How much do tax payers pay for Medicare?

MEDICARE premiums are set to jump by far more than what experts had estimated next year. The new rates were announced by the Centers for Medicare & Medicaid Services (CMS) on November 12, 2021 - we explain what you need to know. Medicare's Part B standard ...

What percentage of your paycheck is Medicare?

What Percentage of Federal Taxes and Medicare Are Deducted out of Gross Pay?

- Social Security and Medicare Tax 2019. Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income ...

- W-4s and Federal Tax Withholdings. ...

- Social Security Withholdings. ...

- Evaluating Medicare Withholdings and the Deduction Amount of Net Pay. ...

- Gaining More Information. ...

How is Medicare calculated for payroll?

- Subtract $4,300 for each Allowance.

- Find the Marital Status claimed, go to the Standard Withholding Rate Schedules (orange) IRS Percentage Method Table below, and use the appropriate status section of the table. ...

- Find the row that your calculated amount falls into. ...

- If you have a Monthly pay period frequency, divide by 12; if Semi-Monthly, divide by 24.

What is the current tax rate for Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

What is the Medicare tax rate for 2021?

1.45%FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

How is Medicare payroll tax calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

What is the Medicare tax limit for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

What percentage do they take out for taxes?

For the 2021 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income (such as your wages) will determine what bracket you're in.

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

What percentage of Medicare is taken from paycheck?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Can I opt out of Medicare tax?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

What is the additional Medicare tax for 2022?

2022 updates 2.35% Medicare tax (regular 1.45% Medicare tax plus 0.9% additional Medicare tax) on all wages in excess of $200,000 ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return).

What is the 3.8 percent Obamacare tax?

Effective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

At what income level does Medicare tax increase?

The regulation has been in place since 2013. Everyone who earns income pays some of that income back into Medicare. The standard Medicare tax is 1.45 percent, or 2.9 percent if you're self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital In...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

How do self-employed people pay Medicare tax?

If you are a self-employed person, Medicare tax is not withheld from your paycheck. You would typically file estimated taxes quarterly and use the...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

