What is the Medicare levy?

Medicare levy calculator. This calculator helps you estimate your Medicare levy. It includes any reductions or exemptions you are allowed. It can be used for the 2013–14 to 2020–21 income years. For most taxpayers the Medicare levy is 2% of their taxable income. The Medicare levy surcharge (MLS) is a separate levy from Medicare levy. It applies to taxpayers on a higher …

Do I have to pay Medicare levy if my income is low?

Who Pays the Medicare Levy? If you earn more than $29,033 in the most recent tax year, you will pay the Medicare Levy at a simple 2% of your taxable income. Using some very simple numbers: A part-time or casual employee who earned $20,000 pays zero Medicare Levy. An employee earning $50,000 in the last tax year pays $1,000. An employee earning $100,000 pays $2,000 in …

How do I calculate my Medicare levy?

Canstar takes a look at what the Medicare Levy is and how much you could be paying when it comes to tax time.

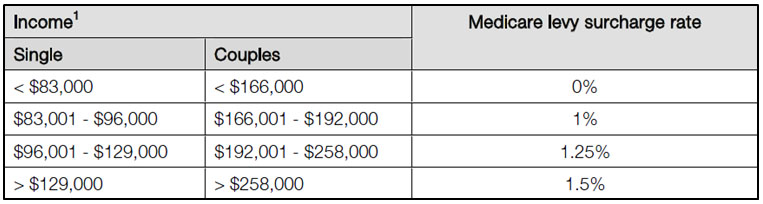

What are the Medicare levy surcharge rates and thresholds?

Mar 26, 2022 · You'll pay part of the Medicare Levy if your taxable income is between $23,227 and $29,033. The full 2% applies on anything over $29,033. Families – $39,167 For couples or single-parent families, the levy is reduced on any taxable income between $39,167 and $48,958, plus $4,496 per dependent child.

What is Medicare levied on?

The Medicare Levy Surcharge is different to the Medicare Levy. It is a charge levied on medium and high income earners who do not have private hospital cover. It ranges from 1-1.5% of your annual income. Please click here to read more about the Medicare Levy Surcharge. Popular Articles.

Do low income people have to pay taxes?

Some low income earners (depends on your annual income) do not have to pay the levy or receive a reduction on the levy rate. Do not pay: Income equal to or less than $22,801 (or $36,056 if entitled to the seniors and pensioners tax offset). Had sole care of one or more dependent children.

How much is Medicare levy?

How much is the Medicare Levy? For the 2019–20 financial year, if you earned over $28,501 you would have paid a Medicare levy of 2% of your taxable income. For a single person earning $28,501 with no dependents, this would have equated to $570.

What is the Medicare levy for 2019-20?

The Medicare levy lower threshold for the 2019-20 financial year is set at $22,801 ($36,056 for seniors and pensioners) advice from the ATO states. This means if you earn equal to or less than this amount you won’t pay any Medicare Levy. Anyone earning above $22,801 but less than $28,501 ($45,069 for seniors and pensioners) will pay ...

Why is MLS important?

The MLS was introduced to help ease the burden on the Medicare system by encouraging Australians on higher incomes to take out private health insurance. As the government’s PrivateHealth website explains, the MLS is different to the Medicare Levy, which applies to almost all Australian taxpayers, and is in addition to this.

How much is Medicare tax?

The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year.

What is Medicare tax?

Medicare Levy vs the Medicare Levy Surcharge? The Medicare Levy is a 2% tax that goes towards funding the public health system. You pay a Medicare Levy in addition to the tax you pay on your taxable income. Most of us have to pay it unless we earn less than $22,801 a year. The Medicare Levy Surcharge, on the other hand, ...

Who is Alex Holderness?

As Finder's insurance group publisher, Alex Holderness aims to make confusing topics easy to understand. She's been published in Money Mag, Yahoo Finance, Hospital Health, and is a contributing author for Google's Startup Grind. She has a keen passion for running and is currently studying for her General Insurance certification.

What is the Medicare tax rate for 2019?

The Medicare Levy is a flat 2% income tax for any earning above the threshold. The 2019-20 upper threshold is $28,501 per year. For example, if you earned $75,000 your Medicare Levy would be $1,500. You will only have to pay part of the Medicare Levy if your taxable income is between $22,801 and $28,501 ...

Does Medicare cover everything?

Unfortunately, Medicare doesn't cover everything – but private health insurance can help fill in the gaps. It can cover you for things like ambulance transportation, dental and optical, and often gives you access to treatment quicker than the public system.

What is Medicare surcharge?

The Medicare Levy Surcharge (MLS) is a levy paid by Australian tax payers who do not have private hospital cover and who earn above a certain income. The surcharge aims to encourage individuals to take out private hospital cover, and where possible, to use the private system to reduce the demand on the public Medicare system.

What is general treatment cover?

General treatment cover without hospital cover; Overseas Visitors Cover or Overseas Student Health Cover; or. Cover held with non-registered insurers, such as international insurers. I have reciprocal Medicare benefits and earn over the surcharge threshold.

What is Medicare levy surcharge?

365. A Medicare levy surcharge may apply if you, your spouse and all your dependants did not maintain an appropriate level of private patient hospital cover for the full income year. Use the number of days listed at A to help you complete the Medicare levy surcharge question on your tax return. See also:

What is the income threshold for MLS?

The base income threshold (under which you are not liable to pay the MLS) is: $90,000 for singles. $180,000 (plus $1,500 for each dependent child after the first one) for families. However, if you had a spouse for the full year, you do not have to pay the MLS if: your family income exceeds the $180,000 ...

Is a super contribution deductible?

if you have a spouse, their share of the net income of a trust on which the trustee must pay tax (under section 98 of the Income Tax Assessment Act 1936) and which has not been included in their taxable income.

Do you have to pay MLS for Medicare?

If you have to pay Medicare levy, you may have to pay the Medicare levy surcharge (MLS) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income.

On this page

You can scroll through and review this salary example or click on the links below to jump to a specific are of interest:

2021 Employer Superannuation Calculation

Employer superannuation in Australia is paid at a flat rate of 10% on your salary. The table belows shows how we calculated employer superannuation contributions in 2021.

2021 Cost of Employee In Australia Calculation

The cost of an employee in Australia is calculated by adding the employee salary to the employers superannuation payments. The cost of an employee In Australia on a $96,000.00 annual salary is illustrated below. The "cost of an employee" is also referred to as the "salary package" in this calculation.