For 2019, $771 happens to be the monthly maximum federal benefit — called the federal benefit limit — for an individual receiving SSI. In this example, your benefit is reduced to $0. So, for 2019, you can earn up to $1,627 in earned income and get at least some SSI benefits.

Full Answer

Who pays for Medicare Advantage plans?

Medicare Advantage plans expect a booming 2023, thanks in part to high projected revenue growth. But some Medicare watchers say the Centers for Medicare and Medicaid Services missed an opportunity to even out payments to the plans, which they say are ...

Why are Medicare Advantage plans bad?

You need to be enrolled in both Medicare Part A and Part B to qualify for a Medicare Advantage plan. You must also live within the plan’s service area. With any kind of Medicare Advantage plan, in most cases you must continue paying your Medicare Part B premium. However, the Medicaid program might pay your premium.

Do I qualify for Medicare Advantage?

Medicare Advantage, a health plan provided by private insurance companies, is paid for by federal funding, subscriber premiums and co-payments. It includes the same coverage as the federal government’s Original Medicare program as well as additional supplemental benefits. What is Medicare Advantage?

Are Medicare Advantage plans federally funded?

How profitable is Medicare Advantage?

Medicare Advantage is the common thread. Big-name health insurers raked in $8.2 billion in profit for the fourth quarter of 2019 and $35.7 billion over the course of the year.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is Medicare Advantage profitable for insurance companies?

While some of that money would provide patients with extra health benefits, Kronick estimates that as much as two-thirds of it could be going toward profits for insurance companies.

Where does the money come from for Medicare Advantage plans?

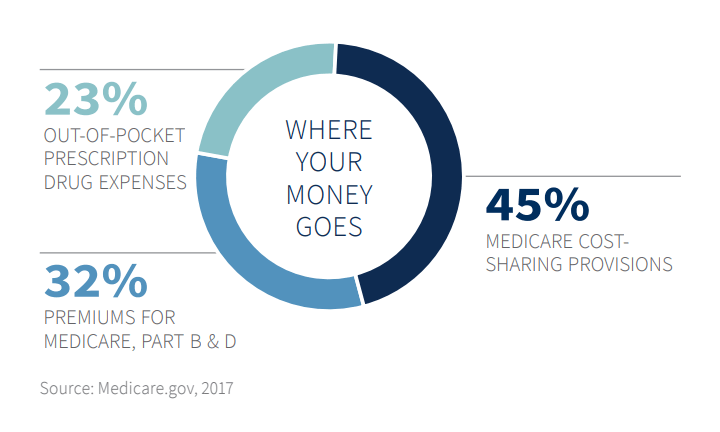

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the HI and the SMI trust funds.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

What percentage of Medicare is Medicare Advantage?

In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion (or 46%) of total federal Medicare spending (net of premiums).

What is the most profitable insurance company?

Top 10 Most Profitable Insurance Companies in 2020Berkshire Hathaway. $81.4B.MetLife. $5.9B.State Farm. $5.6B.Allstate. $4.8B.Prudential. $4.2B.USAA. $4B.Progressive. $4B.MassMutual. $3.7B.More items...•

How much do insurance companies make in profit?

Insurers and Profit Margins Many insurance firms operate on margins as low as 2% to 3%. Smaller profit margins mean even the smallest changes in an insurance company's cost structure or pricing can mean drastic changes in the company's ability to generate profit and remain solvent.

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Does Medicare take money from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Does Medicare Advantage come out of Social Security?

Medicare Part B premiums must be deducted from Social Security benefits if the monthly benefit covers the deduction. If the monthly benefit does not cover the full deduction, the beneficiary is billed. Beneficiaries may elect deduction of Medicare Part C (Medicare Advantage) from their Social Security benefit.

Is Silver Sneakers A Government Program

SilverSneakers is considered a basic fitness service and Original Medicare, Part A and Part B, does not cover this benefit. However, Medicare Advantage plans, also known as Medicare Part C, may provide this benefit. To find a Medicare Advantage plan with SilverSneakers in your area, enter your zip code on this page.

How Do I Know If Im Enrolled In Extra Help

Youll receive notice of your Extra Help status from the SSA. Notices are different colors depending on your status:

Commission For Selling Medicare Advantage Plans

DD: A lot of agents are looking at this like weve talked about it from a final expense standpoint.

What To Expect On Your First Presentation

DD: Lets imagine we have an agent selling Medicare insurance. Theyve done AHIP and certification for the carriers as well as a lead program set up. Theyre running their very first presentation.

Agents Need Someone In Their Corner

The only time Im not going to answer is when Im with a customer. Other than that, Im usually going to pick up the phone or Im going to reply to a text and Im like you, Im a workaholic. I work all the time.

