How much does Medicare cost the federal government?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare: Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure.

Is Medicare funded by state or federal?

Medicare is funded by federal tax revenue, payroll tax revenue (the Medicare tax), and premiums paid by Medicare beneficiaries The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised

What percentage of the budget is Medicare?

Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the...

How does the federal government funds Medicaid?

The federal government guarantees matching funds to states for qualifying Medicaid expenditures; states are guaranteed at least $1 in federal funds for every $1 in state spending on the program.

How much money did the government spend on Medicare in 2021?

$696 billionWhat is the spending on Medicare? In FY 2021 the federal government spent $696 billion on Medicare.

How much did the government spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.

What is the healthcare budget for 2021?

The Medi-Cal budget is $123.8 billion ($26.8 billion General Fund) in 2021-22 and $132.7 billion ($34.9 billion General Fund) in 2022-23. The Governor's Budget assumes that caseload will increase by approximately 8.3 percent from 2020-21 to 2021-22 and decrease by 3 percent from 2021-22 to 2022-23.

How much did the government spend on Medicare in 2019?

$630 billionLooking ahead, CBO projects Medicare spending will double over the next 10 years, measured both in total and net of income from premiums and other offsetting receipts. CBO projects net Medicare spending to increase from $630 billion in 2019 to $1.3 trillion in 2029 (Figure 6).

Is Medicare subsidized by the federal government?

As a federal program, Medicare relies on the federal government for nearly all of its funding. Medicaid is a joint state and federal program that provides health care coverage to beneficiaries with very low incomes.

What percentage of healthcare is paid by the government?

The deceleration was largely associated with slower federal Medicaid spending. Despite the slower growth, the federal government's share of health care spending remained at 28 percent.

How much does the US spend on Medicare and Medicaid?

The federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1). Of that, Medicare claimed roughly $644 billion, Medicaid and the Children's Health Insurance Pro-gram (CHIP) about $427 billion, and veterans' medical care about $80 billion.

What percentage of US GDP is healthcare?

19.7%Or in dollar-terms, health care expenditures will accumulate to about 6.2 trillion U.S. dollars in total....U.S. national health expenditure as percent of GDP from 1960 to 2020.CharacteristicPercentage of GDP202019.7%201917.6%201817.6%201717.7%9 more rows•Jan 4, 2022

How much has Covid cost the US government?

How is total COVID-19 spending categorized?AgencyTotal Budgetary ResourcesTotal OutlaysDepartment of Labor$726,058,979,281$673,702,382,650Department of Health and Human Services$484,524,400,000$279,893,610,481Department of Education$308,328,604,971$127,408,234,7359 more rows

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

What percentage of tax money goes to healthcare?

U.S. health care spending grew 9.7 percent in 2020, reaching $4.1 trillion or $12,530 per person. As a share of the nation's Gross Domestic Product, health spending accounted for 19.7 percent. For additional information, see below.

Does Medicare pay for itself?

It turns out that Medicare payroll taxes fully fund Part A hospital expenses (together with your share of uncovered Part A expenses), but that is literally where the buck stops. Expenses for Parts B, C (Medicare Advantage) and D (prescription drugs) are paid mostly by Uncle Sam, to the tune of nearly $250 billion.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

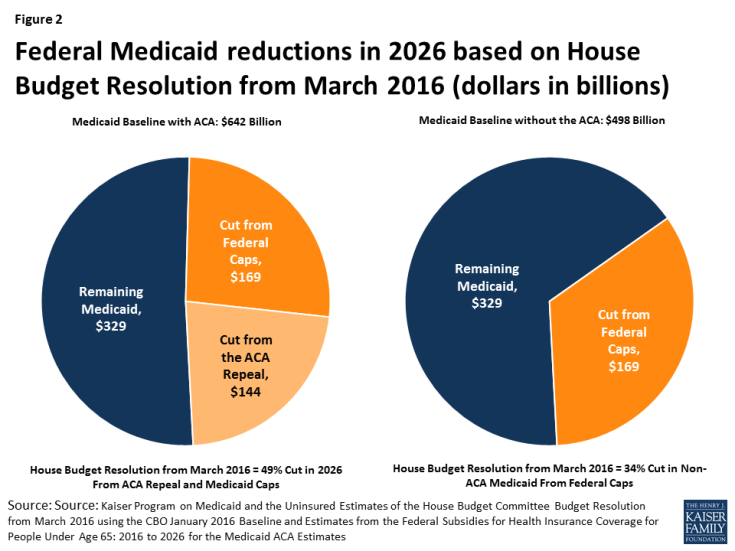

How Does Medicaid Expansion Affect State Budgets?

That’s because the federal government pays the vast majority of the cost of expansion coverage , while expansion generates offsetting savings and , in many states, raises more revenue from the taxes that some states impose on health plans and providers. 19

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much will healthcare cost in 2028?

The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028. This means healthcare will cost an estimated $6.2 trillion by 2028. Projections indicate that health spending will grow 1.1% faster than GDP each year from 2019 to 2028.

How much did the Affordable Care Act increase in 2019?

1 2 . According to the most recent data available from the CMS, national healthcare expenditure (NHE) grew 4.6% to $3.8 trillion in 2019.

What is Medicare recurring?

