Full Answer

Will Medicare run out of money in 2026?

Putting aside that noise, however, here is the utterly unsurprising takeaway: Medicare is rapidly running out of money to cover program costs. According to the Medicare Trustees, the Medicare Trust Fund, which covers hospital services, will be exhausted in 2026, and incoming revenues have long been insufficient to cover expenditures.

What happens when Medicare runs out of money?

There are multiple scenarios that could play out if the HI trust fund for Medicare were to run out, according to the medical journal Health Affairs. CMS could decide to pay recipient health insurance in full, but late. The agency could also choose to pay a portion — projected to be about 83% of costs — of each covered procedure on time.

Is Medicare running out of funds?

BEIJING (AP) — A Chinese developer that is struggling under $310 billion in debt warned Friday it may run out of money to “perform ... SPONSORED — Medicare’s Open Enrollment Period ...

How long can you stay in a hospital with Medicare?

Original Medicare covers up to 90 days in a hospital per benefit period and offers an additional 60 days of coverage with a high coinsurance. These 60 reserve days are available to you only once during your lifetime. However, you can apply the days toward different hospital stays.

What will happen when Medicare runs out?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Does Medicare ever run out?

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That's the same year as predicted in 2020, according to a summary of the trustees 2021 report, which was released on Tuesday.

How long is Medicare projected to last?

2026In their 2021 report, the Medicare trustees project the HI trust fund will be exhausted in 2026. At that time, there will no longer be sufficient funds to fully cover Part A expenditures; although the trust fund would continue to receive tax and other income, those funds would cover only 91% of Part A expenses.

What year will Medicare run out?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.

Is Medicare going away in 2026?

This large and growing income stream can cover things like medical insurance premiums should Medicare truly become insolvent in 2026.

Will there be Medicare in the future?

After a 9 percent increase from 2021 to 2022, enrollment in the Medicare Advantage (MA) program is expected to surpass 50 percent of the eligible Medicare population within the next year. At its current rate of growth, MA is on track to reach 69 percent of the Medicare population by the end of 2030.

How much will my Medicare go up in 2022?

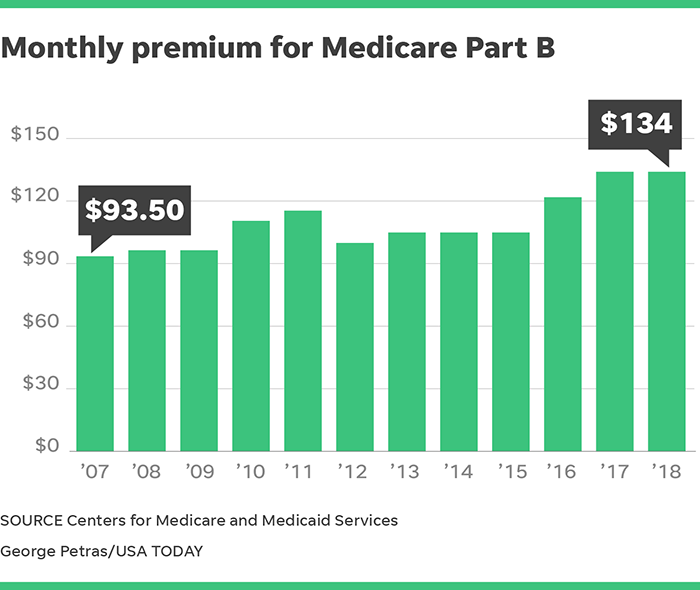

Medicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

Will Medicare premiums increase in 2023?

HHS: Higher Medicare Premiums Stay In Place This Year, Will Drop In 2023.

Will Social Security run out?

When the funds are depleted, benefits will be cut. Come 2034, the year retirement funds are expected to run dry, the Social Security Administration will only be able to pay out 77% of benefits to retirees. Already, this is reshaping how retirement savers feel about their golden years.

What are the income limits for Medicare 2024?

5% Inflation AssumptionPart B Premium2022 Coverage (2020 Income)2024 Coverage (2022 Income)Standard * 3.4Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $409,000Single: >= $500,000 Married Filing Jointly: >= $750,000 Married Filing Separately >= $396,0005 more rows•Jun 10, 2022

Why is Medicare Part A running out of money?

