How much is Medicare Part B annual deductible?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

Does Medicare Part B have a deductible?

What Is the Medicare Part B Deductible? The Medicare Part B deductible is $203 for 2021 and $233 for 2022. 7 Most Medicare participants also pay a monthly premium for Part B, which is $148.50 for 2021 and $170.10 for 2022. Medicare Part B covers doctor's visits, tests, flu shots, physical therapy, and even chemotherapy.

What is the current deductible for Medicare Part B?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the 2018 Medicare Part B deductible?

Monthly Part B premium (per person) The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

What is the 2016 deductible for Medicare Part B?

($166 in 2016)Medicare Part B has an annual deductible ($166 in 2016). The deductible amount is the same across the board for all Medicare Part B beneficiaries, but the monthly premium depends on your situation . If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was Medicare Part B deductible?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the annual deductible for Medicare Part B in 2019?

$185 in 2019On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What is the Medicare Part B deductible 2012?

$140In 2012, the Part B deductible will be $140, a decrease of $22 from 2011.

What is my Medicare deductible?

A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs. For example, if you received outpatient care or services covered by Part B, you would then pay the first $233 to meet your deductible before Medicare would begin covering the remaining cost.

What will the Medicare Part B deductible be in 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021.

How do I find out my deductible?

“Your deductible is typically listed on your proof of insurance card or on the declarations page. If your card is missing or you'd rather look somewhere else, try checking your official policy documents. Deductibles are the amount of money that drivers agree to pay before insurance kicks in to cover costs.

What is the deductible for Medicare Part B 2021?

$203.00 per yearThe standard Part B premium amount is $148.50 (or higher depending on your income) in 2021. You pay $203.00 per year for your Part B deductible in 2021. After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

What was the Medicare deductible for 2017?

$183 inCMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement.

How much does Medicare cost out of your Social Security check?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What is the deductible for Medicare Part B 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.

What Medicare Part B Covers

In a nutshell, Medicare Part B, or "medical insurance," is the part of Medicare that covers most medical services and supplies other than hospital...

What Medicare Part B Costs in 2017

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There ar...

Is Medicare in Financial Trouble?

You may have seen headlines about Medicare's financial troubles, so let's set the record straight. First of all, those headlines are referring to t...

Part B premium and deductible changes for 2017 to increase costs

Every year about this time The Centers for Medicare and Medicaid (CMS) announce the Medicare Part B premium and deductible for the coming year. They also address changes to the Part A premium although this affects very few people.

Medicare premium and deductible changes

The Medicare Part A premium which only affects people who did not work and contribute to payroll taxes for 40 quarter over their working life will increase $2 per month to $417. Determining your Part B premium involves taking your individual situation into consideration.

Medicare Part A premium and deductible changes in 2017

If you are hospitalized your Part A benefits will help pay your covered costs. The changes are as follows:

What this really means to you bottom line

If you are enrolled in a Medicare Advantage Plan or a Medicare supplement policy you may not initially feel the pinch as much as someone insured only by original Medicare. Everyone will see a small increase in Part B premiums and if you are becoming eligible for Medicare in 2017 you’ll pay a price for being a year younger.

How much does Medicare Part B cost?

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There are essentially three categories of beneficiaries, each with different premiums. About 70% of Medicare beneficiaries pay their premiums directly through their Social Security benefits.

What is Medicare Part B?

Medicare Part B is also known as "medical insurance," and it covers most medical services and supplies other than hospital stays. Here's a more detailed explanation of what Medicare Part B covers and what it will cost in 2017. Image source: Getty Images.

What are the preventative services covered by Medicare Part B?

Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, and cancer; and services intended to prevent diseases (such as your annual flu shot).

When will Medicare be privatized?

This change may come in the form of a tax increase, benefit reductions, or privatization. If Republican leaders get their way, Medicare will be privatized by 2024 (which would definitely affect Part B).

Does Medicare cover ambulances?

Medicare Part B also covers ambulance services, but only if other transportation could endanger your health. For instance, if you're having a heart attack , Medicare Part B would cover ambulance transportation. Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, ...

Is Medicare Part A funded by premiums?

First of all, those headlines are referring to the part of Medicare that's funded by tax revenue -- Part A, or hospital insurance -- not Part B, which is funded mostly by premiums. Also, Medicare Part A is in decent financial shape -- for now.

What is the Medicare Part B deductible for 2017?

2017 Medicare Part B (Medical) Monthly Premium & Deductible. CMS announced that the annual deductible for all Part B beneficiaries will be $183 in 2017, an increase of $17 from the 2016 Part B annual deductible of $166.

How much is the 2017 Medicare Part D deductible?

