At that time, Social Security benefits will begin draining the general fund. 10 It also means that Congress can no longer "borrow" from the Social Security Trust Fund

Social Security Trust Fund

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

How much does the government spend on Medicare?

The government has borrowed about $22 trillion from various sources ranging from individuals with savings bonds to banks with surplus cash to corporations seeking to invest surplus cash to social security and medicare surpluses to foreign governments with excess dollars they want to store in a safe place.

How much has the federal government borrowed from the Social Security Fund?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

How is Medicare funded?

Sep 02, 2021 · Medicare is the second largest program in the federal budget: 2020 Medicare expenditures, net of offsetting receipts, totaled $776 billion — representing 12 percent of total federal spending. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and 39 percent of all home health spending.

What are some interesting facts about Medicare?

Nov 02, 2006 · At that time, Social Security benefits will begin draining the general fund. 10 It also means that Congress can no longer "borrow" from the Social Security Trust Fund to pay for other federal programs. Medicare ($722 billion) and Medicaid ($448 billion) are …

Which president first borrowed from Social Security?

| 1. | STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 1964 |

|---|---|

| 8. | LETTER TO THE NATION'S FIRST SOCIAL SECURITY BENEFICIARY INFORMING HER OF INCREASED BENEFITS--SEPTEMBER 6, 1965 |

How much has the US government borrowed from Social Security?

When did Congress start borrowing from Social Security?

Has money been borrowed from Social Security?

What did Reagan do to Social Security?

Why is Social Security taxed twice?

What is the average Social Security benefit per month?

| Type of beneficiary | Beneficiaries | Average monthly benefit (dollars) |

|---|---|---|

| Number (thousands) | ||

| Total | 65,449 | 1,536.94 |

| Old-Age and Survivors Insurance | 56,297 | 1,587.72 |

| Retirement benefits | 50,416 | 1,618.29 |

How much money can you have in the bank on Social Security retirement?

Can you collect Social Security and a pension at the same time?

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

What percentage of Medicare is spending?

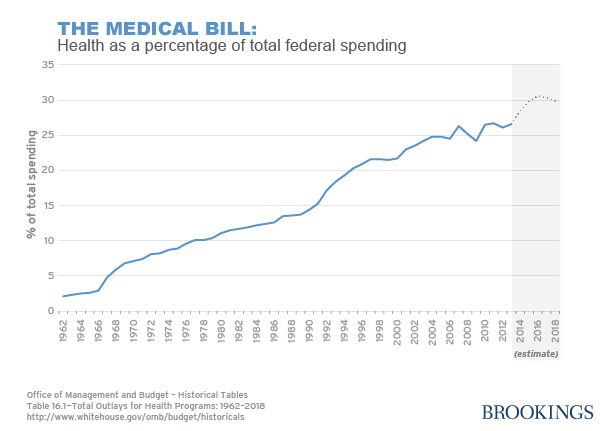

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

How is Medicare's financial condition assessed?

Medicare’s financial condition can be assessed in different ways, including comparing various measures of Medicare spending—overall or per capita—to other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

How much of Medicare is financed?

As a whole, only 53 percent of Medicare’s costs were financed through payroll taxes, premiums, and other receipts in 2020. Payments from the federal government’s general fund made up the difference.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

How much did Medicare cost in 2019?

In 2019, it cost $644 billion — representing 14 percent of total federal spending. 1. Medicare has a large impact on the overall healthcare market: it finances about one-fifth of all health spending and about 40 percent of all home health spending. In 2019, Medicare provided benefits to 19 percent of the population. 2.

How much will Medicaid cost in 2030?

By 2030, the cost will almost double to $665 billion, exceeding that of Medicaid. 1 It's not a mandatory program, but it must be paid in order to avoid a U.S. debt default. These estimates will increase if interest rates rise.

What is the next largest expense for Social Security?

10 It also means that Congress can no longer "borrow" from the Social Security Trust Fund to pay for other federal programs. Medicare ( $722 billion) and Medicaid ($448 billion) are the next largest expenses.

How much is the national debt in 2021?

These are part of mandatory spending, which are programs established by prior Acts of Congress. The interest payments on the national debt total $378 billion for FY 2021. They are necessary to maintain faith in the U.S. government. About $1.485 trillion in FY 2021 goes toward discretionary spending, which pays for all federal government agencies.

How much did the government spend during the Great Recession?

In the decade leading up to the Great Recession, the government kept federal spending below 20% of GDP. It grew no faster than the economy, around 2% to 3% per year. During the recession, spending grew to a record 24.4% of GDP in FY 2009. This increase was due to economic stimulus and two overseas wars. 3

What is the budget for FY 2021?

