Medicare Tax: You will also need to withhold 1.45% of each employee’s taxable wages up until they have reached a total earning of $200,000 for that year. You will need to match this tax as well. For employees who earn salaries above $200,000, withhold an Additional Medicare Tax of 0.9%.

What is the payroll tax for Medicare?

When Medicare was enacted as a federal law in 1965, the funds to support the program became a payroll tax on earned income. The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs. Your employer makes a matching contribution to the Medicare program.

Where do Medicare taxes go on your paycheck?

Your Medicare tax is deducted automatically from your paychecks. Where do Medicare taxes go, and how is Medicare paid for? The Medicare tax that is withheld from your paychecks helps fund health care costs for people enrolled in Medicare. Medicare is financed through two trust fund accounts held by the United States Treasury:

How much do you make after taxes in Florida?

How much do you make after taxes in Florida? The take home pay is $44,290.50 for a single filer with an annual wage of $53,000. For a married couple with a combined annual of $106,000, the take home page after tax is $88,581.

Are all of my wages subject to Medicare tax?

If you do not have nontaxable deductions, all of your wages are subject to Medicare tax. Social Security tax is a federal payroll tax that employers and employees pay. The federal government sets the Social Security tax percentage and the annual wage limit.

What is the Medicare tax rate in Florida?

1.45%Payroll taxes include Medicare tax, with a tax rate of 1.45% on all earnings and Social Security tax, with a rate of 6.2% on the first $147,000 as of 2022.

What is the percentage of tax deducted on payroll in Florida?

6%The Florida payroll tax rate is 6% of the first $7,000 in earnings for each employee. Employers must pay this rate in addition to the 5.5 percent corporate income tax rate. Employee wages in Florida are subject to a payroll tax. Florida payroll taxes are paid by both companies and employees.

What is Medicare tax rate?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000. Federal income tax.

What taxes are taken out in Florida?

There is no personal income tax in Florida.Florida Sales Tax: Florida sales tax rate is 6%.Florida State Tax: Florida does not have a state income tax.Florida Corporate Income Tax: Corporations that do business and earn income in Florida must file a corporate income tax return (unless they are exempt).More items...

What percentage do they take out of your paycheck?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employee's wages.

What percentage of tax is withheld from my paycheck?

FICA Taxes - Who Pays What? Withhold half of the total (7.65% = 6.2% for Social Security plus 1.45% for Medicare) from the employee's paycheck. For the employee above, with $1,500 in weekly pay, the calculation is $1,500 x 7.65% (. 0765) for a total of $114.75.

How is Medicare tax withheld calculated?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

How is Medicare calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

What is the federal tax rate in Florida?

Your Income Taxes BreakdownTaxMarginal Tax Rate2021 Taxes*Federal22.00%$9,600FICA7.65%$5,777State5.97%$3,795Local3.88%$2,4924 more rows•Jan 1, 2021

What is the income tax rate in Florida 2020?

Florida is one of only nine states that doesn't charge an income tax. Other states include Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. (New Hampshire doesn't tax wages but does tax investment earnings and dividends.)

Is Florida's sales tax 7 %?

Florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. There are a total of 367 local tax jurisdictions across the state, collecting an average local tax of 1.037%. Click here for a larger sales tax map, or here for a sales tax table.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What are the taxes that are withheld from paychecks?

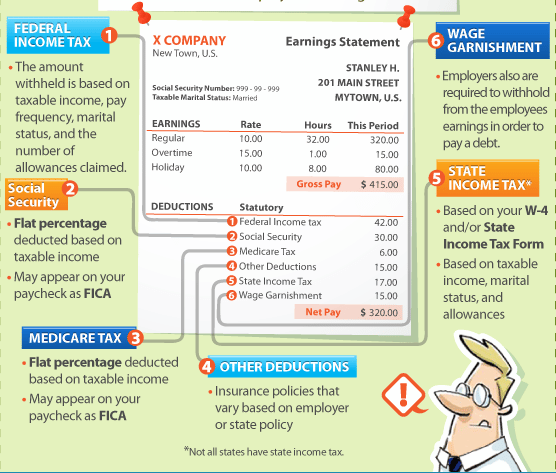

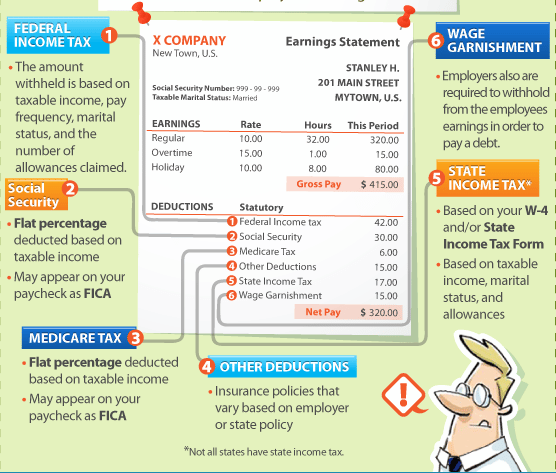

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How many parts are there in self employed tax?

