How much did the Affordable Care Act cost Medicare?

Seven hundred and sixteen billion dollars, funneled out of Medicare by President Obama. We're probably going to be talking about the Affordable Care Act a lot between now and November. So it's worth taking a look at what actually pays for the health-care law and what that means for the future of Medicare and other programs.

How much has Obama taken from Medicare to fund Obamacare?

A report issued by the Congressional Budget Office (CBO) finds that the amount of money President Obama has taken from Medicare to fund Obamacare totals $716 Billion: Senger, Alyene, Heritage.org, "Obamacare Robs Medicare of $716 Billion to Fund Itself".

How much money is generated by investing in Medicare?

Another $318 billion is generated by having those who earn a gross income over $200,000 pay 3.8 percent of investment income toward Medicare's hospital insurance. Here's how it all breaks down:

How will the Affordable Care Act affect Medicare beneficiaries?

The Affordable Care Act aims to cut future Medicare costs by reducing payments to private insurers and hospitals, not beneficiaries, though this could indirectly squeeze beneficiaries. The claim is partially accurate but leaves out important context.

How did Affordable Care Act affect Medicare?

Medicare Premiums and Prescription Drug Costs The ACA closed the Medicare Part D coverage gap, or “doughnut hole,” helping to reduce prescription drug spending. It also increased Part B and D premiums for higher-income beneficiaries. The Bipartisan Budget Act (BBA) of 2018 modified both of these policies.

What did ACA cost taxpayers?

The Affordable Care Act has failed Also prior to this year, ACA subsidies cost taxpayers about $50 billion a year. And yet they led to only about 2 million people gaining exchange-plan coverage. That's a small number in a nation of 330 million.

How much did it cost to implement ACA?

In 2012, the Congressional Budget Office (CBO) updated that amount to $1.8 trillion for the period between 2012-2022, offset in part by $510 billion in receipts and cost savings. By 2018, when the law is fully implemented, total expenses are estimated to be closer to $2.5 trillion.

How was the ACA paid for?

To help offset the cost of the law, the ACA contains a revenue-raising provision that would place an excise tax on high-cost insurance plans, beginning in 2018. Most Americans receive health insurance through their employer and the cost of employer-sponsored health insurance is currently excluded from taxation.

Why the ACA does not work?

The Problem: Affordability The ACA set standards for “affordability,” but millions remain uninsured or underinsured due to high costs, even with subsidies potentially available. High deductibles and increases in consumer cost sharing have chipped away at the affordability of ACA-compliant plans.

Did the ACA reduce the number of the uninsured?

Today's report shows the important role the ACA has played in providing coverage to millions of Americans nationwide. The report also shows that between 2010 and 2016, the number of nonelderly uninsured adults decreased by 41 percent, falling from 48.2 million to 28.2 million.

Did the ACA increase taxes?

To raise additional revenue for reform, the ACA imposed excise taxes on health insurers, pharmaceutical companies, and manufacturers of medical devices; raised taxes on high-income families; and in-creased limits on the income tax deduction for medical expenses.

Why is ACA controversial?

The ACA has been highly controversial, despite the positive outcomes. Conservatives objected to the tax increases and higher insurance premiums needed to pay for Obamacare. Some people in the healthcare industry are critical of the additional workload and costs placed on medical providers.

Has the Affordable Care Act been successful?

The ACA was intended to expand options for health coverage, reform the insurance system, increase coverage for services (particularly preventive services), and provide a funding stream to improve quality of services. By any metric, it has been wildly successful. Has it improved coverage? Indisputably, yes.

What happens to the ACA subsidy when one person goes on Medicare?

Individual market plans no longer terminate automatically when you turn 65. You can keep your individual market plan, but premium subsidies will terminate when you become eligible for premium-free Medicare Part A (there is some flexibility here, and the date the subsidy terminates will depend on when you enroll).

Is Obamacare federally funded?

Subtle Differences. The majority of people buying Obamacare health insurance get help paying for it in the form of subsidies from the federal government,6 so it can be confusing as to how government-subsidized private health insurance (Obamacare) is really all that different from government-funded Medicaid.

Who wrote the Affordable Care Act?

senator Max Baucus ofDecember 24, 2009: In the Senate, 60 Democrats vote for the Senate's version of the bill, called America's Healthy Future Act, whose lead author is senator Max Baucus of California.

How much did the Affordable Care Act save?

