How is the Part B penalty calculated?

Part B late penalties are calculated as an extra 10 percent for each full 12-month period when you should have had Part B but didn't. If you should have signed up at age 65, the penalty calculation is made on the time that elapsed between the end of your IEP and the end of the GEP in which you finally sign up.

Is there a cap on Part B penalty?

As of now, there is no cap when calculating the Medicare Part B late enrollment penalty. However, legislation has been introduced to cap the Medicare Part B penalty at 15% of the current premium, regardless of how many 12-month periods the beneficiary goes without coverage.

How do I get rid of Part B late enrollment penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

What is the grace period for Medicare Part B?

If you pay Part B premiums directly on a monthly basis, the termination process is the same as if you pay quarterly — that is, the grace period for nonpayment is still 90 days. However, if payment is received within 30 days after termination, your coverage may be reinstated.

Can I delay enrolling in Medicare Part B?

Once you have signed up to receive Social Security benefits, you can only delay your Part B coverage; you cannot delay your Part A coverage. To delay Part B, you must refuse Part B before your Medicare coverage has started.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

How do I appeal Medicare Part B penalty?

In order to successfully appeal your penalty, you will need to prove that you were enrolled either in Part B or had coverage through current employment during the relevant period of time. If your appeal is unsuccessful, you will have the right to request a hearing by an administrative law judge (ALJ).

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How long is a member responsible for a late enrollment penalty?

63 daysMedicare beneficiaries may incur a late enrollment penalty (LEP) if there is a continuous period of 63 days or more at any time after the end of the individual's Part D initial enrollment period during which the individual was eligible to enroll, but was not enrolled in a Medicare Part D plan and was not covered under ...

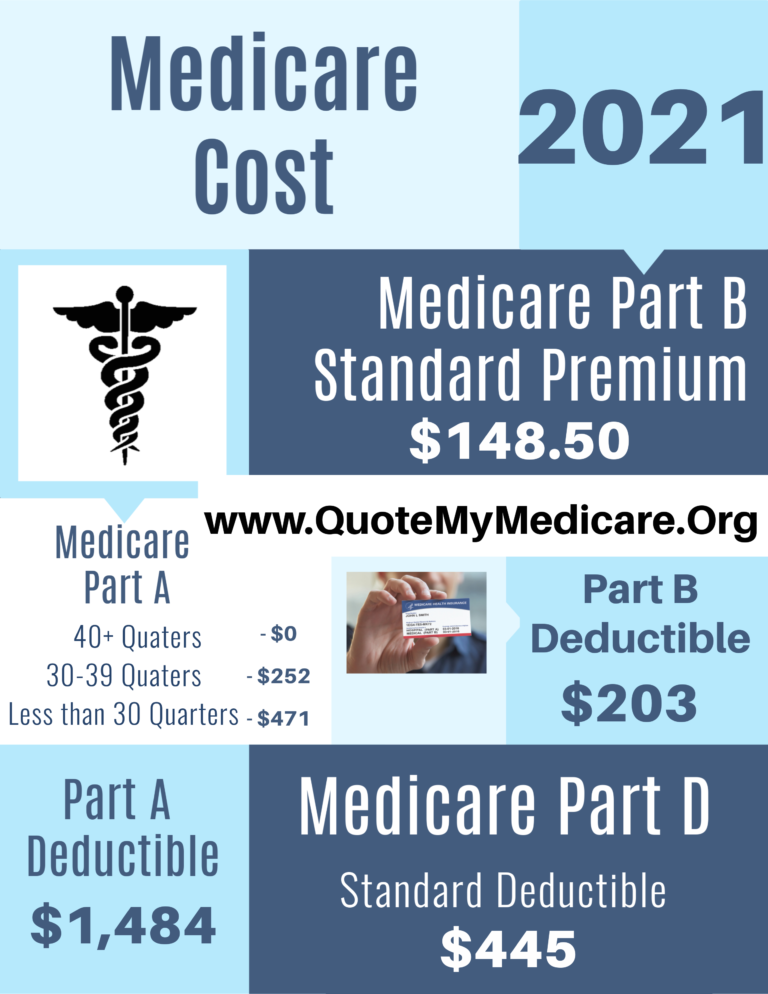

What is the Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Can Medicare Part B be backdated?

This process allows individuals to request immediate or retroactive enrollment into Part B and the elimination of late enrollment penalties from the Social Security Administration (SSA).

How much is Part B late penalty?