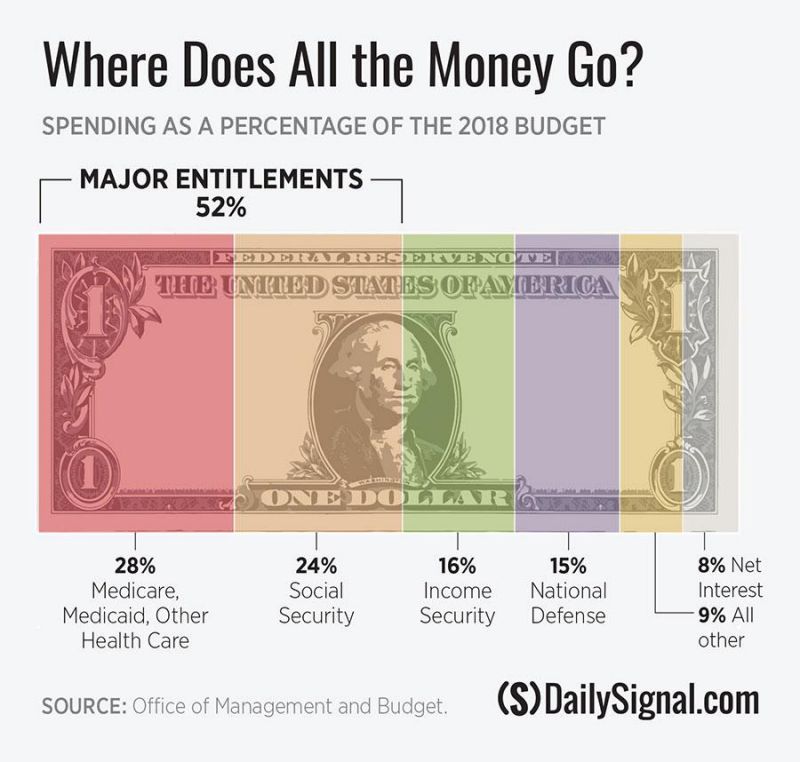

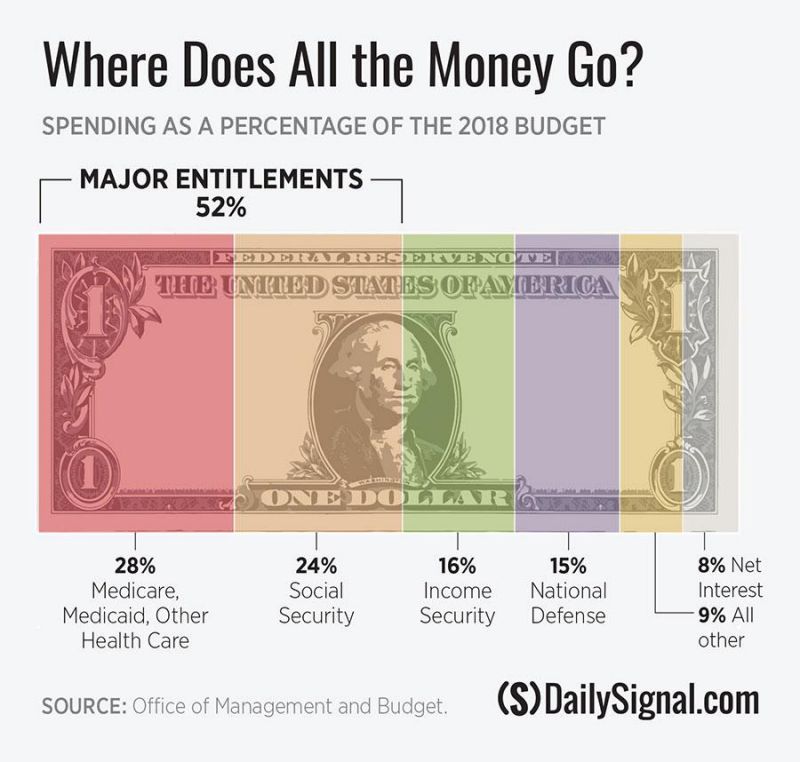

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

What are payroll taxes?

Payroll taxes are broken into two parts: taxes that employers pay and taxes that employees pay. As the employer, you’re responsible for withholding your employee’s taxes due from their paychecks and remitting it to the applicable tax agencies along with any amounts you owe. Employees are responsible for paying federal income taxes ...

How much is Social Security tax?

Federal tax rates, like income tax, Social Security (6.2% each for both employer and employee), and Medicare (1.45% each), are set by the IRS. However, each state specifies its own tax rates. Below is a state-by-state map showing rates for taxes, including supplemental taxes and workers’ compensation.

What happens if you don't pay payroll taxes?

If employers fail to remit payroll tax payments or send them in late, it could have the following impact: 1 Employers may face criminal and civil sanctions 2 Employees may lose access to future Social Security or Medicare benefits 3 Employees may lose access to future unemployment benefits

Why is it important to pay payroll taxes?

Paying your payroll taxes correctly and on time is an important part to becoming a successful employer, but it can become challenging as you grow . Tax rates change from year to year, especially state payroll tax rates, and you must keep track of them to accurately calculate your business and your employees’ tax obligations.

What is the FICA tax rate?

For employees earning more than $200,000, the Medicare tax rate goes up by an additional 0.9%; therefore, FICA can range between 15.3% and 16.2%.

How much does SUTA pay?

New employers pay 3.13% in SUTA for employees making more than $11,100 per year. They refer to it as the Unemployment Insurance Contribution Rate (UI). Existing employers pay between 0.06% and 7.9%. Employers with few unemployment claims may pay nearly 10 times less than those with high unemployment claims. In New York, as in most states, it pays to reduce your turnover.

How much is supplemental pay taxed?

Some states tax supplemental wages like bonuses, commissions, overtime, and severance pay as examples. Less than half of US states have no supplemental tax while the rest range from 1.84% to 11%—except Vermont that charges 30%. For instance, in California, employees are taxed 6.6% for most supplemental pay but are taxed at 10.23% if the supplemental pay is received from a bonus or stock option.

What is the current payroll tax rate for Social Security?

Payroll Tax Rates. The current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee, for a total of 12.4%. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, for a total of 2.9%.

When did Medicare start paying Social Security taxes?

Social Security taxes began in 1937, at a modest rate of 2%. Medicare hospital insurance taxes didn’t kick in until 1966, at a rate of 0.7%. Rates have climbed since then, of course, with the rate increase for Social Security taxes outpacing the rise in Medicare hospital insurance taxes. In 2020, payroll taxes only apply to the first $137,700 ...

Why is my take home pay different from my salary?

Payroll taxes are part of the reason your take-home pay is different from your salary. If your health insurance premiums and retirement savings are deducted from your paycheck automatically, then those deductions (combined with payroll taxes) can result in paychecks well below what you would get otherwise.

