What percentage of your paycheck is Medicare?

What Percentage of Federal Taxes and Medicare Are Deducted out of Gross Pay?

- Social Security and Medicare Tax 2019. Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income ...

- W-4s and Federal Tax Withholdings. ...

- Social Security Withholdings. ...

- Evaluating Medicare Withholdings and the Deduction Amount of Net Pay. ...

- Gaining More Information. ...

What is the current tax rate for Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

Why is Medicare taken from your paycheck?

What Does Medicare Mean on my Paycheck?

- If your paycheck is directly deposited into your checking account you will be given a pay statement with all the itemized deductions.

- If you receive a paycheck, there will a pay stub attached or included with the check that itemizes all of your deductions. ...

- Standard Federal Income Tax is based on your gross earnings and number of exemptions.

How much Medicare is withheld from paycheck?

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes a further 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes.

Is Medicare tax a payroll tax?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

What do payroll taxes go to?

The federal government levies payroll taxes on wages and self-employment income and uses the revenue to fund Social Security, Medicare, and other social insurance programs.

Who pays the most in payroll taxes?

The first is a 12.4 percent tax to fund Social Security, and the second is a 2.9 percent tax to fund Medicare, for a combined rate of 15.3 percent. Half of payroll taxes (7.65 percent) are remitted directly by employers, while the other half (7.65 percent) are taken out of workers' paychecks.

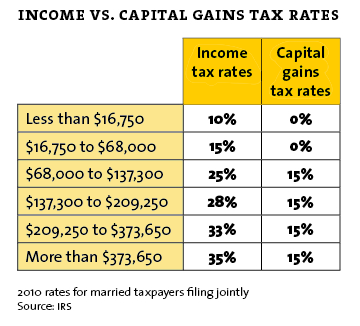

What fraction of all US income tax is paid by the top 10%?

The top 10 percent of earners bore responsibility for over 71 percent of all income taxes paid and the top 25 percent paid 87 percent of all income taxes.

What is the largest source of revenue for the federal government?

individual income taxesThis is especially important as the economic recovery from the pandemic continues. In the United States, individual income taxes (federal, state, and local) were the primary source of tax revenue in 2020, at 41.1 percent of total tax revenue.

Is Social Security fully funded by payroll tax?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

Who bears the burden of payroll taxes?

However, the burden is mostly carried by workers: According to the Tax Foundation, most employers send their portion of the tax to the government and then decrease workers' wages before paying them. The workers then pay their own 6.2 percent tax on the reduced wages.

Who will bear the cost of the payroll tax?

If labor is fixed in supply (or if the labor supply elasticity is zero), then labor will bear the full burden of the payroll tax.

Which of the 9 types of taxes is the largest source of revenue for the government?

individual income taxThe individual income tax has been the largest single source of federal revenue since 1950, amounting to about 50 percent of the total and 8.1 percent of GDP in 2019 (figure 3).

What would happen if the tax system was abolished?

Since these taxes will be abolished, the price of consumer goods could actually fall as a result, as economist Dale Jorgensen of Harvard University suggests. Also, getting rid of the taxes that penalize investing and saving will fuel an increase in economic growth, which means increased business competition.

Does the middle class pay the most taxes?

According to Saez and Zucman, it's not only the bottom 50% of households who pay more — which include many in the middle class — it's also those in the upper-middle class and in the top 1% who pay more in taxes than those in the 0.1% do.

What percentage of taxes do the rich pay in America?

New OMB-CEA Report: Billionaires Pay an Average Federal Individual Income Tax Rate of Just 8.2%

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital In...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

How do self-employed people pay Medicare tax?

If you are a self-employed person, Medicare tax is not withheld from your paycheck. You would typically file estimated taxes quarterly and use the...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is payroll tax?

A. Payroll taxes are levied to finance Social Security, the hospital insurance portion (Part A) of Medicare, and the federal unemployment insurance program. Revenue in 2019 totaled just over $1.2 trillion.

What was the payroll tax rate in 1937?

When the tax was first collected in 1937, the combined payroll tax rate was 2.0 percent ; it raised $580 million (about $10.3 billion in 2019 dollars). In 2019, OASDI taxes totaled about $914 billion and represented 26.4 percent of total federal receipts (figure 1).

How much was the HI tax in 1966?

In 1966, the first year of HI tax collections, the combined tax rate was 0.7 percent, and collections totaled $1.9 billion (about $15.0 billion in 2019 dollars). In 2019, HI taxes totaled $277.6 billion.

How much is the SSA benefit?