Medicare Advantage (MA) plans had a banner year in 2020 due to a massive drop in healthcare use caused by the COVID-19 pandemic. In late 2020, healthcare utilization returned largely to normal, but the decline earlier in the year reduced Part A trust fund spending by $8.4 billion, according to the institute.

Q: What are the changes to Medicare benefits for 2022?

A: There are several changes for Medicare enrollees in 2022. Some of them apply to Medicare Advantage and Medicare Part D, which are the plans that...

How much will the Part B deductible increase for 2022?

The Part B deductible for 2022 is $233. That’s an increase from $203 in 2021, and a much more significant increase than normal.

Are Part A premiums increasing in 2022?

Roughly 1% of Medicare Part A enrollees pay premiums; the rest get it for free based on their work history or a spouse’s work history. Part A premi...

Is the Medicare Part A deductible increasing for 2022?

Part A has a deductible that applies to each benefit period (rather than a calendar year deductible like Part B or private insurance plans). The de...

How much is the Medicare Part A coinsurance for 2022?

The Part A deductible covers the enrollee’s first 60 inpatient days during a benefit period. If the person needs additional inpatient coverage duri...

Can I still buy Medigap Plans C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are n...

Are there inflation adjustments for Medicare beneficiaries in high-income brackets?

Medicare beneficiaries with high incomes pay more for Part B and Part D. But what exactly does “high income” mean? The high-income brackets were in...

How are Medicare Advantage premiums changing for 2021?

According to CMS, the average Medicare Advantage (Medicare Part C) premiums for 2022 is about $19/month (in addition to the cost of Part B), which...

Is the Medicare Advantage out-of-pocket maximum changing for 2022?

Medicare Advantage plans are required to cap enrollees’ out-of-pocket costs for Part A and Part B services (unlike Original Medicare, which does no...

How is Medicare Part D prescription drug coverage changing for 2022?

For stand-alone Part D prescription drug plans, the maximum allowable deductible for standard Part D plans is $480 in 2022, up from $445 in 2021. A...

How is Medicare funded?

Rather, they are funded through a combination of enrollee premiums (which support only about one-quarter of their costs) and general revenues —another way of saying the government borrows most of the money it needs to pay for Medicare.

When did Medicare change to Medicare Access and CHIP?

But that forecast is built on several key assumptions that are unlikely to occur. In the 2010 Affordable Care Act, Congress adopted a package of cost-cutting measures. In 2015, in a law called the Medicare Access and CHIP Reauthorization Act (MACRA), it began to change the way Medicare pays physicians, shifting from a system that pays by volume to one that is intended to pay for quality. As part of the transition, MACRA increased payments to doctors until 2025.

Why did Medicare build up a trust fund?

Because it anticipated the aging Boomers, Medicare built up a trust fund while its costs were relatively low. But that reserve is rapidly being drained, and, in 2026, will be out the money. That is the source of all those “going broke” headlines.

Is Medicare healthy?

Not broke, but not healthy. However, that does not mean Medicare is healthy. Largely because of the inexorable aging of the Baby Boomers, program costs continue to grow. And, as the Trustee’s report forthrightly acknowledges, long-term costs could well increase even faster than the official predictions.

Will Medicare go out of business in 2026?

No, Medicare Won't Go Broke In 2026. Yes, It Will Cost A Lot More Money. Opinions expressed by Forbes Contributors are their own. It was hard to miss the headlines coming from yesterday’s Medicare Trustees report: Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

Will Medicare stop paying hospital insurance?

It doesn’t mean Medicare will stop paying hospital insurance benefits in eight years. We don’t know what Congress will do—though the answer is probably nothing until the last minute. Lawmakers could raise the payroll tax.

Will Medicare be insolvent in 2026?

Government Says Medicare won't be able to cover costs by 2026. Report puts Medicare insolvency sooner than forecast. Let’s get right to the point: Medicare is not going “broke” and recipients are in no danger of losing their benefits in 2026.

When will Medicare become insolvent?

Medicare's Hospital Insurance Trust Fund is projected to become insolvent in 2024 or 2026 — just three to five years from now. Yet you probably haven't heard about that.

What is Medicare Part A funded by?