Part B late penalties are calculated as an extra 10 percent for each full 12-month period when you should have had Part B but didn’t. If you should have signed up at age 65, the penalty calculation is made on the time that elapsed between the end of your IEP and the end of the GEP in which you finally sign up.

What happens if you miss the Part B enrollment deadline?

How much you’d pay each month depends on how long you delayed enrollment and on the amount of the standard Part B premium in any given year.

What happens if you delay enrolling in health insurance after 65?

If you delayed enrollment after age 65 because of receiving health insurance through active employment, the penalty calculation is made on the time that elapsed between the end of the employment (not the end of the SEP) and the end of the GEP in which you finally sign up.

Why is the penalty clock reset?

At that point the penalty clock is reset because you become eligible for Medicare based on age instead of disability. If you have Medicaid as well as Medicare, your state pays your Part B premiums and any late penalties are waived. If you qualify for assistance from your state in paying Medicare costs under a Medicare Savings Program, ...

How long do you have to sign up for Medicare after you return?

Instead, you get a special enrollment period of up to three months after your return to the U.S. to sign up. If you enroll at that time, you are not liable for Part A or Part B late penalties. Return to Medicare Q&A Tool main page >>.

How long does a SEP last?

This SEP lasts for up to eight months after the employment ends.

What happens if you miss Part B?

If you miss either of these deadlines (whichever applies to your own situation), you can still enroll in Part B, but you’d face two consequences: You could sign up only during a general enrollment period (GEP), which runs from Jan. 1 to March 31 each year, with coverage not beginning until July 1 of the same year. And you might be liable for late penalties.

How much is the penalty for Medicare Part B?

For each 12-month period you delay enrollment in Medicare Part B, you will have to pay a 10% Part B premium penalty, unless you have insurance based on your or your spouse’s current work (job-based insurance) or are eligible for a Medicare Savings Program (MSP) .

How much is the Part B penalty for 2021?

Since the base Part B premium in 2021 is $148.50, your monthly premium with the penalty will be $252.45 ($148.50 x 0.7 + $148.50). Note: Although your Part B premium amount is based on your income, your penalty is calculated based on the base Part B premium. The penalty is then added to your actual premium amount.

Do you have to pay Medicare premium penalty every month?

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay premium penalties, once you turn 65 you will no longer have to pay the premium penalty.

What is the late enrollment penalty for Medicare Part B?

This can be when you turn 65, or under the age of 65 if you’ve been receiving disability payments from Social Security or the Railroad Retirement Board for 24 months.

What happens if you sign up for Part B?

If you sign up for Part B after the initial enrollment period and you’re not eligible for a Special Enrollment Period, you may be subject to a late enrollment penalty. The penalty may be imposed for the duration of Part B coverage. The amount may be as much as 10% more than the monthly premium you would normally pay, ...

What age do you have to be to enroll in Medicare?

Sign-up requirements. Anyone approaching age 65 who is not collecting Social Security or Railroad Retirement Board benefits must enroll in Parts A and/or B when they are first eligible for Medicare or risk incurring Part B late enrollment fees. For some Medicare recipients, a Special Enrollment Period may apply.

How much is the 2020 Part B premium?

Part B, on the other hand, will require you to pay a monthly premium. The 2020 Part B premium begins at $144.60 per month and may increase based on an individual’s modified adjusted gross income and tax filing status. Types of enrollment periods. Enrollment periods fall into three categories:

When does Medicare start?

Initial enrollment: This begins three months in advance of the month you become 65, includes the month in which the birthday falls, and ends three months following the end of that month. If you are qualifying for Medicare due to a disability, you will get coverage that starts in your 25 th month of disability.

When does Part B go into effect?

General enrollment: From January 1 through March 31 of each year, you can enroll in Part B and your benefits will go into effect on July 1 of the same year. Unless you had creditable coverage, you’ll have to pay the late enrollment fee.

Can you delay enrollment in Part B?

Special enrollment: If you choose to delay enrollment in Part B because you have creditable coverage through an employer or union, you may enroll without a penalty during a Part B Special Enrollment Period when your employment ends.

How to avoid Medicare Part B late enrollment penalty?

How to Avoid the Medicare Part B Late Enrollment Penalty. The best way to avoid Part B penalties is to plan ahead. You have several Medicare options to choose from, including Original Medicare plus a Medigap Plan. MedicareFAQ can help you through these decisions by answering your questions and helping you prepare for Medicare.

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

How long does Medicare Part B last?

Your IEP begins three months before your birth month and ends three months after your birth month.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

How long do you have to wait to enroll in Part B?