What is the FICA rate for 2020?

That means that combined FICA tax rates for 2020 are 7.65% for employers and 7.65% for employees, bringing the total to 15.3% . A recent report from the Congressional Budget Office suggests that raising Social Security payroll taxes is necessary to extend the solvency of the Social Security Trust. As discussed, raising the maximum taxable income ...

Why did Congress cut payroll taxes?

In tough economic times like the Great Recession, Congress cuts payroll taxes to give Americans a little extra take-home pay. Recently, President Trump allowed employers to temporarily suspend withholding and paying payroll taxes in an effort to offer COVID-19 relief.

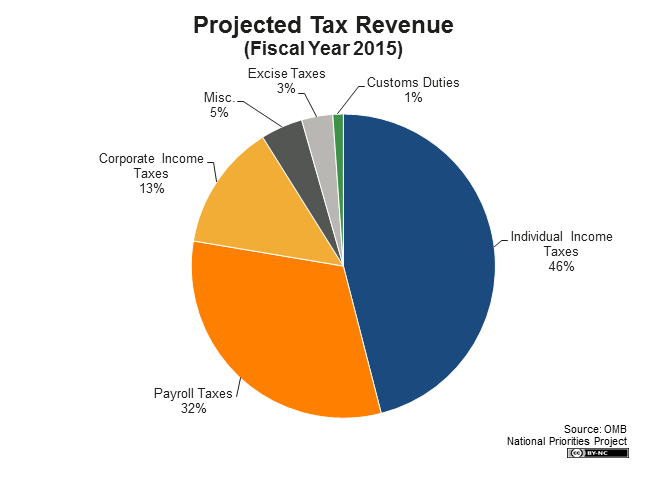

How much is payroll tax in 2020?

According to the US Department of the Treasury, payroll taxes made up 38.3% of federal tax revenue in fiscal year 2020. That’s $1.31 trillion out of $3.42 trillion. These taxes come from the wages, salaries, and tips that are paid to employees, and the government uses them to finance Social Security and Medicare.

How to avoid taxes on self employed?

If you are self-employed, an advisor can help you avoid employment taxes by structuring your business to pay you in dividends instead of a salary. If you’re freelancing on the side, you’ll need to pay taxes on that extra income. You can pay estimated taxes quarterly or get more taxes withheld from your paycheck.

What is payroll tax?

Despite the name, payroll tax is not a single tax, but a blanket term used to refer to all taxes paid on the wages of employees. If you have employees, you are going to be responsible for both: Deducting a portion of employee wages to pay certain taxes on their behalf.

What is the most straightforward way to calculate payroll tax?

Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

What is the current FICA rate?

The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employees wages.

What is FICA in tax?

FICA stands for “Federal Insurance Contributions Act.” It’s a mandatory payroll tax deduction used to pay for programs like Social Security (disability insurance, old age, survivors) and Medicare (covering health insurance for folks over 65).

What taxes come out of your pocket?

Payroll taxes that come out of your pocket: FICA tax: covers social security and Medicare. This cost is shared by employer and employee. The employer portion is 6.2% for social security and 1.45% for Medicare, and you’ll collect and remit the same amount from your employees.

How to calculate Social Security withholding?

To calculate Social Security withholding, multiply your employee’s gross pay for the current pay period by the current Social Security tax rate (6.2%). This is the amount you will deduct from your employee’s paycheck and remit along with your payroll taxes.

How much does an employee pay for FICA?

When it comes to funding FICA, your employee pays 50% from their paycheck while you, the employer, pay 50% out of your own revenue. As the employer, you are required to withhold and pay the amount your employee is responsible for from her paycheck, and remit those funds on their behalf.

Social Security

Social Security taxes have a wage base. In 2021, this wage base is $142,800. The wage base means that you stop withholding and contributing Social Security taxes when an employee earns more than $142,800.

Medicare

Unlike Social Security, Medicare taxes do not have a wage base. Instead, Medicare has an additional withholding tax for employees who earn more than a set amount. In 2021, this base amount is $200,000 (single). Therefore, employees who earn more than $200,000 in 2021 pay 1.45% and an additional 0.9% to Medicare.

Self-employed tax

If you are self-employed, pay the entire cost of payroll taxes (aka self-employment taxes ). And, pay the additional 0.9% Medicare tax, too, if you earn more than the threshold per year.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.