What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

Does Medicaid pay the Part B deductible?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How is the premium calculated for Medicare Part B?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

What is the current cost of Medicare Part B?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible. From day one ...

What is the Medicare Part B deductible for the year 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021. Once the Part B deductible has been paid, Medicare generally pays 80% of the approved cost of care for services under Part B.

What is the deductible for Medicare Part B for 2021?

$203 inThe annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is Medicare yearly deductible?

$233A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs. For example, if you received outpatient care or services covered by Part B, you would then pay the first $233 to meet your deductible before Medicare would begin covering the remaining cost.

What is the Medicare Plan B deductible for 2020?

The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.

How much does Social Security deduct for Medicare?

If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30....Medicare Part B.Income on Individual Tax ReturnIncome on Joint Tax ReturnMonthly Premium$114,001 to $142,000$228,001 to $284,000$340.205 more rows•Feb 24, 2022

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Do prescription drugs count towards deductible?

If you have a combined prescription deductible, your medical and prescription costs will count toward one total deductible. Usually, once this single deductible is met, your prescriptions will be covered at your plan's designated amount. This doesn't mean your prescriptions will be free, though.

What is the Medicare Plan G deductible for 2022?

$2,490* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of$2,490 in 2022 before your policy pays anything.

How do I find out my deductible?

“Your deductible is typically listed on your proof of insurance card or on the declarations page. If your card is missing or you'd rather look somewhere else, try checking your official policy documents. Deductibles are the amount of money that drivers agree to pay before insurance kicks in to cover costs.

What deductions are taken out of Social Security checks?

The Social Security Administration identifies the following instances for which your Social Security benefits may be garnished:Enforcement of child, spousal or family support obligations.Court-ordered victim restitution.Collection of unpaid federal taxes.More items...

What are 2021 Medicare premiums?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

CMS Announces 2022 Medicare Part B Premiums | CMS

Today, the Centers for Medicare & Medicaid Services (CMS) released the 2022 Medicare Parts A and B premiums, deductibles, and coinsurance amounts, and the 2022 Part D income-related monthly adjustment amounts.

CMS Releases 2022 Premiums and Cost-Sharing Information for Medicare ...

2022 Average Cost of Medicare | Part A, Part B, Part C and Part D

Medicare Part B Premiums for 2022 | RRB.Gov

Medicare Part B Premium Increase for 2022 Largest Ever

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Part B for 2021?

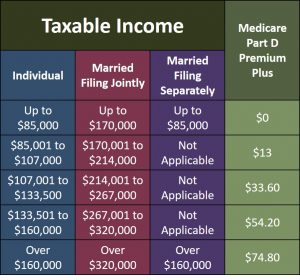

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

How much is Medicare Part B premium?

2019 Medicare Part B Premium. The standard premium for Medicare Part B in 2019 is $135.50 per month , although some people might pay more than that amount. The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017.

How much coinsurance do you pay for Medicare Part B?

After you reach your Medicare Part B deductible, you will typically pay a 20% coinsurance for all services and items that are covered by Part B for the remainder of 2019.

What Is the 2022 Medicare Part B Deductible?

As mentioned above, the annual Medicare Part B deductible for 2022 is $233. So what exactly does that mean?

What Are Other Part B Costs in 2022?

There are several types of Part B costs you may face in 2022, such as:

How much is the $65 out of pocket for Part B?

After the $65 is paid, you have reached $185 in out-of-pocket spending for covered Part B services in 2019. You have reached your deductible and you will now be responsible for any Part B coinsurance charges. There is still $85 remaining for your doctor's visit ($150 total charge minus the $65 you paid out of pocket).

What is the 2019 Medicare premium based on?

So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What is Part B insurance?

Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care. Some durable medical equipment (DME) Medicare Supplement Insurance (Medigap) Plan F and Plan C both provide full coverage for the 2019 Part B deductible.

Medicare Part B Deductible – What It Is

Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B

Find Best Medicare Insurance Plan Coverage

There are countless companies looking to sell you Medicare coverage. Only one resource exclusively lets you find local Medicare insurance agents.

What Does Part B Cover?

Medically necessary services: This includes services or supplies that are needed to diagnose or treat your medical condition. And, they meet accepted standards of medical practice.

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

How much will Medicare premiums decline in 2020?

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage ...

What is the Medicare premium for 2020?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due ...

How much does Medicare cost in 2020?

Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $252 in 2020, a $12 increase from 2019. Certain uninsured aged individuals who have less than 30 quarters of coverage and certain individuals with disabilities who have exhausted other entitlement will pay the full premium, which will be $458 a month in 2020, a $21 increase from 2019.

Why is the Part B premium going up?

The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible. From day one, President Trump has made it a top priority to lower drug prices.

Do you have to file a separate tax return for a high income beneficiary?

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is the Medicare Part B deductible for 2021?

Medicare Part B Deductible. The Part B deductible for 2021 is $203. This is the amount you are responsible for paying before Part B starts helping to pay your health care costs, but it doesn’t apply to most Medicare-covered preventive care services.

What is Medicare Part B?

Medicare Part B covers doctor visits, lab tests, preventive screenings and other outpatient health care services. Part B costs include a monthly premium, an annual deductible and coinsurance for most services.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance. Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

What to do if Medicare costs are a concern?

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

How much is Medicare Part B 2021?

Medicare Part B Premium for 2021. In 2021, the standard Part B premium is $148.50 per month. Most people pay the standard premium amount. It’s either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

Does Medicare Advantage cover doctor visits?

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services . However, your out-of-pocket costs are limited to the annual plan maximum. Once you’ve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

What is the cost of Part B insurance?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. Parts C and D are optional and may cover additional costs, including prescriptions.

How much does Medicare cost?

The cost of Medicare depends on how much you worked, when you sign up, and which types of coverage options you choose. If you paid Medicare taxes for 40 or more quarters, you're eligible for premium-free Medicare Part A. You'll pay a premium for Part A if you worked less than 40 quarters, and you'll also pay a premium for additional coverage you want from Part B, Part C, or Part D, as well as penalties if you enroll in these after your initial enrollment period. 5

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What is the Medicare Advantage premium for 2021?

The average plan premium is about $21.00 a month in 2021. 7 . But coinsurance, copayments, premiums, and deductibles may still vary depending on your plan of choice. 3 .

How much does Medicare pay for a hospital stay in 2021?

Part A also charges coinsurance if your hospital stay lasts more than 60 days. In 2021, for days 61 to 90 of your hospital stay, you pay $371 per day; days 91 through the balance of your lifetime reserve days, you pay $742 per day. 3 Lifetime reserve days are 60 days that Medicare gives you to use if you stay in the hospital for more than 90 days.

How much is the Medicare premium for 2021?

It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3 . Part B also comes with a deductible of $203 per year in 2021. Unlike Part A, your deductible isn’t tied ...

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What is the Medicare premium for 2017?

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. 4 The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration's cost-of-living adjustments (COLA).

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

When do you get Medicare if you don't have Social Security?

If you're not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare .

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Does Medicare have a hold harmless?

Medicare has a "hold harmless" provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. 4 While this keeps seniors from paying more than they should, you'll have to pay the increased premiums if your COLA is higher than the increase.