How Much Does Medicare Part A Cost

Medicare Part A, or hospital insurance, covers a variety of services, such as:

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

How to maximize compensation?

Maintaining strong client relationships is the key to maximizing your compensation. People are much more willing to buy from someone they know and trust. Follow up with your clients and use a CRM to document every interaction in order to make sales tracking more efficient. You can sell additional items in your follow-up appointments depending on the time of year and what type of plan your client has. One caveat is that CMS won’t let you sell a product your client hasn’t already agreed to talk about.

What is senior market advisor?

At Senior Market Advisors, we give our agents the tools they need to succeed. When you partner with us, you have the opportunity to sell plans from all of the major carriers and maximize your potential to make money. You’ll also gain free access to our proprietary CRM and have an experienced sales and marketing team to help your business grow. Ready to start? Call 1-844-452-5020 or eContract with us today.

Can you make a lot of money on Medicare Advantage 2020?

The Centers for Medicare and Medicaid (CMS) raised the maximum Medicare agent commissions for Medicare Part D and Medicare Advantage plans for the fifth year in a row. That means you can make a lot of money on Medicare commissions during AEP 2020. While carriers are not required to pay the maximum, they usually don’t pay much less, because they want you to sell their products.

Can you sell Medigap plans?

Commissions for selling Medigap plans vary from carrier to carrier. It may sound confusing, but it works in your favor to partner with a great FMO that can connect you to many different carriers. You want to provide your clients with the plans that can offer the most benefit, and provide yourself with opportunities to earn more.

Do you get commission on Medicare Advantage?

Your Medicare Advantage clients may have to wait for the AEP to make changes to their existing plans or enroll in new policies, but you still get the commission if clients make changes during your meetings. That makes strong client relationships and following up even more important. A year is enough time to forget about someone, and you want your clients to remember you and the excellent customer service you provide.

How much do Medicare Advantage plans get paid?

The Medicare Advantage plans/providers get paid (depending on region) $750 to $1,500 per month per beneficiary . If they pay less in claims than they take in from the Government, they make a profit. The MA companies make a LOT of profit on most beneficiaries and lose HUGE amounts on a small percentage of beneficiaries.

How does Medicare Advantage make money?

Medicare Advantage Plans make money in the same ways that other health insurance plans make money. They collect premiums, hold expenses down, invest, and pay claims. Insurance businesses work in similar overall fashion to individuals. You collect a paycheck, hold expenses down, save or invest, and pay your bills.

What is the difference between Medicare Advantage and Supplement?

In the simplest terms: Medicare Advantage changes the way your Medicare payments work, while Medicare Supplement gives extra coverage beyond Medicare.

How much is Medicare Part A deductible?

Medicare Part A deductible is $1420/year and -0- after, Advantage plan is $250/day in hosp for 1st 5 or 7 days for each hospital stay). Under Part B, an Advantage plan has a copay for each visit to a Doctor or service, and you can’t buy a supplemental for a Medicare advantage plan.

What is MSA in Medicare?

MSA: Medicare Advantage Medical Savings Account is a High Deductible health insurance plan that deposit funds into an account used for paying your healthcare cost. SNP: Medicare Advantage Special needs Plans are specific to the needs of individuals with specific debilitating, usually chronic, conditions.

What is Medicare for 65?

Medicare is a federally administered health insurance program for people aged 65 and older.

How many standardized Medicare plans are there?

Medicare Advantage plans can be very flexible in costs and coverage. Medicare Supplement comes in 10 standardized plans.

What is the difference between Medicare Supplement and Advantage?

As long as you’ve done that you’ve done your CYA. The other difference between a Supplement and an Advantage plan is you have a prescription portion. So you’ve got to sell a prescription drug plan with a Medicare Supplement.

What is the certification test for Medicare Advantage?

Selling Medicare Advantage plans, you get a contract with a carrier, but once you’re contracted with that carrier every year that you are in Medicare Advantage sales, you’re going to have to take a certification test called AHIP. A lot of people freak out, “Oh, it’s so hard.”. Well, it’s Medicare 101. You need to know the product that you’re ...

What is the biggest objection to Medicare Advantage?

DD: If I may say from a sales perspective, the biggest objection of doing Medicare Advantage and perhaps the biggest concern is compliance as it relates to talking and selling to the prospect and all of the activity involved.

What is the age limit for Medicare?

LM: When somebody has Medicare they’re normally 65 and over. You do have a segment of the population under 65 that get Medicare who are usually disabled. Once someone is on Medicare they have two options – Medicare Advantage or Medicare Supplement. There’s not a good or a bad option, there is simply two options.