Key Takeaways. Government spending for FY 2021 budget is $4.829 trillion. Despite sequestration to curb government spending, deficit spending has increased with the government’s effort to continually boost economic growth. Two-thirds of federal expenses must go to mandatory programs such as Social Security, Medicare, and Medicaid.

How much will the mandatory budget cost in 2021?

The mandatory budget will cost $2.966 trillion in FY 2021. 1 Mandatory spending is skyrocketing, because more baby boomers are reaching retirement age. By 2030, one in five Americans will be older than 65. 8

How much is discretionary spending?

Discretionary spending is $1.485 trillion. 1 It pays for everything else. Congress decides how much to appropriate for these programs each year. It's the only government spending that Congress can cut. 12

How many people are receiving Social Security?

Of the nearly 63 million people currently receiving a benefit check, more than a third are being kept out of poverty as a result of the added income they're receiving from the program.

How much interest did Social Security collect in 2017?

Ultimately, Congress' borrowing allowed Social Security to collect $85.1 billion in interest income for 2017, and it's expected to provide $804 billion in aggregate interest income between 2018 and 2027.

How much is the Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook. If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

What are the effects of Social Security?

Ongoing demographic changes that include the retirement of baby boomers, increased longevity, lower fertility rates, and growing income inequality, are adversely impacting Social Security. According to the June 2018 report, the program is soon expected to begin paying out more money than it collects each year.

When was Social Security signed into law?

Yet for as important as Social Security is, it's also about to encounter its biggest speed bump since being signed into law back in 1935.

Will Social Security be cut in 2034?

Based on the estimates of the Trustees, Social Security's $2.9 trillion in asset reserves will be completely gone by 2034. Should lawmakers not find a way to raise additional revenue and/or cut expenditures by then, an across-the-board cut in benefits of up to 21% may await. That's particularly worrisome, given that 62% of retired workers rely on their benefit check to account for at least half of their income.

Is Social Security generating interest income?

What's more, Social Security is already generating interest income from the federal government on its borrowing. As of Dec. 31, 2018, the $2.9 trillion in special-issue bonds and certificates of indebtedness were yielding an average of 2.85%. Since these bonds range in maturity from 1 to 15 years, there's plenty of opportunity to take advantage of rising yields and adjust the program's bond investments as needed.

How much money did the federal government spend in 2020?

The federal government made $2.6 trillion in funds available to respond to COVID-19 and spent $1.6 trillion of that in fiscal year 2020. Federal revenue decreased 3% in fiscal year 2020. Federal spending grew 45% in fiscal year 2020.

How much did the government spend on 2020?

The federal government spent $6.6 trillion in fiscal year 2020 — or $19,962 per person. Medicare, Social Security, defense and veterans, debt interest, support to businesses, plus assistance like stimulus checks and unemployment insurance accounted for 73% of spending. This includes funding distributed to states.

How much of the federal transportation budget will be spent in 2020?

Infrastructure Nearly 40% of 2020 federal transportation spending was for air transportation, driven in part by stimulus spending in response to the COVID-19 pandemic. Most infrastructure spending comes directly from state and local governments, which spent $169 billion on projects in 2018, excluding federal transfers.

What is the federal budget for 2020?

This is more than double the 2009 increase following the Great Recession. Federal spending in 2020 was equivalent to 31% of GDP, higher than the 20% annual average since 1980.

What is debt owed to the public?

Debt owed to the public is debt sold in credit markets in forms including bills, notes, and treasury bonds. Private US citizens, citizens of other nations and foreign governments can all hold this debt.

What is government revenue and expenditure?

Government Revenue & Expenditures A combined federal, state, local view of how funds flow in and out.

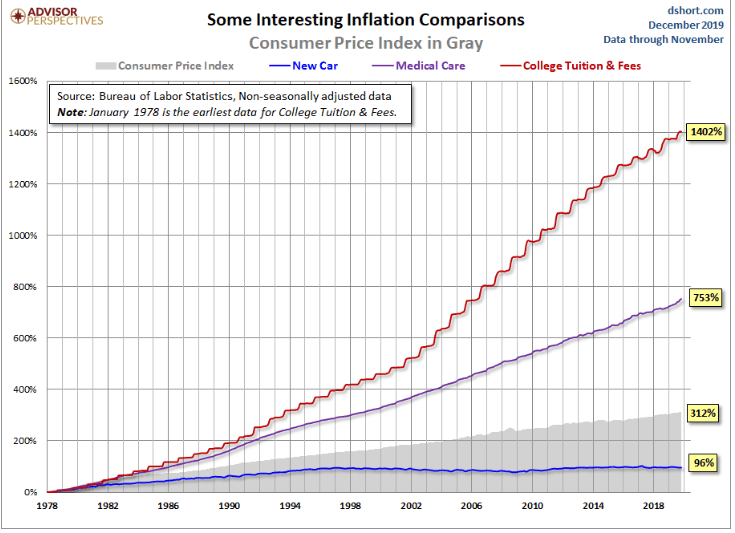

Is healthcare a political issue?

