Full Answer

What is the cheapest Medicare Part D?

- Be aged 65 years or over

- Have Original Medicare

- Aged younger but have a qualifying disability or condition

- Have end-stage renal disease that requires dialysis or a kidney transplant

What is the average cost of Medicare Part D?

So how much does Medicare Part D cost? According to the Centers for Medicare & Medicaid Services (CMS), the average cost of a Medicare Part D plan in 2022 will be approximately $33 per month. That represents a 4.9% increase from the 2021 average of $31.47 per month.

What is the cheapest Medicare Part D plan?

which is as good or better than what Part D would provide. Medicare contracts with private plans to offer drug coverage under Part D. There are two ways to enroll in Part D. You can purchase a stand-alone Part D plan or enroll in a Medicare Advantage plan ...

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the 2021 Part D premium?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Is Part D Medicare expensive?

Are Part D plans expensive? In general, no — at least, not compared with standard premiums for Part B, which are $170.10 per month in 2022 for most Medicare recipients.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Are Part D premiums based on income?

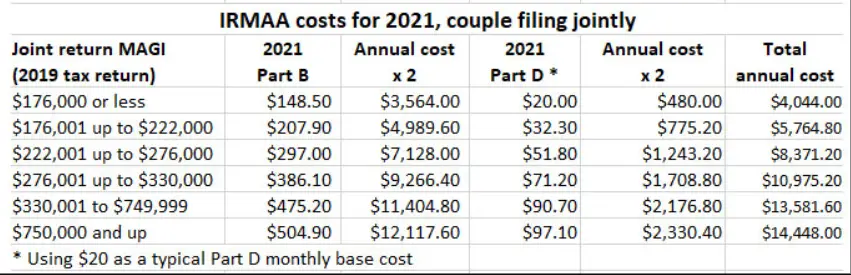

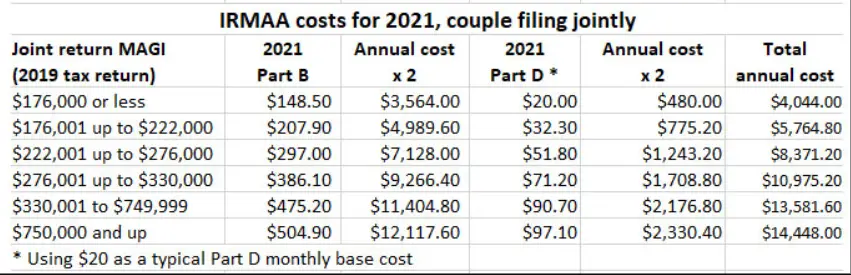

In addition to the monthly premium, Part D enrollees with higher incomes ($88,000/individual; $176,000/couple) pay an income-related premium surcharge, ranging from $12.30 to $77.10 per month in 2021 (depending on income).

What is the max out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000 (beginning in 2024), while under the GOP drug price legislation and the 2019 Senate Finance bill, the cap would be set at $3,100 (beginning in 2022); under each of these proposals, the out-of-pocket cap excludes the value of the manufacturer price ...

How much is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do I have to pay for Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.