How much money does Medicare get?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

How much money goes to Medicare each year?

Historical NHE, 2020: Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE. Private health insurance spending declined 1.2% to $1,151.4 billion in 2020, or 28 percent of total NHE.

How much did the US spend on Medicare in 2019?

roughly $644 billionThe federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1). Of that, Medicare claimed roughly $644 billion, Medicaid and the Children's Health Insurance Pro-gram (CHIP) about $427 billion, and veterans' medical care about $80 billion.

How is Medicare funded in Australia?

The Australian government pays for Medicare through the Medicare levy. Working Australians pay the Medicare levy as part of their income tax. High income earners who don't have an appropriate level of private hospital insurance also pay a Medicare levy surcharge.

How much is Medicare in debt?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

Does Medicare pay for itself?

It turns out that Medicare payroll taxes fully fund Part A hospital expenses (together with your share of uncovered Part A expenses), but that is literally where the buck stops. Expenses for Parts B, C (Medicare Advantage) and D (prescription drugs) are paid mostly by Uncle Sam, to the tune of nearly $250 billion.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

HOW MUCH OF US taxes go to healthcare?

Government health expenditures in the United States account for a larger share of gross domestic product (11.2% in 2013) than do total health expenditures in any other nation.

How much does Medicare cost the Australian government per year?

The Morrison Government will invest $125.7 billion over four years, an increase of over $6 billion since last year's Budget, in Medicare, including record funding of $29.7 billion in 2021–22, and $30.5 billion in 2022–23, $32 billion in 2023–24 and $33.5 billion in 2024–25.

Who owns Medicare Australia?

Australia's Medicare scheme operates under power granted to the federal Parliament by Section 51 of the Australian Constitution, enacted by the 1946 Australian referendum (Social Services).

Who has the best healthcare system in the world?

South Korea has the best health care systems in the world, that's according to the 2021 edition of the CEOWORLD magazine Health Care Index, which ranks 89 countries according to factors that contribute to overall health.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

How to maximize compensation?

Maintaining strong client relationships is the key to maximizing your compensation. People are much more willing to buy from someone they know and trust. Follow up with your clients and use a CRM to document every interaction in order to make sales tracking more efficient. You can sell additional items in your follow-up appointments depending on the time of year and what type of plan your client has. One caveat is that CMS won’t let you sell a product your client hasn’t already agreed to talk about.

Can you sell Medigap plans?

Commissions for selling Medigap plans vary from carrier to carrier. It may sound confusing, but it works in your favor to partner with a great FMO that can connect you to many different carriers. You want to provide your clients with the plans that can offer the most benefit, and provide yourself with opportunities to earn more.

Can you make a lot of money on Medicare Advantage 2020?

The Centers for Medicare and Medicaid (CMS) raised the maximum Medicare agent commissions for Medicare Part D and Medicare Advantage plans for the fifth year in a row. That means you can make a lot of money on Medicare commissions during AEP 2020. While carriers are not required to pay the maximum, they usually don’t pay much less, because they want you to sell their products.

Do you get commission on Medicare Advantage?

Your Medicare Advantage clients may have to wait for the AEP to make changes to their existing plans or enroll in new policies, but you still get the commission if clients make changes during your meetings. That makes strong client relationships and following up even more important. A year is enough time to forget about someone, and you want your clients to remember you and the excellent customer service you provide.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much of Medicare is financed?

As a whole, only 53 percent of Medicare’s costs were financed through payroll taxes, premiums, and other receipts in 2020. Payments from the federal government’s general fund made up the difference.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

