How much do Highmark Medicare Advantage plans cost?

| Location/plan | Monthly Premium | Health deductible, drug deductible | Specialist visit copay | Out-of-pocket max |

| Pittsburg, PA: Community Blue Medicare H ... | $0 | $0, $0 | $30 | $7,550 in network |

| Harrisburg, PA: Freedom Blue PPO Standar ... | $174 | $0, $0 | $35 | $5,000 in network, $10,000 in and out of ... |

| Morgantown, WV: Freedom Blue PPO Signatu ... | $0 | $0, $0 | $40 | $7550 in network, $10,000 in and out of ... |

| Wheeling, WV: Freedom Blue PPO Standard ... | $166 | $0, $0 | $35 | $6,500 in network, $10,000 in and out of ... |

Full Answer

Does Highmark have Medicare supplement plans?

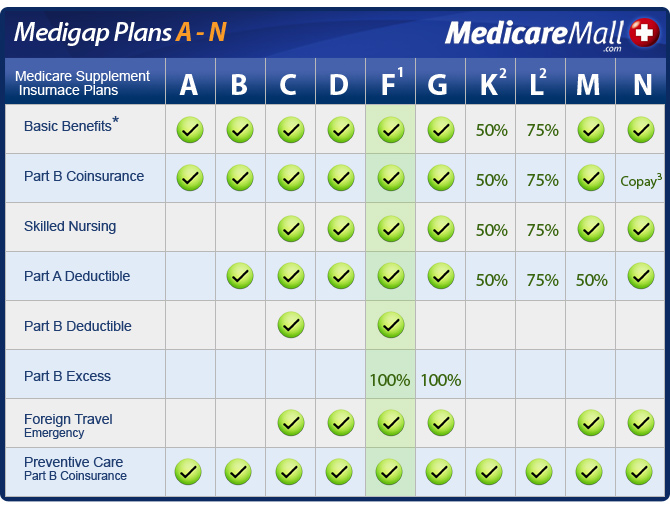

Highmark is a Blue Cross Blue Shield Association member. Highmark offers Medicare supplement plans in three states: Delaware, West Virginia, and most parts of Pennsylvania. You can choose from among a variety Medigap plans, including high-deductible Plan F if you qualify.

Does Highmark Medigap cover dental?

Highmark offers a plan called Whole Health Balance, which you may be able to add to your Medigap benefits. This is an optional program that includes benefits such as dental, fitness, and hearing services. The plan is available for $34.50 per month.

How much is the Medicare drug plan deductible for prescriptions?

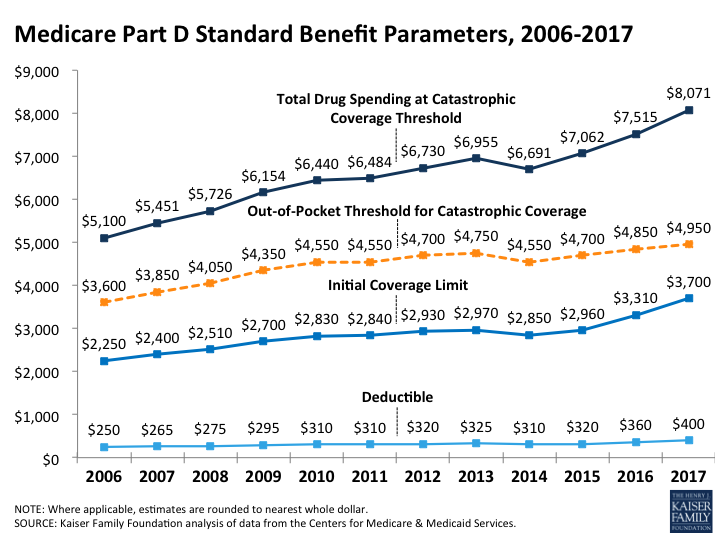

Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $405 in 2018 ($415 in 2019).

What is the Medicare drug plan deductible for 2020?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $435 in 2020.

How much is the Part G deductible?

$233With a standard Supplement Plan G, you're covered immediately and are responsible only for the $233 Part B deductible, plus your monthly premium. With a high-deductible Plan G, your coverage begins once you pay your $2,490 deductible, which then covers all future out-of-pocket costs.

Do Medicare plans have deductibles?

Let's take a look at deductibles. Medicare plans have deductibles just like individual or employer health insurance plans do. Both Original Medicare and, typically, Medicare Advantage Plans, require you to meet a deductible—an amount you pay for healthcare or for prescriptions—before your healthcare plan begins to pay.

What is the Part B deductible for Plan G?

Plan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $233 deductible. This means you pay no copays or coinsurance. If you don't need that level of coverage, though, you might want a plan with less coverage.

Does Plan G pay Part A deductible?

What does Medicare Part G cover? Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end.

What is a deductible for prescription drugs?

A prescription drug deductible is the amount you pay for drugs before we begin to pay our share. Several of our HMO plans have a prescription drug deductible. A prescription drug deductible is the amount you pay for drugs before we begin to pay our share.

