Seven hundred and sixteen billion dollars, funneled out of Medicare by President Obama. We're probably going to be talking about the Affordable Care Act a lot between now and November. So it's worth taking a look at what actually pays for the health-care law and what that means for the future of Medicare and other programs.

How much did the Affordable Care Act cost Medicare?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

Did Obamacare really cut Medicare spending by $716 billion?

Aug 06, 2015 · On the flip side, the Affordable Care Act also funds illness prevention benefits, expands preventive care benefits, and provides $48 billion for …

How is Obamacare paid for?

Aug 14, 2012 · Instead, President Obama took Medicare dollars from today's seniors to fund Obamacare. A report issued by the Congressional Budget Office (CBO) finds that the amount of money President Obama has taken from Medicare to fund Obamacare totals $716 Billion: Senger, Alyene, Heritage.org, "Obamacare Robs Medicare of $716 Billion to Fund Itself".

What is the difference between the ACA and Medicare?

Dec 06, 2021 · The Affordable Care Act (ACA, also commonly called Obamacare) and Medicare are two very different concepts.. The ACA is a sweeping series of laws that regulate the US health insurance industry. Medicare is a federal health insurance program for people 65 and older, as well as certain younger people with disabilities or medical conditions.

Is Obamacare funded by Medicare?

Funding. While Medicare does receive some revenue by charging premiums, the bulk of the program's funding comes from payroll taxes. Obamacare works in a very different way: ACA Marketplace plans receive some federal funding, but the bulk of their revenue comes from premiums charged to plan members.Jan 20, 2022

How did the Affordable Care Act Impact Medicare?

The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.Oct 29, 2020

Where did the funding for Obamacare come from?

To help offset the cost of the law, the ACA contains a revenue-raising provision that would place an excise tax on high-cost insurance plans, beginning in 2018. Most Americans receive health insurance through their employer and the cost of employer-sponsored health insurance is currently excluded from taxation.

How much does the Affordable Care Act cost taxpayers?

The Affordable Care Act has failed Also prior to this year, ACA subsidies cost taxpayers about $50 billion a year. And yet they led to only about 2 million people gaining exchange-plan coverage. That's a small number in a nation of 330 million.Aug 20, 2021

Is Medicare more expensive than Obamacare?

The average Medicare Supplement Insurance plan premium in 2019 was $125.93 per month. The average Obamacare benchmark premium in 2021 is $452 per month.Dec 6, 2021

Why is Obamacare not good?

The ACA has been highly controversial, despite the positive outcomes. Conservatives objected to the tax increases and higher insurance premiums needed to pay for Obamacare. Some people in the healthcare industry are critical of the additional workload and costs placed on medical providers.

Do taxpayers pay for ACA?

The CBO originally estimated that Obamacare would cost $940 billion over ten years. That cost has now been increased to $1.683 trillion. Below is a list of some of the new taxes needed to pay for it. Medicare investment tax: A 3.8% tax on investment incomes for single taxpayers over $200,000 or couples over $250,000.

Has the Affordable Care Act saved money?

More than 20 million people have gained coverage as a result of the ACA. It has dramatically reduced the uninsured rate. On the day President Obama signed the ACA, 16 percent of Americans were uninsured; in March 2020, it was nine percent.May 6, 2021

Was the Affordable Care Act successful?

The ACA is the most consequential and comprehensive health care reform enacted since Medicare. The ACA has gained a net increase in the number of individuals with insurance, primarily through Medicaid expansion. The reduction in costs is an arguable achievement, while quality of care has seemingly not improved.

Who paid for ObamaCare?

the federal governmentUnder the ACA, the federal government pays 100 percent of the coverage costs for those newly insured under Medicaid expansion. After 2016, the federal share shrinks to 90 percent, which is still considerably more than the pre-ACA level.

What are the cons of the Affordable Care Act?

Cons:The cost has not decreased for everyone. Those who do not qualify for subsidies may find marketplace health insurance plans unaffordable. ... Loss of company-sponsored health plans. ... Tax penalties. ... Shrinking networks. ... Shopping for coverage can be complicated.Sep 29, 2021

What did ObamaCare do to the economy?

Based solely on recent economic growth, the ACA has subtracted $250 billion from GDP. At that pace, the cumulative loss by the end of the decade will exceed $1.2 trillion. Lost growth in work hours per person has removed the equivalent of 800,000 full-time jobs from the economy.

How much money did Obama take from Medicare?

A report issued by the Congressional Budget Office (CBO) finds that the amount of money President Obama has taken from Medicare to fund Obamacare totals $716 Billion: Obama's Cuts to Medicare: Total Amount Cut by Service: Hospital Services.

How many IRS agents are there in 2019?

This is an increase from 2019, when the number was 60 percent. And now President Biden and the Democrats want to sic 87,000 new IRS agents on the American people, with a 50 percent increase in small business audits.

