How much does Medicare premium cost?

Nov 08, 2019 · For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

What is Medicare monthly premium?

Jan 26, 2022 · Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more.

How to compare Medicare Part D plans?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A" ). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

Is Medicare tax deductible?

Jan 24, 2020 · This base premiums is used even if the plan you wish to enroll in does not charge you a monthly premium. For 2020, the national base premium is $32.74; the penalty percentage is 1%. If you are without coverage for a full 10 months, you would multiply 10 by $0.3274, which would make your penalty payment $3.27.

What is the monthly Medicare premium for 2020?

$144.60The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the Part B monthly premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the Medicare premium for 2021?

$148.50The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What was the monthly cost of Medicare in 2021?

$148.50In 2021, the standard monthly premium will be $148.50, up from $144.60 in 2020.Dec 16, 2020

How much does Medicare take out of Social Security?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How much does Medicare cost at age 83?

$220.81How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F82$236.5383$220.8184$225.5685$234.2018 more rows•Dec 8, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How are Medicare Part D premiums calculated?

Medicare determines the penalty amount by multiplying the number of full months you were eligible for but didn't have drug coverage by 1%, then multiplying that product by the national base beneficiary premium ($33.37 for 2022).

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the Part D deductible for 2021?

$445 a yearSummary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

Summary Of Medicare Benefits And Cost

The chart below is a comprehensive list of Medicare Part A and B costs, including premiums, deductibles and coinsurance. Medicare supplemental insurance, known as Medigap, can help cover some of the gaps in coverage and pay for part or all of Medicares coinsurance and deductibles, depending on the policy.

Government May Scale Back Medicare Part B Premium Increase

This year’s standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer’s disease.

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

Medicare Part C Premiums

Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and location.

Get Help From A Medicare Savings Program

Medicare Savings Programs, or MSPs, are special programs designed to help low-income seniors pay their Medicare expenses Part B premiums included. These programs are funded via Medicaid, so theyre run at the state level .

How Can I Avoid Paying For Medicare

Delaying enrollment in Medicare when youre eligible for it could result in a penalty that will remain in effect for the rest of your life.

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much does Medicare pay for prescriptions in 2020?

In 2020, the catastrophic coverage threshold is $6,350. Once you are eligible for catastrophic coverage, you will only pay 5% ...

What factors determine how much the monthly premium will be?

Factors that determine how much the monthly premium will be include the copay the insurer requires for each prescription, the deductible recipients are obligated to pay and the list of drugs available on the carrier’s formulary.

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

What is the deductible for Part D?

Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit.

How long does Medicare have to enroll in a Part D plan?

Medicare recipients who do not enroll in a Part D prescription drug plan or have creditable coverage with another plan for 63 days or more past their Initial Enrollment Period may be charges a late enrollment penalty if they choose a Part D plan later on.

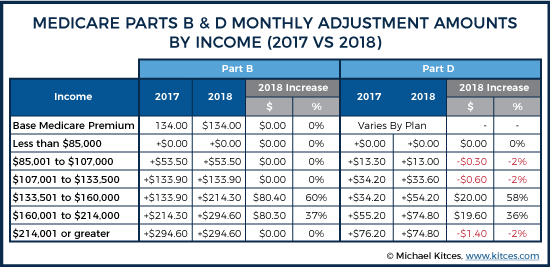

What is the IRMAA for 2020?

In addition to a monthly premium, recipients with certain incomes may be required to pay extra for their Part D plan; this is called the Part D income-related monthly adjust amount (IRMAA). For 2020, this amount is based on the recipient’s tax filing status for 2018.

What is the penalty for not having insurance for 10 months?

If you are without coverage for a full 10 months, you would multiply 10 by $0.3274, which would make your penalty payment $3.27.

How much is Medicare Part B?

Part B participants pay premiums, with the monthly premium for most people in 2020 set to go up to $144.60. That's up by $9.10 per month from 2019 levels, which is a fairly high boost compared with recent years.

What happens if you don't plan for Medicare?

In fact, if you don't plan for healthcare expenses under Medicare, you'll get a nasty shock when you approach retirement. In particular, the various parts of Medicare coverage impose a wide variety of different costs for participants to pay. Whether you face deductibles, co-payments, premiums, or other expenses, ...