What is the deduction for Medicare prescription drug plan?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year.

What is the Medicare Plan G deductible for 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the Medicare Part G deductible for 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

What is the plan g deductible for 2022?

$2,490$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.

Is Plan F better than Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What is Medicare Advantage?

Medicare Advantage plans combine all the coverage of Medicare parts A and B, plus some great additional benefits. Medigap plans are designed to work with Medicare Parts A and B to help cover your share of Medicare covered services like copays, coinsurance, and deductibles.

Does Medicare cover prescriptions?

Original Medicare does not cover prescriptions. These plans cover generic and brand name drugs as well as providing some gap coverage.

How to find highmark Medicare supplement plans?

You can search for available Highmark Medicare supplement plans through Medicare’s plan finder tool. Just enter your ZIP code, and Medicare will show you available plans in your area and how much each may charge. You can also search Highmark’s pricing specifically by visiting the company’s website.

What is highmark insurance?

Highmark is an insurance company that offers Medicare Advantage and Medigap plans in specific states and areas. Keep reading to find out where these plans are offered, what they include, and how much they may cost in 2021.

What is highmark medicaid 2021?

What Highmark Medicare Supplement Plans Are Offered in 2021? What's Medigap? Highmark is a Blue Cross Blue Shield Association member. Highmark offers Medicare supplement plans in three states: Delaware, West Virginia, and most parts of Pennsylvania. You can choose from among a variety Medigap plans, including high-deductible Plan F if you qualify.

What is Medicare Part B?

Medicare Part B covers your outpatient medical care. Medigap plans can help pay for many of the Part B out-of-pocket expenses, depending on your plan. Examples include Part B coinsurance or copayments, which are usually 20 percent of the Medicare-approved cost for services.

Is Highmark Medicare Supplement Plan F still available?

Highmark Medicare Supplement Plan F. Like Plan C, Medigap Plan F is no longer available if you qualified for Medicare after January 1, 2020. Formerly, Plan F provided the most comprehensive Medigap coverage and was often the most expensive plan. If you were eligible for Medicare before 2020, you may still purchase Plan F.

Can you have Medicare Advantage and Medigap at the same time?

Remember, this coverage is available only to people who have original Medicare. You cannot have Medicare Advantage and Medigap at the same time.

Does Medicare cover coinsurance?

Medicare helps cover many of your medical costs, but deductibles, copayments, and coinsurance costs can still add up. That’s where Medicare supplement insurance, or Medigap, can come in. These policies are designed to lower your out-of-pocket healthcare costs. Highmark is an insurance company that offers Medicare Advantage ...

What does Highmark Medicare Advantage cover?

What do Highmark Medicare Advantage plans cover? Each Highmark Medicare Advantage plan will cover several basic services, and plans offer additional services such as prescription drug coverage and dental plans, if you choose to purchase them.

What is a highmark HMO?

Highmark HMO plans. HMO plans typically offer the most cost savings, but they restrict you to receiving care from physicians and hospitals within your plan’s network. These can also come in the form of HMO Point-of-Service (HMO-POS) plans, which may give you the ability to see out-of-network providers.

What is Medicare Advantage?

Medicare Advantage (Part C) plans combine multiple elements of the Medicare program into a tailored package designed to fit individual needs and budgets. They’re offered by private insurers, like Highmark, that contract with Medicare. These plans feature hospital and physician services, plus optional programs for things like prescription medication ...

What are the parts of Medicare?

Services provided under original Medicare, which is made up of Medicare parts A and B include hospital inpatient services, hospice care, limited skilled nursing care, outpatient and physician visits, preventive care, and some therapies.

What are the services offered by Highmark?

Optional services offered as a part of Highmark Medicare Advantage plans include: routine annual vision, dental, and hearing screenings. glasses or contacts. hearing aids. dental work. chiropractic care.

Does Highmark sell Medicare Advantage plans?

Highmark sells its Medicare Advantage plans in Pennsylvania, West Virginia, and Delaware. As of 2019, Highmark was serving approximately 5.6 million members in its coverage areas. Several plans are available based on your needs and budget. Medicare Advantage (Part C) plans combine multiple elements of the Medicare program into a tailored package ...

Can you tailor Medicare Advantage plans to fit your needs?

The plans and products available to you depend on your location. You can tailor Medicare Advantage plans to fit your specific healthcare needs and budget. Additional coverage and services will cost more, and your plan may set limitations on which providers, services, and products you can choose from.

How to determine if you qualify for a low income subsidy?

To determine if you are eligible, or to recertify your low-income subsidy status with the federal government, go to Extra Help With Medicare Prescription Drug Plan Costs . If you believe you qualify for a low-income subsidy and you believe you are paying an incorrect copayment amount, Medicare has established a process that will allow you ...

Does Freedom Blue PPO include Medicare Part B?

The below premiums do not include the Medicare Part B premium you may still have to pay. Freedom Blue PPO’s premium includes coverage for both medical services and prescription drug coverage. 2019 Monthly Premium.

How many pharmacies does Highmark have?