What is Biden's plan for taxes?

Included in this plan is a proposal to slug small businesses with higher taxes by eliminating step-up in basis and creating a second death tax.

Who introduced the Don't Weaponize the IRS Act?

Senator Braun, along with Senate Minority Leader Mitch McConnell (R-Ky.), has introduced the “ Don’t Weaponize the IRS Act .” This legislation, which has the support of 48 Senate Republicans, codifies important protections for non-profit organizations irrespective of their political affiliation so that the IRS has one less tool to harass Americans that are exercising their first amendment rights.

What is the IRS Customer Service Improvement Act?

In order to ensure IRS employees do their job and help taxpayers during filing season , Senator Braun introduced the “IRS Customer Service Improvement Act.” Specifically, this bill would prohibit agency employees from engaging in taxpayer-funded union time during tax filing season, ensuring that agency employees are doing what they are paid to do.

How much tax cut did Nevada get?

Every income group in every Nevada congressional district received a tax cut. Nationwide, a typical family of four received a $2,000 annual tax cut and a single parent with one child received a $1,300 annual tax cut.

What is Senator Braun's bill?

Senator Braun has also introduced the “Protect Taxpayer Privacy Act,” legislation that will hold IRS employees accountable by increasing the penalty for releasing private taxpayer information and making it easier for the IRS to terminate employees found responsible.

What is the ACA?

The ACA is a sweeping series of laws that regulate the US health insurance industry. Medicare is a federal health insurance program for people 65 and older, as well as certain younger people with disabilities or medical conditions. There are several different types of Medicare coverage.

How many people will be covered by Medicare in 2021?

Medicare provides health insurance to nearly 63 million Americans in 2021. 1. Medicare is available to people who are at least 65 years old or younger Americans who have a qualifying disability, such as ALS (Lou Gehrig’s Disease) or End-Stage Renal Disease (ESRD).

Is Obamacare the same as Medicare?

Are Obamacare and Medicare the Same Thing? Medicare and Obamacare are very different things. Compare Medicare and the Affordable Care Act (ACA) to learn the differences. The Affordable Care Act ( ACA, also commonly called Obamacare) and Medicare are two very different concepts. The ACA is a sweeping series of laws that regulate ...

What is the difference between Medicare and Medicaid?

Medicare, which is a federally-funded health insurance program for adults over age 65 and some younger people with certain disabilities and medical conditions. Medicaid, which is a government health insurance program for people who have limited financial resources.

How much is Medicare Part A 2021?

Medicare#N#Most people receive premium-free Medicare Part A. The standard premium for Part B is $148.50 per month in 2021.#N#There are other 2021 costs you may face with Medicare Part A and Part B, such as deductibles, coinsurance and copayments.

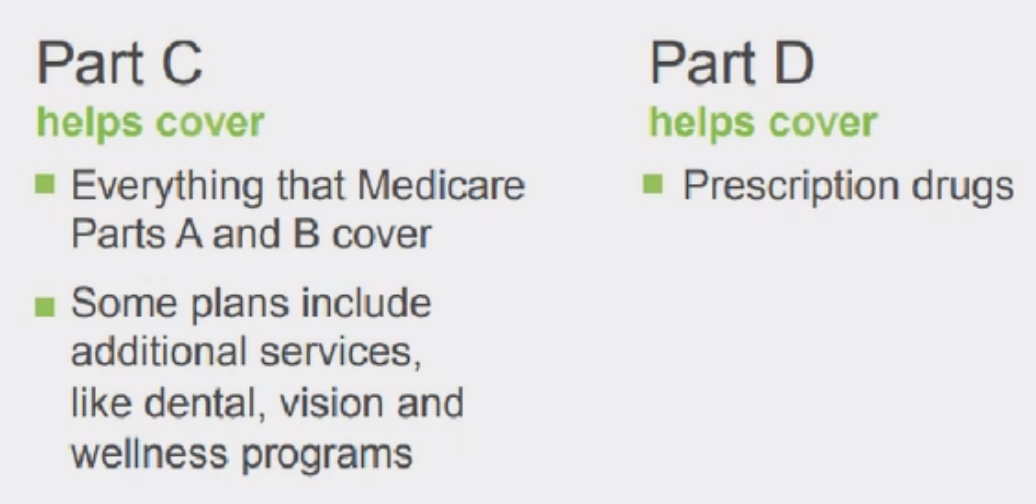

Does Medicare Advantage cover vision?

Many Medicare Advantage plans offer additional benefits that may include routine dental and vision care, as well as prescription drug coverage, all of which are not covered by Original Medicare. Medicare Part D. Medicare Part D plans provide coverage for certain prescription drugs.

Does Medicare cover cosmetic procedures?

Medicare does not typically cover services such as cosmetic procedures, alternative therapies and long-term custodial care. Obamacare plans. Plans purchased through the ACA exchange will provide different benefits according to their coverage level.