The Affordable Care Act (ACA) enacted savings estimated at that time of $716 billion to the Medicare program over ten years ( now estimated at $800 billion), which was used to pay for some of the cost of the new law under pay-as-you-go budget scoring conventions.

How much was Medicare robbed to pay for Obamacare?

Was Medicare Robbed $700 Billion to Pay for Obamacare? When talking about his plans for Social Security and Medicare, Gov. Mike Huckabee (R-AR) stated that Congress should not be “talking about getting rid of Social Security and Medicare that was robbed $700 billion dollars to pay for Obamacare.”.

How long will Medicare be solvent?

Partially as a result these changes, the Medicare Trust Fund is expected to be solvent through 2030, 13 years longer than projected before the 2010 law was passed.

Did Medicare reduce payroll taxes?

However, there was no reduction in the amount of money going towards paying for Medicare; rather, the law reduced the amount that Medicare spends. In fact, Medicare payroll tax revenues increased, increasing the amount that could be spent.

How much money was robbed from Medicare to fund Obamacare?

Huckabee said, "$700 billion was robbed (from Medicare) to fund Obamacare.". It’s an old claim and an old figure. The law does reduce Medicare spending, but not in the way Huckabee suggests.

Why did private insurers run Medicare?

Under President George W. Bush, private insurers began to run a subset of Medicare plans with the idea that more competition produced lower costs. However, those plans grew to cost more than traditional Medicare, so the Affordable Care Act pared down the payments to private insurers.

Does Obamacare rob Medicare?

Obamacare doesn’t literally "rob" Medicare. But the Affordable Care Act does include provisions that reduce future increases in Medicare spending. In other words, the law slows down the rising costs of Medicare. It’s also important to note that the savings come at the expense of insurers and hospitals, not beneficiaries.

How much money did Obama take from Medicare?

A report issued by the Congressional Budget Office (CBO) finds that the amount of money President Obama has taken from Medicare to fund Obamacare totals $716 Billion: Obama's Cuts to Medicare: Total Amount Cut by Service: Hospital Services.

How much money has been removed from the Senate infrastructure proposal?

Media reports indicate that $40 billion in new funding for the IRS has been removed from the bipartisan Senate infrastructure proposal. The purpose of this new IRS funding is not to help taxpayers navigate the tax code or receive better customer service, but to raise $100 billion in new revenues.

How many IRS agents are there in 2019?

This is an increase from 2019, when the number was 60 percent. And now President Biden and the Democrats want to sic 87,000 new IRS agents on the American people, with a 50 percent increase in small business audits.

What was the average pharmaceutical worker salary in 2017?

The average annual wage of a pharmaceutical worker in 2017 was $126,587, which is more than double the average private sector wage of $60,000. President Biden has repeatedly promised to create millions of new high paying manufacturing jobs in America.

What is Biden's plan for taxes?

Included in this plan is a proposal to slug small businesses with higher taxes by eliminating step-up in basis and creating a second death tax.

How much tax cut did Nevada get?

Every income group in every Nevada congressional district received a tax cut. Nationwide, a typical family of four received a $2,000 annual tax cut and a single parent with one child received a $1,300 annual tax cut.

How many employees did pass throughs have in 2011?

The majority, or 64 percent, of pass-throughs in 2011 had fewer than five employees while nearly 99 percent had fewer than 500 employees, according to the Congressional Research Service . Of the 26 million businesses in 2014, 95 percent were pass-throughs.

How much is Medicaid spending?

In fiscal year (FY) 2018, total Medicaid spending was estimated at $616.1 billion, with spending on the newly eligible adults ( CMS 2020 ). [1]

What was the impact of Medicaid in 2014?

In 2014, high Medicaid spending growth rates nationally reflected the combined effects of increased enrollment as well as increased spending per enrollee. Along with new high-cost drugs and a required increase in primary care payments, expanded coverage for adults was a key driver of spending growth rates. However, spending growth rates were lower for 2015–2017 and are projected to be even lower for 2018 ( CMS 2020 ). This is due, in part, to the initial 2014 surge in enrollment continuing to diminish ( Keehan et al. 2016 ).

How much will the US government spend on adult expansion in 2027?

Over the next decade (2018 to 2027), spending on the adult expansion population is expected to grow from $74.2 billion in 2018 to $124.3 billion in 2027. Due to the higher federal matching rate, the vast majority (91 percent) of this spending will be paid for by the federal government ( CMS 2020 ).