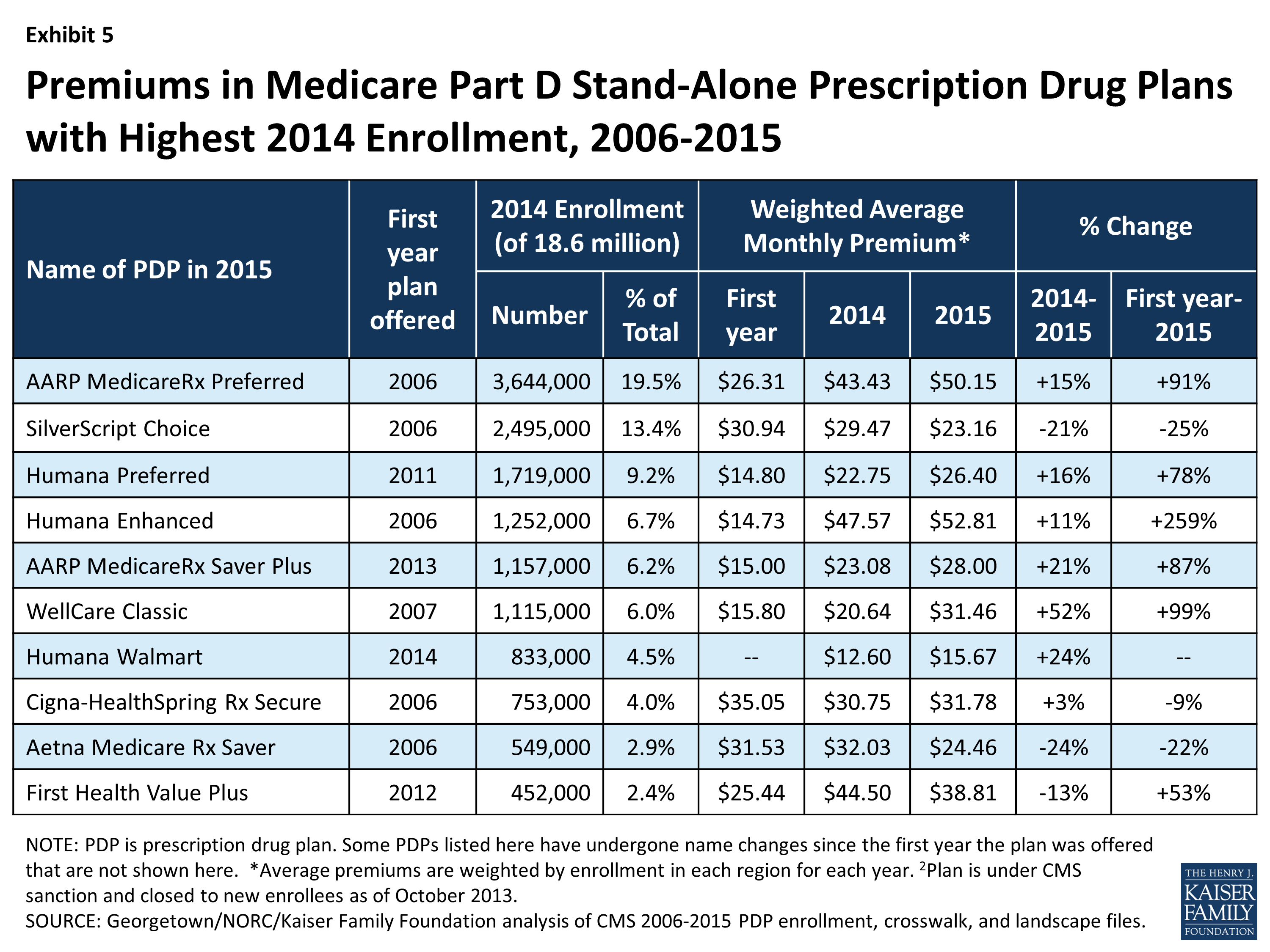

Highmark has a large national network of more than 58,000 pharmacies, including chain and independent drug stores.

How many tablets does Highmark provide?

Quantity Limits. For safety purposes, certain drugs are covered in limited amounts per prescription. For example, Highmark provides up to nine tablets per prescription for the drug Imitrex.

What is Highmark alert system?

Pharmacy Messaging Alert System. Highmark has a real-time messaging alert system in place to inform pharmacists of potential drug problems. When a pharmacist, who is dispensing a drug, bills Highmark, the computer system performs a series of clinical checks.

What is a highmark drug?

Prescription drugs are listed by brand and generic names. Most dosage forms and strengths of a drug are included in the formulary. Highmark covers both brand name drugs and generic drugs. Generic drugs have the same active ingredient formula as a brand name drug. Generic drugs usually cost less than brand name drugs and are rated by ...

Does Highmark cover prescriptions?

This means you will need to get approval from Highmark before you fill certain prescriptions. If you don’t get approval, Highmark may not cover the drug. Our prior authorization policies are in place to ensure the safe and effective use of medications.