How do you Bill CPT code 20610?

The charge, if any, for the drug or biological must be included in the physician’s bill and the cost of the drug or biological must represent an expense to the physician. If an aspiration and an injection procedure are performed at the same session, bill only one unit for CPT code 20610.

How much does Medicare Part a cost?

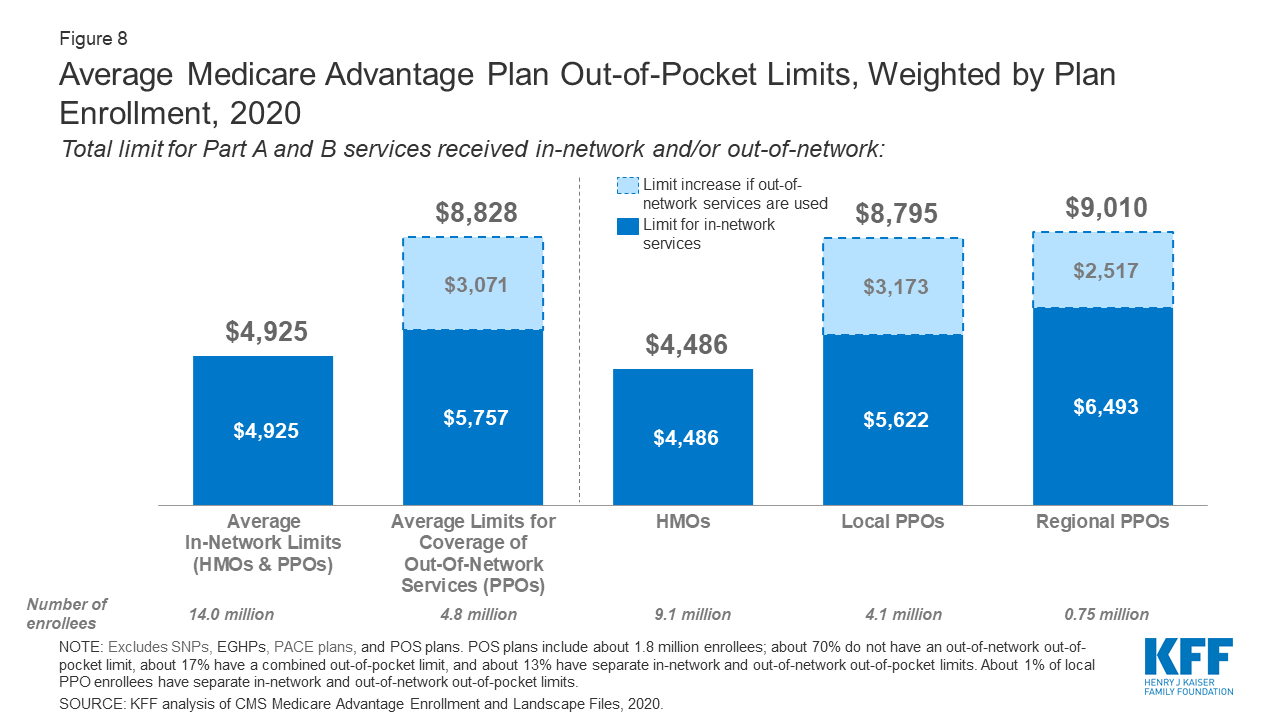

Medicare costs at a glance. Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $437 each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240.

What percentage of Medicare reimbursement goes to specialty care?

For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1 Medicare uses a coded number system to identify health care services and items for reimbursement.

How much does Medicare Part B cost in 2020?

Review the " Evidence of Coverage " from your plan. In 2020, you pay $198 for your Part B Deductible. After you meet your deductible for the year, you typically pay 20% of the Medicare-approved amount for these: Clinical laboratory services: You pay $0 for Medicare-approved services. $0 for home health care services.

What is included in CPT code 20611?

The CPT code 20611 is for an arthrocentesis, aspiration and/or injection, major joint or bursa (e.g., shoulder, hip, knee or subacromial bursa with ultrasound guidance, with permanent recording and reporting).

What is the difference between 20610 and 20611?

Use 20610 for a major joint or bursa, such as the shoulder, knee, or hip joint, or the subacromial bursa when no ultrasound guidance is used for needle placement. Report 20611 when ultrasonic guidance is used and a permanent recording is made with a report of the procedure.

What is the Medicare reimbursement rate?

roughly 80 percentAccording to the Centers for Medicare & Medicaid Services (CMS), Medicare's reimbursement rate on average is roughly 80 percent of the total bill. Not all types of health care providers are reimbursed at the same rate.

Does CPT code 20611 need a modifier?

For bilateral administration of HYALGAN, some payers may require modifier “-50” (bilateral procedure) to be documented after CPT code 20610/20611. Use “EJ” modifier on drug codes to indicate subsequent injections of a series. Do not use this modifier for the first injection of each series of injections.