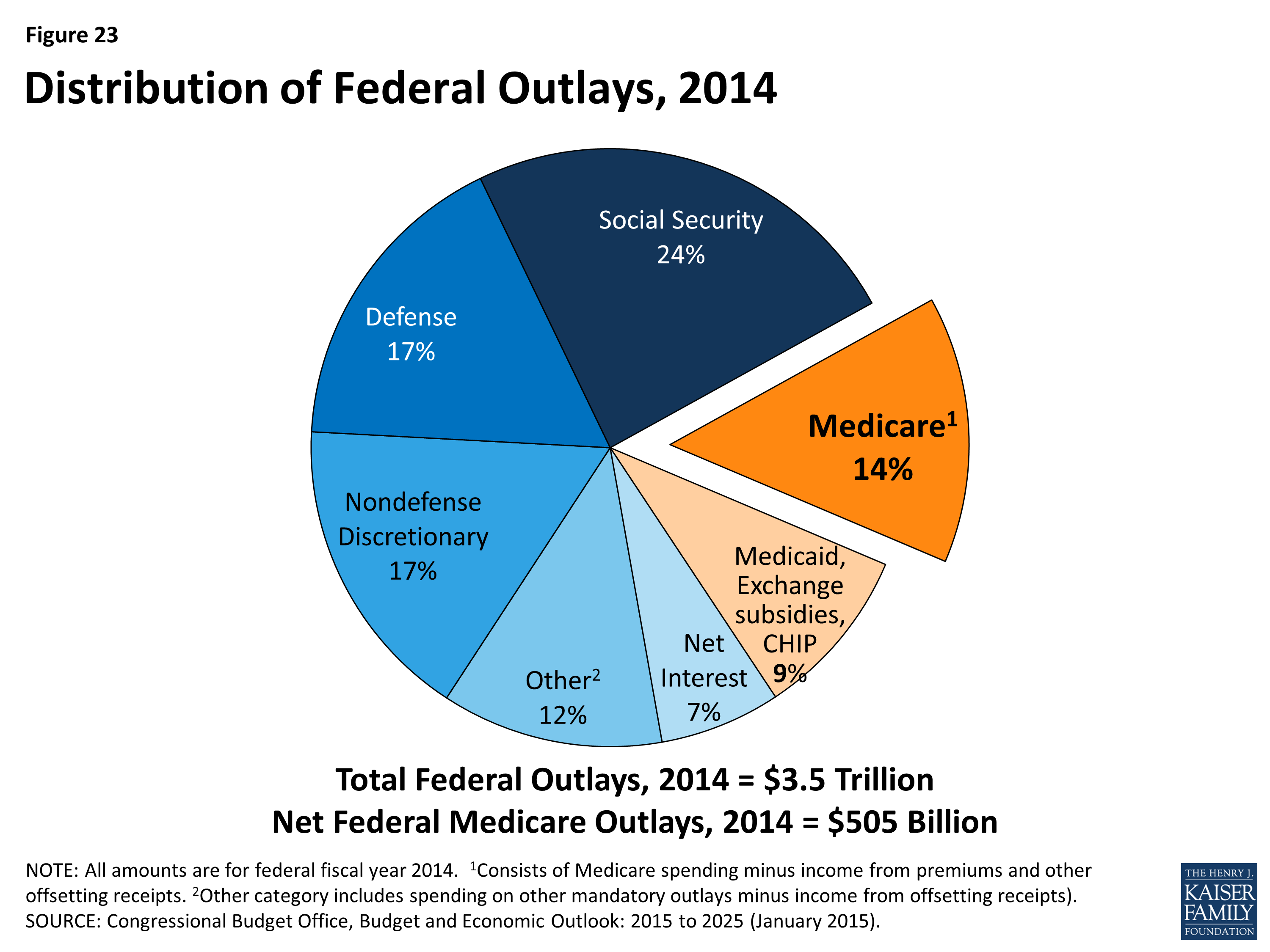

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much can you spend on Medicare Part C?

After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage can’t exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is designed to help Original Medicare beneficiaries pay their out-of-pocket expenses, like copays and deductibles.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

What is the coinsurance amount for Medicare Part B?

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare have a 0 premium?

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Does Medicare Advantage cover Part A?

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B (Original Medicare)? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Who sells Medicare Part C?

Medicare Part C plans (also called Medicare Advantage) and Medicare Supplement Insurance plans (also called Medigap) are sold by private insurance companies. The cost of plans can vary from one provider to the next.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

What is Medicare premium based on?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 ...

What is the Medicare Part B rate for 2021?

If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

What is a hold harmless on Medicare?

If you pay a higher premium, you are not covered by “hold harmless,” the rule that prevents most Social Security recipients from seeing their benefit payment go down if Medicare rates go up. “Hold harmless” only applies to people who pay the standard Part B premium and have it deducted from their Social Security benefit.

Does Medicare Part D increase with income?

Premiums for Medicare Part D (prescription-drug coverage), if you have it , also rise with higher incomes .

Can you ask Social Security to adjust your premium?

You can ask Social Security to adjust your premium if a “life-changing event” caused significant income reduction or financial disruption in the intervening tax year — for example, if your marital status changed , or you lost a job , pension or income-producing property. You’ll find detailed information on the Social Security web page “Medicare ...

Do you pay Medicare Part B if you are a high income beneficiary?

If you are what Social Security considers a “higher-income beneficiary,” you pay more for Medicare Part B, the health-insurance portion of Medicare. (Most enrollees don’t pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That’s your total adjusted gross income ...

How much did Medicare spend in 2019?

If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019, which is 21% of total NHE, while Medicaid spending grew 2.9% to $613.5 billion in 2019, which is 16% of total NHE. 3 . The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028.

What is Medicare contribution tax?

It is known as the unearned income Medicare contribution tax. Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans .

What is CMS and Medicaid?

CMS works alongside the Department of Labor (DOL) and the U.S. Treasury to enact insurance reform. The Social Security Administration (SSA) determines eligibility and coverage levels. Medicaid, on the other hand, is administered at the state level.

What is Medicare 2021?

Updated Jun 29, 2021. Medicare, and its means-tested sibling Medicaid, are the only forms of health coverage available to millions of Americans today. They represent some of the most successful social insurance programs ever, serving tens of millions of people including the elderly, younger beneficiaries with disabilities, ...

How much will healthcare cost in 2028?

The CMS projects that healthcare spending is estimated to grow by 5.4% each year between 2019 and 2028. This means healthcare will cost an estimated $6.2 trillion by 2028. Projections indicate that health spending will grow 1.1% faster than GDP each year from 2019 to 2028.

How much did the Affordable Care Act increase in 2019?

1 2 . According to the most recent data available from the CMS, national healthcare expenditure (NHE) grew 4.6% to $3.8 trillion in 2019.

Is Medicare a government program?

Both Medicare and Medicaid are government-sponsored health insurance plans. Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults.