What caregiving costs and services will Medicare cover?

Medicare doesn’t cover long-term care (also called custodial care) if that's the only care you need. Most nursing home care is custodial care, which is care that helps you with daily living activities (like bathing, dressing, and using the bathroom).

How to reduce the cost of long term care insurance?

Mar 09, 2021 · Although Medicare covers long-term hospital care, you could face significant charges if you receive long-term care beyond three months. In 2021 under Medicare Part A, you generally pay $0 coinsurance for the first 60 days of each benefit period, once you have paid your Part A deductible.

How much long term care insurance coverage do I Need?

Nov 17, 2021 · In these qualified situations, Medicare will cover the total cost of a skilled nursing facility for the first 20 days. On days 21 through 100, you’ll be responsible for covering a daily co-pay ($185.50 in 2021), and Medicare will cover the rest. After 100 days, Medicare coverage ends, and you’ll have to pay the full bill.

What should I know about long term care insurance?

Dec 09, 2021 · Although Original Medicare does not cover long-term custodial care (including nursing home care), Medicare Part A and Part B may help cover other specialized types of care for limited periods of time: Care in a long-term care hospital* Skilled nursing care in a skilled nursing facility; Eligible home health services; Hospice and respite care

Does Medicare pays most of the costs associated with nursing home care?

How many days will Medicare pay 100% of the covered costs of care in a skilled nursing care facility?

Who pays for most long term care?

Does Medicare cover all costs for seniors?

What is the difference between skilled nursing and long term care?

What happens when you run out of Medicare days?

How much does a nursing home cost?

What is the main goal of long-term care?

Who can be a long-term care?

Does Medicare cover ICU costs?

What medical expenses are not covered by Medicare?

- Routine dental exams, most dental care or dentures.

- Routine eye exams, eyeglasses or contacts.

- Hearing aids or related exams or services.

- Most care while traveling outside the United States.

- Help with bathing, dressing, eating, etc. ...

- Comfort items such as a hospital phone, TV or private room.

- Long-term care.

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare Pay For Long Term Home Care?

Medicare benefits for home care are limited. If you are home bound, Medicare will pay for some home health services ordered by your doctor, such as...

Does Medicare Pay For Long Term Assisted Living?

No. Assisted living facilities provide help with day to day activities, and this is not covered by Medicare.

Does Medicare Pay For Long Term Nursing Care?

Medicare pays for skilled care in a long-term facility for up to 100 days after you have been discharged from a hospital stay lasting at least thre...

Does Medicare Pay For Long Term Memory Care?

Like long term nursing home care, long term memory care is custodial care not covered by Medicare. You can find more information on long term memor...

Does Medicare Pay For Long Term Acute Care?

Medicare pays for acute care in a long-term care hospital, using the same rules that apply to any other hospital stay. Long term care hospitals foc...

Does Medicare cover long term care?

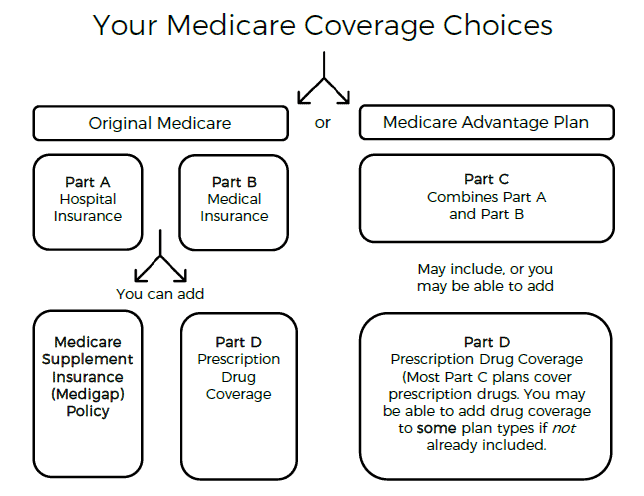

Medicare Part D covers some prescription drugs. Medicare generally doesn’t cover long-term care except in certain circumstances. Medicare draws a line between medical care (which is generally covered) and what it calls “custodial care” which is generally not covered.

What is long term care hospital?

A long-term care hospital (generally you won’t pay more than you would pay for care in an acute care hospital) Skilled nursing facility (Medicare covered services include a semi-private room, meals, skilled nursing care and medications) Eligible home health services such as physical therapy and speech-language pathology.

How much is the Medicare deductible for 2021?

The deductible is $1,484 in 2021. Feel free to click the Compare Plans button to see a list of plan options in your area you may qualify for.

Why do seniors need long term care?

Chronic conditions such as diabetes and high blood also make you more likely to need long-term care. Alzheimer’s and dementia are very common among seniors and may be another reason to need long-term care. According to the Alzheimer’s foundation, one in three seniors dies with Alzheimer’s or another dementia.