From health insurance to prescription drug prices, the cost of healthcare has been a political issue for decades.

How much money does the government owe to the Social Security Fund?

Technically the government owes the Social Security fund an estimated $2.9 trillion, money that has been used and not repaid to the fund. The money is legally held in a special type of bond that by law cannot be used for any other purpose other than to put the money back into the fund.

When will Social Security outflow exceed inflow?

There is an ongoing debate about whether the Federal government and its spending policies are responsible for the current projections that by the year 2034 the outflow of payments will exceed the inflow of tax revenues to fund the social security program.

Why is Social Security like a lottery?

Actually, the Social Security program has become much like a state lottery or casino because it depends on people playing, not to fund the intended program (education, assistance for the elderly) but to fill holes in the larger budget where overspending has occurred.

Do millennials pay taxes?

Millennials and younger generations complain they are paying their taxes in just to finance the 63 million retirees, about half who depend on their Social Security check to pay part or all of their monthly bills. But when looking at that $2.9 trillion owed to the fund, and the fact that the fund actually has more money going in than coming out, the problem clearly lies with the government’s addiction to spending. Money is the drug of choice in Washington D.C., and whoever gets elected will get their fix sooner or later.

Is there cash in the bank for Social Security?

There is no cash in the bank to pay out monthly benefit checks. The Congress, those keepers of the financial retirement flame, have been using Social Security taxes to fund other parts of the government because, well the money is there. Technically the government owes the Social Security fund an estimated $2.9 trillion, ...

Is the $2.9 trillion problem the government's fault?

An odd thing is taking place in some financial and economic circles, where people are arguing that the problem of the $2.9 trillion is somehow not the government’s fault and is really not that big of a deal. The clock is running and no one seems to have a solution, yet all admit the government does owe the Social Security fund the money and that the government continues to borrow from the fund every year. Maybe many of these so-called experts won’t be around in 2034 and can act as if the problem is not really a problem. The real problem is that neither the average person or the accountants and financial planners in the government actually understand what $1 trillion is in real money. Maybe someone could make $1 trillion in dollar bill sized pieces of paper and have them delivered to the Congress. But that would cost too much.

How long was Social Security on budget?

This means at no point over this 22-year period where Social Security was on-budget did a dime of Social Security income, benefits, or asset reserves get commingled with the federal government's General Fund.

How much interest did Social Security get in 2018?

In 2018, $83 billion in interest income was collected by Social Security. If the folks who believe that Congress stole from Social Security got their way, and the federal government repaid every cent it borrowed, Social Security would have lost out on this $83 billion in interest income in 2018.

Why is Social Security facing a huge cash shortfall?

One of the more common theories as to why Social Security is facing a huge long-term cash shortfall is that lawmakers in Congress have pilfered cash from the program and never returned it. This idea goes all the way back to 1968, when then-President Lyndon B. Johnson made a change to how the federal budget would be presented.

How much is Social Security shortfall?

According to the latest report from the Social Security Board of Trustees, Social Security is staring down a $13.9 trillion cash shortfall between 2035 and 2093, with the expectation that its $2.9 trillion in asset reserves will be completely exhausted in ...

What has Congress not done?

What Congress hasn't done is steal from Social Security. However, lawmakers have known of the program's shortcomings since 1985, and have yet to find a middle-ground solution to fix it. If you want to point the finger at lawmakers, do so because bountiful solutions exist, but political hubris appears to be getting in the way.

What was the President's Commission on Budget Concepts?

Prior to 1974, before Congress had an independent budgeting process, the President's Commission on Budget Concepts had three separate budgets, all of which had differing deficits. To simplify things, Johnson called for Social Security and its trust funds to be included in the annual federal budget. In 1983, the Reagan administration voted ...

When did Social Security get pilfered?

First of all, there's the period between 1968 and 1990, which is believed to be when Congress pilfered America's top social program. What needs to be understood here is that, while Social Security's two trusts (the Old Age and Survivors Insurance Trust and Disability Insurance Trust) and its asset reserves were technically "on-budget," funding ...

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical and projected Medicare spending data published in the 2018 annual repor…

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased ...

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…