayers to fund all future shortfalls from scratch.

What is Medicare Part A?

Medicare. Medicare was created in 1965 to provide medical care to Americans age 65 and older. An average of just under $10,000 is spent annually on each of Medicare's 43 million enrollees. [18] Medicare has three main components: 1 Medicare Part A covers hospital and skilled nursing care. It is funded by a 2.7 percent payroll tax (split equally between employer and employee) on all income. For most enrollees, Medicare operates as a fee-for-service system, meaning that once the enrollee satisfies a modest deductible, Washington reimburses participating health care providers for services based on a set payment schedule. 2 Medicare Part B covers physical and outpatient care. This optional program, in which most Medicare recipients participate, requires recipients to pay a monthly premium set at approximately 25 percent of total program costs, leaving the taxpayers to fund the remaining 75 percent. 3 Medicare Part D is the new prescription drug benefit enacted in 2003. This optional program is funded mostly from general tax revenues, although enrollees pay a small deductible and monthly premium. Enrollees choose from competing private health plans, which are reimbursed by Washington.

What is the ratio of Social Security to Medicare in 2030?

In 1960, five workers supported each retiree. This ratio has fallen to 3:1 and will drop to 2:1 by 2030. A 2:1 ratio means that each married couple in 2030 will be supporting the Social Security and Medicare benefits of one retiree. Higher benefit levels will drive the rest of the cost increase.

Why is Medicare reform so difficult?

While Social Security transfers income from one group to another and therefore can be fixed with formula changes, fixing Medicare is more difficult because it is a major part of the health care economy.

How many baby boomers are over 55?

By 2019, all 77 million baby boomers will have turned 55, [4] leaving future lawmakers with the unpalatable options of massive, economy-stagnating tax increases, unprecedented program terminations, or the paring back of benefits for those over 55.

What will the federal budget be in 2050?

The Congressional Budget Office (CBO) projects that federal spending on Social Security, Medicare, and Medicaid will leap from 8.4 percent of GDP today to 18.6 percent by 2050. [2] (See Chart 1.) For comparison, the entire federal budget is 20 percent of GDP (18 percent spent on programs and 2 percent on net interest). This massive cost increase will be fueled by the 77 million retiring baby boomers, combined with steep inflation in health care costs and automatic scheduled benefit hikes.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

Why do people support budget reform?

A lot of people support budget process reform because they don’t want to deal with the underlying policy issue of what to do with spending and revenues. On the other hand, it could have profound effects.

Who is the president of the Committee for a Responsible Federal Budget?

As president of the Committee for a Responsible Federal Budget, MacGuineas leads an organization that helps analyze and develop policies to control deficit spending and the nation’s federal debt, which is the accumulation of all our deficits over time.