If you paid Medicare taxes for under 30 quarters, the Part A premium is $499 in 2022. Those who paid Medicare taxes for 30 to 39 quarters will pay $274 per month in premiums. Please note that, if you have to pay monthly Medicare premiums, you cannot qualify for Social Security benefits.

What is Medicare SSA benefits?

Nov 24, 2021 · The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits.

What are the benefits of SSA?

If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. Part A hospital inpatient deductible and coinsurance: You pay: $1,556 deductible for each benefit period

How much does Medicare premium cost?

Feb 24, 2022 · 30 to 39 QCs: $274 a month. Less than 30 quarters: $499 a month. If you don’t have enough QCs to qualify for premium-free Part A coverage, you typically won’t have enough Social Security credits to qualify for monthly benefits your premium can be deducted from, so you’ll get a bill from Medicare each month.

How much is deducted for Medicare?

$170.10 each month (or higher depending on your income). The amount can change each year. The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

How much is Social Security taken out for Medicare?

How much does Medicare take out in social security in 2020?

If your 2020 income was $91,000 to $408,999, your premium will be $544.30. With an income of $409,000 or more, you'll need to pay $578.30. If you receive Social Security benefits, your monthly premium will be deducted automatically from that amount.Feb 24, 2022

What is the monthly Medicare fee?

What is the Medicare premium for 2021?

What month is Medicare deducted from Social Security?

Does Medicare have to come out of your Social Security check?

Are Medicare Part B premiums going up in 2021?

Do I have to pay for Medicare Part A?

Can I get Medicare Part B for free?

Does Medicare Part B have a monthly premium?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Is Medicare Part A free at age 65?

What changes are coming to Social Security in 2022?

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

Does Medicare pay for prescription drugs?

Medicare prescription drug coverage helps pay for your prescription drugs. For most beneficiaries, the government pays a major portion of the total costs for this coverage, and the beneficiary pays the rest.

Do you pay monthly premiums for Medicare?

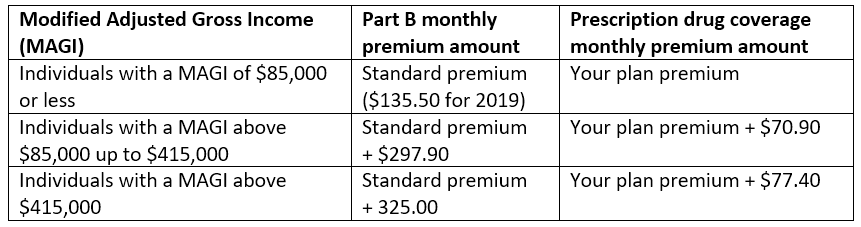

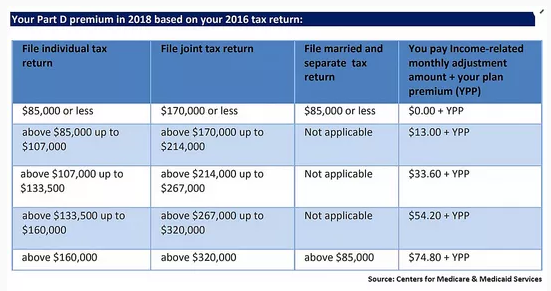

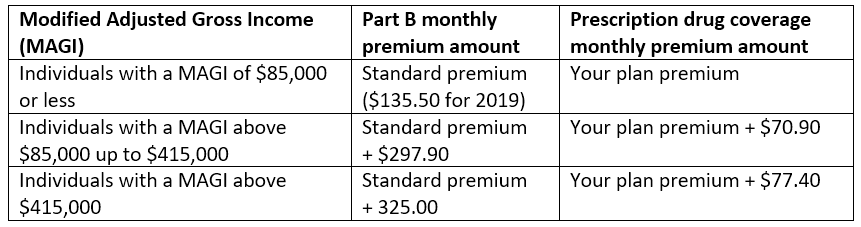

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much will Medicare pay in 2021?

In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is the Part B premium for 2021?

2021. The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How do I know if I will have money taken out of my Social Security check?

If you receive Social Security retirement benefits, your Medicare benefits will be deducted automatically. This means that you do not have to do anything to make this happen – it will be automatic when you enroll in Medicare.

How much is taken out, exactly?

There is no standard amount that is taken out of your Social Security check when you sign up for Medicare. Instead, the amount deducted depends on several factors. Each part of Medicare has a different cost. On top of this, Part C and Part D are offered by private plans, which means their monthly premiums vary even more.

How much is deducted from Social Security for Medicare Part A?

For most people, Medicare Part A hospital insurance is premium-free. This doesn’t mean it is actually free, because you still have to pay your deductible, co-insurance, and other out-of-pocket costs. However, you will have no monthly premium fees if you qualify.

How much do Part A premiums cost?

If you paid Medicare taxes for under 30 quarters, the Part A premium is $471 in 2021. Those who paid Medicare taxes for 30 to 39 quarters will pay $259 per month in premiums. Please note that, if you have to pay monthly Medicare premiums, you cannot qualify for Social Security benefits.

How much is deducted from Social Security for Medicare Part B?

There is no premium-free version of Medicare Part B. If you are enrolled in Part B and receive Social Security benefits, then your Medicare Part B premiums are deducted automatically. If you are enrolled in Part B but do not receive Social Security benefits, you have to pay your monthly premium online or by check.

Medicare Advantage premiums and Social Security benefits

Medicare Advantage, also known as Medicare Part C, is a type of insurance provided by private insurance companies that contract with Medicare. Private insurance companies manage the plans but have to work within guidelines provided by the federal government. They are only available to people who are eligible for Original Medicare.

How much is taken out for Part D drug plans?

Medicare Part D plans help pay for prescription drug costs. This coverage is not included with Original Medicare (Medicare Parts A and B). However, some Medicare Advantage plans also provide drug coverage. If you join a Medicare Advantage Prescription Drug plan (MA-PD), you cannot also join a standalone Part D plan.

Is money taken out of my Social Security check for Medicare?

Yes. To pay for Medicare Part B premiums, Medicare may take that payment directly from your Social Security check.

Which forms of Medicare take money out of my Social Security check?

Typically, only Medicare Part B. Part A does not usually have premiums. If you wish to add a Part D drug plan, there may be extra payments that would require money that could come from your Social Security benefits.

How much is taken from my Social Security benefit per month?

In 2021, the Part B premium is $148.50. Keep in mind that the Part B premium is based on income, so while most people will pay $148.50, some people will pay more.

Do Part D drug plans come out of my check?

You can have your Medicare Part D (drug plan) premiums deducted from your Social Security check if you wish. When you enroll in your drug plan, the system will give you the option.

Do Medicare Advantage premiums come out of my Social Security check?

About half of Medicare Advantage plans have $0 premiums, but if you do have a premium, you can deduct it right from your Social Security check. This is your choice, as it is not required to come from the Social Security check.

Do Medigap costs come out of my Social Security check?

Medigap premiums are paid directly to the private insurance carrier that provides the plan. In other words, you cannot deduct your Medigap premiums from your Social Security check.

Conclusion

Medicare and Social Security can be confusing at first. They both kick in at times when you’re dealing with a lot of change in life. Both are complicated systems. That’s why we’re here. It’s in the name — Medicare Allies.