Does Medicare Advantage include prescriptions?

For Medicare Advantage a prescription plan is included. The copays per carrier are probably different, but they function the same way. All you’ve got to do is pull up the formulary, which is usually in a PDF and just do the search for the medications and make sure they’re in there.

Can you make a ton upfront selling Medicare Advantage?

Selling Medicare Advantage insurance, you don’t make a ton upfront.

Can you sell Medicare Advantage plans?

The unique thing about selling Medicare Advantage plans is that you don’t get to sell a product unless you’ve passed tests and meet knowledge requirements. LM: Correct. Further, you may have face-to-face training requirements before selling. You’ll be in a room of other new agents.

What is Medicare Part B premium?

Here’s the basics: Original Medicare is made up of two parts: Medicare Part A, or preventative care coverage, and Medicare Part B, or hospital coverage. ...

How much does Medicare cost in 2020?

Under traditional Medicare, most people do not pay a Part A premium. However, there is no way to avoid a Part B premium, which starts at $144.60 per month as of 2020. Generally, this amount increases annually with inflation. This premium is based on income; anyone with an individual yearly Modified Adjusted Gross Income up to $87,000 or a joint income of up to $174,000 will pay the base rate. Pricing for Plan B premiums scales up from there based on income, topping out at $491.60 per month for single taxpayers making over $500,000 and joint taxpayers making over $750,000.

Does Medicare Advantage have a standard premium?

However, many Medicare Advantage plans will come with an individual premium, in addition to standard Part B premiums. This amount must be paid to the insurance provider on top of any Plan B premiums owed. Medicare Advantage premiums will vary from one plan to another, as well as from one insurance provider to another. There is no standard pricing for Part C premiums.

Is Medicare Advantage the same as Original Medicare?

Medicare Advantage premiums are primarily based on the services offered within a plan, not a policyholder’s income. Not all Medicare Advantage plans have premiums; these plans are usually the same price as Original Medicare. Pricing can be even less than Original Medicare if a Medicare Advantage plan pays part of the standard Plan B premium amount but does not require its own premium.

Does Medicare have a higher premium?

However, plans with more expansive coverage, such as those that cover hearing, vision, dental or prescription drugs, will likely have a higher premium. Overall, how much seniors pay in Medicare premiums has two components: the income-based Plan B premium and any additional premium a Medicare Advantage provider charges.

Is Medicare Advantage based on income?

Unlike Original Medicare Plan B, Medicare Advantage premiums are not based on income but rather the options offered within a particular plan. Plans that limit coverage to standard Plan A and Plan B offerings may have little to no additional premium.

Do Medicare Advantage plans pay Part B?

Even Medicare Advantage users must pay Part B premiums, based on their annual income. However, some Medicare Advantage plans may pay a portion of this amount on the user’s behalf, which reduces the total amount of Part B premiums owed. Eldercare Financial Assistance Locator. Discover all of your options.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What age does QDWI pay Medicare?

The QDWI program helps pay the Medicare Part A premium for certain individuals under age 65 who don’t qualify for premium-free Part A.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What does it mean when you assign commissions to the FMO?

When you assign your commissions to the FMO, this means the carrier will pay the FMO, who will then pay you . Agents signing an Assignment of Commissions contract must be careful, because depending on their contract, their upline could keep their renewals should they choose to leave.

How does Medicare Advantage work?

Agents selling Medicare Advantage and Part D plans get a flat dollar amount of money per application. This comes to them in the form of initial commissions and renewal commissions. Carriers pay out initial commissions when an agent makes a new sale or when the beneficiary enrolls in a new, “unlike” plan (different type). Each year and beyond, carriers pay out renewal commissions to the agent if the beneficiary remains enrolled in the plan or enrolls in a new, “like” plan (same type).

Is Medicare Advantage sales good for 2022?

The 2022 plan year will be a fantastic year for Medicare Advantage sales, which is good news for agents looking to earn more commission! Let’s get right to the facts and figures.

Is selling Medicare a lucrative business?

Selling Medicare can be very lucrative, if done right. Hopefully now you have a better idea of how much Medicare agents can make and know that working with an FMO should never hurt your commissions, only help them grow!

Do insurance carriers have to pay Medicare Advantage commissions?

The Centers for Medicare & Medicaid Services (CMS) set the maximum broker commissions for Medicare Advantage and Medicare Part D annually; however, insurance carriers aren’t required to pay these amounts. What you earn for Medicare Advantage and PDP sales could be less, depending on the carrier and your contract with them.

Do carriers pay agents?

It’s important for agents to know that carriers pay agents and FMOs separately. Your relationship with an FMO is comparable to your clients’ relationship with you.