Is Medicaid expansion good for the state budget?

Although the share of Medicaid spending borne by states has increased as states take on a larger share of the costs for the newly eligible, there is some evidence to indicate that Medicaid expansion has been beneficial for state budgets.

Does Medicaid have a higher matching rate for childless adults?

States that expanded Medicaid eligibility to 100 percent of the federal poverty level (FPL) for parents and adults without dependent children prior to the ACA can also receive a higher matching rate for childless adults. Specifically, the traditional matching rate was increased by a transition factor so that in 2020 it is equal to ...

How much will Medicare be reduced?

The nonpartisan Congressional Budget Office estimated that Medicare spending would be reduced by $716 billion over 10 years, mainly because the law puts the brakes on annual increases in Medicare reimbursement for Medicare Advantage, hospital costs, home health services, hospices and skilled nursing services.

How much less will Medicare get in 2022?

Other cuts include $66 billion less for home health, $39 billion less for skilled nursing services and $17 billion less for hospice care — all by 2022. Medicare costs will still grow, just more slowly than they would without the ACA. But some experts predict that beneficiaries will feel ...

How does the Medicare law affect hospitals?

It also penalizes hospitals with too many readmissions of Medicare patients who have heart attacks , heart failure or pneumonia within 30 days of a hospital stay.

How many states have Medicare cut doctors?

The American Medical Association says that in at least 11 states, Medicare Advantage plans have cut thousands of physicians. Critics worry that more doctors may stop taking Medicare patients or that patients will face lengthy waits for appointments or other changes.

What is Medicare Advantage?

About three in 10 Medicare beneficiaries are enrolled in Medicare Advantage options, which are premium insurance plans that often include dental, vision and drug insurance. These plans have been subsidized by the federal government for years. The ACA is simply aiming to equalize costs, according to its proponents.

Can Medicare Advantage plan reduce dental insurance?

There are only a few ways Medicare Advantage plans can cope with reductions in payments, says Wilensky, the former Medicare chief. "They can reduce some of the optional benefits, such as vision or dental coverage. They can raise premiums. And they can also tighten their physician networks," she says.

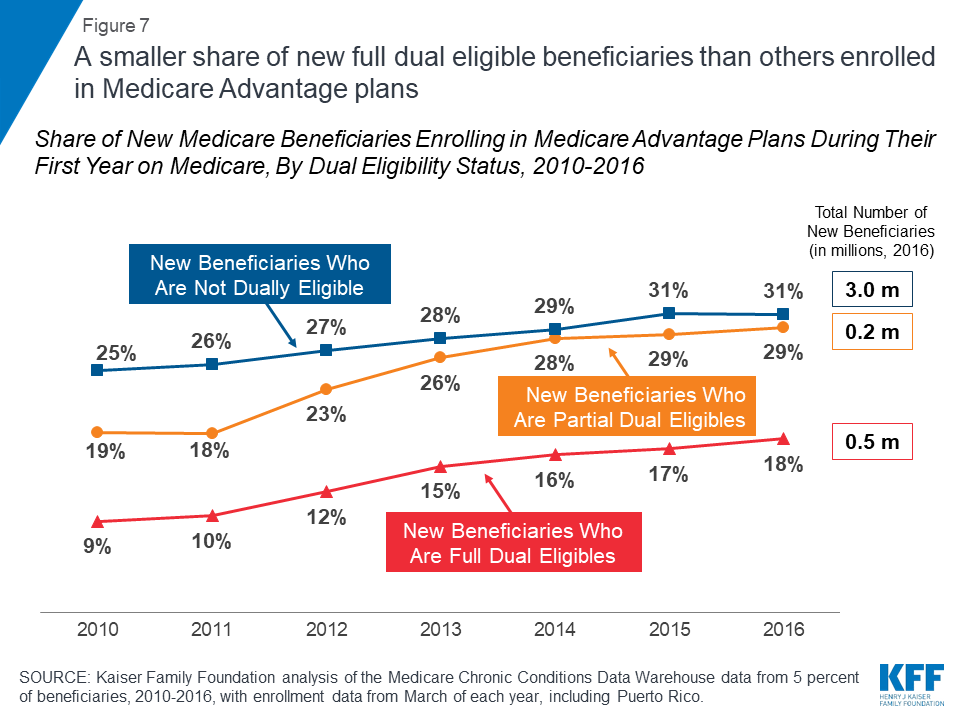

Did Medicare change before the law?

