How do you calculate Medicare withholding?

- The rates are for Australian residents.

- Your marginal tax rate does not include the Medicare levy, which is calculated separately.

- The Medicare levy is calculated as 2% of taxable income for most taxpayers. ...

What is the current tax rate for Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

What percentage of your paycheck is Medicare?

What Percentage of Federal Taxes and Medicare Are Deducted out of Gross Pay?

- Social Security and Medicare Tax 2019. Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income ...

- W-4s and Federal Tax Withholdings. ...

- Social Security Withholdings. ...

- Evaluating Medicare Withholdings and the Deduction Amount of Net Pay. ...

- Gaining More Information. ...

How to calculate additional Medicare tax properly?

- Normal medicare tax rate for individual is 1.45 % of gross wages or salary

- Normal medicare tax rate for self employed person is 2.9 % of Gross income.

- If wage or self employment income is more than the threshold amount , only then you are liable for additional medicare tax .

What percentage of Medicare tax is withheld from my paycheck?

1.45%The current Medicare tax rate is 1.45% of your wages and is withheld from your paycheck. Your employer matches your contribution by paying another 1.45%. If you are self-employed, you have to pay the full 2.9% of your net income as the Medicare portion of your FICA taxes.

How do I calculate my Medicare tax withheld?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

How much Social Security and Medicare is withheld?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Is Medicare tax withheld on all wages?

No. An employer does not combine wages it pays to two employees to determine whether to withhold Additional Medicare Tax. An employer is required to withhold Additional Medicare Tax only when it pays wages in excess of $200,000 in a calendar year to an employee.

How do I calculate Medicare withholding 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

What federal Medicare withheld?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000. Federal income tax.

What percentage of federal tax is withheld?

For the 2021 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income (such as your wages) will determine what bracket you're in.

What is the Medicare tax limit for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

Do I get Medicare tax back?

No, you can not get the Social Security and Medicare taxes refunded.

Can I opt out of paying Medicare tax?

To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.

Why is Medicare tax withheld?

Also called the hospital insurance tax, the Medicare tax helps fund the Medicare program. It's typically withheld from your taxes, according to the Internal Revenue Service.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you must pay the Medicare tax regardless of your or your employer’s citizenship or residency s...

Are tips subject to Additional Medicare Tax?

If tips combined with other wages exceed the $200,000 threshold, they are subject to the additional Medicare tax.

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What Determines How Much My Employer Sets Aside For Fica And Other Tax Withholding

The amount your employer sets aside for FICA is based on percentages set by the federal government. As for federal, state and local income taxes, the amount your employer withholds will usually depend upon the information you provided when filling out your W-4 Form or a similar state or local form.

Get More With These Free Tax Calculators And Money

See if you qualify for a third stimulus check and how much you can expect

Does Everyone On Medicare Have To Pay This Tax

While everyone pays some taxes toward Medicare, youll only pay the additional tax if youre at or above the income limits. If you earn less than those limits, you wont be required to pay any additional tax. If your income is right around the limit, you might be able to avoid the tax by using allowed pre-tax deductions, such as:

The Tax On Combined Types Of Income

An adjustment can be made on Form 8959 beginning at line 10, if you’re calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they’re combined and exceed the threshold amount.

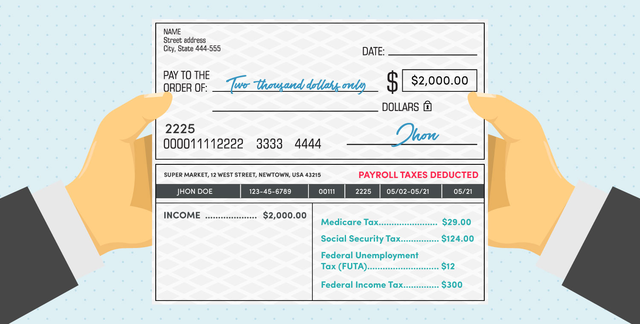

An Example Of An Employee Pay Stub

In the case of the employee above, the weekly pay stub would look like this:

Social Security And Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Why Do I Have To Pay Fica Tax

Employers have to withhold taxes from employee paychecks because taxes are a pay-as-you-go arrangement in the United States. When you earn money, the IRS wants its cut as soon as possible.

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

What form do you need to request an additional amount of income tax withholding?

Some taxpayers may need to request that their employer withhold an additional amount of income tax withholding on Form W-4, Employee’s Withholding Certificate, or make estimated tax payments to account for their Additional Medicare Tax liability.

What is the responsibility of an employer for Medicare?

Employer Responsibilities. An employer is responsible for withholding the Additional Medicare Tax from wages or railroad retirement (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year, without regard to filing status. An employer must begin withholding Additional Medicare Tax in the pay period in which ...

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

Is railroad retirement subject to Medicare?

All Medicare wages, railroad retirement (RRTA) compensation, and self-employment income subject to Medicare Tax are subject to Additional Medicare Tax, if paid in excess of the applicable threshold for the taxpayer's filing status. For more information on ...

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

What is the Medicare tax rate?

