How much does Medicare Part D cost?

Your actual drug coverage costs will vary depending on:

- Your prescriptions and whether they’re on your plan’s list of covered drugs ( formulary A list of prescription drugs covered by a prescription drug plan or another insurance plan offering ...

- What “tier” the drug is in.

- Which drug benefit phase you’re in (like whether you’ve met your deductible, or if you’re in the catastrophic coverage phase).

How much does a part D cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount.

What are the requirements for Medicare Part D?

- Prior to the individual’s initial period of entitlement for Medicare Part D

- Prior to the effective date of the individual’s enrollment in the employer’s prescription drug plan

- Upon any change in the employer’s prescription drug coverage as creditable or non-creditable

- Annually, on or before October 15 of each year

- Upon an individual’s request.

What is the average cost of Part D?

Today, the Centers for Medicare & Medicaid Services (CMS) issued a proposed rule that would make updates to the Medicare Advantage (MA) and Medicare Part D programs that would lower out-of-pocket prescription drug costs for beneficiaries with Medicare Part D and improve price transparency and market competition.

What is the cost for Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.

What is the standard Part D premium for 2020?

Part D prescription drug coverage helps millions of Original Medicare beneficiaries pay for their medication costs. Those benefits, however, come at a price. Nationwide, the average monthly Part D premium in 2020 is $30.

What is the 2021 Part D premium?

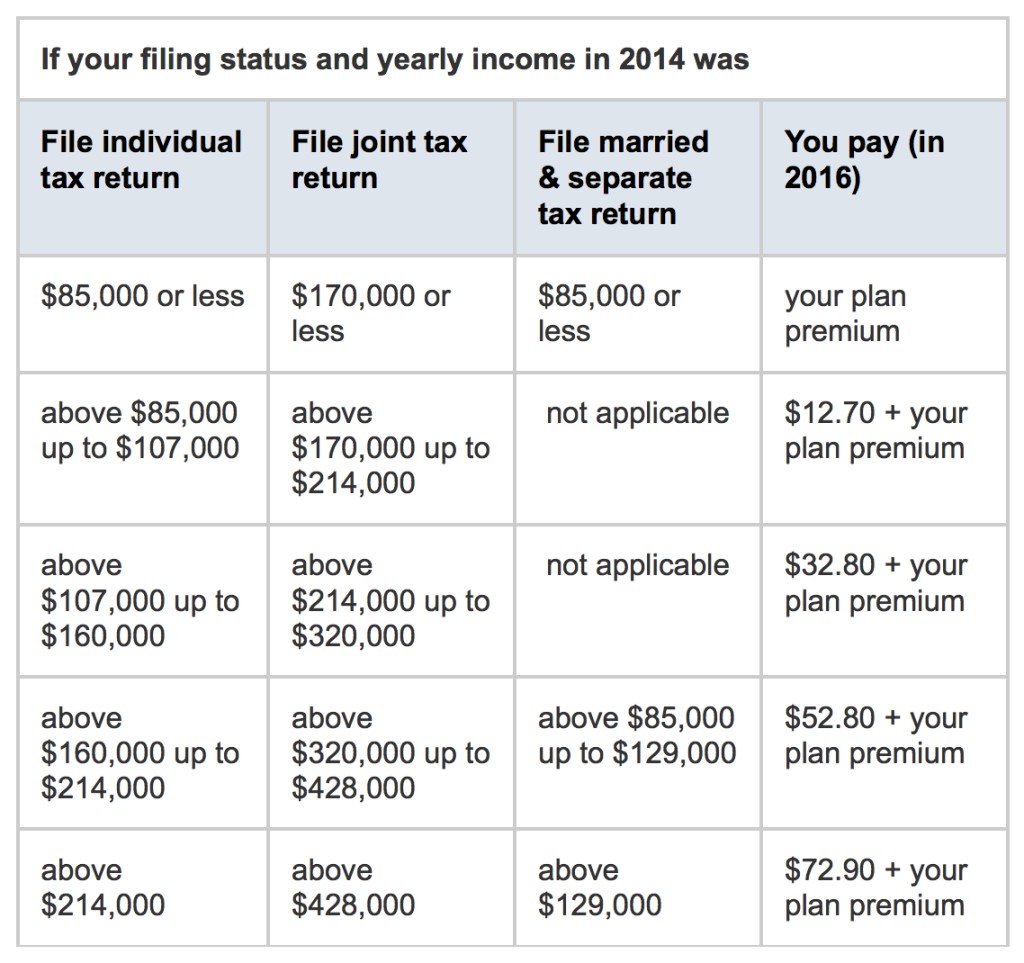

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Is Medicare going to do away with the donut hole?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

What is the Doughnut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

How much is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is the coverage gap in Medicare Part D?