Does Medicare cover knee injections?

Yes, Medicare will cover knee injections that approved by the FDA. This includes hyaluronan injections. Medicare does require that the doctor took x-rays to show osteoarthritis in the knee. The coverage is good for one injection every 6 months.

Can CPT code 20610 and 20611 be billed for injection contrast?

The procedure code (CPT code) 20610 or 20611 (with ultrasound guidance) may be billed for the intra-articular injection in addition to the drug. If an aspiration and an injection procedure are performed at the same session, bill only one unit for CPT code 20610 or 20611 (if applicable).

How are Medicare payments calculated?

Medicare primary payment is $375 × 80% = $300.Primary allowed of $500 is the higher allowed amount.Primary allowed minus primary paid is $500 - $400 = $100.The lower of Step 1 or 3 is $100. ( Medicare will pay $100)

What is the reimbursement rate for?

Reimbursement rates means the formulae to calculate the dollar allowed amounts under a value-based or other alternative payment arrangement, dollar amounts, or fee schedules payable for a service or set of services.

Is the Medicare 2021 fee schedule available?

The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021.

How do you bill CPT 20611 bilateral?

03/01/2019 Billing the injection procedure: Added CPT code 20611 to following statement: The appropriate site modifier (RT or LT) must be appended to CPT code 20610 or CPT code 20611 to indicate if the service was performed unilaterally and modifier (-50) must be appended to indicate if the service was performed ...

Can 20611 and 76942 be billed together?

For example, the parenthetical note following CPT code 20611 states: “(Do not report 20610, 20611 in conjunction with 27370, 76942)”.

How do I bill bilateral knee injections to Medicare?

Indicate which knee was injected by using the RT (right) or LT (left) modifier (FAO-10 electronically) on the injection procedure (CPT 20610). Place the CPT code 20610 in item 24D. If the drug was administered bilaterally, a -50 modifier should be used with 20610.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is 20611?

20611 Arthrocentesis, aspiration and/or injection, major joint or bursa (eg, shoulder, hip, knee, subacromial bursa); with ultrasound guidance, with permanent recording and reporting (Do not report 20610, 20611 in conjunction with 27370, 76942) (If fluoroscopic, CT, or MRI guidance is performed, see 77002, 77012, 77021)

What is the code for a hip arthrectomy?

Use code 20610 for an Arthrocentesis, aspiration and/or injection; major joint or bursa (eg, shoulder, hip, knee joint, subacromial bursa). Use this code if an SI Joint Injection is done without any imaging (instead of 27096 or G0260)

What is the meaning of Title XVIII of the Social Security Act?

This section states that no payment shall be made to any provider for any claims that lack the necessary information to process the claim.

What is CPT code 25115?

For example, CPT code 25115 describes a radical excision of a bursa or synovia of the wrist. It is standard surgical practice to preserve neurologic function by isolating and freeing nerves as necessary. A neuroplasty (e.g. CPT code 64719) should not be reported separately for this process. Therefore, CPT code 64719 is bundled into CPT code 25115.

Is it appropriate to bill an E/M visit?

It would not be appropriate to bill the E/M visit , because the focus of the visit is related to the knee pain, which precipitated the injection procedure. The evaluation of the knee problem and the patient’s medical suitability for the procedure is included in the injection procedure reimbursement

Is arthrocentesis covered by Medicare?

Arthrocentesis, aspiration and/or injection (20600, 20605, 20610) is a covered service under the Medicare program when performed by a physician/ non-physician practitioner ( NPP) in compliance with state laws, within their scope of practice/training and within the accepted standards of medical practice.

General Information

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

Article Guidance

This article contains billing and coding guidelines that complement the Local Coverage Determination (LCD) Drugs and Biologicals, Coverage of, for Label and Off-Label Uses. Abstract: Purified natural hyaluronans have been approved by the FDA for the treatment of pain associated with osteoarthritis of the knee in patients who have failed to respond adequately to conservative nonpharmacologic therapy and simple analgesics.

Bill Type Codes

Contractors may specify Bill Types to help providers identify those Bill Types typically used to report this service. Absence of a Bill Type does not guarantee that the article does not apply to that Bill Type.

Revenue Codes

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service. In most instances Revenue Codes are purely advisory. Unless specified in the article, services reported under other Revenue Codes are equally subject to this coverage determination.

General Information

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

Article Guidance

Purified natural hyaluronates have been approved by the FDA for the treatment of symptomatic osteoarthritis of the knee in patients who have failed to respond to simple analgesics or conservative nonpharmacologic therapy.

ICD-10-CM Codes that Support Medical Necessity

Note: Diagnosis codes must be coded to the highest level of specificity.