What is Medicare Part D?

Original Medicare (Part A and Part B) covers some hospital and medical costs. Medicare Part D covers some prescription drugs. Medicare generally doesn’t cover long-term care except in certain circumstances. Medicare draws a line between medical care (which is generally covered) and what it calls “custodial care” which is generally not covered. Custodial care includes help bathing, eating, going to the bathroom, and moving around. However, Medicare may cover long-term care that you receive in: 1 A long-term care hospital (generally you won’t pay more than you would pay for care in an acute care hospital) 2 Skilled nursing facility (Medicare covered services include a semi-private room, meals, skilled nursing care and medications) 3 Eligible home health services such as physical therapy and speech-language pathology 4 Hospice care including nursing care, prescription drugs, hospice aid and homemaker services

Does Medicare cover nursing home care?

Many Medicare Advantage plans also cover prescription drugs , and some plans may also provide coverage for: Although Original Medicare does not cover long-term custodial care (including nursing home care), Medicare Part A and Part B may help cover other specialized types of care for limited periods of time:

What percentage of people turn 65 need long term care?

52% of people turning 65 will need some form of long-term care in their lifetimes. Does your Medicare plan include long-term care? Compare Medicare plans in your area. Some Medicare Advantage plans may cover certain long-term care and at-home care services, such as home-delivered meals, grab bars for home bathrooms and other additional benefits.

Does Medicare Advantage cover dental care?

This means that Medicare Advantage plans cover the same specialized care that is outlined below. The only exception is hospice care, which you will still receive through your Medicare Part A benefits. Many Medicare Advantage plans also cover prescription drugs , and some plans may also provide coverage for: Dental care. Vision care.

What is Medicare Part A?

Medicare Part A provides hospital insurance and covers care received in a long-term care hospital (LTCH). You may qualify for this type of care if you meet the following two requirements:

What is SNF in Medicare?

Your SNF is certified by Medicare. You need this care for a hospital-related health condition or a condition that started while you were in an SNF for a hospital-related condition. You will also need to meet your Part A deductible for each benefit period before Medicare Part A begins paying for your SNF care.

How much is Medicare Part A 2020?

Your Part A coinsurance in 2020 is $176 per day for days 21-100 of your stay, and you pay all costs for days 101 and beyond.

Does Medicare cover home health care?

A doctor certifies that you are homebound. You typically have no Medicare costs for home health care services , and you typically pay 20 percent of the Medicare-approved amount for qualified durable medical equipment (DME) you may require while receiving home health care.

Does Medicare cover long term care?

Aside from the inpatient costs that Part A pays for, Medicare doesn’t cover long-term care. Medicare pays for long-term care for a short time under specific requirements. Part A covers hospital inpatient care, but you may have a deductible and coinsurance expense for each benefit. Medicare stops covering the costs once you exhaust your lifetime ...

How long does Medicare pay for long term care?

How many days does Medicare pay for long term acute care? Long term acute care is when you need 25 or more days of inpatient hospital service to treat your condition. Part A pays for medical bills in full for the first 20 days. But, Medicare stops paying entirely after 100 days of inpatient care.

How long does it take to qualify for Medicare?

Medicare long term care eligibility is attainable under the following conditions when hospitalized: 1 You must be an inpatient at an approved hospital for at least three days 2 After being admitted to a Medicare-certified nursing facility within 30 days of your inpatient hospital visit 3 You must require additional therapy such as physical or occupational 4 Your condition medically demands skilled nursing services

How long does it take for Medicare to pay for nursing home?

Medicare long term eligibility starts after meeting these requirements and pays for a maximum of 100 days during each benefit period.

How much does a nursing home cost?

A private nursing home room costs over $250 per day or $8,000 a month. You can imagine how financially exhausting this may become – and fast if you’re unprepared. However, proper long-term care insurance must meet your healthcare needs.

What states have long term care partnerships?

Four original states pioneered the Long Term Care Partnership Program; terms are different in California, Connecticut, New York, and Indiana. The program is protection for your lifestyle, income, and assets. Although conventional long-term care insurance is the only type to qualify for Partnership asset protection, without long-term care insurance, ...

What is a partnership program?

The program is protection for your lifestyle, income, and assets. Although conventional long-term care insurance is the only type to qualify for Partnership asset protection, without long-term care insurance, family or personal assets and income likely pay the hefty medical bills. The Partnership Program helps keep some ...

Do skilled nursing facilities accept Medicare?

Not all skilled nursing facilities are Medicare-certified. Often referred to as “private pay” providers, these facilities do not accept Medicare and, therefore, residents must pay out-of-pocket for services beginning on day one.

Who is Brad Breeding?