Its Hospital Insurance Trust Fund pays for what's known as Medicare Part A: hospitals, nursing facilities, home health and hospice care and is primarily funded by payroll taxes. Employers and employees each kick in a 1.45% tax on earnings; the self-employed pay 2.9% and high-income workers pay an additional 0.9% tax.

How much money did the Cares Act get from the Medicare Trust Fund?

And last year's Covid-19 relief CARES Act tapped $60 billion from the Medicare trust fund to help hospitals get through the pandemic. Meantime, Medicare rolls have been growing with the aging of the U.S. population. With the insolvency clock ticking, the Biden administration and Congress will need to act soon.

When his administration and Congress get around to staving off Medicare insolvency, should they address?

When his administration and Congress get around to staving off Medicare insolvency, some experts say, they ought to also address longer-term questions about how best to provide high-quality health care at an affordable price for older Americans.

When will the Congressional Budget Office deplete?

Last September, the Congressional Budget Office (CBO) forecast depletion in 2024. In February 2021, the CBO pushed back that date to 2026 due to improved prospects for stronger economic growth and higher employment rates.

Can a trust fund pay 90% of Part A?

Current insolvency projections mean that the trust fund could pay 90% of Part A bills once the depletion date is breached. The bills would be paid, but with delay. And it's possible that a risk of lower payments to hospitals and other health care providers might limit access to some of their services.

Is Medicare insolvency a new issue?

Medicare Insolvency Issues Aren't New. The Medicare Hospital Insurance Trust Fund has actually confronted the risk of insolvency since Medicare began in 1965 because of its dependence on payroll taxes (much like Social Security).

How many people will have Medicare Advantage in 2020?

People who enroll in Medicare Advantage pay their Part B premium and whatever the premium is for their Medicare Advantage plan, and the private insurer wraps all of the coverage into one plan.) About 24 million people had Medicare Advantage plans in 2020, and CMS projects that it will grow to 26 million in 2021.

When will Medicare stop allowing C and F?

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), Medigap plans C and F (including the high-deductible Plan F) are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020.

What is the maximum out of pocket limit for Medicare Advantage?

The maximum out-of-pocket limit for Medicare Advantage plans is increasing to $7,550 for 2021. Part D donut hole no longer exists, but a standard plan’s maximum deductible is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending decreases significantly) is increasing to $6,550.

What is the Medicare premium for 2021?

The standard premium for Medicare Part B is $148.50/month in 2021. This is an increase of less than $4/month over the standard 2020 premium of $144.60/month. It had been projected to increase more significantly, but in October 2020, the federal government enacted a short-term spending bill that included a provision to limit ...

How much is the Medicare coinsurance for 2021?

For 2021, it’s $371 per day for the 61st through 90th day of inpatient care (up from $352 per day in 2020). The coinsurance for lifetime reserve days is $742 per day in 2021, up from $704 per day in 2020.

What is the income bracket for Medicare Part B and D?

The income brackets for high-income premium adjustments for Medicare Part B and D will start at $88,000 for a single person, and the high-income surcharges for Part D and Part B will increase in 2021. Medicare Advantage enrollment is expected to continue to increase to a projected 26 million. Medicare Advantage plans are available ...

How long is a skilled nursing deductible?

See more Medicare Survey results. For care received in skilled nursing facilities, the first 20 days are covered with the Part A deductible that was paid for the inpatient hospital stay that preceded the stay in the skilled nursing facility.

Why does Medicare pay the benefits owed?

Trustees’ reports have been projecting impending insolvency for over four decades, but Medicare has always paid the benefits owed because Presidents and Congresses have taken steps to keep spending and resources in balance in the near term.

How much is Medicare payroll tax?

This means that Congress could close the projected funding gap by raising the Medicare payroll tax — now 1.45 percent each for employers and employees — to about 1.9 percent, or by enacting an equivalent mix of program cuts and tax increases.

Why did Medicare repeal the Independent Payment Advisory Board?

Policymakers also repealed the Independent Payment Advisory Board, which was projected to help slow Medicare’s cost growth. And the Administration has failed to address excessive Medicare Advantage payments due to insurance company assessments of their beneficiaries that make them appear less healthy than they are.

What will Medicare be in 2040?

Total Medicare spending is projected to grow from 3.7 percent of gross domestic product (GDP) today to 5.9 percent in 2040. Medicare has been the leader in reforming the health care payment system to improve efficiency and has outperformed private health insurance in holding down the growth of health costs.

