What does Medicare Part a cost in 2017?

Part A costs Type of Cost 2017 Cost (Change From 2016) Hospital deductible $1,316 (up $28) Coinsurance for days 61-90 of hospital s ... $329 (up $7) Coinsurance for days 91 and beyond of ho ... $658 (up $14) Coinsurance for skilled nursing facility ... $164.50 (up $3.50)

How much does Medicare cost per month?

Medicare costs at a glance. If you buy Part A, you'll pay up to $437 each month in 2019 ($458 in 2020). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437 ($458 in 2020). If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240 ($252 in 2020).

How much do you pay for Medicare after deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible. If you have limited income and resources, you may be able to get help from your state to pay your premiums and other costs, like deductibles, coinsurance, and copays.

What is a Medicare pre-payment amount?

The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. applies. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

What was the cost of Medicare in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

How Medicare cost is calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How much does Medicare charge each month?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How much did Medicare cost in 2018?

$134 per monthAnswer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$85,001 to $107,000$170,001 to $214,000$187.505 more rows

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What income is counted for Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is the cost of Medicare Part A for 2022?

2022 costs at a glance If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274.

How much is the Medicare deductible for 2022?

$233The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

When did Medicare start charging a premium?

1966President Johnson signs the Medicare bill into law on July 30 as part of the Social Security Amendments of 1965. 1966: When Medicare services actually begin on July 1, more than 19 million Americans age 65 and older enroll in the program. 1972: President Richard M.