Insurers changed Medicare Advantage plans before the law, and they're still changing them, he says. "Overall, seniors are not paying that much more, and more people are still enrolling in Medicare Advantage plans," says Gruber, who advised the Obama administration on the ACA.

When was the Affordable Care Act enacted?

Recurring Publications. The Affordable Care Act, enacted in March 2010, made significant changes in federal programs and tax policies regarding health care (and in other areas)—including changes affecting insurance coverage, affordability and accessibility of insurance, the financing of medical care, and the operation of the Medicare program.

How much will the federal government subsidize health insurance in 2021?

CBO and JCT project that federal subsidies, taxes, and penalties associated with health insurance coverage for people under age 65 will result in a net subsidy from the federal government of $920 billion in 2021 and $1.4 trillion in 2030.

How many people will be uninsured in 2016?

June 5, 2014. Under the ACA, most legal residents must get health insurance or pay a penalty. CBO and JCT estimate that 30 million will be uninsured in 2016, but most will be exempt from the penalty; 4 million will make payments totaling $4 billion.

Why did Obamacare cut Medicare?

(Photo credit: Wikipedia) As you know if you’ve been reading this blog, Obamacare cuts $716 billion from Medicare in order to pay for its $1.9 trillion expansion of coverage to low-income Americans. It’s one of the reasons why seniors are more opposed to the new health law than any other age group.

How much did Obamacare save the AARP?

Obamacare, on the other hand, saved the AARP from $1.8 billion in Medigap reforms, while potentially earning the group an additional $1 billion in royalties from seniors who are forced out of Medicare Advantage. That’s a swing of $2.8 billion over ten years, all thanks to Obamacare. "There's an inherent conflict of interest," says Marylin Moon, ...

What is a Medigap plan?

Medigap plans are private insurance plans that seniors buy to cover the things that traditional, government-run Medicare doesn’t, like catastrophic coverage. Medigap plans also help seniors eliminate the co-pays and deductibles that are designed to restrain wasteful Medicare spending.

How much did the AARP get in 1990?

In 1990, the AARP had gross receipts of $300 million (which would be about $525 million in 2009 dollars); by 2009, gross receipts had grown to $2.2 billion. This makes the organization eight times as large as the second-largest non-profit advocacy group, the National Rifle Association.

Why do Democrats excoriate private insurers?

Democrats routinely excoriate private insurers for supposedly putting profits above people. "No American should ever spend their golden years at the mercy of insurance companies," President Obama told the AARP yesterday. But the typical private insurer gets by on a profit margin of about 5 to 6 percent.

How much did Obamacare swing over the last 10 years?

That’s a swing of $2.8 billion over ten years, all thanks to Obamacare. "There's an inherent conflict of interest," says Marylin Moon, who served as director of AARP's Public Policy Institute from 1986 to 1989.

Does AARP make royalties?

The AARP steps in by lending its name to commercial insurers for the sale of AARP-approved and -branded Medicare supplemental, Medicare Advantage, and Medicare prescription-drug policies. AARP earns enormous royalties from these sources; indeed, they now account for about half of the group's income.

How much money does the Health Care Act cut?

The first category, the cuts to government spending, accounts for $741 billion of the health law's financing. It's mostly changes to how the government pays the doctors and hospitals who provide care to Medicaid and Medicare patients.

Did Paul Ryan have hidden taxes?

Paul Ryan devoted a party of his speech Wednesday to tweaking the Affordable Care Act's funding sources, taking on the "hidden taxes" needed to pay for the insurance expansion: Even with all the hidden taxes to pay for the health care takeover , even with new taxes on nearly a million small businesses, the planners in Washington still didn’t have ...

Does the Affordable Care Act reduce healthcare costs?

A new report indicates that the Affordable Care Act may have reduced American health-care spending. But there’s a catch. The Affordable Care Act is likely reducing the country’s medical bills. A new report from the Urban Institute provides strong evidence that the law is directly lowering total health-care spending, ...

Does Obamacare reduce health care spending?

Data finally shows that Obamacare is reducing health spending, one of its original stated goals. But as long as a disproportionate amount of those savings come from a ruling that gutted a major coverage provision, and as long as the savings aren’t felt in beneficiaries’ pockets, the ACA still has work to do.