How much is the surcharge for married filing separately?

If you're married filing separately, there are two numbers to consider. Those making $87,000 to $413,000 pay the $318.10 surcharge, while those making more than $413,000 pay $347 extra. On top of these monthly premiums, Part B also imposes a deductible of $198, which is $13 higher than it was for 2019.

Can I sign up for a prescription drug plan with Medicare?

Even if you're part of traditional Medicare, you can also sign up for a prescription drug plan under Medicare Part D. Private insurers are also behind Part D plans, and again, they have considerable flexibility to charge monthly premiums based on the services they provide.

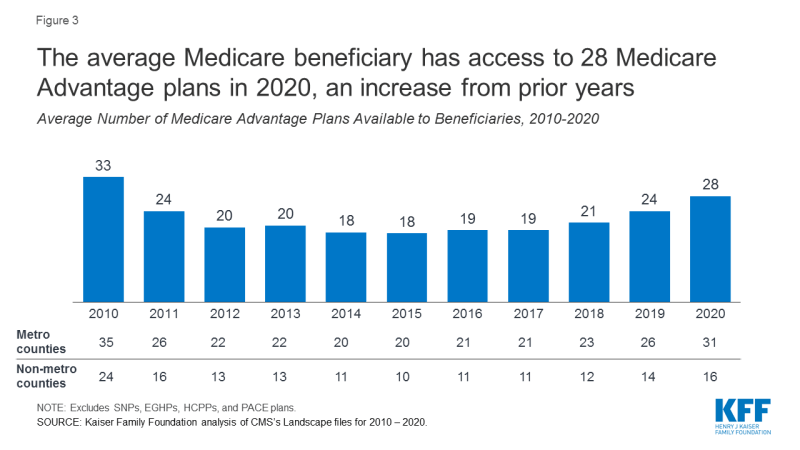

Can I get Medicare Advantage?

Medicare participants have the option to get a Medicare Advantage plan rather than using Parts A and B. Private insurers offer Advantage plans to eligible participants, and they typically provide comprehensive coverage than includes not only hospital and medical services but also prescription drug coverage. The costs of these plans vary widely, with more-comprehensive plans typically charging higher premiums. The trade-off is that you might have to use certain networks of medical providers under a Medicare Advantage plan, limiting your choices for healthcare professionals beyond what traditional Medicare does.

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

Is Medicare making ends meet?

Making ends meet. The challenges of living on a fixed income are tough for Medicare participants. 2020's cost increases for Medicare are somewhat harsher than they were in 2019, and that could make it even harder on those struggling to make ends meet. Prev. 1.

What is the Medicare premium for 2020?

For 2020, the standard monthly rate is $144.60. However, it will be more if you reported above a certain level of modified adjusted gross income on your federal tax return two years ago. Any additional amount charged to you is known as IRMAA, which stands for income-related monthly adjustment amount. Visit Medicare.gov, point to “Your Medicare Costs,” and then click “Part B costs” to see a matrix of premiums corresponding to income ranges across different tax filing statuses.

How long do you have to be on Medicare to receive Part A?

People under age 65 may receive Part A with no liability for premiums under the following circumstances: Have received Social Security or Railroad Retirement Board disability benefits for two years.

What is included in W-2?

The annual W-2 Form that U.S. employees receive includes not only year-to-date earnings but also taxes paid toward Social Security and Medicare. Forty credits are required to be eligible for benefits. The requirements may be modified for young people claiming disability or survivor benefits.

How many years of work do you need to be eligible for Medicare?

Four is the maximum number of credits a person can earn per year, so it takes at least 10 years or 40 quarters of employment to be eligible for Medicare.

Is Medicare the same for everyone?

Medicare is a federal program that mandates standardization of services nationwide, so many people may assume the premiums would be the same for everyone. In reality, there are variations in the premiums people pay, if they pay any at all.

Can Medicare be charged at 65?

For Part A, most Medicare recipients are not charged any premium at all. Seniors at age 65 are eligible for premium-free Part A if they meet the following criteria: Currently collect retirement benefits from Social Security or the Railroad Retirement Board. Qualify for Social Security or Railroad benefits not yet claimed.