The self-employed tax consists of two parts:

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How much Medicare tax do you pay if you make $460 a week?

Therefore, if you earn $460 weekly, you pay $6.67 week ly in Medicare tax. Your employer pays a matching amount in Medicare tax. If you are self-employed, you'll need to set aside 2.9 percent of your income to cover this tax. 00:00.

How much is Social Security tax?

As of 2018, Social Security tax is on wages of up to $128,400. While Medicare is withheld from all wages earned, Social Security withholding stops for the year when you satisfy the annual wage limit and resumes when the next year begins. Your employer pays 6.2 percent up to $128,400 for the year in Social Security tax. As of June 2018, the employee's contribution is also 6.2 percent. Those who are considered self-employed will be responsible for paying both the employee and employer percentages for a total of 12.4 percent.

How to determine federal income tax withholding?

To determine the amount subject to withholding, your employer obtains your filing status and number of allowances from lines 3 and 5 of your W-4 form and applies the IRS Circular E percentage method table that matches your wages after allowances, plus your pay period and filing status. Based on this information, you are taxed on 10, 12, 24, 32, 35 or 37 percent of wages exceeding the indicated amount. To determine the amount of allowance to subtract from your wages, your employer multiplies your number of allowances by the amount the agency specifies per allowance, which is based on your payroll frequency.

How to determine how much allowance to subtract from wages?

To determine the amount of allowance to subtract from your wages, your employer multiplies your number of allowances by the amount the agency specifies per allowance, which is based on your payroll frequency.

Does Florida have state income tax?

Most states require employers to withhold state income tax from employees’ paychecks, but Florida does not. Still, employees in Florida are subject to federal income tax, Social Security tax and Medicare tax withholding, which the Internal Revenue Service oversees. These taxes are based on a certain percentage of your pay.

How much Medicare tax do you have to pay?

Medicare Tax: You will also need to withhold 1.45% of each employee’s taxable wages up until they have reached a total earning of $200,000 for that year. You will need to match this tax as well. For employees who earn salaries above $200,000, withhold an Additional Medicare Tax of 0.9%. Only the employee is responsible for paying the Additional Medicare Tax.

What is the federal tax rate?

Federal income tax ranges from 0% to 37%. Further withholding information from the IRS can be found here.

What is the tax credit for unemployment?

If you pay state unemployment taxes, you are eligible for a tax credit of up to 5.4%. Employees are not responsible for paying the FUTA tax. You may need to deduct court-ordered wage garnishments, child support, post-tax contributions to savings accounts, elective benefits, etc.

How to divide annual salary?

For all your employees on salary, divide each employee’s annual salary by the number of pay periods you have.

Does Florida have a local income tax?

You already know that the State of Florida charges 0% income tax. And even better, no cities within Florida charge a local income tax. All of which means less work for you. However, this doesn’t mean you’re in the clear, because you still have to pay State Unemployment Insurance, AKA Reemployment Tax.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

What is Medicare tax?

Medicare tax is a federal payroll tax that employers and employees in the United States pay. Your employer is supposed to withhold Medicare tax at the rate the federal government sets. Currently, you pay 1.45 percent of all your taxable wages for Medicare tax. Your taxable wages is your pay after your employer subtracts nontaxable deductions, ...

How much is Social Security tax?

Currently, you pay 6.2 percent of your taxable wages for Social Security tax, up to $128,400 for the year.

What is taxable wages?

Your taxable wages is your pay after your employer subtracts nontaxable deductions, such as a Section 125 medical or dental plan. If you do not have nontaxable deductions, all of your wages are subject to Medicare tax. Social Security tax is a federal payroll tax that employers and employees pay. The federal government sets ...

What is federal income tax?