Will Medicare run out of money in 2026?

This shortfall will need to be closed through raising revenues, slowing the growth in costs, or most likely both. But the Medicare hospital insurance program will not run out of all financial resources and cease to operate after 2026, as the “bankruptcy” term may suggest.

Is Medicare a major change?

In contrast to Social Security, which has had no major changes in law since 1983, the rapid evolution of the health care system has required frequent adjustments to Medicare, a pattern that is certain to continue.

Is Medicare going bankrupt?

Medicare Is Not “Bankrupt”. Claims by some policymakers that the Medicare program is nearing “bankruptcy” are highly misleading. Although Medicare faces financing challenges, the program is not on the verge of bankruptcy or ceasing to operate. Such charges represent misunderstanding (or misrepresentation) of Medicare’s finances.

How many people died on Medicare in 2014?

About eight of 10 of the 2.6 million people who died in the US in 2014 were people on Medicare, making Medicare the largest insurer of health care provided during the last year of life. 1 In fact, roughly one-quarter of traditional Medicare spending for health care is for services provided to Medicare beneficiaries in their last year of life—a proportion that has remained steady for decades. 2 The high overall cost for health care received in the last year of life is not surprising given that many who die have multiple serious and complex conditions.

What percentage of Medicare beneficiaries died in 2014?

Of all Medicare beneficiaries who died in 2014, 46 percent used hospice—a rate that has more than doubled since 2000 (21 percent). 21 The rate of hospice use increases with age, with the highest rate existing among decedents ages 85 and over. Hospice use is also higher among women than men and among white beneficiaries than beneficiaries ...

How much did Medicare cost per beneficiary in 2014?

A: Among seniors in traditional Medicare who died in 2014, Medicare spending averaged $34,529 per beneficiary – almost four times higher than the average cost per capita for seniors who did not die during the year. 27 Other research shows over the past several decades, roughly one-quarter of traditional Medicare spending for health care is for services provided to beneficiaries ages 65 and older in their last year of life. 28

What are the most common causes of death for Medicare?

For people ages 65 and over, the most common causes of death include cancer, cardiovascular disease, and chronic respiratory diseases. 4 Medicare covers a comprehensive set of health care services that beneficiaries are eligible to receive up until their death. These services include care in hospitals and several other settings, home health care, ...

What are the services covered by Medicare?

These services include care in hospitals and several other settings, home health care, physician services, diagnostic tests, and prescription drug coverage through a separate Medicare benefit. Many of these Medicare-covered services may be used for either curative or palliative (symptom relief) purposes, or both.

Does Medicare cover hospice care?

A: Yes. For terminally ill Medicare beneficiaries who do not want to pursue curative treatment, Medicare offers a comprehensive hospice benefit covering an array of services, including nursing care, counseling, palliative medications, and up to five days of respite care to assist family caregivers. Hospice care is most often provided in patients’ homes. 19 Medicare patients who elect the hospice benefit have little to no cost-sharing liabilities for most hospice services. 20 In order to qualify for hospice coverage under Medicare, a physician must confirm that the patient is expected to die within six months if the illness runs a normal course. If the Medicare patient lives longer than six months, hospice coverage may continue if the physician and the hospice team re-certify the eligibility criteria.

When did Medicare start covering advance care?

Starting January 1, 2016, Medicare began covering advance care planning as a separate service provided by physicians and other health professionals (such as nurse practitioners who bill Medicare using the physician fee schedule).

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

Can I qualify for QI if I have medicaid?

You can’t qualify for the QI program if you have Medicaid. If you have a monthly income of less than $1,456 or a joint monthly income of less than $1,960, you are eligible to apply for the QI program. You’ll need to have less than $7,860 in resources. Married couples need to have less than $11,800 in resources.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

Is telehealth waiver permanent?

Medicare is reviewing whether to make telehealth waivers permanent. Waivers have expanded provider eligibility lists and available payment from Medicare. Hospitals are asking Congress to expand other federal telehealth programs.

Does CMS have telehealth waivers?

CMS has issued a range of telehealth waivers that apply to various components of providing and paying for such services, including: Waiving limitations on the types of healthcare professionals eligible to offer telehealth services.