Another factor to consider in your Medicare Part D cost is the coverage gap, commonly known as the “donut hole.” Most Part D plans have a temporary limit to their benefits. The coverage gap doesn’t affect everyone, though—it comes into play once you’ve spent a certain amount. In 2018, once you’ve spent $3,700 on covered prescriptions, you’re in the donut hole. When you meet your out-of-pocket spending limit, you’re out of the coverage gap.

Is Medicare Part D insurance?

Medicare Part D plans are Medicare-approved insurance plans, but private companies administer them . This makes their costs widely variable. Your Medicare Part D cost could depend on where you live, what kind of plan you have, which drugs you use and whether they’re covered in your plan’s formulary, whether you take generic or brand-name drugs, and many other factors. Your premiums and copays are variable, too. In addition, you may pay extra fees if you enroll after your initial enrollment period.

What is Medicare Part D?

Launched in 2006, Part D is Medicare’s prescription drug coverage. The goal for Medicare prescription drug plans is to decrease costs for people age 65 and older. If you are eligible for Medicare, you are required to have an adequate form of prescription drug coverage. You can buy coverage from a company that offers Medicare Part D, ...

How is Medicare Part D late enrollment penalty calculated?

The Medicare Part D late enrollment penalty you must pay depends on how long you did not have any form of prescription drug coverage. The longer you went without coverage, the higher the penalty. Here is how the late enrollment penalty is calculated: Count the number of months you didn’t have prescription drug coverage.

How long do you have to pay Medicare Part D late enrollment penalty?

You may owe a Medicare Part D late enrollment penalty if you do not have any form of prescription drug coverage for 63 days in a row after your IEP. You will be required to pay this penalty for as long as you have Medicare coverage. The Medicare Part D late enrollment penalty you must pay depends on how long you did not have any form ...

How many drugs does Medicare cover?

Medicare requires a drug company to cover at least two drugs in the most-prescribed drug categories. The company will usually place the medications in “ tiers ” or levels. Here’s an example of how tiers usually work: Tier 1: most generic prescription drugs are on this tier, and you usually pay the least for these.

When is the open enrollment period for Medicare?

October 15 to December 7: open enrollment period for Medicare or when you can make changes to your current Part D plan. January 1 through March 31: the time period you can enroll in Medicare Part D if you have Medicare Advantage, but wish to switch to original Medicare with or without Part D.

Do you have to pay deductible for prescription drugs?

Having Part D insurance can help cut down on much of these costs, but you will likely still have to pay some amount for brand-name prescription medications.

Can you make a list of medications on Medicare?

However, some companies may order their tiers slightly differently. If you are considering a Medicare prescription plan, it’s a good idea to make a list of medications you take. You can review a potential plan’s list of covered medications, called a formulary, to see how many of your drugs are there.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

Can you still receive Medicare Part D coverage?

These are Medicare’s rules for late payments of Part D premiums: You can still receive coverage without penalties. You’re granted a grace period and warning. You receive a letter informing you to contact your plan for resolution. You must receive notification before a plan can drop you from your coverage.

What is the deductible for Part D?

Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit.

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

What factors determine how much the monthly premium will be?

Factors that determine how much the monthly premium will be include the copay the insurer requires for each prescription, the deductible recipients are obligated to pay and the list of drugs available on the carrier’s formulary.

How long does Medicare have to enroll in a Part D plan?

Medicare recipients who do not enroll in a Part D prescription drug plan or have creditable coverage with another plan for 63 days or more past their Initial Enrollment Period may be charges a late enrollment penalty if they choose a Part D plan later on.

How much does Medicare pay for prescriptions in 2020?

In 2020, the catastrophic coverage threshold is $6,350. Once you are eligible for catastrophic coverage, you will only pay 5% ...

Does Medicare limit copayments?

Medicare does not limit the amount plans can require for copayments and coinsurance amounts. Medicare also does not standardize how drugs are categorized into different tiers, which impacts how much the copayment or coinsurance amount for that medication may be in each tier.

What Determines Medicare Part D Premiums?

Medicare Part D premiums are the monthly fee you pay for coverage. Medicare Part D prescription drug plans are sold by private insurance companies that contract with Medicare.

What Is the Medicare Part D Deductible?

The Medicare Part D deductible is the amount of money you have to pay out of your own pocket for your prescriptions each year before your prescription drug plan starts paying its share.

Medicare Part D Copays and Coinsurance

Once you pay your Medicare Part D deductible, you will only pay a portion of the cost for your prescriptions for the rest of the year. These payments will be in the form of either a copayment or coinsurance.

Help Covering Medicare Part D Costs

If you have limited income and resources, a program called Extra Help may be able to help you with Medicare Part D prescription drug costs, including premiums, coinsurance and your deductible.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.