Bill Type Codes

Contractors may specify Bill Types to help providers identify those Bill Types typically used to report this service. Absence of a Bill Type does not guarantee that the article does not apply to that Bill Type.

Revenue Codes

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service. In most instances Revenue Codes are purely advisory. Unless specified in the article, services reported under other Revenue Codes are equally subject to this coverage determination.

What percentage of Medicare reimbursement is for social workers?

According to the Centers for Medicare & Medicaid Services (CMS), Medicare’s reimbursement rate on average is roughly 80 percent of the total bill. 1. Not all types of health care providers are reimbursed at the same rate. For example, clinical nurse specialists are reimbursed at 85% for most services, while clinical social workers receive 75%. 1.

What is Medicare reimbursement?

Medicare reimburses health care providers for services and devices they provide to beneficiaries. Learn more about Medicare reimbursement rates and how they may affect you. Medicare reimbursement rates refer to the amount of money that Medicare pays to doctors and other health care providers when they provide medical services to a Medicare ...

Is it a good idea to use HCPCS codes?

Using HCPCS codes. It’s a good idea for Medicare beneficiaries to review the HCPCS codes on their bill after receiving a service or item. Medicare fraud does happen, and reviewing Medicare reimbursement rates and codes is one way to help ensure you were billed for the correct Medicare services.

How much is Medicare reimbursement enhanced?

As a result, depending on physician performance within this program, Medicare reimbursements can be enhanced or penalized by up to 9%, although there is a two-year delay in this application (e.g. provider performance in 2021 will lead to the enhancement or penalty in 2023).

When will CMS update the E/M code?

These revisions build on the goals of CMS and the provider community to reduce administrative burden and put “patients over paperwork.” These revisions will be effective Jan. 1, 2021 .

When will the CPT code 99201 be revised?

On Nov. 1, 2019, CMS finalized revisions to the evaluation and management (E/M) office visit CPT codes 99201-99215. These revisions will go into effect on Jan. 1, 2021. They build on the goals of CMS and providers to reduce administrative burden and put “patients over paperwork” thereby improving the health system.

What is the conversion factor for 2021?

Conversion Factor: The 2021 conversion factor (CF) had originally been set at $32.41, which was a decrease of 10% or $3.68 from the CY 2020 PFS CF of $36.09. This change was necessary due to the re-evaluation of the work relative value units (RVUs) for evaluation and management services. Due to the passage of the Omnibus and COVID Relief bill on December 27, 2020, the conversion factor has been readjusted to $34.89.

When will CMS change the physician fee schedule?

CMS has announced changes to the physician fee schedule for 2021. On December 2, 2020, the Centers for Medicare and Medicaid Services (CMS) published its final rules for the Part B fee schedule, referred to as the Physician Fee Schedule (PFS). Substantial changes were made, with some providers benefiting more than others, ...

Is QPP extended for 2021?

2020 has been a difficult year for virtually all providers. With that in mind, CMS has provided an extension for the “extreme and uncontrollable circumstances exception” until February 21, 2021. QPP was a result of the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, which represents CMS’s move towards a value-based reimbursement program. As a result, depending on physician performance within this program, Medicare reimbursements can be enhanced or penalized by up to 9%, although there is a two-year delay in this application (e.g. provider performance in 2021 will lead to the enhancement or penalty in 2023).

Is telehealth included in CMS 2021?

In the 2021 Final Rule, CMS has included several Category 1 Telehealth Service additions as well as the addition of telehealth services, on an interim basis, to those services put in place during COVID-19.

How much does Medicare pay for coinsurance?

In fact, Medicare’s reimbursement rate is generally around only 80% of the total bill as the beneficiary is typically responsible for paying the remaining 20% as coinsurance. Medicare predetermines what it will pay health care providers for each service or item. This cost is sometimes called the allowed amount but is more commonly referred ...

How much more can a health care provider charge than the Medicare approved amount?

Certain health care providers maintain a contract agreement with Medicare that allows them to charge up to 15% more than the Medicare-approved amount in what is called an “excess charge.”.

What is the difference between CPT and HCPCS?

The CPT codes used to bill for medical services and items are part of a larger coding system called the Healthcare Common Procedure Coding System (HCPCS). CPT codes consist of 5 numeric digits, while HCPCS codes ...

What is Medicare reimbursement rate?

A Medicare reimbursement rate is the amount of money that Medicare pays doctors and other health care providers for the services and items they administer to Medicare beneficiaries. CPT codes are the numeric codes used to identify different medical services, procedures and items for billing purposes. When a health care provider bills Medicare ...

Is it a good idea to check your Medicare bill?

It’s a good idea for Medicare beneficiaries to review their medical bills in detail. Medicare fraud is not uncommon, and a quick check of your HCPCS codes can verify whether or not you were correctly billed for the care you received.