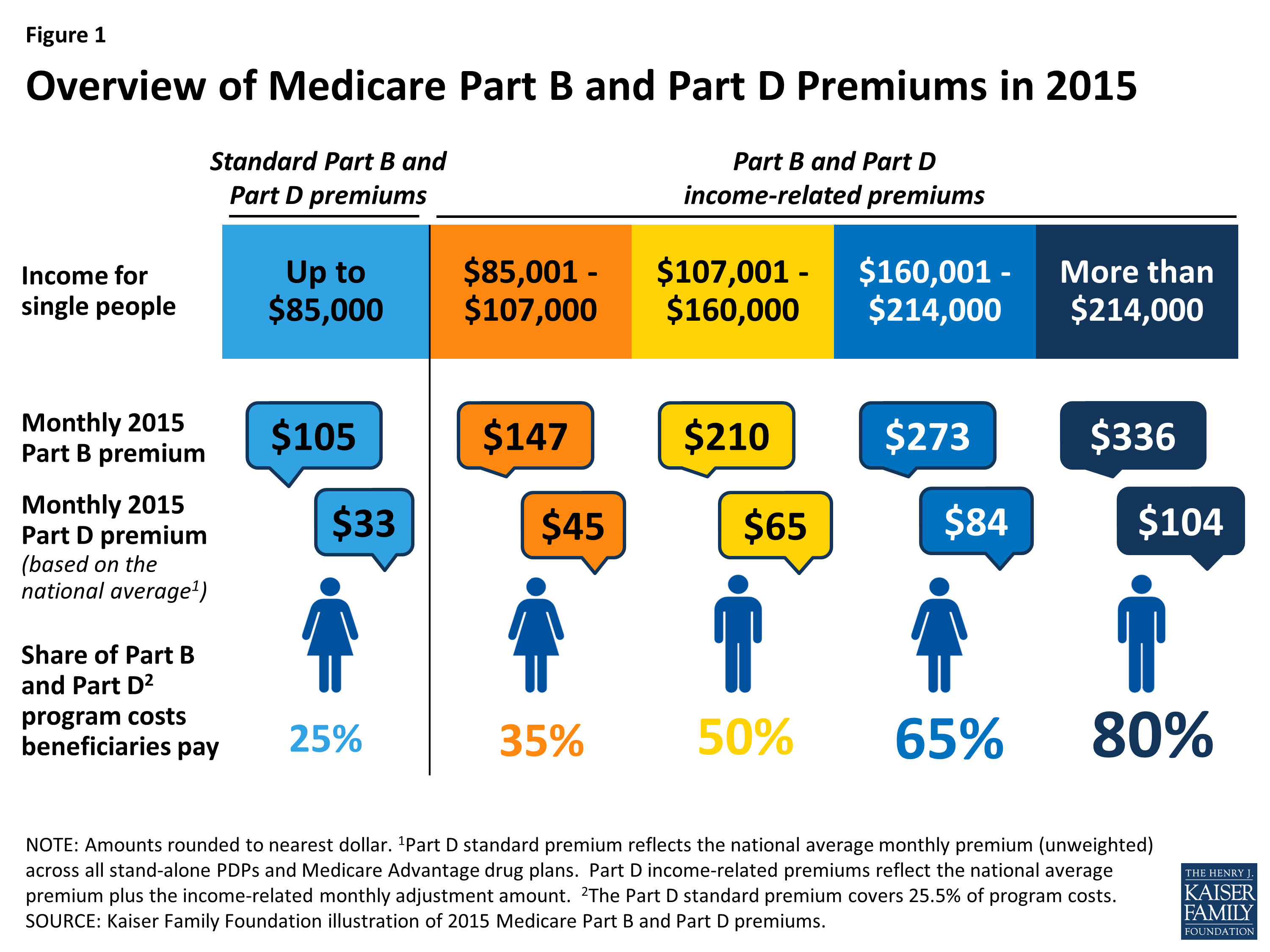

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

How much does Part B pay in 2017?

If you're enrolled in Part B but are not receiving Social Security payments, or the premiums are not deducted from them, you'll pay $134 a month in 2017. If you enroll in Part B for the first time in 2017 — regardless of whether you're receiving Social Security payments — you will pay $134 a month.

How much more will COLA pay for Part B?

In 2017, because the COLA will raise benefits by a measly 0.3 percent, they will pay an average of $4.10 more for Part B, depending on the dollar increase in their Social Security checks.

Can you pay more in Part B than you receive from Cola?

Under the law, people with Medicare who draw Social Security benefits cannot pay more in Part B premium increases than they receive from the COLA. So in 2016, these people — about 70 percent of beneficiaries — were "held harmless" from any premium increase and paid the same as they had in 2015. In 2017, because the COLA will raise benefits by ...

Medicare Part A (Inpatient Care) Is Free

Have you paid into Social Security for at least 10 years (40 quarters)? Then your premiums for Part A are paid for!

Interested In A More Personalized Analysis?

So there you have it! This should give you a good idea of what Medicare costs for the average 65-year old. But—as I said before—the cost of Medicare is different for every person. If you are interested in more personalized figures, call us at 937-492-8800 for a free consultation.

About the Author

Dan Hoelscher founded Seniormark in 2007 in an effort to help individuals make a successful transition into retirement. Dan is a Certified Financial Planner™ Practitioner and holds Certified Senior Advisor (CSA)© and Certified Kingdom Advisor™ certifications. Since founding Seniormark, Dan has helped thousands of retirees throughout Ohio.

Annual increases will hit those who rely on Medicare for their healthcare coverage

Medicare covers more than 57 million Americans, providing the healthcare coverage they need. Every year, though, the cost of Medicare typically goes up, and the program passes through those increases to its participants in the form of higher premiums, deductibles, and other expenses.

Part A costs

Most Medicare participants get hospital insurance coverage under Part A without paying a premium. However, for those who didn't collect enough credits for paying Medicare taxes during their career and don't have a qualifying spouse, Medicare charges a monthly premium of up to $413 per month. That's $2 higher than the maximum amount for 2016.

Part B costs

Medical care coverage under Medicare Part B will also see cost increases in 2017. The deductible that you have to pay on doctors' visits and other outpatient services goes up to $183 per year in 2017, climbing $17 from 2016.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much did Medicare Part B cost in 2017?

So, the monthly Medicare Part B premium will only increase by a few dollars from $104.90 in 2016 to $109 in 2017 for most existing Social Security recipients.

What percentage of Medicare premiums are deducted from Social Security?

About 70 percent of Medicare enrollees will experience this small premium increase, according to the Centers for Medicare and Medicaid Services. Most Social Security beneficiaries have their Medicare premiums deducted from their Social Security payments. [See: 10 Social Security Rules Everyone Should Know .]

How long do you have to sign up for Medicare if you are still working?

However, if you delay signing up for Medicare because you are still working and have group health insurance through your job, you will need to sign up for Medicare within eight months of leaving the job or the coverage ending in order to avoid the penalty. [See: 10 Medical Services Medicare Doesn't Cover .]

What is the full retirement age for a baby boomer?

The Social Security full retirement age is 66 for most baby boomers, which is a year later than the Medicare eligibility age of 65. Retirees who sign up for Social Security before age 66 collect a reduced payment. Those who delay signing up for Social Security between ages 66 and 70 will qualify for higher monthly payments.

When do you sign up for Medicare Part B?

You are first eligible to sign up for Medicare Part B during a seven-month period that begins three months before you turn 65. If you don't sign up during this initial enrollment period you might have to pay a late enrollment penalty for the rest of your life.

Do retirees pay the same Medicare premium?

Retirees don't all pay the same Medicare Part B premium. While most Medicare beneficiaries will experience a modest premium increase next year, a few specific groups of seniors will have to pay much higher premiums. Here's a look at how much retirees will need to pay for Medicare Part B in 2017. Existing Social Security beneficiaries.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.