If you then retire at age 67, you can avoid a penalty by signing up for Part B during your eight-month SEP. If you instead decide to wait until age 70 to enroll, you will pay a 30% penalty every month. 10% for every 12-month period you delayed.

How much is the Part B penalty?

The Part B penalty increases your monthly Part B premium by 10% for each full 12-month period you waited before signing up. The penalty is based on the standard Part B premium, regardless of the premium amount you actually pay.

When does Part B start?

General Enrollment runs from January 1st to March 31st each year. If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have ...

How much is the penalty for Medicare Part B?

Therefore, your penalty is 20 percent per month for the entire time you have Medicare Part B. If your monthly premium is $144.60, that means you pay an extra $28.92 every month.

How much is the late penalty for Medicare?

The late penalty is 10 percent for every year you could have signed up for Medicare Part B but failed to do so. That means that you pay a 10 percent penalty for year one, 20 percent for two years, 30 percent for three, etc. For example, if you were eligible for Medicare Part B in February 2018 but delayed enrollment until June 2020, ...

What does "creditable" mean in Medicare?

In this instance, creditable means at least as good as a Medicare Prescription Drug Plan. Premiums for Medicare Prescription Drug Plans vary according to your income as well as the plan and carrier you choose. One insurance company may offer several different drug plans, all with different premiums and coverage levels.

What happens if you don't sign up for Medicare Part B?

In most cases, if you don’t sign up for Medicare Part B when you’re first eligible and don’t qualify for a Special Enrollment Period, you’ll pay a late enrollment penalty for as long as you have Part B . The late penalty is 10 percent for every year you could have signed up for Medicare Part B but failed to do so.

How much is the penalty for not having prescription coverage?

Unlike A and B, your penalty accumulates monthly. You pay a 1 percent penalty for every month you go without prescription drug coverage. So, 1 percent for one month, 2 percent for two months, etc.

Why would Medicare not sustain itself?

The reason is simple. If everyone waited until they were sick to enroll in Part B or Part D, Medicare would never be able to sustain itself. The cost of paying for care for individuals who are ill and/or require expensive medications would far outstrip the amount of money taken in by Medicare in the form of premiums.

How much penalty do you pay for failing to enroll in Medicare?

However, those who have a premium for Part A pay a 10 percent penalty for every year they were eligible but failed to enroll, for double the number of years they delayed enrollment.

What is Medicare late enrollment penalty?

What is a Medicare Late Enrollment Penalty? A Medicare Late Enrollment Penalty (LEP) is an additional monthly amount you will be required to pay to Medicare if you did not enroll in Medicare Part B and/or D when you first became eligible.

What is the late enrollment penalty for Medicare Part D?

The late enrollment penalty for Medicare Part D is 1% of the average national base monthly premium, rounded to the nearest 10 cents for each month you did not enroll. This penalty is added to your premium each month you are enrolled, and generally lasts for as long as you have Medicare drug coverage.

How long does Medicare Part A last?

Additionally, for those that have to pay for Medicare Part A, there is also a late enrollment penalty for not signing up when first eligible, which is typically when you turn 65. The penalties for Parts B and D will last for your lifetime. For Part A, the maximum number of years the penalty can last is four.

What is the penalty for Medicare Part A?

Medicare Part A Late Enrollment Penalties. The late enrollment penalty for Medicare Part A (for those who are not automatically enrolled), is 10% of your monthly premium if you miss your Medicare enrollment deadline. This is applied no matter how long the delay is, and the penalty is added to your premium cost for twice the number ...

How much is the penalty for not paying Part D insurance?

This would equate to a 60% penalty (1% times 60 months), multiplied by the national premium average ($33.06 in 2021), which would equal an added penalty of $19.80. This penalty would be paid in addition to your Part D premiums, as well as any applicable Part D IRMAA payments.

How much is Part B insurance in 2021?

So for 2021, the base cost would be $148.50, multiplied by 50%, and would equal $74.25, which would be added to your Part B monthly premium costs.

Can you speculate on the amount of your Medicare penalty?

You can speculate on the amount of your penalty; however, you will be notified of the actual amount when you formally apply for Medicare Parts A, B or D. Once the government is aware of your enrollment into these parts of Medicare, they will calculate your penalty and send you, in writing, the actual amount you owe for the upcoming year. ...

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What happens if Medicare pays late enrollment?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

How much is Medicare penalty in 2021?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.06 in 2021, $33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $.10 and added to your monthly Part D premium.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance.

How often does the national base beneficiary premium change?

The national base beneficiary premium may change each year, so your penalty amount may also change each year.