Recurring Publications. Medicare is the second-largest federal program and provides subsidized medical insurance for the elderly and certain disabled people. CBO’s work on Medicare includes projections of federal spending under current law, cost estimates for legislative proposals, and analyses of specific aspects of the program ...

What percentage of prescriptions were brand name drugs in 2015?

In 2015, brand-name specialty drugs accounted for about 30 percent of net spending on prescription drugs under Medicare Part D and Medicaid, but they accounted for only about 1 percent of all prescriptions dispensed in each program.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How is Medicare Financed?

Medicare is funded primarily from general revenues (43 percent), payroll taxes (36 percent), and beneficiary premiums (15 percent) (Figure 7) .

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.

Why is Medicare underfunded?

Medicare is already underfunded because taxes withheld for the program don't pay for all benefits. Congress must use tax dollars to pay for a portion of it. Medicaid is 100% funded by the general fund, also known as "America's Checkbook.".

How much is the budget for FY 2021?

In May 2021, President Joe Biden released a $6.011 trillion federal budget proposal for fiscal year (FY) 2022. The U.S. government estimates it will receive $4.174 trillion in revenue, creating a $1.837 trillion deficit for October 1, 2021, through Sept. 30, 2022. 1

What is the main goal in creating the federal budget?

The federal budget sets government spending priorities and identifies the sources of revenue it will use to pay for those priorities. It's a key tool for executing the agenda of a given administration, and the budget process is designed to facilitate cooperation between the White House and Congress in setting these priorities. Often, however, it becomes a source of partisan gridlock.

How does the federal government finance a budget deficit?

The government finances its debt by selling its Treasury notes, bills, and bonds to a variety of creditors, such as state and local governments, corporations, and foreign governments . This increases the national debt that the federal government must pay back over time.

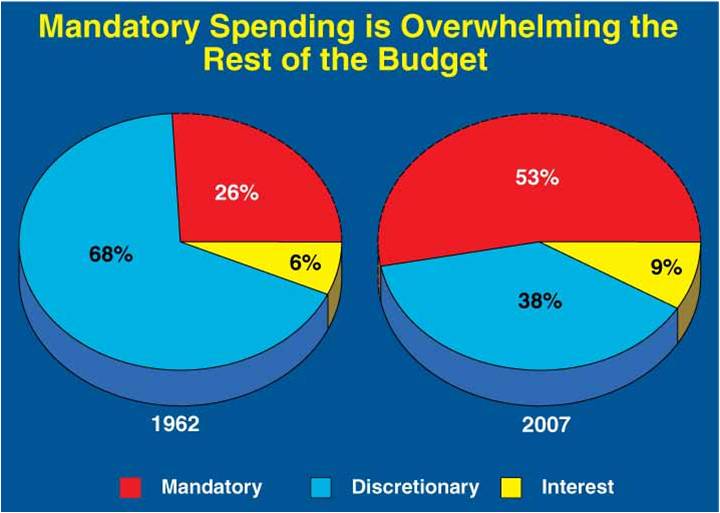

What is mandatory spending in 2022?

Mandatory spending is estimated at $4.018 trillion in FY 2022. This category includes entitlement programs such as Social Security, Medicare, and unemployment compensation. It also includes welfare programs such as Medicaid.

How much is discretionary spending?

Discretionary spending, which pays for everything else, will be $1.688 trillion. The U.S. Congress appropriates this amount each year, using the president's budget as a starting point. Interest on the U.S. debt is estimated to be $305 billion.

What is the most expensive program in 2022?

It also includes welfare programs such as Medicaid. Social Security will be the biggest expense, budgeted at $1.196 trillion.

How much of Medicare will be paid by 2034?

That means Medicare contributes to the budget deficit. Rising health care costs mean that general revenues would have to pay for 49% of Medicare costs by 2034. 13 As with Social Security, the tax base is insufficient to pay for this.

Which Medicare program collects payroll taxes?

The Medicare Part A Hospital Insurance program, which collects enough payroll taxes to pay current benefits.

How is Social Security funded?

Social Security is funded through payroll taxes.

How much is mandatory spending in 2021?

Mandatory spending is estimated to be $2.966 trillion for FY 2021. 1 The two largest mandatory programs are Social Security and Medicare. That's 38.5% of all federal spending. It's more than two times more than the military budget. 2.

Why is mandatory spending growing?

That's one reason mandatory spending continues to grow. Another reason is the aging of America. As more people require Social Security and Medicare, costs for these two programs will almost double in the next 10 years. 18 At the same time, birth rates are falling. As a result, the elder dependency ratio is worsening.

What is the federal spending for FY 2021?

Mandatory spending is estimated to be $2.966 trillion for FY 2021. 1 The two largest mandatory programs are Social Security and Medicare. That's 38.5% of all federal spending.

What is the Social Security Trust Fund?

The Social Security Trust Fund is made up of two parts: Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI).

How much did the federal government spend on healthcare in 2019?

The federal government spent nearly $1.2 trillion in fiscal year 2019. In addition, income tax expenditures for health care totaled $234 billion.

How much did the medical exclusion reduce government revenue?

Including its impact on both income and payroll taxes, the exclusion reduced government revenue by $273 billion in 2019. Updated May 2020.