Brad Breeding is president and co-founder of myLifeSite, a North Carolina company that develops web-based resources designed to help families make better-informed decisions when considering a continuing care retirement community (CCRC) or lifecare community.

Does Medicare cover long term care?

Although Medicare covers some services of long-term care, there are many others that it doesn’t cover. For example, Medicare doesn’t cover custodial care, which entails assistance with daily living activities like eating, dressing, and using the toilet.

What is long term care?

Long-term care refers to a variety of services deemed necessary to take care of your health and medical needs over an extended period of time. This differs from short-term care, such as a visit to the doctor’s office or emergency room. Here are the following long-term care services that Medicare covers:

Does Medicare cover SNF?

care that requires intravenous medications, such as after a severe infection or long illness. Medicare Part A covers short stays at an SNF. Here is the breakdown of covered costs depending on length of stay: Days 1 through 20: Part A pays the entire cost of any covered services.

What is Medicare Part A?

Medicare Part A covers short stays at an SNF. Here is the breakdown of covered costs depending on length of stay: Days 1 through 20: Part A pays the entire cost of any covered services. Days 21 through 100: Part A pays for all covered services, but you’re now responsible for a daily coinsurance payment.

Can you get Medicare if you are homebound?

If you have original Medicare, you qualify for in-home care if your doctor classifies you as “homebound.” This means that you have trouble leaving home without assistive equipment (such as a wheelchair) or the help of another person.

What is a skilled nursing facility?

A skilled nursing facility (SNF) can provide medical or health-related services from a professional or technical staff to monitor, manage, or treat a health condition. Staff at an SNF include professionals such as: registered nurses.

What is in home care?

In-home care involves any healthcare services that you receive in your home, instead of going to a hospital or doctor’s office. Typically, these in-home care services are coordinated with a home health care agency. Both Medicare parts A and B can cover this type of care.

Does Medicare cover long term care?

Of course, Medicare covers medical services in these settings. But it does not pay for a stay in any long-term care facilities or the cost of any custodial care (that is, help with activities of daily life, such as bathing, dressing, eating and going to the bathroom), except for very limited circumstances when a person receives home health services ...

Does Medicare cover nursing homes?

Under specific, limited circumstances, Medicare Part A, which is the component of original Medicare that includes hospital insurance, does provide coverage for short-term stays in skilled nursing facilities, most often in nursing homes.

Does Medicare cover skilled nursing facilities?

Skilled nursing facilities are the only places that have to abide by the rule. If you’re discharged from the hospital to another kind of facility for ongoing care, such as a rehabilitation hospital, Medicare provides coverage under different rules.

How much does Medicare pay for skilled nursing?

If you qualify for short-term coverage in a skilled nursing facility, Medicare pays 100 percent of the cost — meals, nursing care, room, etc. — for the first 20 days. For days 21 through 100, you bear the cost of a daily copay, which was $170.50 in 2019.

What is the 3 day rule for Medicare?

Two more things to note about the three-day rule: Medicare Advantage plans, which match the coverage of original Medicare and often provide additional benefits, often don’t have those same restrictions for enrollees. Check with your plan provider on terms for skilled nursing care.

Does Medicare pay for long term care?

Medicare does not pay for most long-term care services except in particular circumstances, and typically doesn’t payout at all for personal or custodial care (i.e., when assistance is present to provide supervision or help with bathing, dressing, or eating).

Does Medicaid cover nursing home services?

Medicaid coverage for Nursing Facility Services only applies to services provided in a nursing home licensed and certified as a Medicaid Nursing Facility (NF). Availability is additionally limited to Medicaid-eligible persons who have no other payment options.

Is Medicare considered an entitlement?

Medicare is considered an “entitlement” program. All people who have reached the age of 65 (or who are permanently disabled, or are victims of end-stage renal disease) are entitled to begin receiving their social security entitlements. These benefits, which were paid in over their lifetime as part of employment taxes, also qualifies them to receive Medicare.

Is Medicare only for people over 65?

Medicare is a federal program providing medical and hospital expense benefits and is typically applicable only to people over age 65, or those who meet specific disability standards. Home health services and nursing home coverage is severely limited.

Does Medicare cover SNF?

Medicare will cover the balance owed through day 100 of your stay in an SNF. After day 100, Medica re does not cover any costs for stays in an SNF. The above applies to Original Medicare. Medicare Advantage plans cover the same services in an SNF, but the way cost-sharing is determined can vary.

What is Medicaid for low income?

Medicaid pays for health care services for those individuals with low income and assets who may incur very high medical bills.

What is a Medicaid certified nursing home?

Medicaid certified nursing homes deliver specific medically indicated care , known as Nursing Facility Services , including: Medicaid coverage for Nursing Facility Services only applies to services provided in a nursing home licensed and certified as a Medicaid Nursing Facility (NF).