It is one of the largest items in the federal budget, with benefits payments of $989 billion in 2018 (SSA 2019). Benefits are mainly financed by a payroll tax on cash wages, up to an annual maximum indexed to average wage growth (table 1). For 2020, maximum taxable earnings are $137,700.

When did the HI tax cap end?

The cap on wages subject to the HI tax was removed in 1994. Also, beginning in 2013, single households earning more than $200,000 and married households earning more than $250,000 contributed an additional 0.9 percent of earnings over those thresholds (there is no employer portion for this “surtax”).

Is Social Security a retirement program?

The Social Security Administration operates one of the largest of these, a retirement program for the railroad industry that functions similarly to Social Security. Retirement programs for federal employees absorb most of the rest of payroll tax receipts. Updated May 2020.

Does Medicare pay payroll taxes?

Federal costs for other parts of Medicare, such as Part B, which covers doctors’ and other providers’ fees, are not covered by payroll taxes but mainly by general revenues and premiums paid by beneficiaries.. The HI program is financed mainly through payroll taxes on workers.

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

What is a 401(k) plan?

A 401 (k) is a qualified employer-sponsored retirement plan into which eligible employees can make salary deferral contributions. Earnings in a 401 (k) accrue on a tax-deferred basis.

Can you deduct retirement from paycheck?

In many cases, you can elect to have a portion deducted from your paycheck for this purpose. Many employers offer certain types of retirement plans, depending on the length of time an employee has been with an organization (known as vesting) and the type of organization (company, nonprofit, or government agency).

Do self employed people pay Medicare?

Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically pay half of these taxes. But they are allowed to deduct half of their Medicare and Social Security taxes from their income taxes. 6 .

What is the HI payroll tax?

The primary source of financing for Hospital Insurance (HI) benefits provided under Medicare Part A is the HI payroll tax. The basic HI tax is 2.9 percent of earnings. For employees, 1.45 percent is deducted from their paychecks and 1.45 percent is paid by their employers. Self-employed individuals generally pay 2.9 percent of their net self-employment income in HI taxes. Unlike the payroll tax for Social Security, which applies to earnings up to an annual maximum ($128,400 in 2018), the 2.9 percent HI tax is levied on total earnings.

Why would the HI tax increase?

That is because a larger share of the income of lower-income families is, on average, from earnings, which are subject to the HI tax. As a result, an increase in the HI tax would represent a greater proportion of the income of lower-income taxpayers than would be the case for higher-income taxpayers.

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

How is Medicare Part D funded?

Part D is financed by general revenues (71 percent), beneficiary premiums (17 percent), and state payments for beneficiaries dually eligible for Medicare and Medicaid (12 percent). Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

What is the current payroll tax rate for Social Security?

Payroll Tax Rates. The current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee, for a total of 12.4%. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, for a total of 2.9%.

When did Medicare start paying Social Security taxes?

Social Security taxes began in 1937, at a modest rate of 2%. Medicare hospital insurance taxes didn’t kick in until 1966, at a rate of 0.7%. Rates have climbed since then, of course, with the rate increase for Social Security taxes outpacing the rise in Medicare hospital insurance taxes. In 2020, payroll taxes only apply to the first $137,700 ...

Why is my take home pay different from my salary?

Payroll taxes are part of the reason your take-home pay is different from your salary. If your health insurance premiums and retirement savings are deducted from your paycheck automatically, then those deductions (combined with payroll taxes) can result in paychecks well below what you would get otherwise.

What is the FICA rate for 2020?

That means that combined FICA tax rates for 2020 are 7.65% for employers and 7.65% for employees, bringing the total to 15.3% . A recent report from the Congressional Budget Office suggests that raising Social Security payroll taxes is necessary to extend the solvency of the Social Security Trust. As discussed, raising the maximum taxable income ...

Why did Congress cut payroll taxes?

In tough economic times like the Great Recession, Congress cuts payroll taxes to give Americans a little extra take-home pay. Recently, President Trump allowed employers to temporarily suspend withholding and paying payroll taxes in an effort to offer COVID-19 relief.

How much is payroll tax in 2020?

According to the US Department of the Treasury, payroll taxes made up 38.3% of federal tax revenue in fiscal year 2020. That’s $1.31 trillion out of $3.42 trillion. These taxes come from the wages, salaries, and tips that are paid to employees, and the government uses them to finance Social Security and Medicare.

How to avoid taxes on self employed?

If you are self-employed, an advisor can help you avoid employment taxes by structuring your business to pay you in dividends instead of a salary. If you’re freelancing on the side, you’ll need to pay taxes on that extra income. You can pay estimated taxes quarterly or get more taxes withheld from your paycheck.