Federal income tax is a tax that the federal government levies on personal income. Your federal income tax withholding is based on the IRS withholding tax tables (Circular E) and your W-4 form data. Your employer obtains your filing status and allowances from your W-4 and uses the withholding tax table that matches your W-4 information, ...

Does Florida require employees to pay state taxes?

Florida is one of the few states that does not require employees to pay state income tax. While some city and local governments in other states mandate employees to pay city and local income tax, Florida does not require its employees to pay those taxes either. As a Florida employee, you are required to pay federal taxes, ...

Does Florida require a W-2?

Unlike employees in states that charge state income tax, your Florida employer does not have to file your W-2 with the state since you paid no state income tax.

What is the reemployment rate in Florida?

You’re required to pay a reemployment rate of 2.7% if you’re a new employer. That rate applies to $7,000 on an annual basis for every employee. Earnings above the $7,000 are not taxable under Florida payroll taxes. If you’re a new owner taking over a business, you can use the tax rate from the previous owner but you’re also liable then ...

Why is Florida a good place to retire?

Florida is a popular destination for retirees not only because of the great weather but also because of the absence of state income tax. Just because Florida doesn’t have state income tax doesn’t mean that you don’t have to worry about other types of taxes.

What is the payroll tax rate for 2021?

Payroll taxes include Medicare tax, with a tax rate of 1.45% on all earnings and Social Security tax, with a rate of 6.2% on the first $142,800. as of 2021. You’re also responsible for paying state and federal unemployment taxes. You’re required to pay a reemployment rate of 2.7% if you’re a new employer.

How long does it take to appeal a 5.4% tax rate?

If you are assigned a high tax rate, you can appeal it if you file the appropriate paperwork, within 20 days.

Is Florida a PTO state?

While it’s similar to the process for other states, you may find the process in Florida easier and more streamlined. For example, the laws about overtime and leave are not as restrictive as what you would find in other states. You can take advantage of the Paid Time Off (PTO) laws that require that employees use their time off within the year they accrued it. It’s the use-it-or-lose-it policy, which is beneficial to you as an employer for a variety of reasons.

How to calculate Florida state income tax?

Calculating your Florida state income tax is similar to the steps we listed on our Federal paycheck calculator: 1 figure out your filing status 2 work out your adjusted gross income [ Total annual income – Adjustments = Adjusted gross income] 3 calculate your taxable income [ Adjusted gross income – (Post-tax deductions + Exemptions) = Taxable income] 4 understand your tax liability [ Taxable income × Tax rate = Tax liability] 5 determine whether your tax liability is more than your tax credits and withheld#N#Tax liability – (Credits + Withheld) = What you owe or#N#(Credits + Withheld) – Tax liability = Tax refunds

When will Florida start fiscal year 2021?

Hooray! Florida fiscal year starts from July 01 the year before to June 30 the current year. So the fiscal year 2021 will start from July 01 2020 to June 30 2021.

Is Florida a state without income tax?

The median household income is $52,594 (2017). Flordia is one of the eight states without income tax.

How to deduct Medicare Advantage premium from Social Security?

To have your Medicare Advantage monthly premium deducted from your Social Security benefit, you have to contact the Social Security Administration. Otherwise, you will have to pay the premium directly to your insurance company.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of insurance provided by private insurance companies that contract with Medicare. Private insurance companies manage the plans but have to work within guidelines provided by the federal government. They are only available to people who are eligible for Original Medicare.

What is the Medicare premium for 2022?

The amount varies depending on the income that you reported to the IRS on your most recent tax return. In 2022, the highest your monthly premium will be is $578.30. Fewer than 5% of Medicare beneficiaries owe IRMAA.

How is Part A paid?

Part A is paid for through income taxes that you pay for while you work. This is why the amount of years that you paid this tax is used to determine how much you pay in premiums.

How to find out if Social Security is taking out?

If you want to find out for sure whether this applies to you, your best bet is to contact the Social Security Administration (SSA). They will look up your current status to determine whether payments will be taken out automatically.

Is Medicare Part B premium free?

There is no premium-free version of Medicare Part B. If you are enrolled in Part B and receive Social Security benefits, then your Medicare Part B premiums are deducted automatically. If you are enrolled in Part B but do not receive Social Security benefits, you have to pay your monthly premium online or by check.

Does Medicare automatically deduct Social Security?

If you receive Social Security retirement benefits, your Medicare benefits will be deducted automatically. This means that you do not have to do anything to make this happen – it will be automatic when you enroll in Medicare.