The 2017 standard Part D plan deductible is $400, however the actual plan deductible can be anywhere from $0 to $400 . Use our 2017 Part D Plan Finder to see plan premiums, deductibles, and features in your state. use our 2016/2017 Part D plan comparison to see annual changes for each Medicare Part D plan.

How much is Medicare Advantage 2017?

The 2017 Medicare Advantage plan premiums range from $0 to $364. Use our 2017 Medicare Advantage Plan Finder to see plan premiums, deductibles, ...

How long can you get Medicare Part A if you are disabled?

(If you’re under 65 and disabled, you can continue to get premium-free Part A for up to 8 1/2 years after you return to work.) The chart below shows the annual Medicare Part A deductible and the Medicare Part A monthly premium for people who do not ...

How much does a Part A premium go up?

If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. If you aren’t eligible for premium-free Part A, and you don’t buy it when you’re first eligible, your monthly premium may go up 10%. You will have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign-up. For example, if you were eligible for Part A for 2 years but didn’t sign-up, you will have to pay the higher premium for 4 years. Usually, you don’t have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a Special Enrollment Period. Read more under Medicare Part A Special Enrollment Period.

How much does Medicare Part D cost?

The 2017 Part D plan premiums range from $12 to $179.

Where do I mail my Medicare premiums?

You can mail your premium payments to the Medicare Premium Collection Center, P.O. Box 790355, St. Louis, Missouri 63179-0355.

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

How much does Medicare pay after deductible?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services. If your income is over a certain amount, your Medicare Part B monthly premium may be higher. The government looks to your reported income from two years ago to see if you have to pay a higher amount.

What is the 20% coinsurance for Medicare Part B?

Besides the premium and deductible, there are other Medicare Part B costs you should know about: for example, many Medicare services and supplies require a 20% coinsurance payment or a copayment after you’ve reached your annual deductible .

What is Medicare Advantage?

Medicare Part A continues to pay for hospice benefits when you have a Medicare Advantage plan. Some Medicare Advantage plans include prescription drug coverage and may include other benefits as well. Premiums and deductibles for Medicare Advantage plans may vary, depending on which plan you choose and the extent of your health coverage.

What is Medicare Part B 2021?

Medicare Part B costs in 2021. Medicare Part B (medical insurance) is also part of Original Medicare. Part B carries a monthly premium and an annual deductible. Costs shown below are for 2021. Medicare Part B premium. The amount you pay for your Part B premium may vary based on your situation.

How to calculate late enrollment penalty for Medicare?

You can calculate the late-enrollment penalty by multiplying the number of full months you went without Part D or creditable coverage by 1% of the national base beneficiary premium , which is $33.06 in 2021. Then, round the total to the nearest $0.10, and add it to your Medicare prescription drug plan’s monthly premium.

How much will Medicare pay for prescription drugs in 2021?

For the year 2021, once you and your plan have spent a combined $4,130 on covered prescription drugs, you’ll reach the coverage gap (sometimes also referred to as the “donut hole”).

How many Medigap plans are there?

Medigap is private insurance, and premiums may vary depending on the area you live in and which plan you choose. There are 10 standardized Medigap insurance plans in most states, and while plans of the same name have the same basic coverage, the coverage varies among standardized plans of different names.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

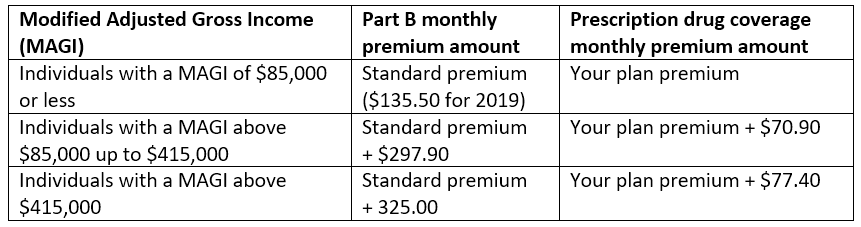

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What is the Medicare Part B deductible for 2019?

As mentioned above, the annual Medicare Part B deductible for 2019 is $185. So what exactly does that mean? You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019.

What happens after you meet your Medicare Part B deductible?

What Happens After You Meet the Part B Deductible? After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019. On Jan. 1, 2020, your deductible will reset, and you will have to pay the 2020 Medicare Part B deductible before your Part B ...

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What is Part B insurance?

Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care. Some durable medical equipment (DME) Medicare Supplement Insurance (Medigap) Plan F and Plan C both provide full coverage for the 2019 Part B deductible.

How much is a knee injury deductible in July?

In July, you injure your knee and schedule another appointment with your doctor. This time you are billed $150 for the appointment. You will be responsible for paying the first $65 of the $150 for the appointment out of your own pocket, because that is how much is left on your deductible. After the $65 is paid, ...