Medicare tax is withheld at the rate of 1.45% of gross wages after subtracting for any pre-tax deductions that are exempt, just as with Social Security. Medicare is assessed at this flat rate and there's no wage base, so the amount withheld is usually equal to the amount for which an employee is liable.

What is the tax rate for Social Security?

The Social Security tax is withheld at a flat rate of 6.2% on gross wages after subtracting any pre-tax deductions that are exempt from Social Security taxation. Not all gross wages are subject to this tax.

What is withholding allowance?

Withholding allowances used to correspond with the number of personal exemptions that taxpayers were entitled to claim on their tax returns for themselves, their spouses, and their dependents, but the Tax Cuts and Jobs Act (TCJA) eliminated personal exemptions from the tax code in 2018. The IRS rolled out a revised Form W-4 for ...

How much Medicare surtax is required for 2020?

Earnings subject to this tax as of 2020 depend on your filing status. You must pay the surtax on earnings over: $125,000 for married taxpayers who file separate returns.

What is federal tax withholding 2021?

Updated April 09, 2021. Employers are required to subtract taxes from an employee's pay and remit them to the U.S. government in a process referred to as "federal income tax withholding.". Employees can then claim credit on their tax returns for the amounts that were withheld. Employers are required to withhold federal income ...

What is the maximum amount of Social Security withheld in 2021?

An annual wage base limit caps earnings that are subject to withholding for Social Security at $142,800 in 2021, up from $137,700 in 2020. 4 Income over this amount isn't subject to Social Security withholding. 5 .

Can you claim a credit on your taxes?

Employees can then claim credit on their tax returns for the amounts that were withheld. Employers are required to withhold federal income tax, Social Security tax, and Medicare tax from employees' earnings.

What is Medicare tax?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000. Federal income tax.

What is withholding tax?

A withholding tax is an income tax that a payer (typically an employer) remits on a payee's behalf (typically an employee). The payer deducts, or withholds, the tax from the payee's income. Here's a breakdown of the taxes that might come out of your paycheck. Social Security tax: 6.2%.

What is federal income tax?

Federal income tax. This is income tax your employer withholds from your pay and sends to the IRS on your behalf. The amount largely depends on what you put on your W-4. State tax: This is state income tax withheld from your pay and sent to the state by your employer on your behalf.

Why do employers have to withhold taxes from paychecks?

Employers have to withhold taxes from employee paychecks because taxes are a pay-as-you-go arrangement in the United States. When you earn money, the IRS wants its cut as soon as possible. Some people are “exempt workers,” which means they elect not to have federal income tax withheld from their paychecks.

What is payroll tax?

Payroll taxes, including FICA tax or withholding tax, are what your employer deducts from your pay and sends to the IRS, state or other tax authority on your behalf. Here are the key factors, and why your tax withholding is important to monitor.

How much is OASDI tax?

Frequently labeled as OASDI (it stands for old-age, survivors and disability insurance), this tax typically is withheld on the first $137,700 of your wages in 2020 ($142,800 in 2021). Paying this tax is how you earn credits for Social Security benefits later. Medicare tax: 1.45%.

How much Social Security tax is paid on net earnings?

That’s because the IRS imposes a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Typically, employees and their employers split that bill, which is why employees have 6.2% and 1.45%, respectively, held from their paychecks. Self-employed people, however, pay the whole thing.

What is the Medicare withholding rate?

The Medicare withholding rate is gross pay times 1.45 % , with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9%. For a total of 7.65% withheld, based on the employee's gross pay. 2 .

How much Medicare tax is required to be deducted?

The 0.9% additional Medicare tax must be deducted when the employee's wages reach $200,000 each year, and the additional amount is calculated on only the amount over $200,000.

What is Medicare additional tax?

The Additional Medicare Tax. The pay amount at which additional Medicare taxes must be withheld from higher-paid employees. The pay amount is different depending on the individual's tax status (married, single, etc.) At the specified level for the year, an additional 0.9% must be withheld from the employee's pay for the remainder of the year.

How to calculate FICA taxes?

First, multiply 40 hours x $12.50 = $500. Then multiply 4 overtime hours x $18.75 (1 1/2 times the hourly rate) = $75.00. Add $500 + $75 for a total of $575 in gross wages for the week. Determine the amount of employee wages/salaries that are subject to FICA taxes.

What to do if you deduct too much tax?

If you deducted too much tax from an employee's pay, either for Social Security or for Medicare tax, you may have several things to fix: Refund the employee. You will need to pay the employee back for the excess deduction amount. You can give this amount back to the employee in a paycheck or as a separate check.

How to calculate gross pay for hourly?

The gross pay for an hourly employee is the total calculated pay, multiplying hours times hourly rate and including hours for overtime and the overtime rate . First, multiply 40 hours x $12.50 = $500. Add $500 + $75 for a total of $575 in gross wages for the week.

Does FICA tax come from paycheck?

Updated November 07, 2019. Every person working in the U.S. as an employee must have FICA taxes withheld from every paycheck by law. FICA taxes include taxes for both Social Security and Medicare. The FICA tax is shared by employees and employers, so one half of the tax is deducted from employee paychecks each payday.